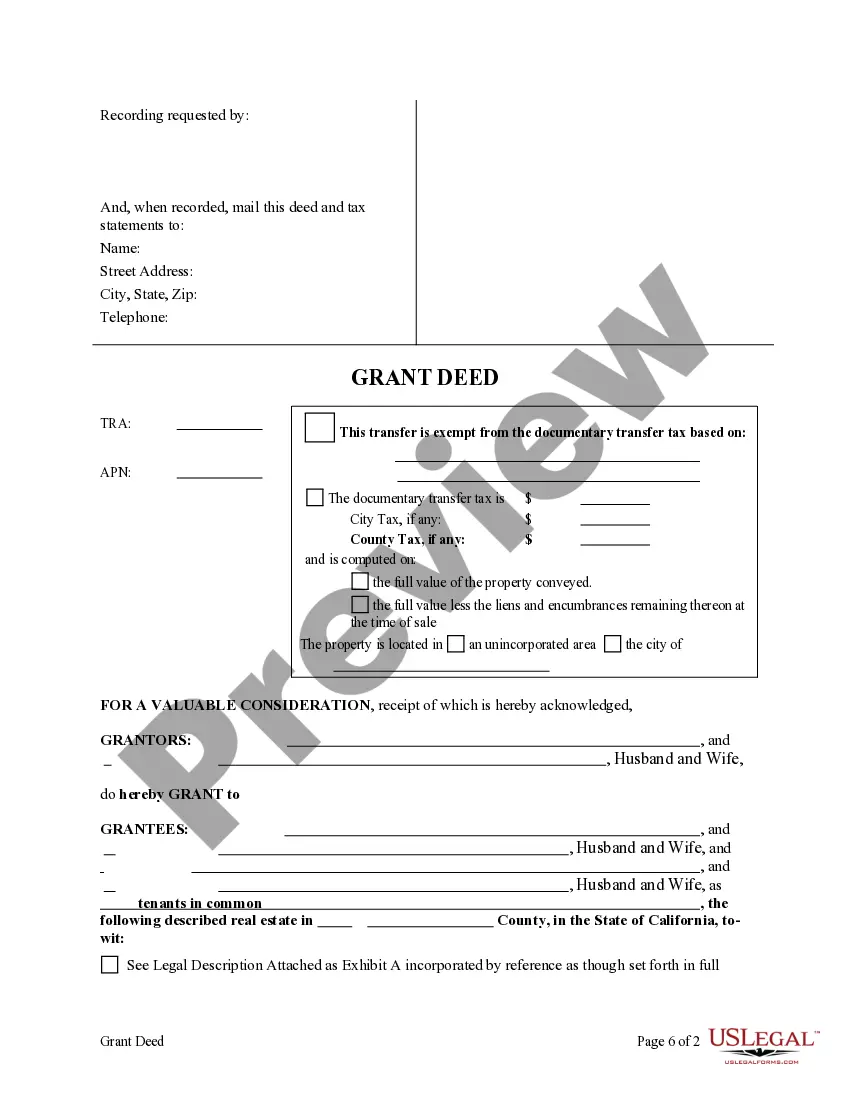

This form is a Grant Deed where the Grantors are Husband and Wife and the Grantees are two married couples. This deed complies with all state statutory laws.

Anaheim California Grant Deed from Three Individuals to an Individual

Description

How to fill out California Grant Deed From Three Individuals To An Individual?

Take advantage of US Legal Forms and gain instant access to any document you require.

Our advantageous site featuring a vast array of templates facilitates the process of locating and acquiring nearly any document specimen you seek.

You can export, complete, and sign the Anaheim California Grant Deed from Three Individuals to an Individual within minutes, instead of spending hours online searching for the correct form.

Utilizing our directory is an excellent strategy to enhance the security of your document submission.

If you have not yet created an account, follow these steps.

Visit the page containing the form you need. Verify that it is the form you intended to find: review its title and description, and utilize the Preview feature if accessible. Otherwise, use the Search bar to find the necessary form.

