This form is a Grant or Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Stockton California Grant Deed from Individual to Trust

Description

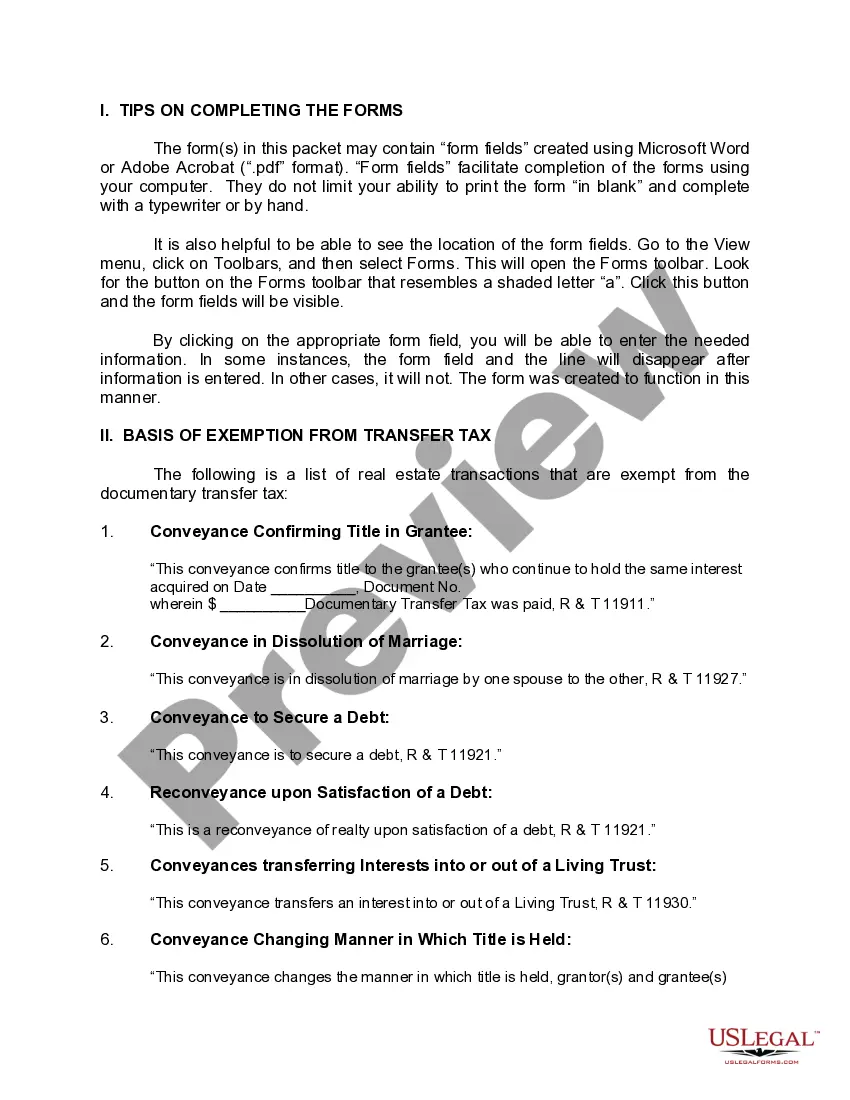

How to fill out California Grant Deed From Individual To Trust?

Regardless of social standing or professional level, completing legal documents is an unfortunate requirement in the modern world.

Often, it is nearly impossible for individuals lacking any legal knowledge to draft such paperwork from scratch, primarily due to the intricate language and legal subtleties they involve.

This is where US Legal Forms comes to the aid.

Verify that the form you have located is appropriate for your location as the laws of one state or region may not apply to another.

Examine the form and read a brief description (if available) of the situations the document can address.

