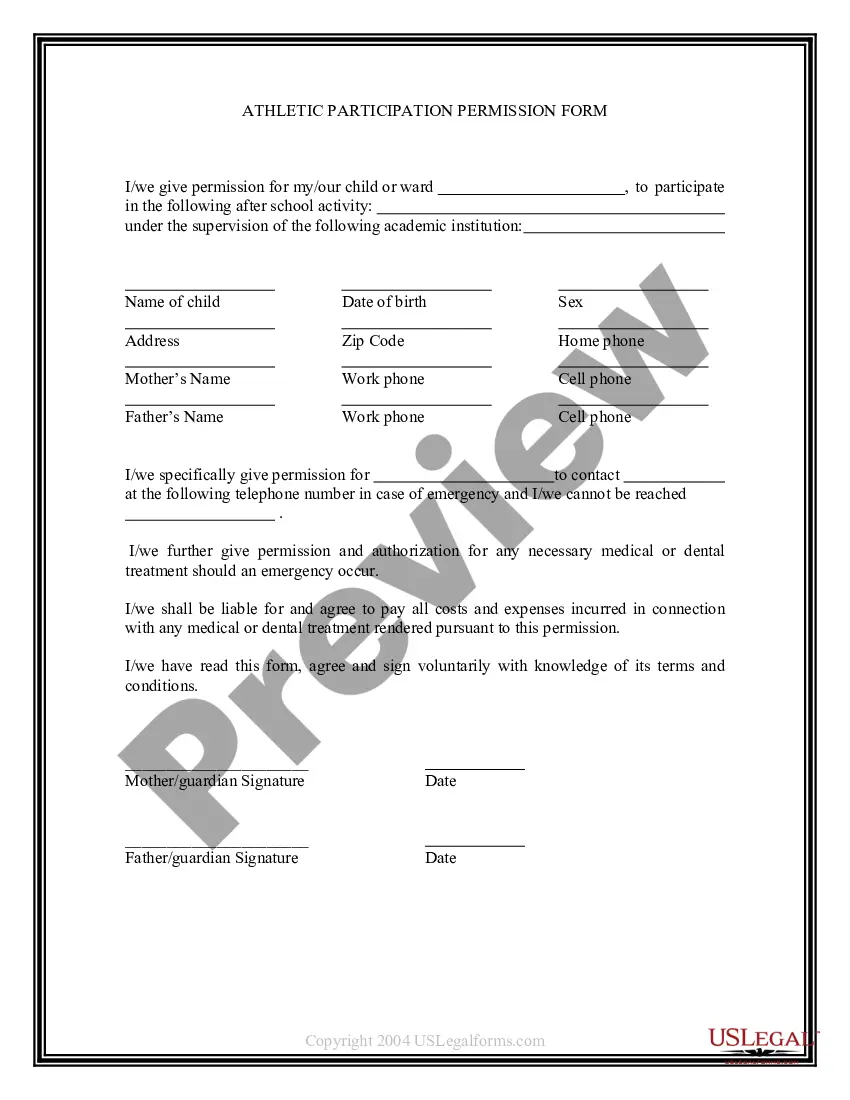

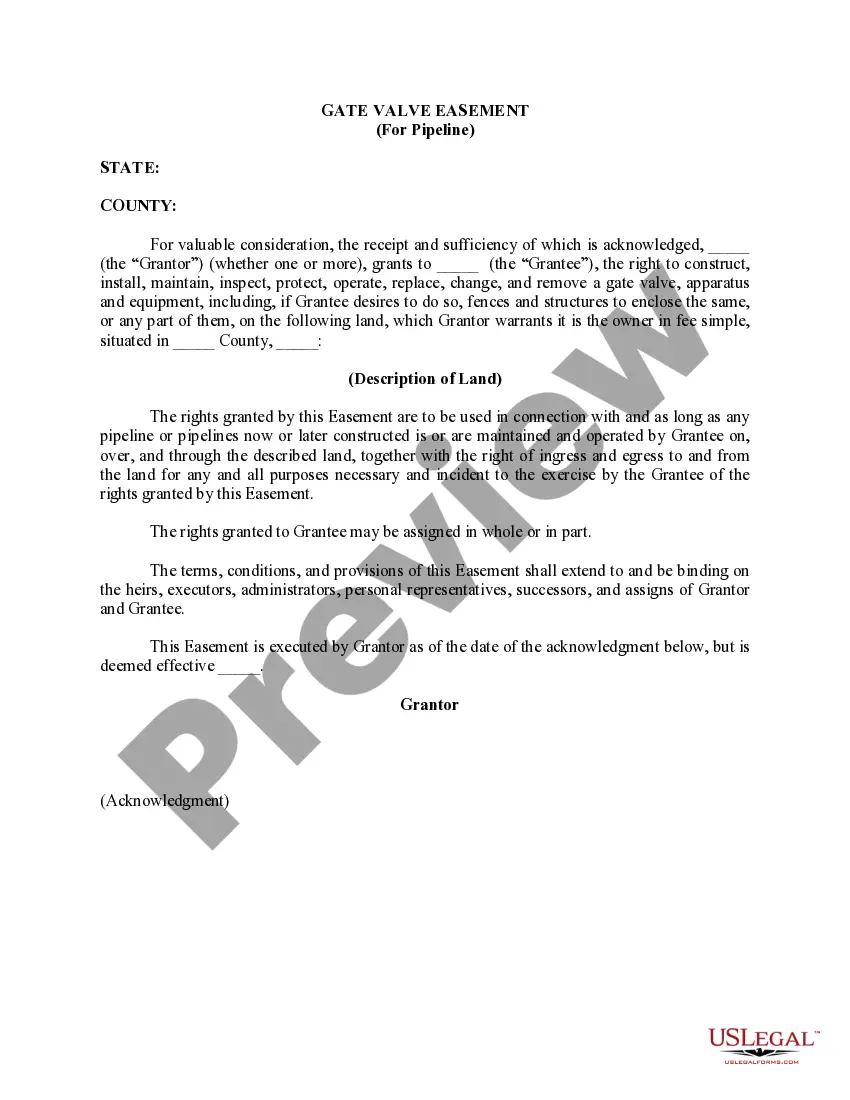

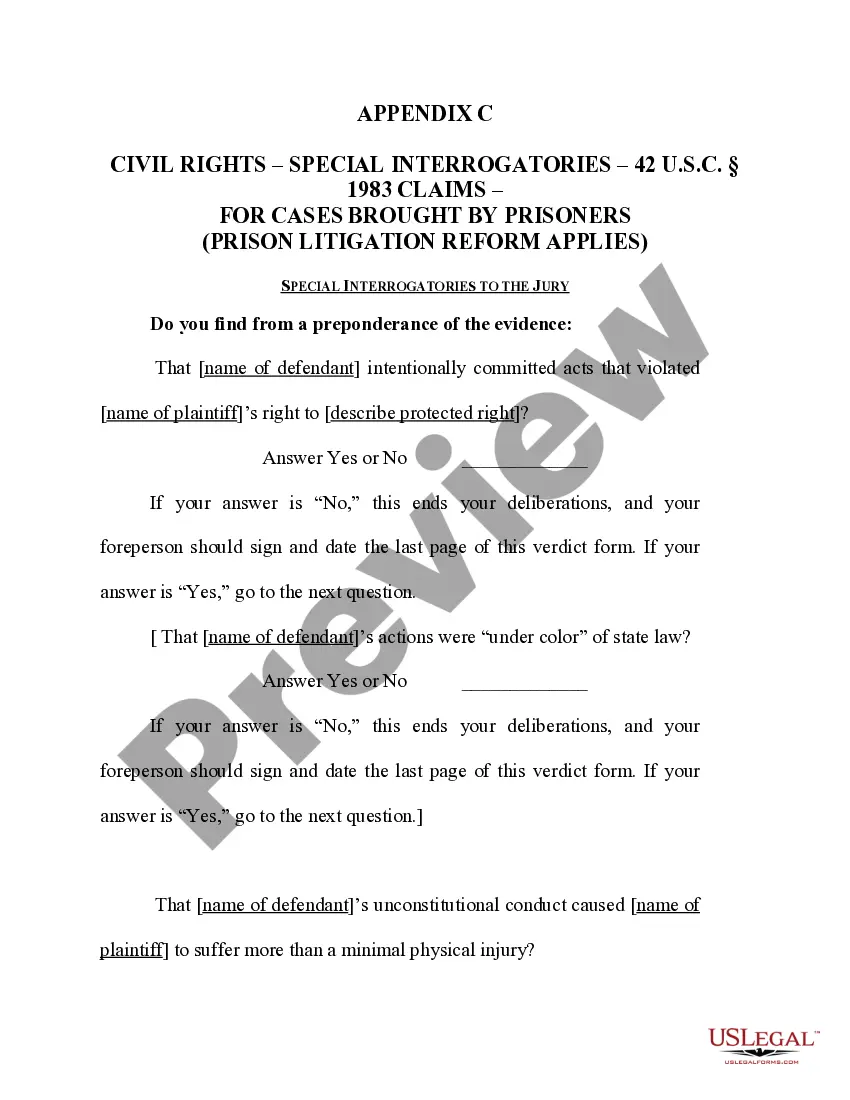

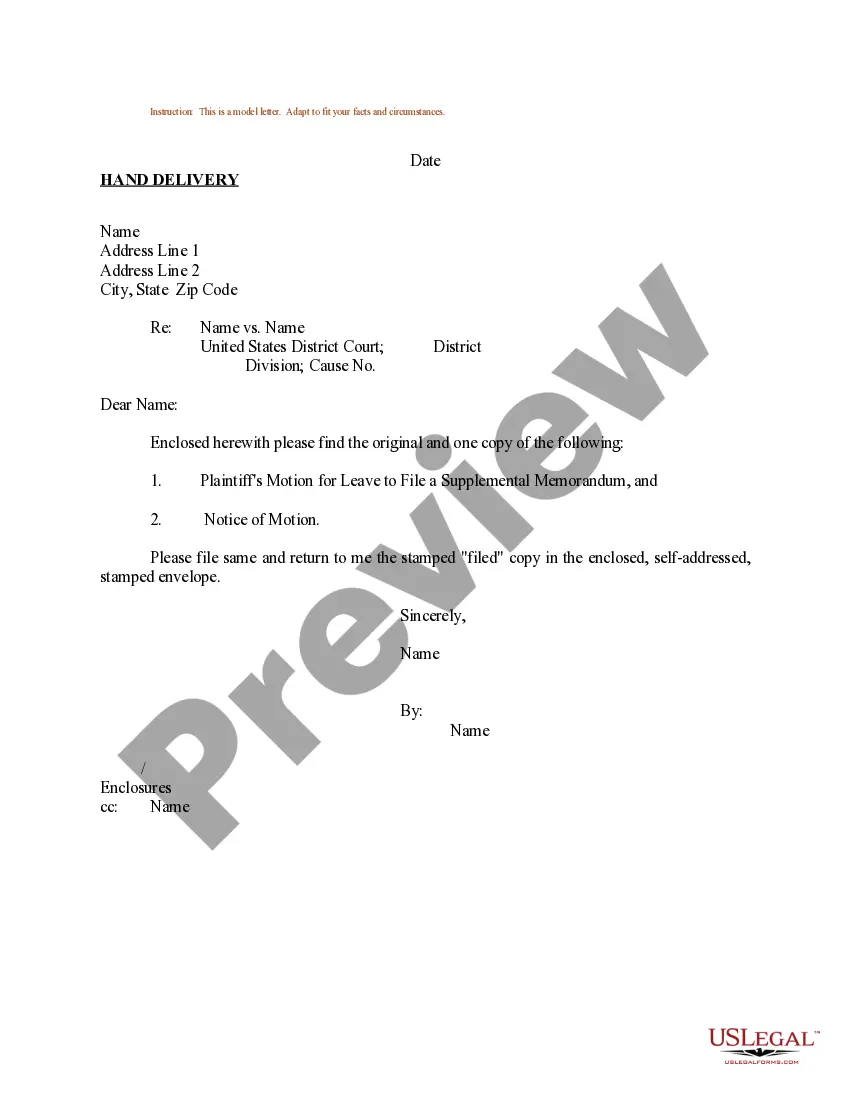

This form is a generic example that may be referred to when preparing such a form.

Long Beach California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually

Description

How to fill out California Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

If you are seeking a legitimate form template, it's incredibly challenging to discover a more user-friendly service than the US Legal Forms website – arguably the largest collections on the internet.

With this collection, you can obtain thousands of templates for business and personal use categorized by type and region, or searchable keywords.

With our top-notch search functionality, locating the most current Long Beach California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is as simple as 1-2-3.

Verify your choice. Click on the Buy now button. Then, select your desired subscription plan and provide the necessary information to register for an account.

Complete the payment process. Utilize your credit card or PayPal account to finish the registration procedure.

- Furthermore, the accuracy of every document is validated by a team of expert attorneys who routinely assess the templates on our platform and update them in accordance with the latest state and county regulations.

- If you are already familiar with our service and possess an account, all you need to access the Long Beach California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is to Log In to your user account and select the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have opened the form you require. Review its description and utilize the Preview tool to inspect its contents.

- If it doesn't meet your requirements, use the Search bar at the top of the page to locate the correct document.

