This purpose of this document is to release one of the owners of the property form the obligation of the loan which was used to purchase the property. The party being released will transfer his or her interest in the property to the other owner.

Vista California Assumption of Deed of Trust, and Release of One of Original Borrowers

Description

How to fill out California Assumption Of Deed Of Trust, And Release Of One Of Original Borrowers?

We consistently aim to minimize or bypass legal complications when handling subtle legal or financial matters.

To achieve this, we seek legal assistance which, typically, can be quite expensive.

Nonetheless, not every legal issue is similarly intricate. Many can be managed independently.

US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions.

To begin, simply Log In to your account and click the Get button next to the desired form. If you misplace the form, it can always be redownloaded from the My documents section. The process remains equally straightforward for new users! You can establish your account in just a few minutes.

- Our collection empowers you to manage your affairs without needing a lawyer's services.

- We offer access to legal form templates that are not always widely available.

- Our templates are specific to states and regions, which greatly simplifies the search process.

- Utilize US Legal Forms whenever you need to obtain and download the Vista California Assumption of Deed of Trust, and Release of One of Original Borrowers or any other form effortlessly and securely.

Form popularity

FAQ

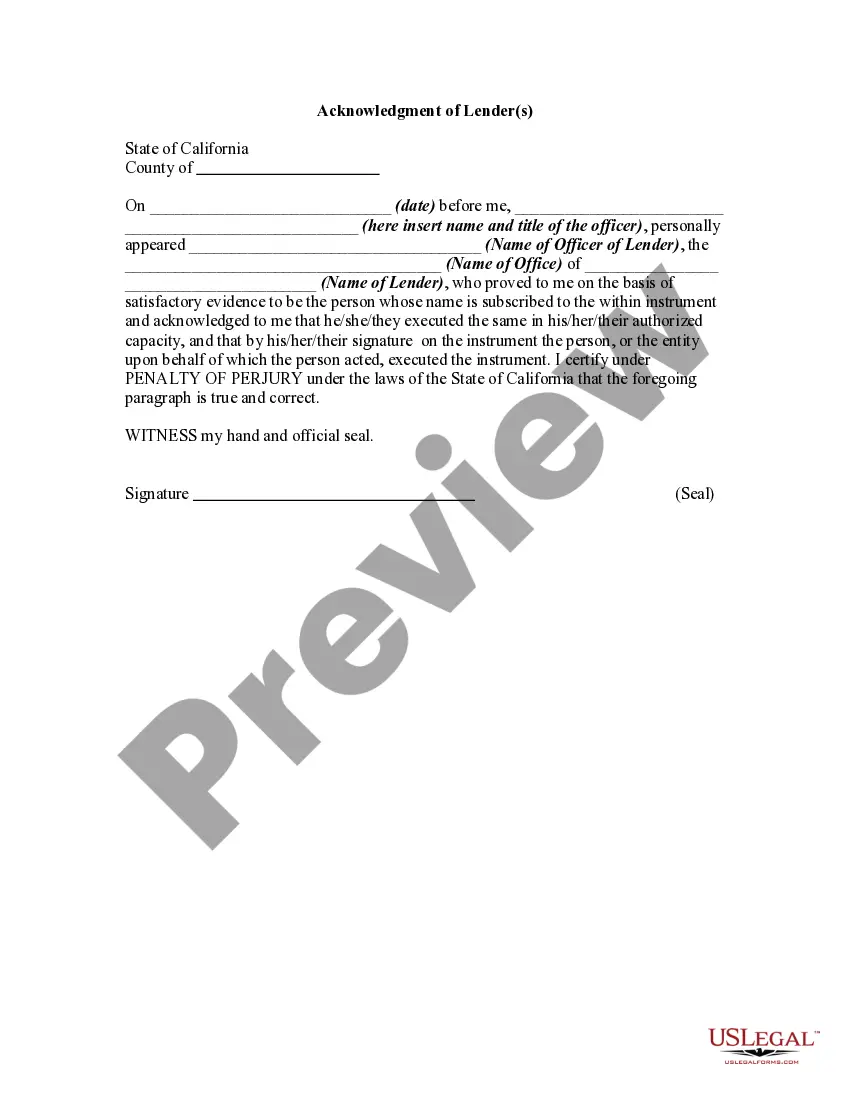

In California, a deed of trust requires a few essential elements. It must include the names of the borrower, lender, and trustee, along with a clear description of the property involved. Additionally, the deed of trust must be signed by the borrower and notarized to be enforceable. Understanding these requirements is crucial for those engaged in transactions involving the Vista California Assumption of Deed of Trust, and Release of One of Original Borrowers.

When a deed is released, it means that the lender has acknowledged that the borrower has fulfilled their obligations, effectively removing the lien on the property. This release has important implications for property ownership, as it clears the title and allows for greater freedom in managing the property. If you are involved in a Vista California assumption of deed of trust and release scenario, understanding this concept is crucial.

Filing a deed of trust in California requires you to complete the necessary paperwork, which includes details about the borrower, lender, and the property. Once you have filled the forms, you need to submit them to the county recorder's office where the property is located. For residents of Vista, California, using resources like USLegalForms can make this process easier and more efficient.

A release clause in a trust deed specifies the conditions under which the deed can be released from the lien on the property. This clause protects the original borrower by allowing the release of their obligation once certain criteria are met. Understanding this clause is essential for anyone involved in a Vista, California, assumption of deed of trust, especially when considering the release of one of the original borrowers.

