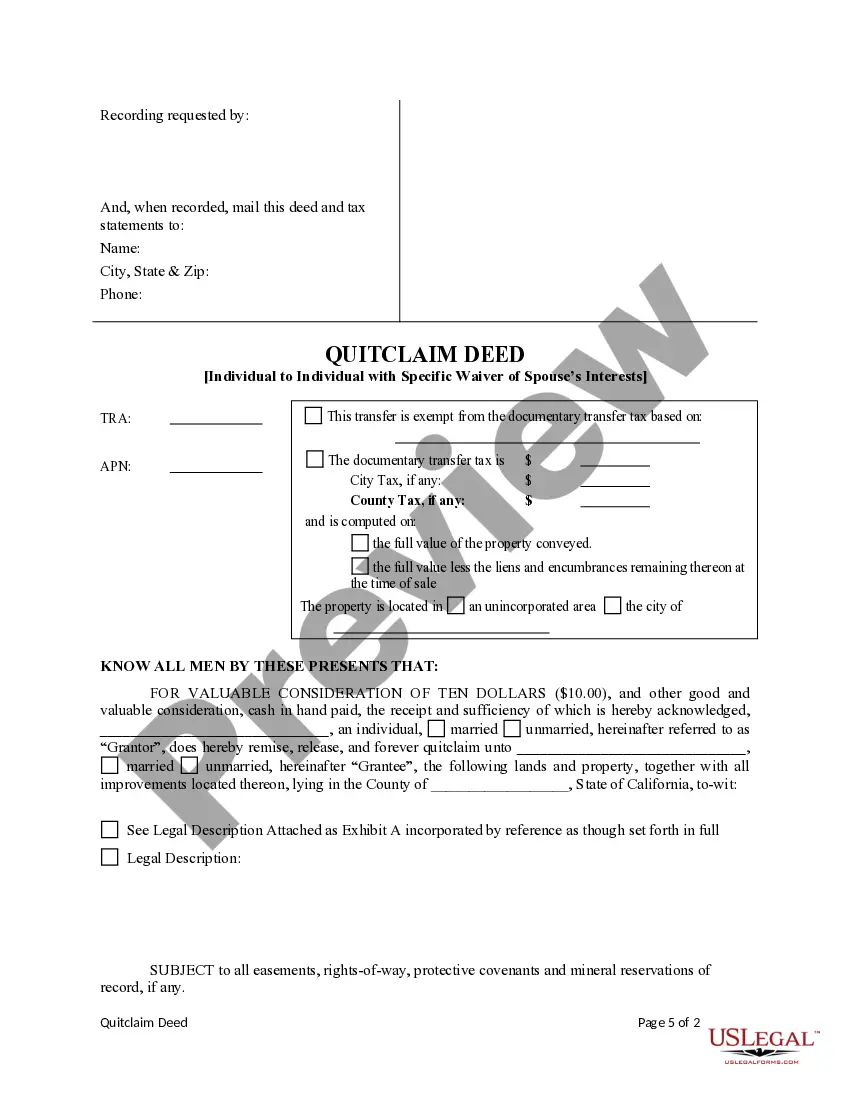

This form is a Quitclaim Deed where the Grantor is an Individual and the Grantee is an Individual. Grantor conveys and quitclaims the described property to Grantee. The form includes a specific waiver of any interest on the part of Grantor's spouse. This deed complies with all state statutory laws.

Santa Clara California Quitclaim Deed from Individual to Individual with Specific Waiver of Spouse's Interests

Description

How to fill out California Quitclaim Deed From Individual To Individual With Specific Waiver Of Spouse's Interests?

If you are looking for a suitable form, it’s hard to discover a more user-friendly platform than the US Legal Forms site – likely the most extensive collections on the web.

With this collection, you can discover a vast number of templates for both business and personal use categorized by type and location, or keywords.

With our premium search feature, locating the most current Santa Clara California Quitclaim Deed from Individual to Individual with Specific Waiver of Spouse's Interests is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the account creation process.

Retrieve the template. Specify the file format and save it to your device.

- Moreover, the validity of each document is verified by a group of experienced lawyers who routinely review the templates on our site and update them in accordance with the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Santa Clara California Quitclaim Deed from Individual to Individual with Specific Waiver of Spouse's Interests is to Log In to your user account and click the Download button.

- If this is your first time using US Legal Forms, simply follow the instructions provided below.

- Ensure you have located the document you need. Review its description and utilize the Preview feature (if available) to view its content. If it doesn’t meet your requirements, use the Search bar at the top of the page to find the suitable document.

- Confirm your choice. Hit the Buy now button. Afterwards, select your desired subscription plan and enter your information to create an account.

