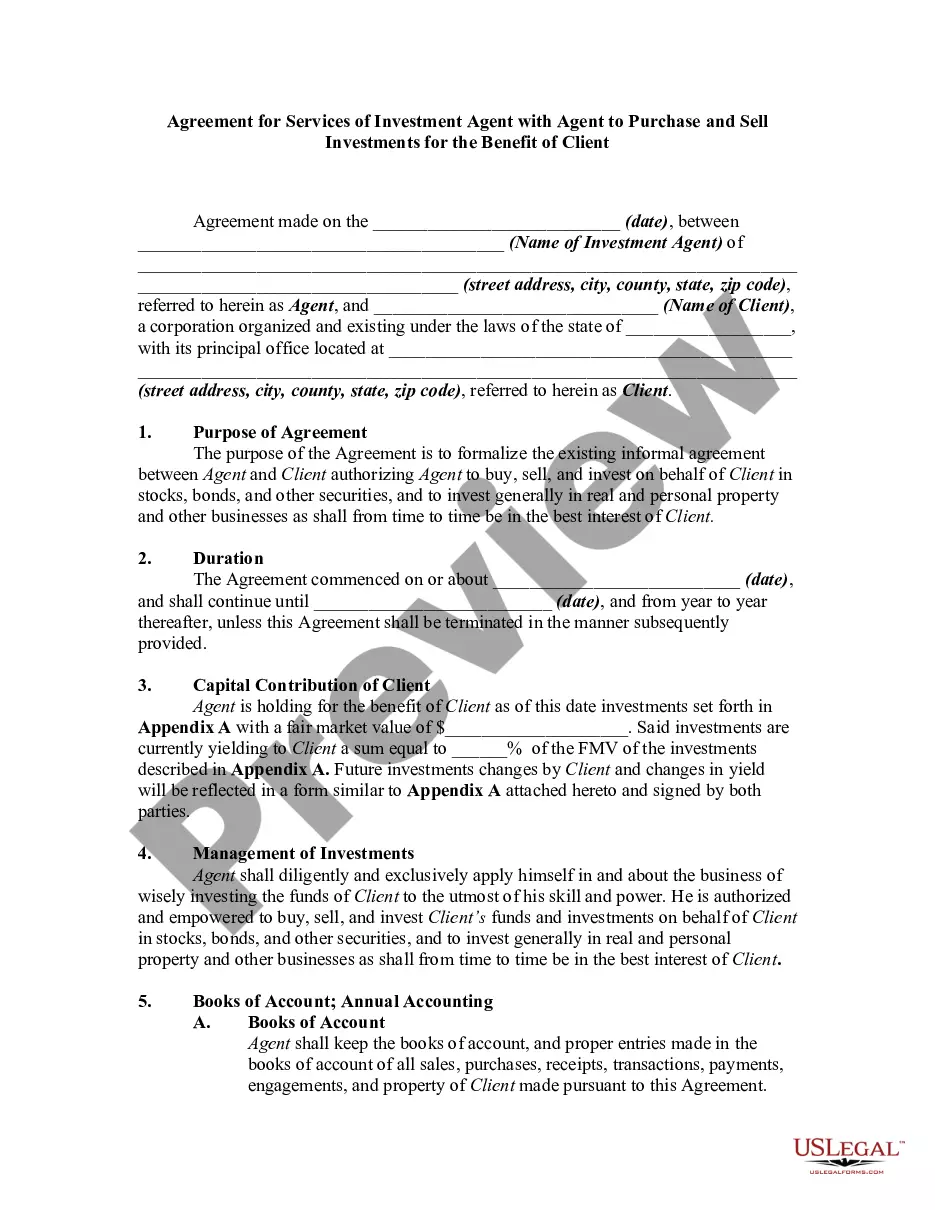

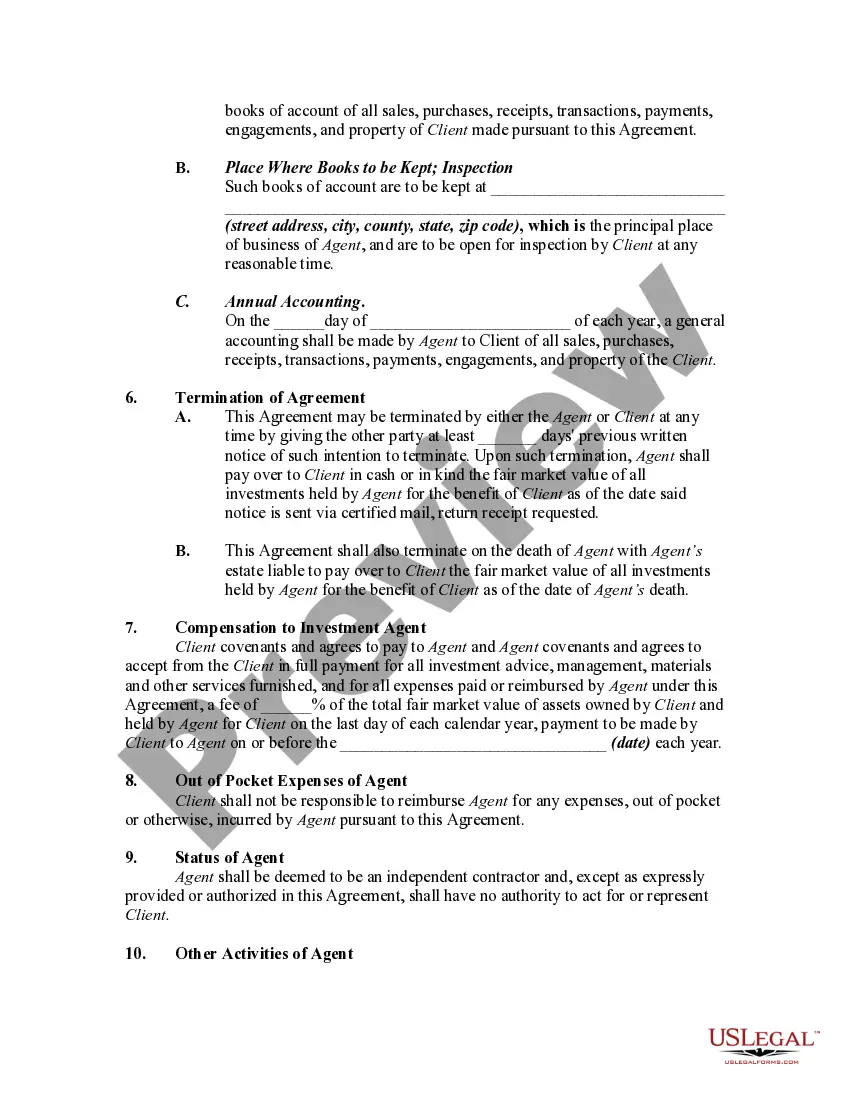

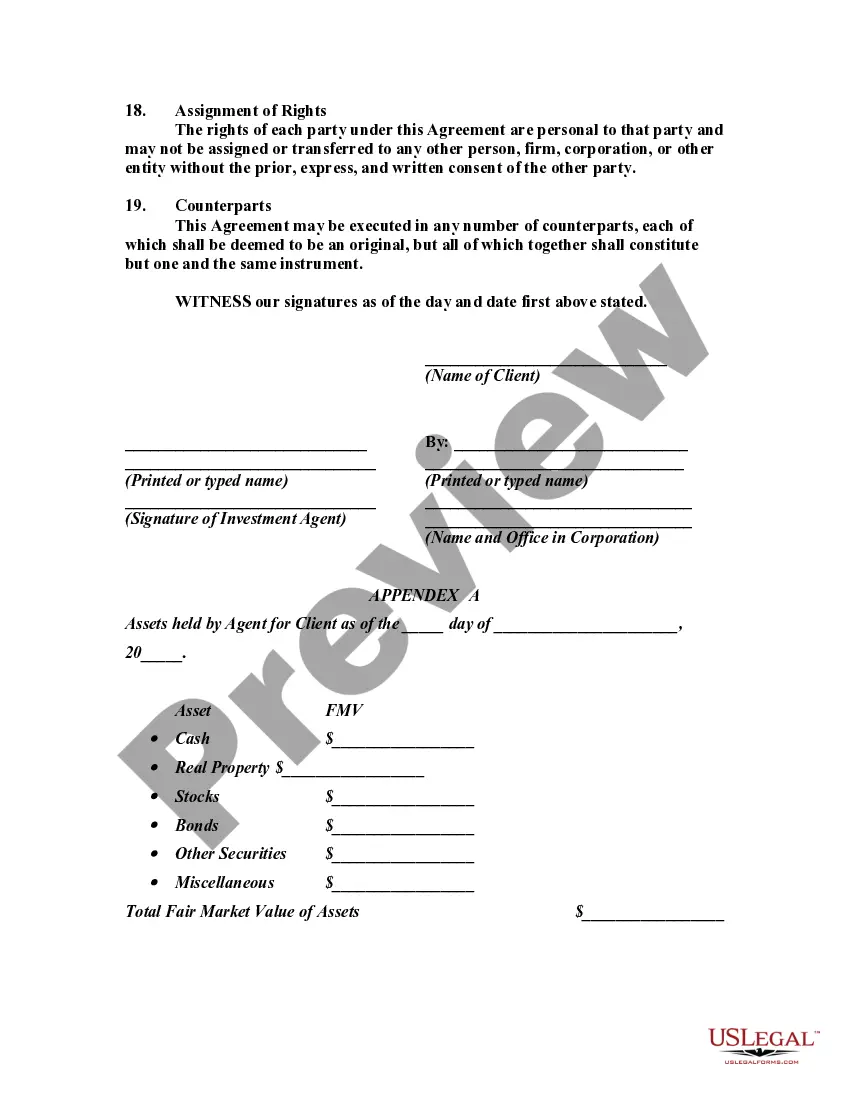

This form is an agreement between an independent investment agent (or consultant) and a corporation whereby the investment agent actually holds the investments as well as makes them for the client. We are assuming that the investment agent is duly licensed to perform this activity and will make any necessary filings with the state of California and the United States.

Rialto California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client

Description