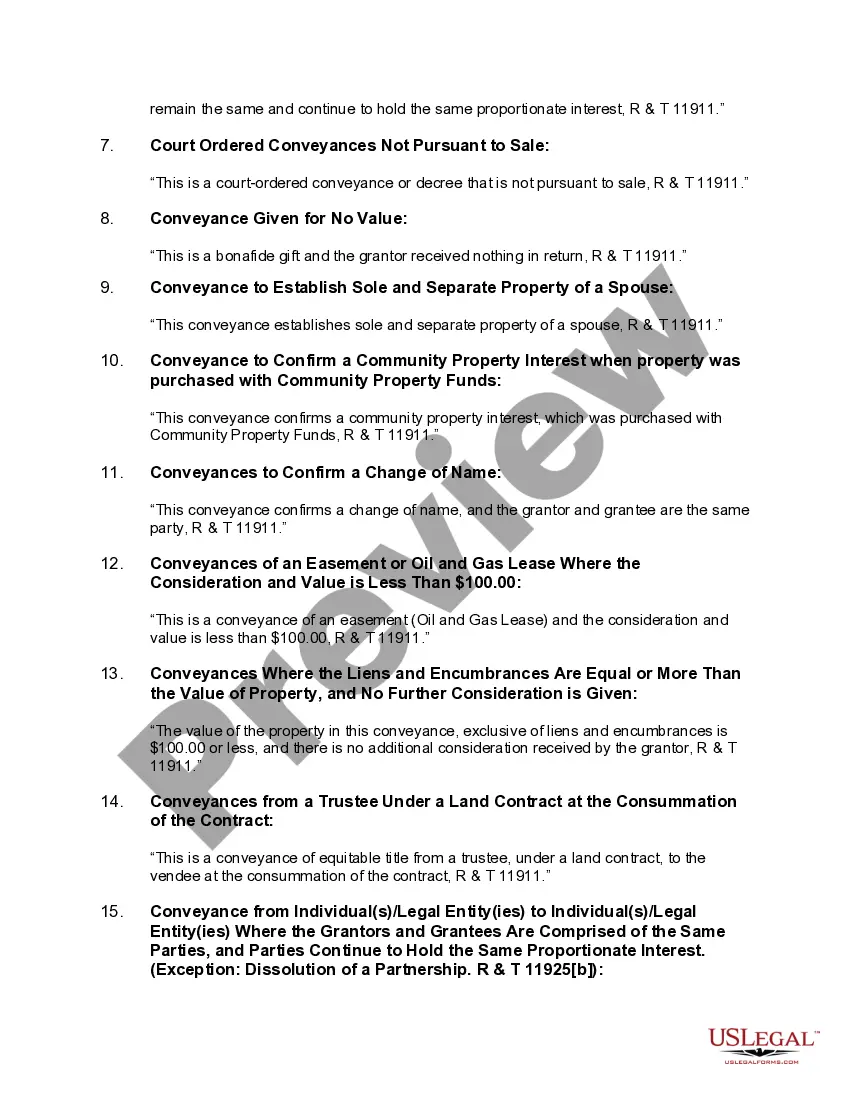

- Our service offers an extensive collection of over 85,000 ready-to-use state-specific documents applicable for nearly any legal scenario.

- US Legal Forms is also a fantastic resource for associates or legal advisors aiming to enhance their time efficiency with our DIY forms.

- Whether you need the Stockton California Grant Deed from Individual to Trust or any other document suitable for your state or locality, with US Legal Forms, everything is easily accessible.

- Here’s how to quickly acquire the Stockton California Grant Deed from Individual to Trust using our dependable service.

- If you are a current subscriber, you may proceed to Log In to your account to retrieve the necessary form.

- However, if you are new to our library, please ensure to follow these steps before obtaining the Stockton California Grant Deed from Individual to Trust.

