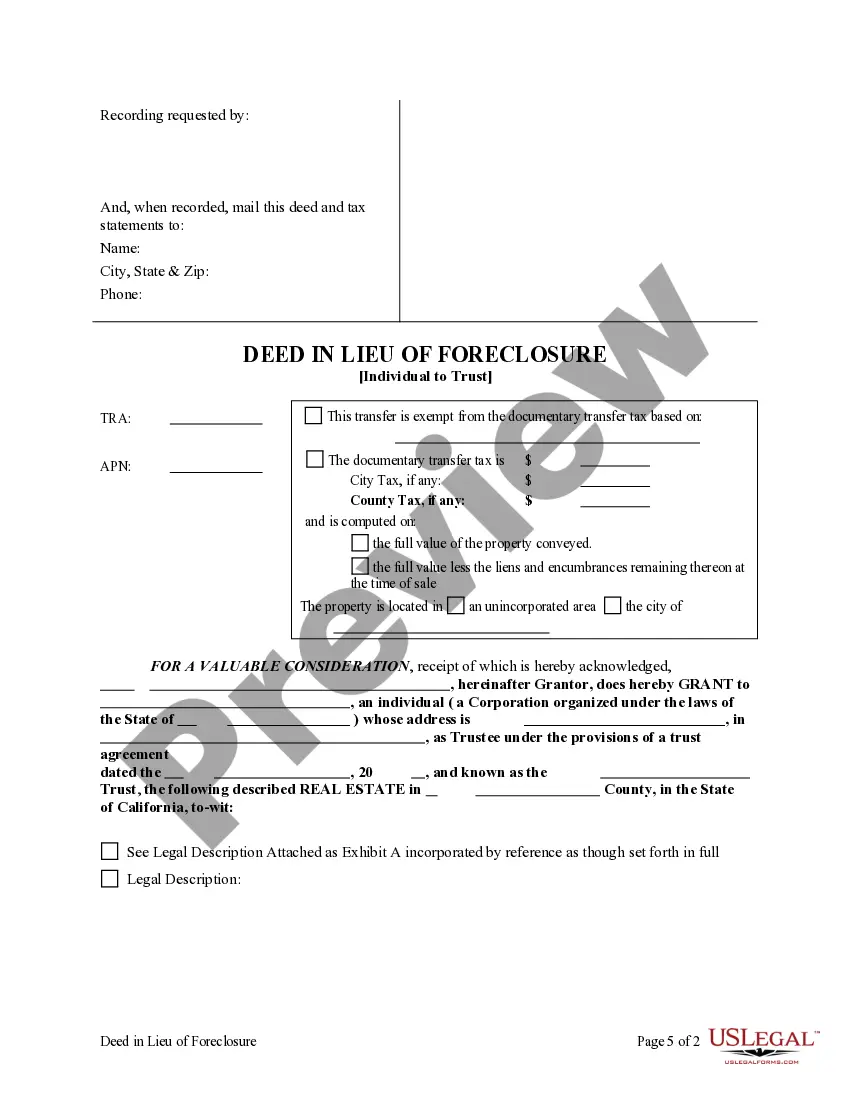

This s a Grant Deed in the form of a Deed in Lieu of Foreclosure where the Grantor and the Grantee is a Trust. Grantor conveys and grants the described property to the Grantee. The transfer to the Grantee serves as satisfaction of the prior Deed of Trust and Promissory Note. This deed complies with all state statutory laws.

Santa Clarita California Deed in Lieu of Foreclosure - Individual to a Trust

Description

How to fill out California Deed In Lieu Of Foreclosure - Individual To A Trust?

Are you in need of a dependable and cost-effective provider of legal documents to obtain the Santa Clarita California Deed in Lieu of Foreclosure - Individual to a Trust? US Legal Forms is your trusted source.

Whether you require a straightforward agreement to establish guidelines for living with your partner or a collection of documents to facilitate your divorce proceedings in court, we have you covered. Our platform features over 85,000 current legal document templates available for personal and business use. All templates we provide are not generic and are designed in line with the stipulations of specific states and counties.

To retrieve the document, you must Log In to your account, find the necessary template, and click the Download button adjacent to it. Please note that you can download your previously acquired form templates at any time from the My documents section.