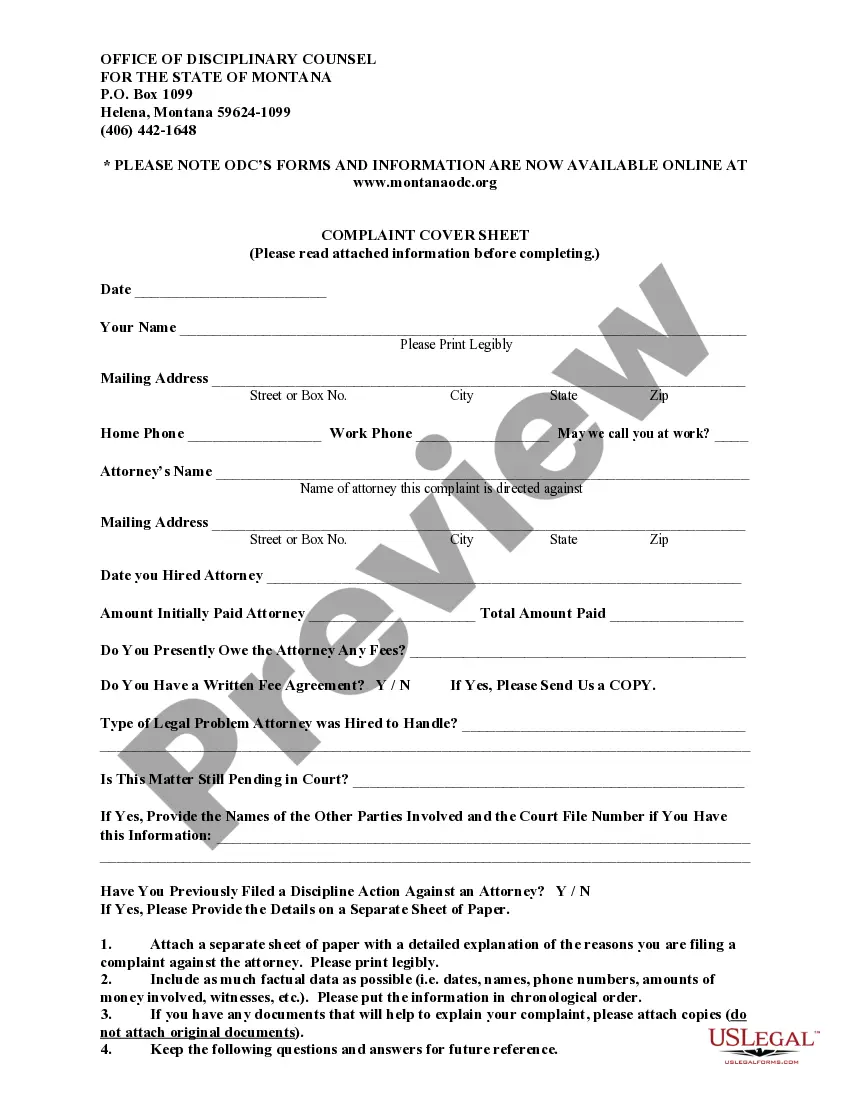

How to fill out California Agreement For Services Of Investment Agent With Agent To Purchase And Sell Investments For The Benefit Of Client?

If you’ve previously availed yourself of our service, Log In to your account and retrieve the Rialto California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client on your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to obtain your file.

You have continuous access to every document you have purchased: you can locate it in your profile within the My documents section whenever you need to use it again. Utilize the US Legal Forms service to conveniently locate and save any template for your personal or professional purposes!

- Ensure you’ve located an appropriate document. Browse through the description and utilize the Preview option, if available, to verify whether it suits your requirements. If it’s not suitable, employ the Search tab above to find the right one.

- Purchase the template. Hit the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Acquire your Rialto California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client. Choose the file format for your document and save it onto your device.

