This form is a generic example that may be referred to when preparing such a form.

Sunnyvale California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually

Description

How to fill out California Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

Utilize the US Legal Forms and gain immediate access to any form template you need.

Our advantageous website with a vast collection of templates enables you to locate and acquire nearly any document example you want.

You can save, complete, and sign the Sunnyvale California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually in just a few minutes, instead of spending hours searching the web for the appropriate template.

Using our library is an excellent method to enhance the security of your document filing.

If you don’t have an account yet, follow the steps below.

Navigate to the page with the form you require. Ensure that it is the document you were looking for: verify its title and description, and make use of the Preview option when available. Alternatively, utilize the Search field to find the needed one.

- Our expert legal professionals frequently review all the documents to ensure that the forms are pertinent to a specific state and in conformity with the latest laws and regulations.

- How can you obtain the Sunnyvale California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually.

- If you already have a subscription, simply Log In to your account.

- The Download button will be active on all the samples you view.

- Additionally, you can retrieve all the previously saved files in the My documents section.

Form popularity

FAQ

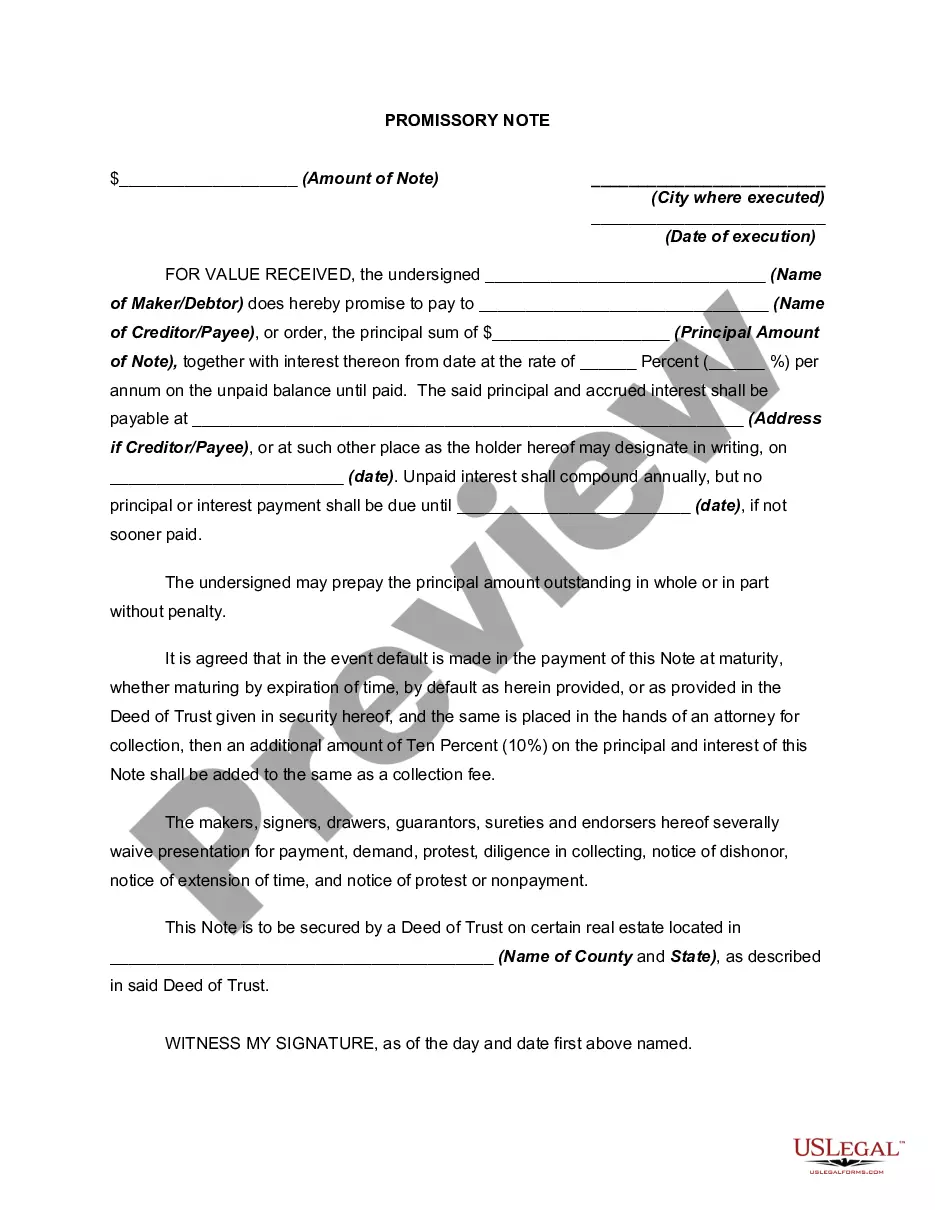

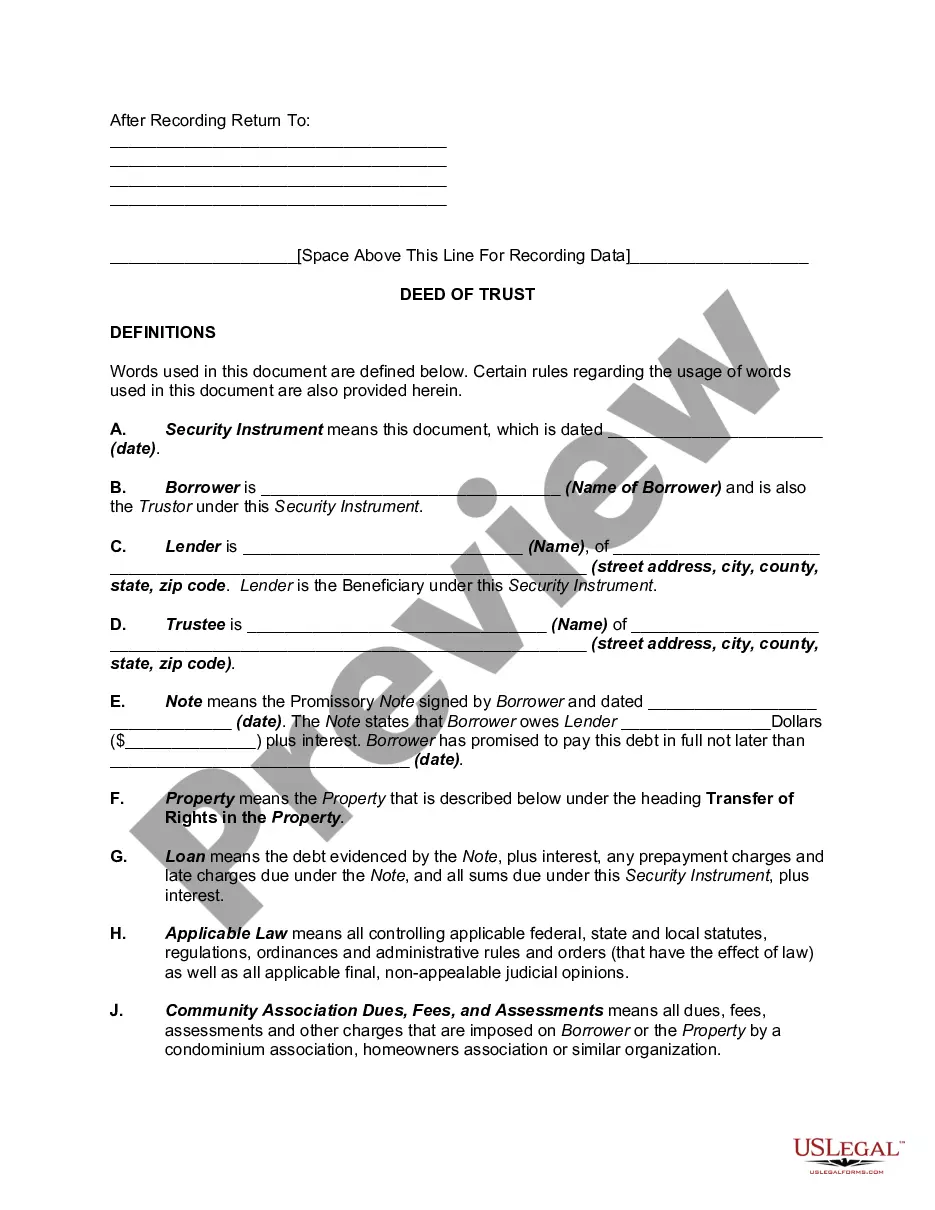

Filling out a Sunnyvale California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually involves several key steps. Start by entering the date, the borrower's name, and the lender's name. Next, specify the principal amount, detail the repayment structure, and outline the interest terms, including the compounding schedule. Lastly, ensure both parties sign the document to make it legally binding, potentially using a platform like uslegalforms for support.

Not all notes require a maturity date, particularly in situations where the parties agree on flexible terms. In contexts like a Sunnyvale California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, the absence of a maturity date can offer significant advantages. This flexibility allows borrowers to align repayments with their financial circumstances without the constraints of a strict timeline.