Form popularity

FAQ

The mortgage lender will then need to give you written consent in order to remove the other party from the deeds to your house. The lender will require the change in ownership to be carried out by a solicitor.

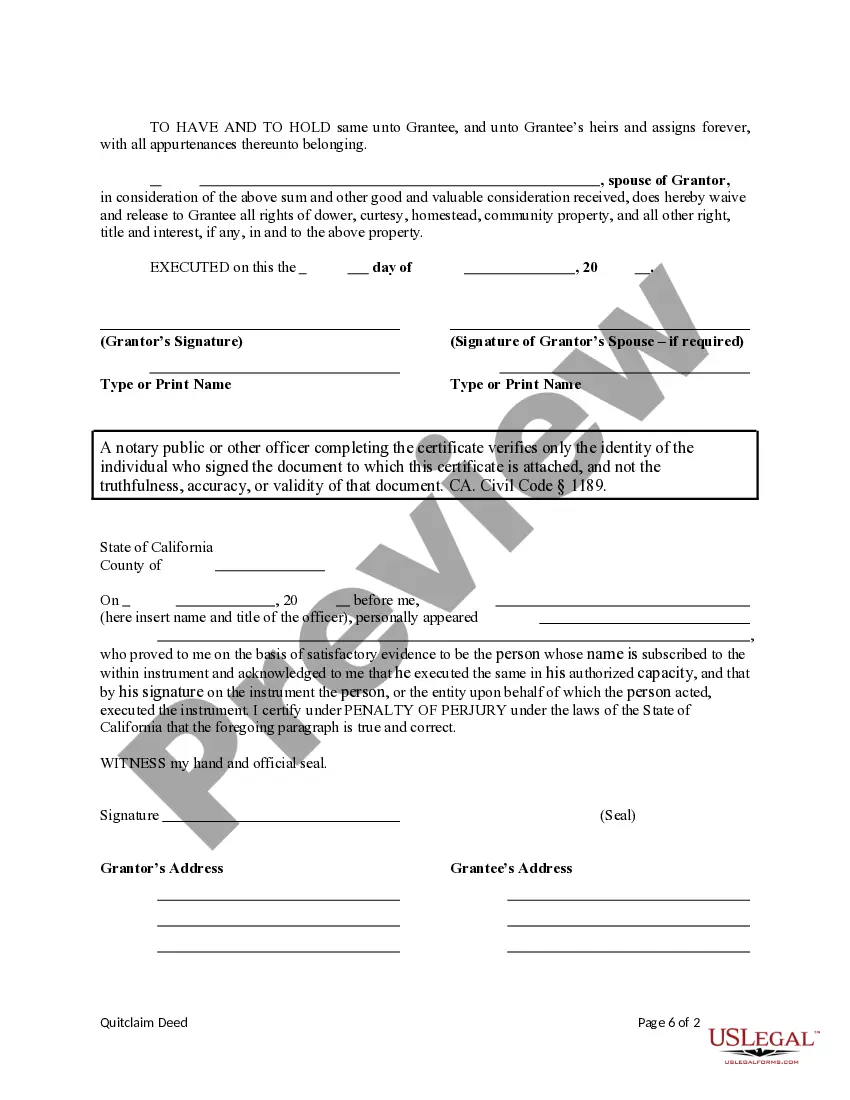

Property and debts acquired during a marriage are joint property in California. This means that each spouse has equal rights and responsibilities in the marital home and any mortgage that's secured by it. When a spouse signs a quit claim deed, he gives up all rights to the property.

You can do this through a transfer of equity. This is where a share of equity is transferred to one or multiple people, but the original owner stays on the title deeds. You'll need a Conveyancing Solicitor to complete the legal requirements for you in a transfer of equity.

It usually takes four to six weeks to complete the legal processes involved in the transfer of title.

California mainly uses two types of deeds: the ?grant deed? and the ?quitclaim deed.? Most other deeds you will see, such as the common ?interspousal transfer deed,? are versions of grant or quitclaim deeds customized for specific circumstances.

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

To transfer ownership, disclaim ownership, or add someone to title, you will choose between a ?grant deed? and a ?quitclaim deed.? Spouses/domestic partners transferring property between each other may choose an ?interspousal deed.? Blank deeds are available at saclaw.org/forms.

Calculating real property transfer tax is straightforward. Currently, most counties charge $1.10 per $1000 value of transferred real property in California. For example, on real property valued at $20,000, the county documentary tax would be $22.00.

No, you cannot be removed from a deed without your express consent. If you hold title to a property and are listed as an owner on your deed, then your interest in the property cannot be transferred to another party without your knowledge.

Review the divorce decree to determine who gets the real estate. Obtain a copy of the prior deed to the property. Create a new deed to transfer the property as described in the divorce decree. Submit the new deed to the city or county land records for recording.