- Complete your document. Print it or use online professional editors to fill it out and sign it digitally.

Form popularity

FAQ

For example, if you're an accredited investor, you can invest in restricted securities, venture capital, and hedge funds. 5 These investments come with significant risks, but also the potential for high rewards. Non-accredited investors do not have the opportunity to profit from these investments.

Individuals who want to become accredited investors, must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an

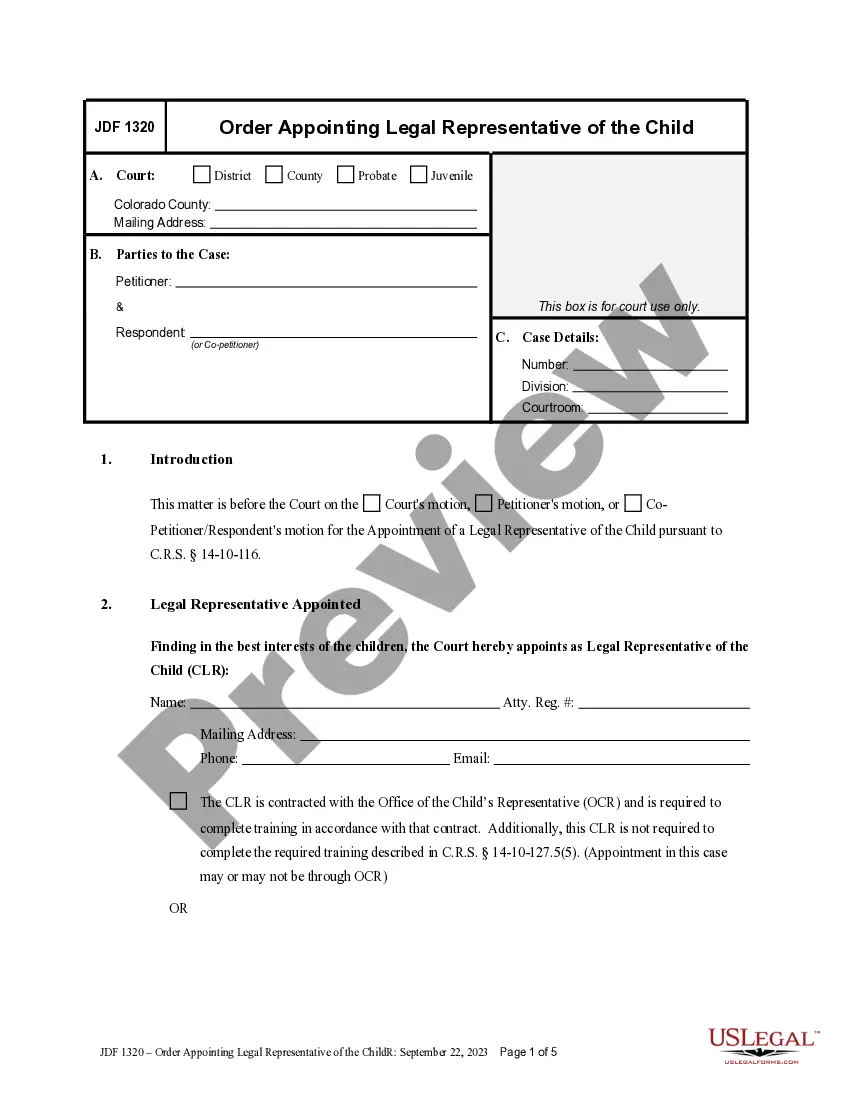

What to Include in an Investor Agreement The names and addresses of the parties. The purpose of the investment. The date of the investment. The structure of the investment. The signatures of the parties.

If you are accredited based on assets, you can provide recent brokerage, bank account, or similar statements clearly showing your name, the date, and the value of your account(s).

An investment contract is a broad category of security under The Securities Act of 1933.

The SEC defines an accredited investor as either: an individual with gross income exceeding $200,000 in each of the two most recent years or joint income with a spouse or partner exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

Investment contracts are agreements wherein one party invests money with the expectation of receiving a return on investment (ROI). These contracts are used in various industries, including real estate.

Qualified purchasers typically have broader investment opportunities then accredited investors. After all, if an investor meets the $5M investment threshold for qualified purchaser status, they will also typically meet the $1M net worth threshold for accredited investor status?meaning they can invest in 3(c)(1) funds.

Generally speaking, investment in the contract is the total amount of money the policyholder has contributed. Investment in the contract is the principal amount of money that the holder has invested. This term, investment in the contract, generally applies to fixed, indexed, and variable annuities.

There are four main investment types, or asset classes, that you can choose from, each with distinct characteristics, risks and benefits. Growth investments.Shares.Property.Defensive investments.Cash.Fixed interest.