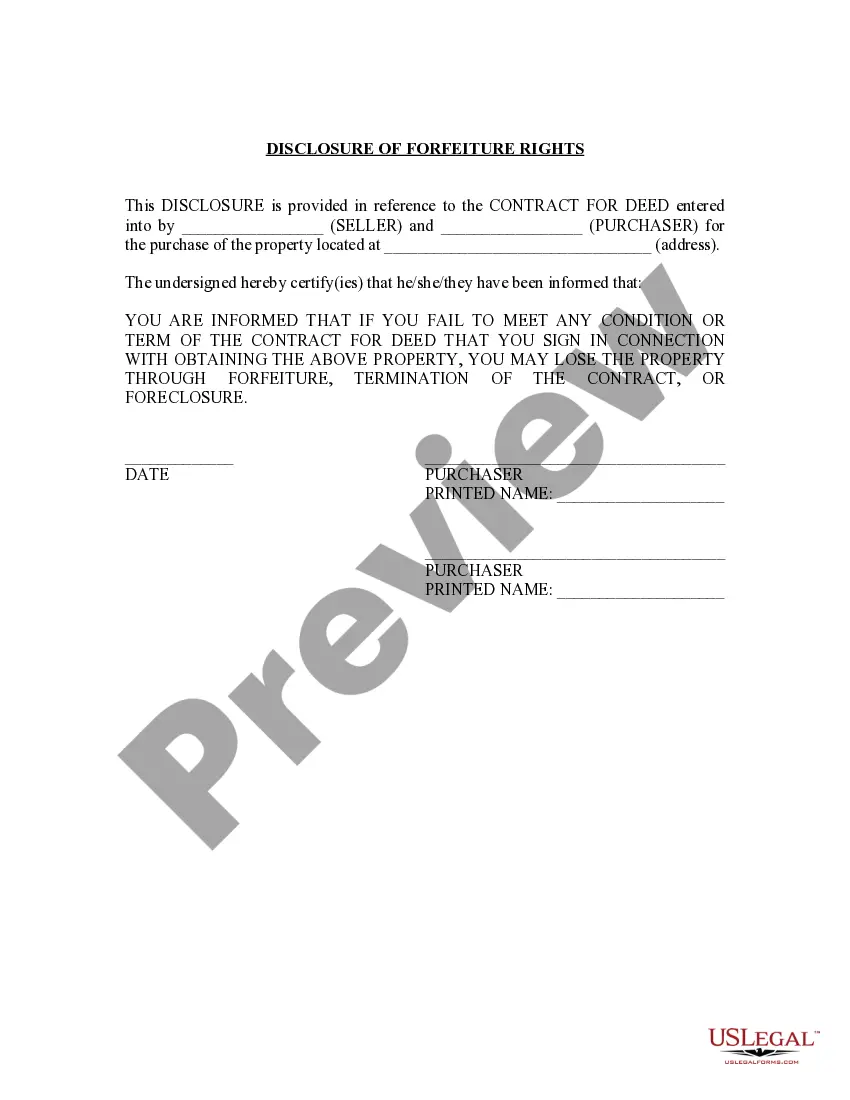

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Alameda California Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial transactions and obligations between the seller and buyer in a contract for deed agreement. This annual accounting statement serves as an essential record for both parties involved in the real estate transaction, providing a comprehensive overview of the financial aspects of the contract. It is crucial for sellers to complete this statement accurately and in a timely manner to maintain transparency and ensure compliance with contractual obligations. The Alameda California Contract for Deed Seller's Annual Accounting Statement includes various sections that cover the income, expenses, and financial activities related to the property subject to the contract. Key details that should be included in this statement are the property's address, the buyer's name, and the accounting period covered in the statement. Additionally, the annual accounting statement should specify the total amount received from the buyer during the accounting period, including the principal payment, interest, and any other charges or fees agreed upon in the contract. It is essential to accurately break down these amounts to provide a clear report of the financial transactions. Moreover, the statement should highlight any expenses incurred by the seller during the accounting period, such as property taxes, insurance premiums, maintenance costs, or any other relevant expenses related to the property. These expenses should be meticulously recorded to present a comprehensive view of the contract's financial activities. Furthermore, it is important to note that there might be different types of Alameda California Contract for Deed Seller's Annual Accounting Statements depending on the specific terms and conditions of the contract. For instance, there could be separate statements for residential and commercial properties or variations based on the duration of the contract. Each type of statement should be tailored to accurately reflect the financial transactions and obligations specific to that contract. To summarize, the Alameda California Contract for Deed Seller's Annual Accounting Statement is a vital document that ensures clarity and transparency in the financial aspects of a contract for deed agreement. It assists both sellers and buyers in maintaining accurate records of financial transactions and meeting contractual obligations. Keeping meticulous and up-to-date accounting records is key to successful contract management in Alameda, California.The Alameda California Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial transactions and obligations between the seller and buyer in a contract for deed agreement. This annual accounting statement serves as an essential record for both parties involved in the real estate transaction, providing a comprehensive overview of the financial aspects of the contract. It is crucial for sellers to complete this statement accurately and in a timely manner to maintain transparency and ensure compliance with contractual obligations. The Alameda California Contract for Deed Seller's Annual Accounting Statement includes various sections that cover the income, expenses, and financial activities related to the property subject to the contract. Key details that should be included in this statement are the property's address, the buyer's name, and the accounting period covered in the statement. Additionally, the annual accounting statement should specify the total amount received from the buyer during the accounting period, including the principal payment, interest, and any other charges or fees agreed upon in the contract. It is essential to accurately break down these amounts to provide a clear report of the financial transactions. Moreover, the statement should highlight any expenses incurred by the seller during the accounting period, such as property taxes, insurance premiums, maintenance costs, or any other relevant expenses related to the property. These expenses should be meticulously recorded to present a comprehensive view of the contract's financial activities. Furthermore, it is important to note that there might be different types of Alameda California Contract for Deed Seller's Annual Accounting Statements depending on the specific terms and conditions of the contract. For instance, there could be separate statements for residential and commercial properties or variations based on the duration of the contract. Each type of statement should be tailored to accurately reflect the financial transactions and obligations specific to that contract. To summarize, the Alameda California Contract for Deed Seller's Annual Accounting Statement is a vital document that ensures clarity and transparency in the financial aspects of a contract for deed agreement. It assists both sellers and buyers in maintaining accurate records of financial transactions and meeting contractual obligations. Keeping meticulous and up-to-date accounting records is key to successful contract management in Alameda, California.