A promissory note can be deemed invalid for various reasons, including lack of essential terms, absence of signatures, or if it involves illegal considerations. An incomplete or ambiguous Sunnyvale California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually may lead to disputes or difficulties in enforcement. To avoid such pitfalls, ensure that all necessary components are present and clearly defined. Resources like uslegalforms can assist in validating your document.

Yes, promissory notes are legally binding in California, as long as they meet specific requirements. To be enforceable, a Sunnyvale California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually must include the amount owed, the interest rate, and the terms of repayment. Therefore, it is crucial for borrowers and lenders to understand their rights and obligations under California law. Using platforms like uslegalforms can help ensure your documentation meets legal standards.

Calculating the maturity value for a $5,000 note at 12% over 60 days confirms the final amount is indeed $5,600. The interest accrued in this instance totals $600, calculated based on the time and rate. This example emphasizes how a Sunnyvale California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually can lead to tangible financial outcomes. Hence, knowing the interest calculations can broaden a borrower’s understanding of their potential financial commitments.

The maturity of a promissory note refers to the specific date on which the borrower must repay the principal and interest to the lender. This date is crucial for both parties involved and creates a clear timeline for financial obligations. For a Sunnyvale California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, understanding that the maturity date signifies the end of the note's term is vital. This clarity fosters better planning for repayment and ensures compliance with agreed terms.

The maturity value of a promissory note is the total amount due at the note's maturity date, including both the principal and any interest that has accrued. For those using a Sunnyvale California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, this means calculating the total amount owed as time progresses. Therefore, keeping track of interest compounding is essential to determine the final repayment amount accurately. It becomes evident that good records of these calculations benefit both parties.

To find the maturity value of a 90-day note at 12%, calculate the interest for that time period first. The interest would be $300, making the maturity value $10,300. This process is similar to computing the value of a Sunnyvale California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, where interest accumulates until the note matures. Thus, understanding this calculation helps clarify the overall financial expectations.