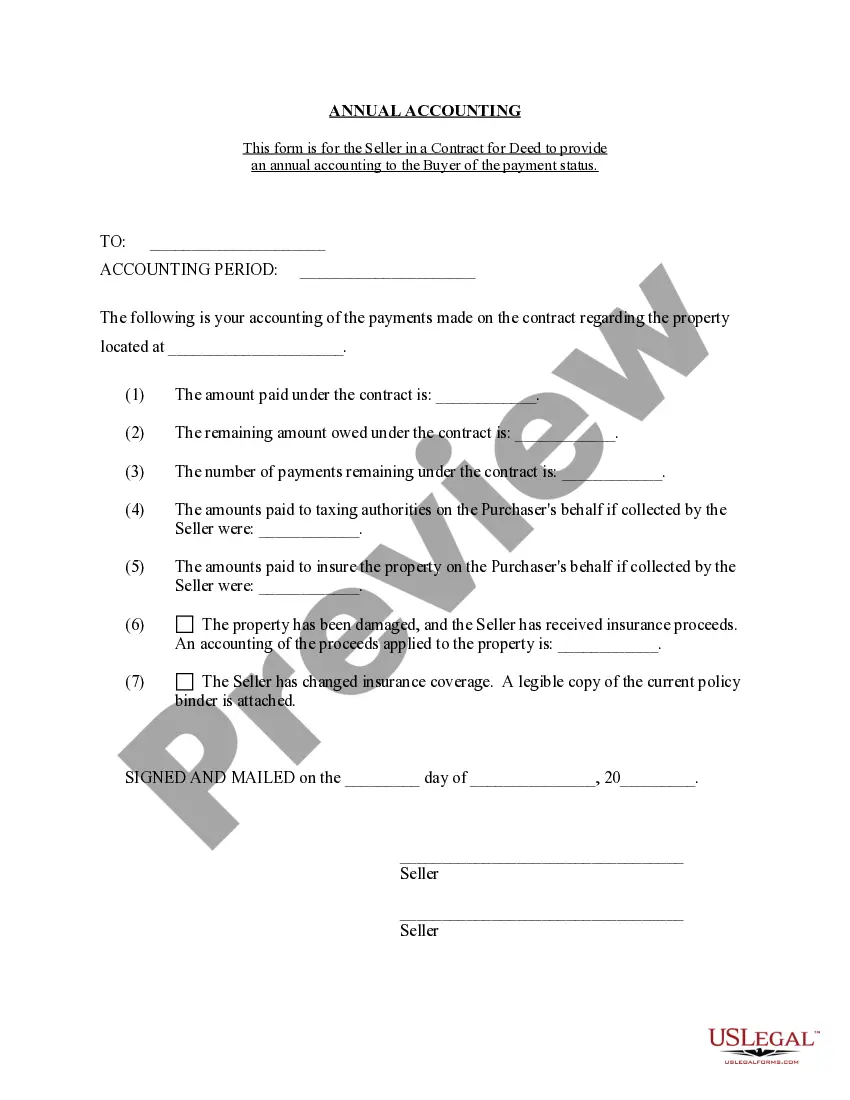

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Santa Maria California Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out California Contract For Deed Seller's Annual Accounting Statement?

Regardless of social or occupational position, completing legal documents is a regrettable but essential requirement in today’s society.

Frequently, it’s nearly unfeasible for individuals lacking legal training to draft such documents independently, primarily due to the intricate language and legal subtleties they comprise.

This is where US Legal Forms becomes invaluable.

- Our service offers an extensive collection of over 85,000 ready-made, state-specific forms applicable to nearly any legal matter.

- US Legal Forms is also a significant resource for associates or legal advisors seeking to save time by using our DIY forms.

- Whether you need the Santa Maria California Contract for Deed Seller's Annual Accounting Statement or other documents relevant to your jurisdiction, US Legal Forms has everything readily available.

- Here’s a quick guide to acquiring the Santa Maria California Contract for Deed Seller's Annual Accounting Statement using our trusted service.

- If you are already an existing user, you can simply Log In to your account to download the required form.

Form popularity

FAQ

A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

Risk to the Buyer A contract for deed has risk for the buyer. Because the seller keeps legal title to property until the contract price is paid in full, the buyer does not become the owner of the property until he or she completes his payment obligations and receives title from the seller.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

An agreement for deed is often referred to as ?land contract.? This arrangement is where a seller provides owner financing to a buyer. In turn, this allows a buyer to make monthly payments to the seller (instead of a bank). The seller will transfer the property title once receiving a certain amount of money.

The land contract purchaser takes possession of the real estate and agrees to make installment payments of principal and interest, typically on a monthly basis, until the contract is paid in full or balloons. During the term of the contract, the purchaser has ?equitable title? to the property.

The Land Contract or Memorandum must state that the buyer is responsible for paying the property taxes. The Land Contract or Memorandum must be selling the property. Option to buy or lease agreements will not qualify for the homestead and mortgage deductions. The Land Contract or Memorandum must be recorded.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

The Michigan land contract process is as follows: Most land contracts will require the buyer to make a down payment of 10% or more of the purchase price. Then, the seller will have to make installment payments for a set period of time. The terms can vary, but most agreements are between two and four years.

Recorded in the public record, contracts for deed are legally enforceable. Many sellers prefer to keep the contract details between themselves and buyers private. Benefits for buyer and seller. Contracts for deed can help both buyers who need a home but have poor credit and sellers in difficult lending situations.