Are you unfamiliar with our platform? No problem. You can create an account in a matter of minutes, but before that, ensure to do the following.

Now you can establish your account. Then select the subscription plan and proceed with the payment. After the payment is finalized, download the Santa Clarita California Deed in Lieu of Foreclosure - Individual to a Trust in any available format. You can return to the website whenever needed and redownload the document at no additional cost.

Locating current legal forms has never been simpler. Try US Legal Forms today and stop wasting hours trying to understand legal documents online.

- Verify if the Santa Clarita California Deed in Lieu of Foreclosure - Individual to a Trust adheres to the laws of your state and locality.

- Review the document’s description (if available) to determine who and what the form is intended for.

- Restart your search if the template does not fit your particular situation.

Form popularity

FAQ

To fill out a trust deed, begin by identifying the granter, the grantee, and the property details, including the legal description. Next, input the terms of the trust, including what happens in the event of a default. Once completed, ensure that all parties involved sign the document in the presence of a notary. This process is vital for ensuring an effective Santa Clarita California Deed in Lieu of Foreclosure - Individual to a Trust, which may help you manage your estate more efficiently.

While putting your house in a trust in California has benefits like avoiding probate, there are some disadvantages to consider. For example, transferring property into a trust may incur costs for creating the trust document and recording a grant deed, as well as potential tax implications. Additionally, if you require financing, lenders may view a Santa Clarita California Deed in Lieu of Foreclosure - Individual to a Trust differently. Evaluating these factors is essential before making a decision.

Writing a deed in lieu of foreclosure letter starts with addressing the lender and clearly stating your intention to transfer the property to them to avoid foreclosure. Include relevant details such as the property address, explanation of your financial situation, and request for the deed to be processed as a Santa Clarita California Deed in Lieu of Foreclosure - Individual to a Trust arrangement. Remember to sign the letter and keep a copy for your records.

To transfer property to a trust in California, you first need to create a trust document outlining the terms and beneficiaries. Next, you will prepare a deed, such as a grant deed, that specifies the transfer of property ownership into the trust. This document must be signed and notarized before recording it with the county. Ensuring proper execution guarantees that your Santa Clarita California Deed in Lieu of Foreclosure - Individual to a Trust is valid.

There are a few disadvantages to a deed in lieu of foreclosure. One major concern is the potential impact on credit scores, which can still decline, albeit less severely than in a formal foreclosure. Additionally, with Santa Clarita California Deed in Lieu of Foreclosure - Individual to a Trust, there may be issues regarding any remaining debt after the transfer that could complicate the transaction. Consulting with experts can help clarify and navigate these concerns.

The new foreclosure law in California introduces several protections for homeowners facing foreclosure. It requires lenders to engage in loss mitigation efforts before they can initiate a foreclosure process. For those considering the Santa Clarita California Deed in Lieu of Foreclosure - Individual to a Trust, understanding these changes can help better navigate options to protect your property and interests.

A deed in lieu of foreclosure in California allows a homeowner to transfer the property title back to the lender rather than going through the formal foreclosure process. This option can be beneficial for borrowers who want to avoid the negative effects of foreclosure on their credit report. In the context of Santa Clarita California Deed in Lieu of Foreclosure - Individual to a Trust, this process can make it easier for individuals transferring property into a trust.

A deed of trust may be considered invalid in California if it lacks essential elements such as proper signatures, necessary parties, or if it is not properly recorded with the county. Additionally, if the document contains fraud or if the signer lacked capacity, it could also invalidate the deed. It is crucial to ensure that all aspects of your Santa Clarita California Deed in Lieu of Foreclosure - Individual to a Trust are completed accurately.

California primarily uses a deed of trust instead of a traditional mortgage. A deed of trust involves three parties: the borrower, the lender, and the trustee, which adds a layer of security for the lender. Knowing this distinction is important for managing your Santa Clarita California Deed in Lieu of Foreclosure - Individual to a Trust effectively.

Transferring a deed to a trust in California requires preparing a deed with the trust as the new owner. Use a quitclaim deed or grant deed for this transfer. Once completed, sign the document and file it with the local county recorder's office to secure your Santa Clarita California Deed in Lieu of Foreclosure - Individual to a Trust.