A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

Thousand Oaks California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee

Description

How to fill out California Disclaimer By Beneficiary Of All Rights Under Trust And Acceptance Of Disclaimer By Trustee?

Regardless of one's social or professional standing, completing legal paperwork is an unfortunate requirement in our contemporary society.

Often, it’s nearly impossible for an individual lacking legal education to create such documents from scratch due to the complicated terminology and legal subtleties they entail.

This is where US Legal Forms can be a lifesaver.

If you are new to our library, please follow these steps before downloading the Thousand Oaks California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

Make sure the form you selected is appropriate for your location, as the regulations of one state or area do not apply to another. Review the document and read a brief description (if available) of situations for which the paper may be utilized. If the form you chose does not satisfy your requirements, you may start over and search for the desired form. Click Buy now and select the subscription package that suits you best. Use your Log In details or create a new account. Choose the payment method and proceed to download the Thousand Oaks California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee once payment has been processed. You’re all set! Now you can either print the document or fill it out online. If you encounter any issues accessing your purchased forms, you can quickly find them in the My documents section. Regardless of the issue you’re attempting to address, US Legal Forms has you covered. Give it a try today and see for yourself.

- Our platform provides an extensive collection of over 85,000 ready-to-use, state-specific documents that cater to just about any legal need.

- US Legal Forms is also an excellent resource for associates or legal advisors who wish to enhance their efficiency by utilizing our DIY papers.

- Whether you require the Thousand Oaks California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee or any other document relevant to your state or locality, with US Legal Forms, everything is readily available.

- Here’s how you can quickly acquire the Thousand Oaks California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee using our reliable platform.

- If you’re already a subscriber, feel free to Log In to your account to download the necessary document.

Form popularity

FAQ

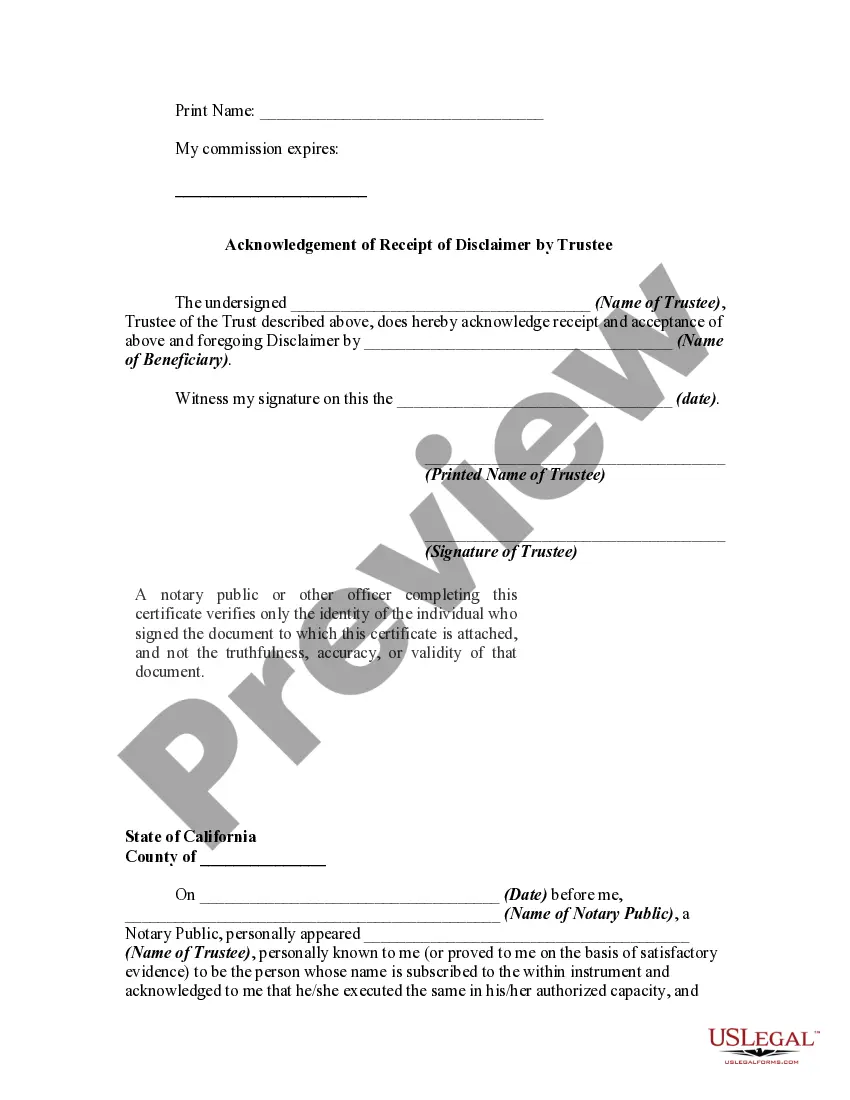

The trustee's duty to inform beneficiaries in California entails regularly updating them on trust matters, including asset values and distribution timelines. This duty is crucial for ensuring beneficiaries understand their rights, especially regarding a Thousand Oaks California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. Clear communication helps prevent misunderstandings and disputes.