- Our knowledgeable attorneys routinely examine all documents to ensure that the templates are applicable to a specific state and in accordance with updated laws and regulations.

- How can you acquire the Anaheim California Grant Deed from Three Individuals to an Individual.

- If you possess an account, simply Log In.

- The Download option will be visible on all the templates you access.

- Additionally, you can locate all your previously stored documents in the My documents section.

Form popularity

FAQ

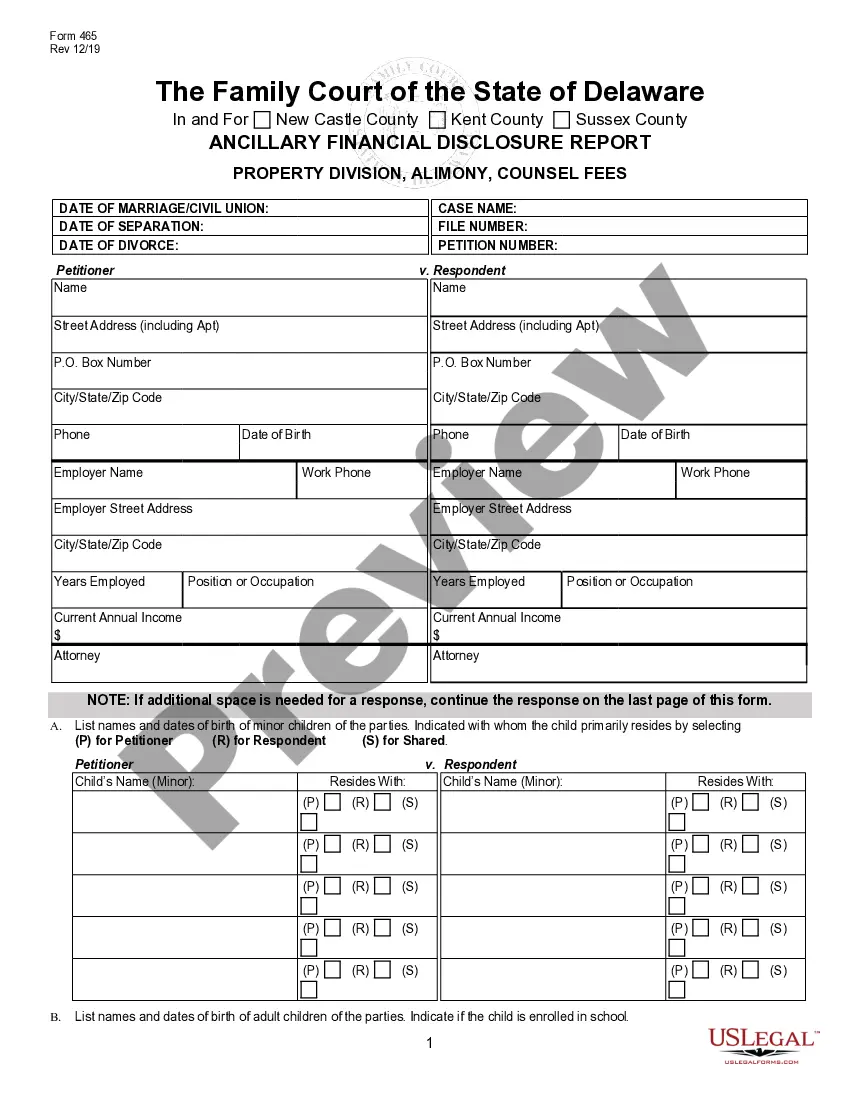

How do I add someone or remove someone from my deed? To make changes to ownership of property, a new deed will need to be prepared and recorded in the Clerk's Office where the property is located.

You can own real estate in California with two or more people. Your property deed lists all the different owners' names and how they hold title.

Adding a name to the deeds Equity transfer is not just about removing a name from the deeds. It also includes adding a name. For example, parents may want to add their children to the deeds of the family home. When someone marries their partner, they may want to add them to the deeds of the property they already owned.

