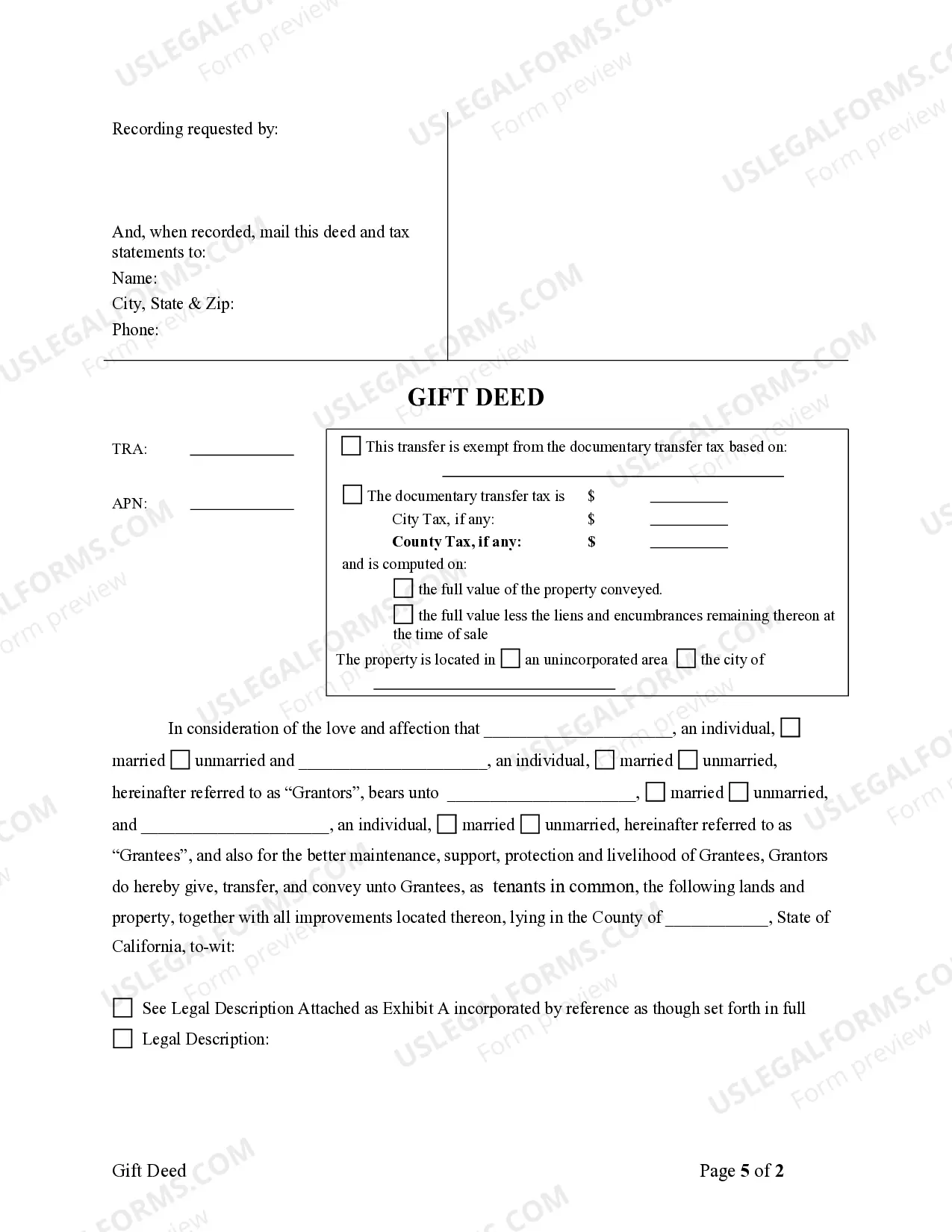

This form is a Gift Deed where the grantors are two individuals and the grantees are two individuals. Grantors grant and convey the described property to grantees. The grantees take the property as tenants in common or as joint tenants with the right of survivorship. This deed complies with all state statutory laws.