Form popularity

FAQ

Notes can be issued with any time period, but the most common note periods are less than one year. In other words, the contract and loan will mature in less than one year from when it was issued. Notes that mature in less than one year don't typically state the maturity date on their face, but some do.

Compound interest is calculated by multiplying the initial loan amount, or principal, by the one plus the annual interest rate raised to the number of compound periods minus one. This will leave you with the total sum of the loan including compound interest.

A good personal loan interest rate depends on your credit score: 740 and above: Below 8% (look for loans for excellent credit) 670 to 739: Around 14% (look for loans for good credit) 580 to 669: Around 18% (look for loans for fair credit)

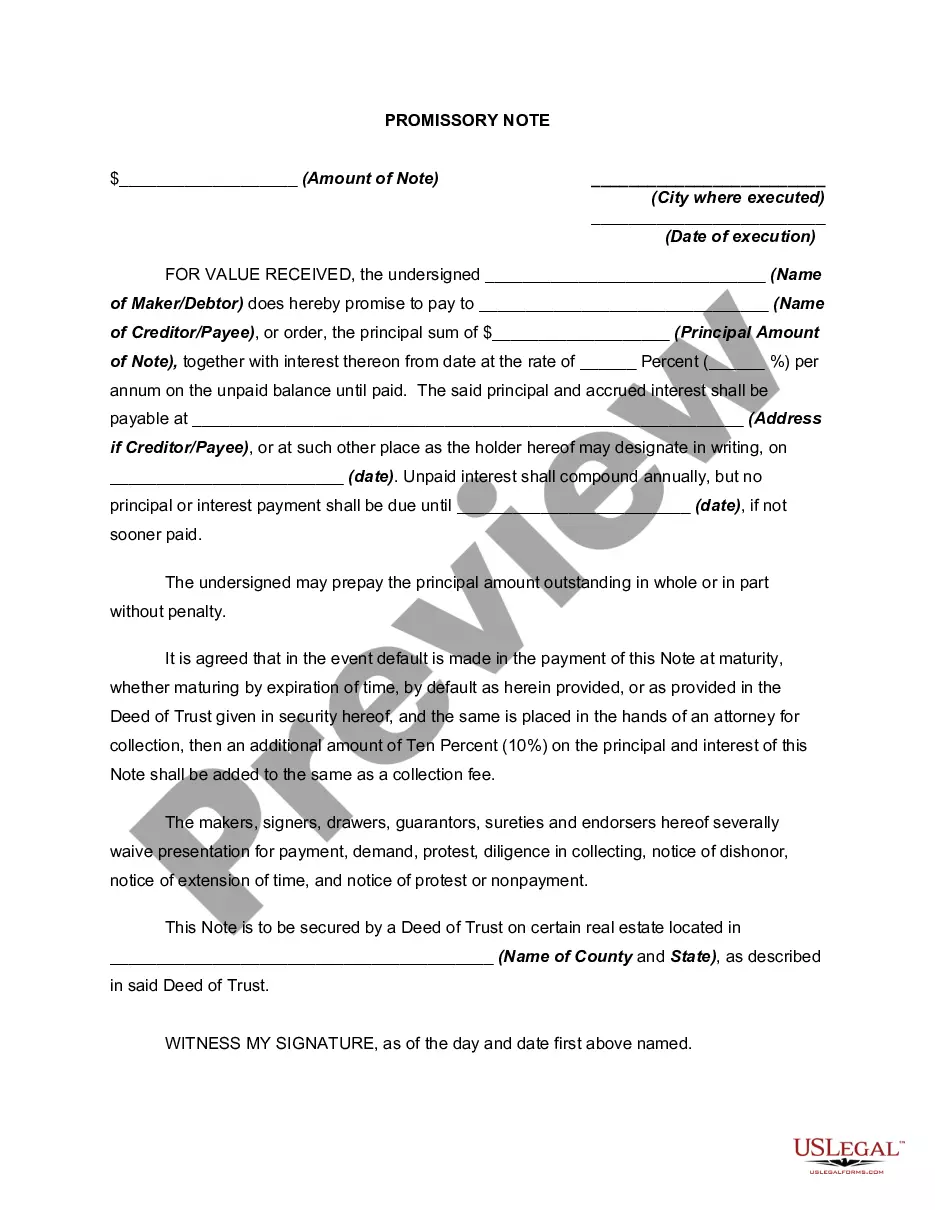

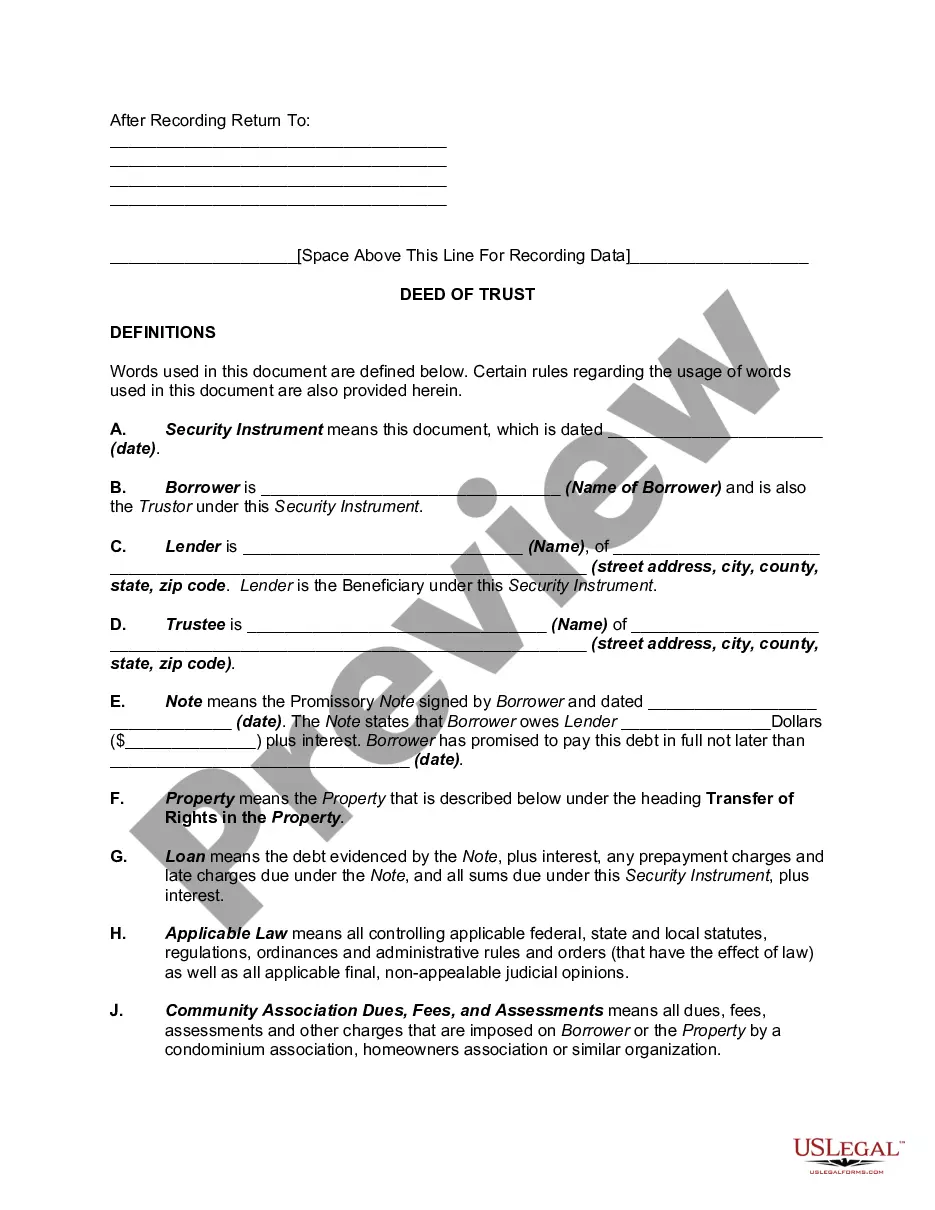

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

interest loan is one with an annual percentage rate above 36%, the highest APR that most consumer advocates consider affordable. Highinterest loans are offered by online and storefront lenders that promise fast funding and easy applications, sometimes without checking your credit.

A promissory note is a written promise to pay a specified amount of money with, or without, interest at a stated time or on demand. The main purpose of a promissory note is to serve as written evidence of the amount loaned, the interest rate, if any, and the terms under which the loan is to be repaid.

Based on discussions with professionals who buy and sell notes, the market rate of return for a privately held note typically ranges from 12% for a well collateralized note with a strong payment history to 25% for an uncollateralized note.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note. This time period starts from the due date that's listed on the note.

According to Bankrate, people with a good credit score of 720?850 get an average loan interest rate of 10.3?12.5% from banks or online lenders. Meanwhile, people with credit scores of 630?689 pay an average of 17.8?19.9%.