To release a deed of trust in Vista, California, you need to obtain a release document from your lender or trustee. This document states that the obligations under the deed have been satisfied. Once you have it, file it with the county recorder’s office. This step is crucial, as it formally removes the deed from the public record.

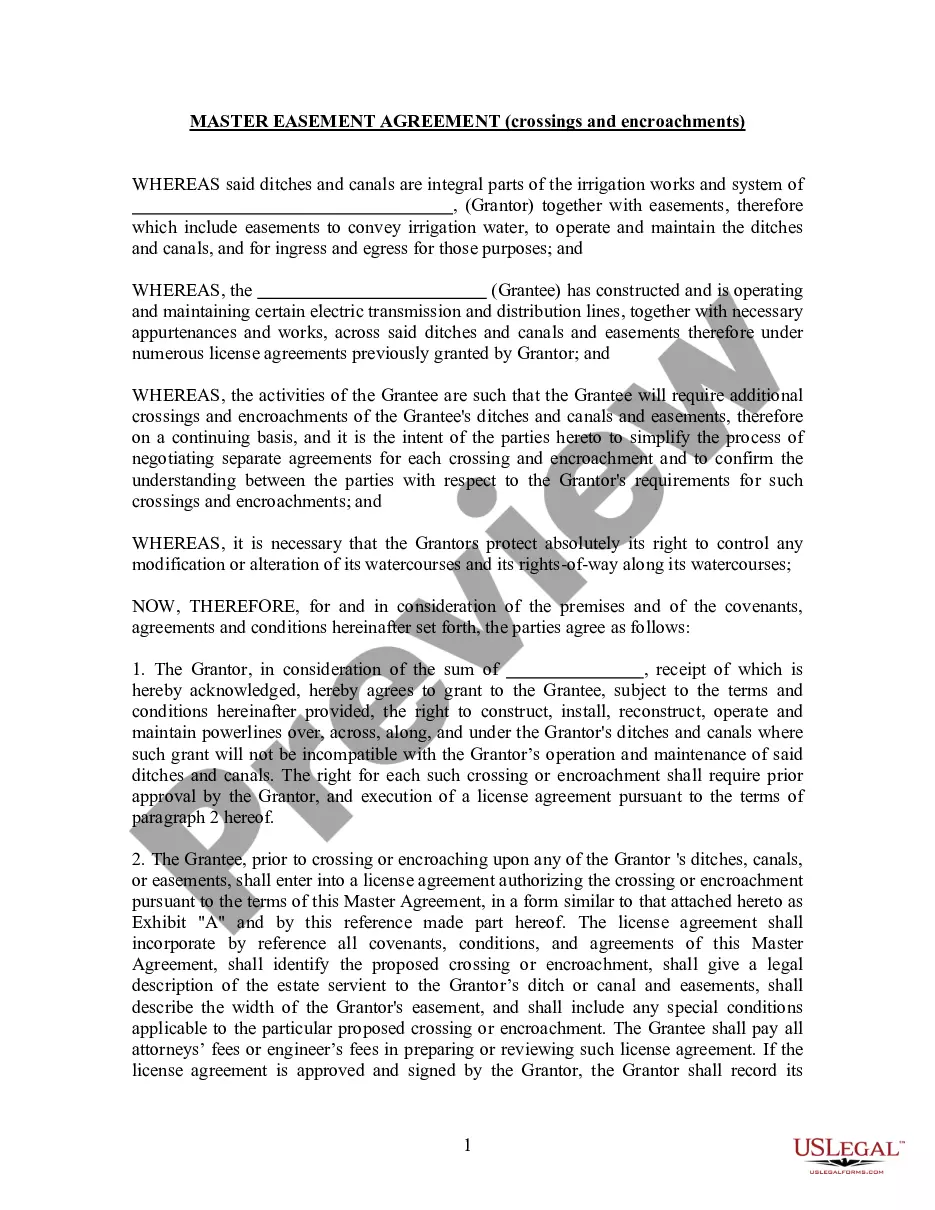

The assumption of the deed of trust occurs when a new borrower takes over the mortgage from the original borrower, assuming their payment obligations. In the context of the Vista California Assumption of Deed of Trust, this process typically requires the lender's approval to ensure that the new borrower meets the necessary criteria. This arrangement can provide smoother transitions in homeownership and financial responsibilities.

In California, a deed of trust may be considered invalid if it lacks essential components like the proper signatures, correct legal descriptions, or if it fails to adhere to statutory requirements. Additionally, any fraudulent activity or lack of mutual consent can invalidate such agreements. Understanding these factors is vital for ensuring the legality of the Vista California Assumption of Deed of Trust.

Several factors can render a deed of trust invalid, including improper signing, lack of a clear legal description, or failure to follow state requirements. In the case of the Vista California Assumption of Deed of Trust, issues such as fraud or coercion might also invalidate the document. It’s crucial to ensure all aspects comply with legal standards to protect all parties involved.

The beneficiary in a deed of trust to secure assumption is typically the lender who provided the mortgage for the property. Their role involves ensuring that the terms of the Vista California Assumption of Deed of Trust are met and that payments continue to be made by the new borrower. Understanding who the beneficiary is can help borrowers navigate the assumption process more effectively.

The release of obligation under the deed of trust refers to the process in which a borrower is released from their financial commitment on a property. In the context of the Vista California Assumption of Deed of Trust, this typically occurs when one of the original borrowers is released, allowing them to step away from liability while the remaining borrower assumes the responsibilities. This release can help ease financial burdens and facilitate smoother transactions.