Alameda California Gift Deed - From Two Individual Grantors to Two Individual Grantees

Description

How to fill out California Gift Deed - From Two Individual Grantors To Two Individual Grantees?

Utilize the US Legal Forms and gain immediate access to any form template you need.

Our user-friendly website with a vast array of templates enables you to locate and secure nearly any document sample you desire.

You can download, complete, and sign the Alameda California Gift Deed - From Two Individual Grantors to Two Individual Grantees in a matter of minutes rather than spending numerous hours searching online for the correct template.

Leveraging our collection is an excellent way to enhance the security of your document submissions.

Moreover, you can retrieve all previously saved documents in the My documents section.

If you do not yet have an account, follow the steps outlined below.

- Our experienced attorneys routinely assess all documents to ensure that the templates are applicable for a specific region and adhere to current laws and regulations.

- How can you acquire the Alameda California Gift Deed - From Two Individual Grantors to Two Individual Grantees.

- If you possess an account, simply Log In to your profile. The Download button will be active on all the samples you access.

Form popularity

FAQ

In California, a quitclaim deed and an interspousal transfer deed serve different purposes. A quitclaim deed, like the Alameda California Gift Deed - From Two Individual Grantors to Two Individual Grantees, transfers an individual's interest in a property without making any promises about the title’s validity. On the other hand, an interspousal transfer deed specifically allows spouses to transfer property to each other without tax consequences. Understanding these distinctions can simplify your property transactions and help you choose the right deed for your needs.

To transfer ownership of a property in California, you can use an Alameda California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This deed provides a legal framework for gifting property while maintaining clarity in ownership. It's crucial to file the deed with the county recorder's office, as this makes the transfer official. Tools like uslegalforms can guide you through the necessary steps and documents needed.

One effective method to transfer property title between family members is through an Alameda California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This type of deed allows you to transfer ownership without a sale. It is essential that both parties understand the implications, including potential tax consequences. Utilizing services like uslegalforms can simplify this process, ensuring all legal requirements are met.

Yes, it is possible to add someone to a deed without a lawyer in California. You can complete the process by filling out the appropriate forms, signing the deed, and recording it with the county. However, seeking legal advice is wise to ensure you comply with local laws and avoid future complications. Using resources like the Alameda California Gift Deed - From Two Individual Grantors to Two Individual Grantees can help guide you through the process effectively.