Form popularity

FAQ

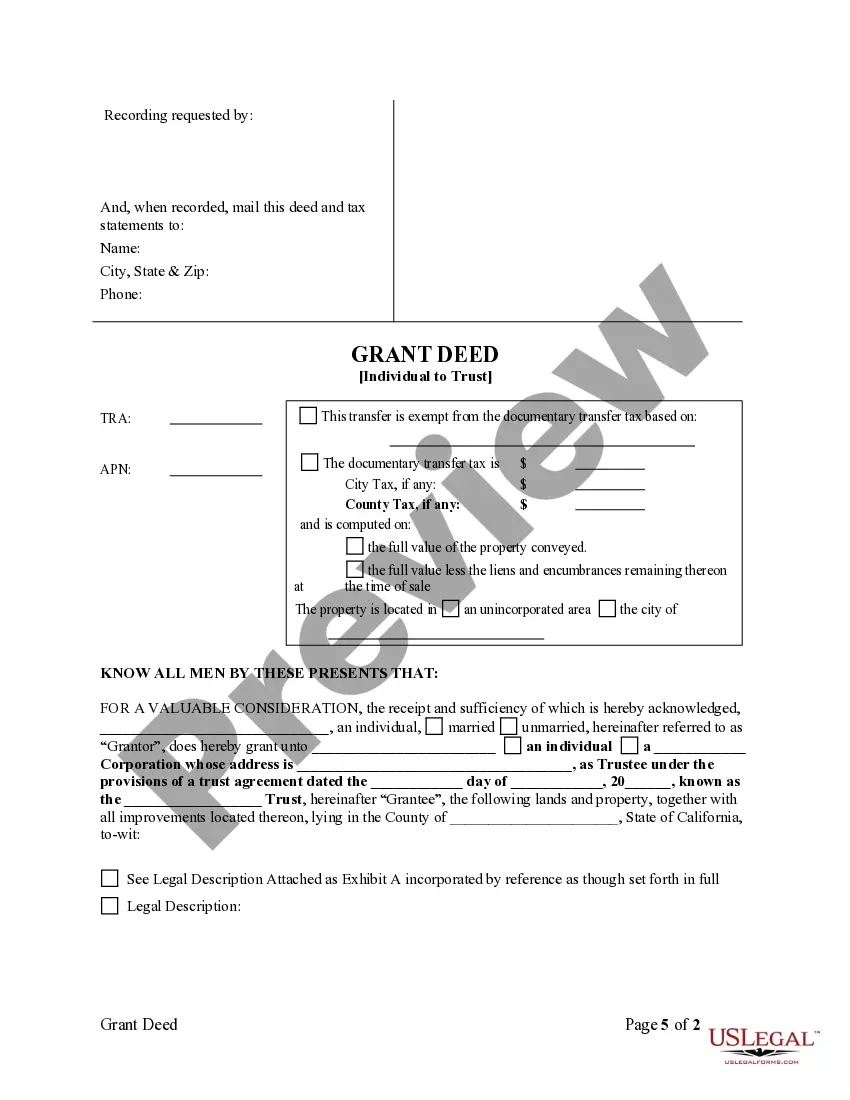

To put your property in a trust in California, you first need to establish the trust itself. Once the trust is created, you can execute a Stockton California Grant Deed from Individual to Trust, transferring the property into the trust’s name. After completing the deed, file it with the county recorder's office. For a seamless process, consider using US Legal Forms, which offers templates and guidance tailored for your specific needs.

A Grant Deed is a legal document that conveys property ownership and guarantees that the grantor holds title to the property. In contrast, a trust transfer deed specifically transfers ownership from an individual to a trust. Understanding these differences is crucial when completing a Stockton California Grant Deed from Individual to Trust to avoid potential legal issues later.

To transfer a deed to a trust in California, you need to create a Grant Deed. This document serves to transfer your property from your name to the trust's name. Once you've completed the Grant Deed, you should file it with the county recorder's office where your property is located. By doing so, you ensure that your Stockton California Grant Deed from Individual to Trust is officially recognized.

Filling out a California grant deed is a straightforward process, especially when transferring property from an individual to a trust using the Stockton California Grant Deed from Individual to Trust. Start by clearly identifying the parties involved, including the entity receiving the property. Ensure you include a legal description of the property, which can typically be found on your current deed. Finally, sign the deed in front of a notary and file it with your county recorder's office to complete the process.

Whenever land changes hands in California, certain documents must be ?recorded? with the county. Commonly recorded documents include deeds, liens, homestead forms, affidavits of death of joint tenants or trustees, and other forms related to ownership of property.

Step 1: Locate the Current Deed for the Property.Step 2: Determine What Type of Deed to Fill Out for Your Situation.Step 3: Determine How New Owners Will Take Title. Step 4: Fill Out the New Deed (Do Not Sign)Step 5: Grantor(s) Sign in Front of a Notary.Step 6: Fill Out the Preliminary Change of Ownership Report (PCOR)

Document must contain original signatures OR be a certified copy of the original; certified copies must be unaltered (Gov. Code 27201(b)). Names of party(ies) to be indexed must be legibly printed or typed near all signatures and be consistent throughout the entire document (Gov. Code 27280.5).

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

Calculating real property transfer tax is straightforward. Currently, most counties charge $1.10 per $1000 value of transferred real property in California. For example, on real property valued at $20,000, the county documentary tax would be $22.00.

While recording a deed does not affect its validity, it is extremely important to record since recordation protects the grantee. If a grantee fails to record, and another deed or any other document encumbering or affecting the title is recorded, the first grantee is in jeopardy.