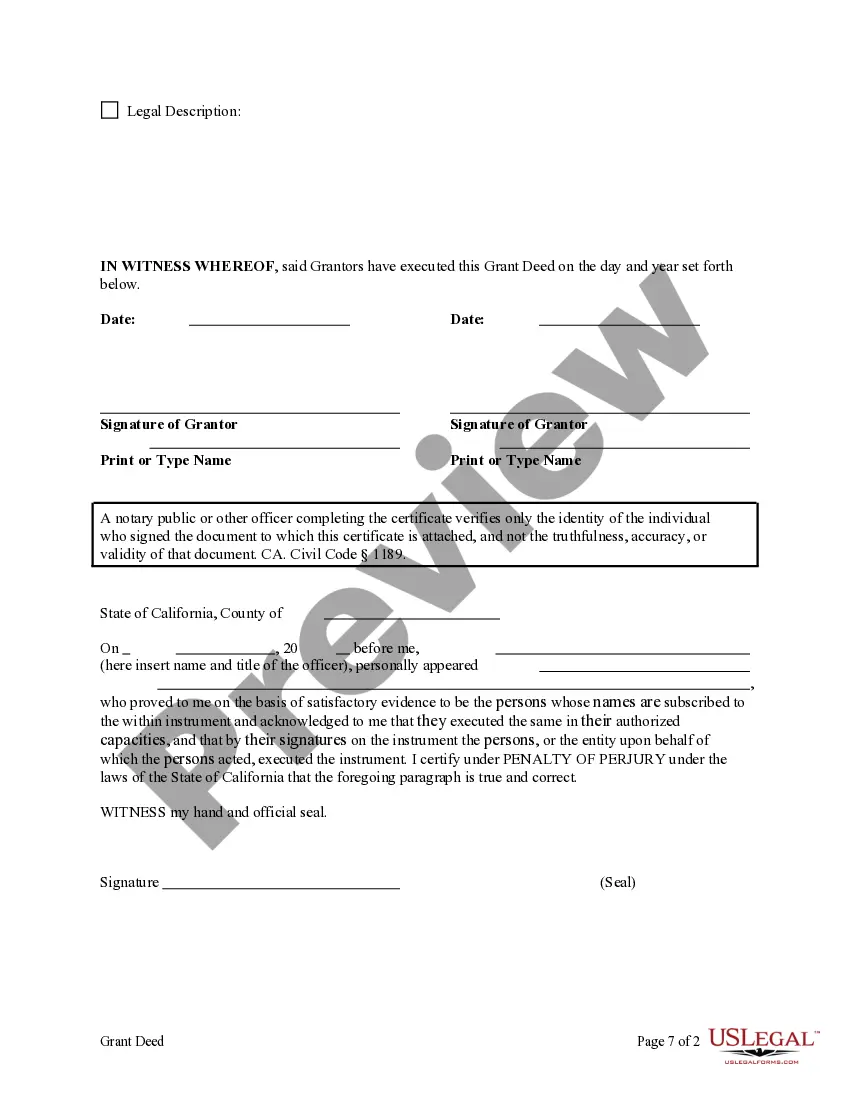

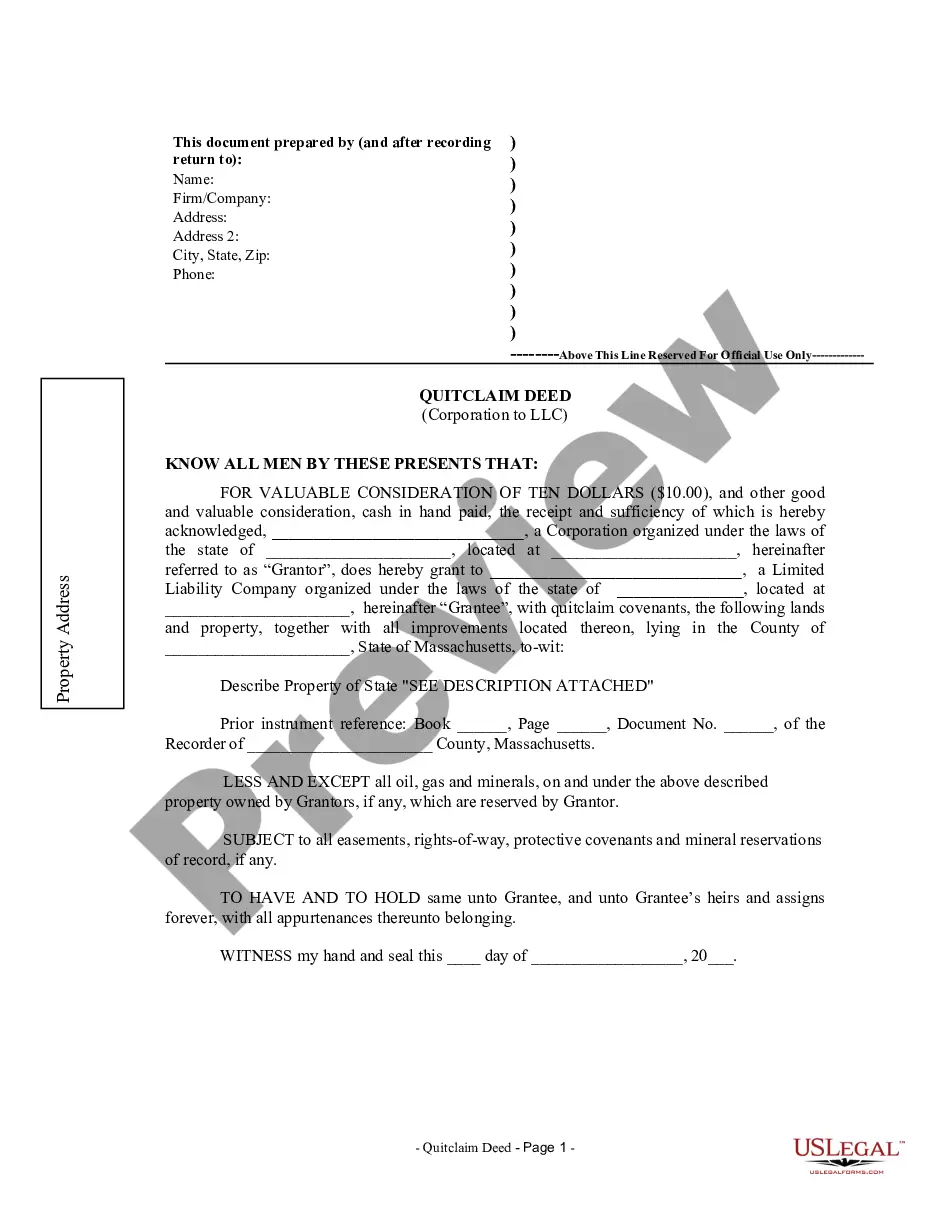

How to Correct a Deed Re-recording of the original document. With corrections made in the body of the original document. A cover sheet detailing the changes. Must be re-signed and re-acknowledged. Correction Deed. A new deed reflecting the corrections/changes. Must meet all recording requirements of a deed.

To add, remove, or change a name on a deed, have a lawyer, title company, or other real estate professional prepare the deed. Then, record the new deed with the Department of Records. Note: We recommend that you do not prepare a deed on your own. We also recommend that you get title insurance.

What does it cost? The recording charge is set by the county and we charge a administative fee. For counties from Erie, Elk, Franklin and Centre to Bucks, Berks, and Butler, the charge for a deed transfer across Pennsylvania is $700, with the sole exception of Philadelphia, which is $800.