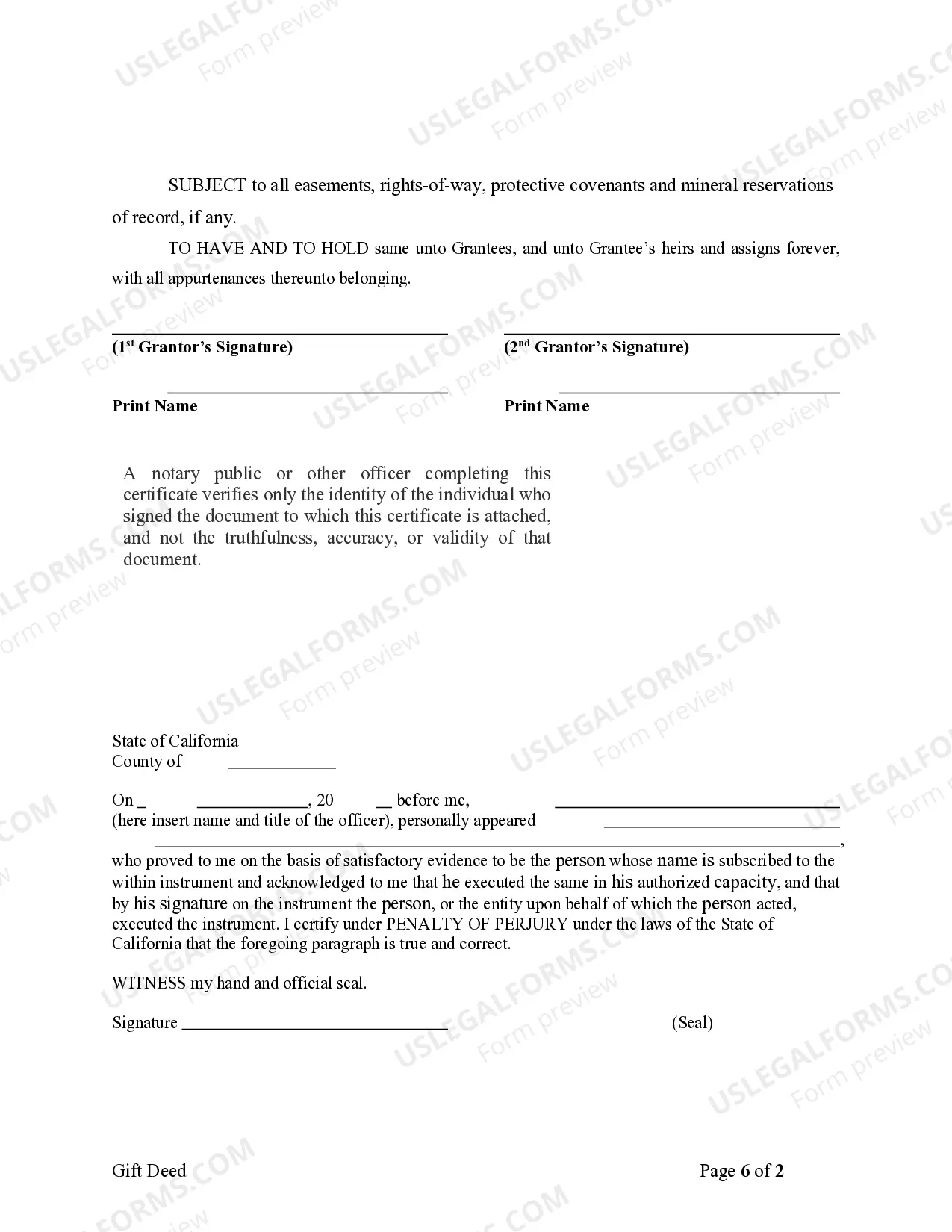

The best way to add someone to a deed is to draft a quitclaim or grant deed that clearly states the new addition of ownership. Ensure the deed is executed in compliance with California laws, which includes notarization and recording at the county recorder’s office. This method ensures legal protection and clarity in the ownership transfer. For ease of use, consider the Alameda California Gift Deed - From Two Individual Grantors to Two Individual Grantees, which provides a straightforward solution.

To add a name to your property deed in California, create a new deed that lists both the current owners and the person you wish to add. This deed should be signed, notarized, and then recorded with the county recorder’s office. The process ensures that the new name reflects on the public record, protecting everyone’s ownership rights. Utilizing the Alameda California Gift Deed - From Two Individual Grantors to Two Individual Grantees provides a clear structure for this modification.

Removing someone from a grant deed in California involves executing a new deed that reflects the change in ownership. This typically requires the consent of all original grantors, and the new deed should be prepared and notarized. Afterward, you must file the updated deed with the county recorder’s office to make the change official. Using the Alameda California Gift Deed - From Two Individual Grantors to Two Individual Grantees can simplify this process.

When you add someone to a deed in California, it can trigger property tax reassessment depending on the nature of the transfer. If the added individual is a close relative and the transfer qualifies under familial exclusions, it may not result in reassessment. However, for other situations, it's important to understand potential capital gains taxes and how they can affect you later. Always consult a tax professional to navigate these implications effectively.

To add a person to a deed in California, you will need to prepare a new deed, often called a quitclaim deed or grant deed, listing both the original grantors and the new grantee. This deed must be signed by the original grantors and should be notarized to ensure its validity. After signing, you must record the new deed with the county recorder's office where the property is located. Consider utilizing the Alameda California Gift Deed - From Two Individual Grantors to Two Individual Grantees for a smooth process.