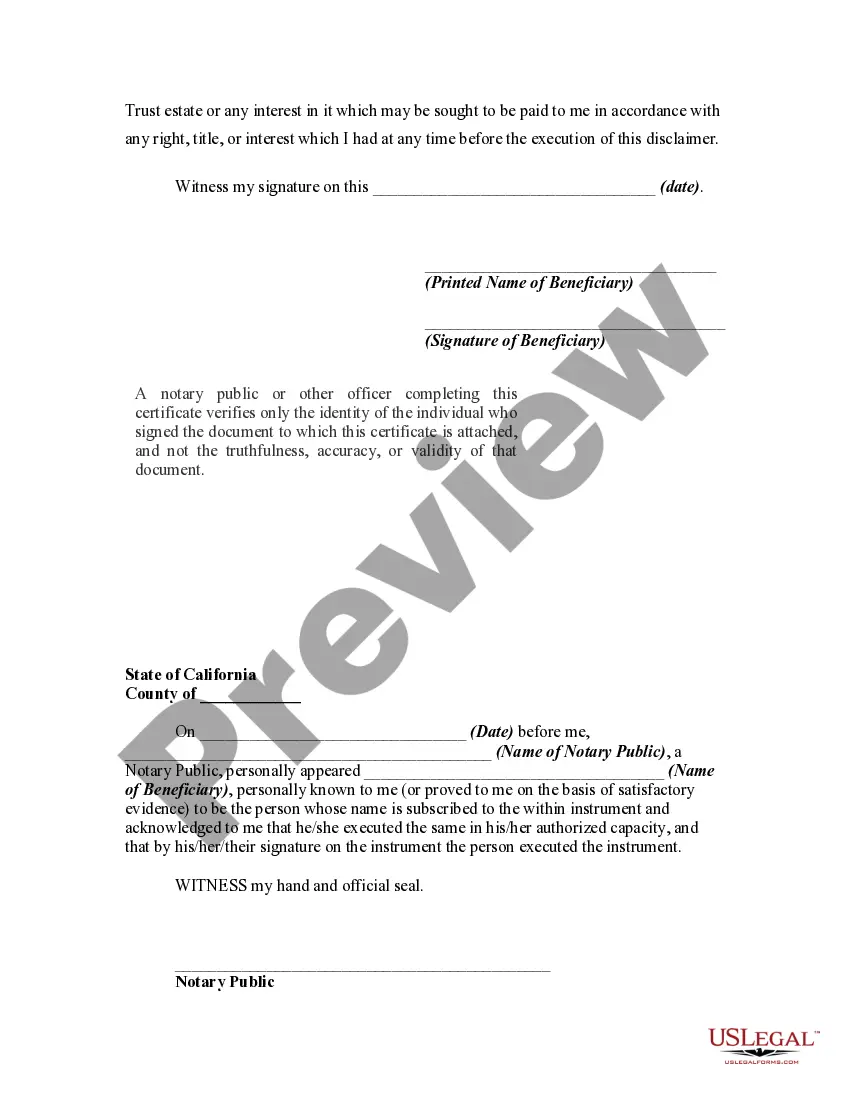

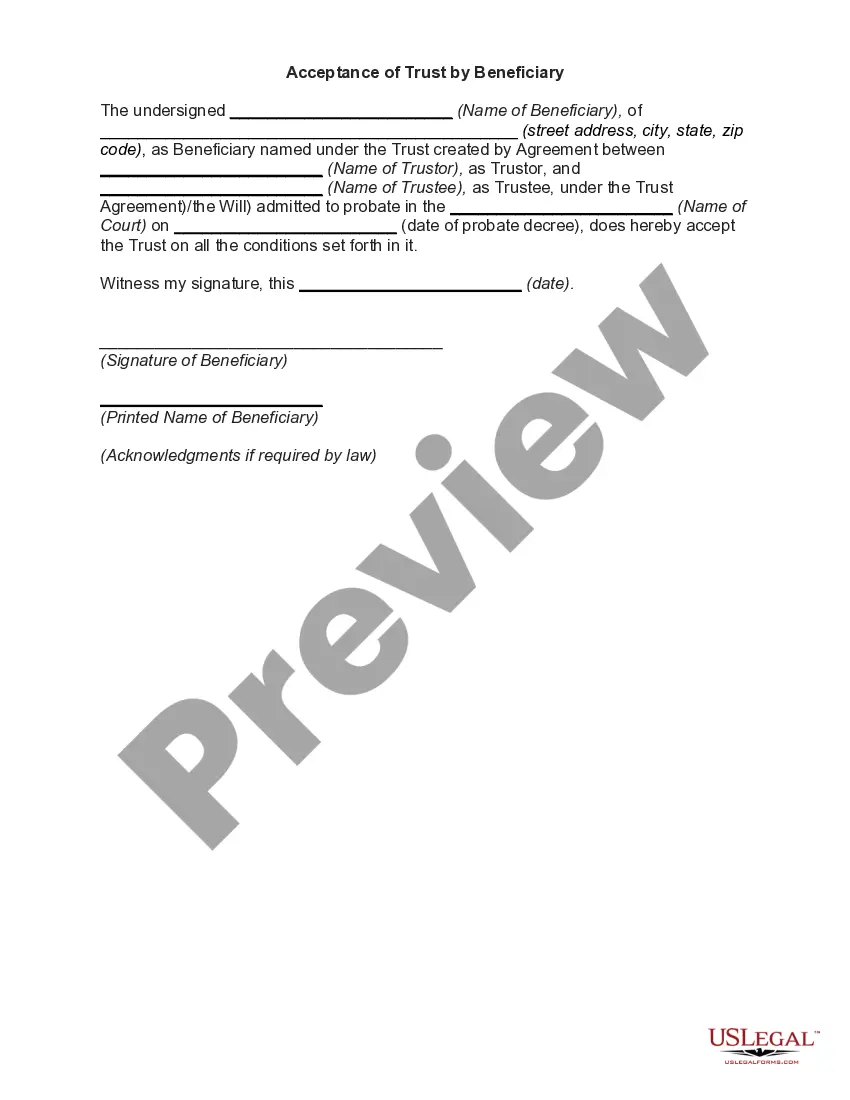

A disclaimer by a beneficiary of a trust is a formal refusal to accept assets or rights under the trust. This process can be useful for tax planning or personal reasons and must comply with the applicable laws and regulations in California. Understanding disclaimers is crucial; they can significantly impact trust distributions and administration.

The trustee's duty to keep beneficiaries informed involves providing regular updates on trust administration and asset management. This includes sharing financial statements, reporting on distributions, and communicating any relevant changes. In Thousand Oaks, California, fulfilling this duty helps maintain a positive relationship between trustees and beneficiaries.

Yes, a trustee must communicate with beneficiaries regularly to keep them informed of the trust's status. This includes providing updates regarding distributions, investments, and any changes that may affect the trust. Effective communication fosters trust and transparency, reinforcing the trustee's duty in Thousand Oaks, California.

In California, trustees have a clear duty to inform beneficiaries about the nature and value of the trust assets. This obligation also includes notifying beneficiaries about significant changes and the terms of the trust. Failure to do so could lead to disputes, emphasizing the importance of clear communication in the administration of the trust.

Beneficiaries have essential rights under a trust, including access to trust information and distributions as specified in the trust document. In Thousand Oaks, California, beneficiaries can enforce their rights by requesting relevant documents from trustees. Understanding your rights is vital for ensuring compliance and protecting your interests as a beneficiary.

A disclaimer of inheritance typically does not require notarization in California, but it is recommended for added legal assurance. Following the protocols outlined in the Thousand Oaks California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee can provide you with the necessary information regarding your disclaimer's validity. Always consult a legal professional for tailored advice.

When drafting an inheritance Disclaimer letter, include a clear statement of disclaimer, your relationship to the deceased, and the specific assets you are refusing. Aim to follow the formal structure provided by the Thousand Oaks California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee for guidance on legal requirements. Consider advising the executor or trustee of your decision promptly.

To write a disclaimer letter for inheritance, start by clearly stating your intent to reject the inheritance, along with your name and the specific details of the estate. Follow the structure recommended by the Thousand Oaks California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee to ensure your letter meets legal standards. Sending the letter to the appropriate party and retaining a copy for your records is essential.

Yes, inheritance can impact your tax obligations and may need to be reported on your income tax return. Depending on your situation, you may find the resource of the Thousand Oaks California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee beneficial in understanding how to proceed. It is wise to consult a tax professional for specific advice regarding declarations.