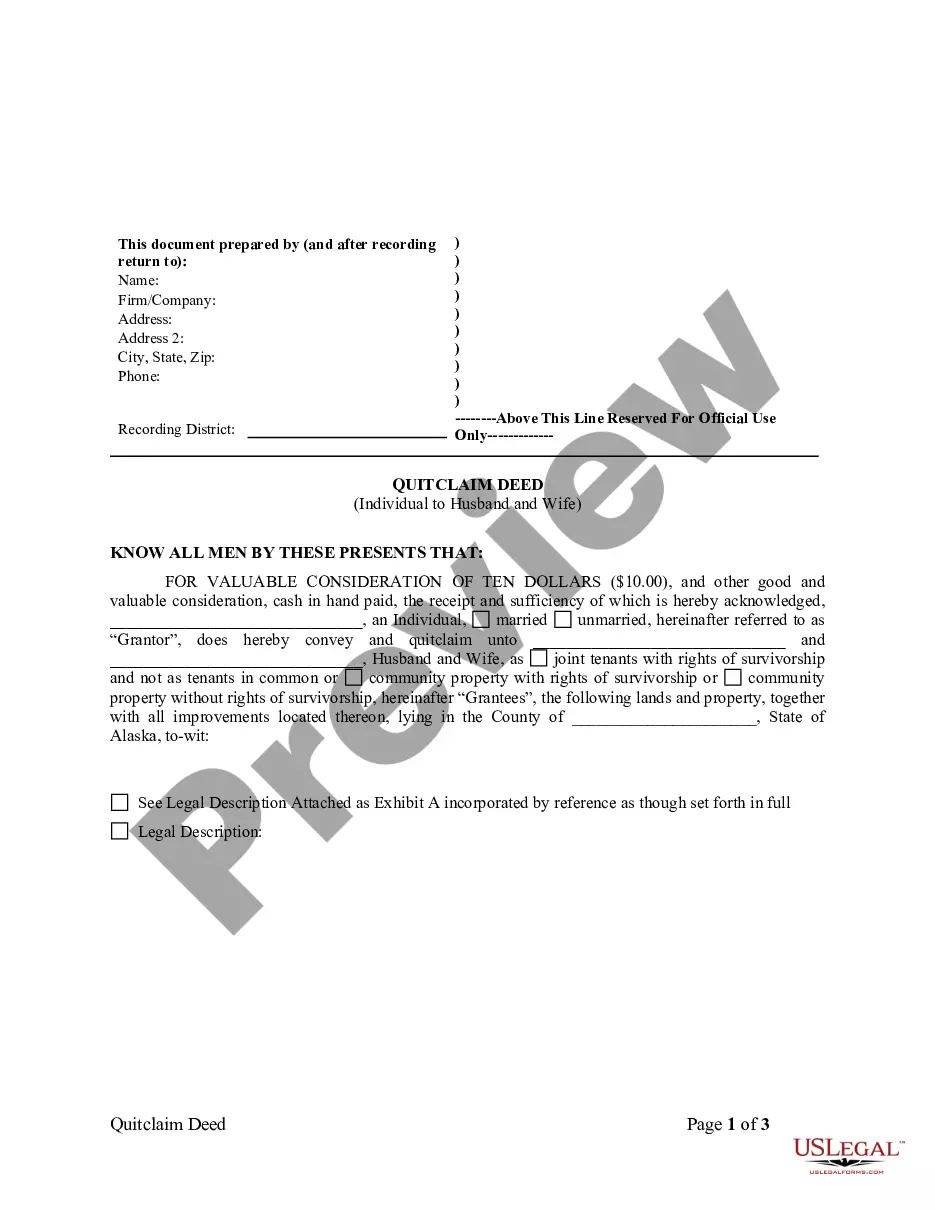

In order to accomplish this, you can't just pen in the name on your deed. You'll need to transfer an interest by writing up another deed with the person's name on it. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

We recommend you consult with an experienced real estate lawyer for professional advice as each circumstance is unique. (Please note, the fee for our office to add someone to your deed is $650.00, plus recording costs and documentary stamps ? recordings costs are normally less than $50.00.)

Recording Fee for Grant DeedType of FeeFeeBase Fee G.C. § 27361(a) G.C. § 27361.4(a) G.C. § 27361.4(b) G.C. § 27361.4(c) G.C. § 27361(d)(1) G.C. § 27397 (c) Subsection 1$15.005 more rows