This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Anaheim California Promissory Note in Connection with Sale of Vehicle or Automobile

Description

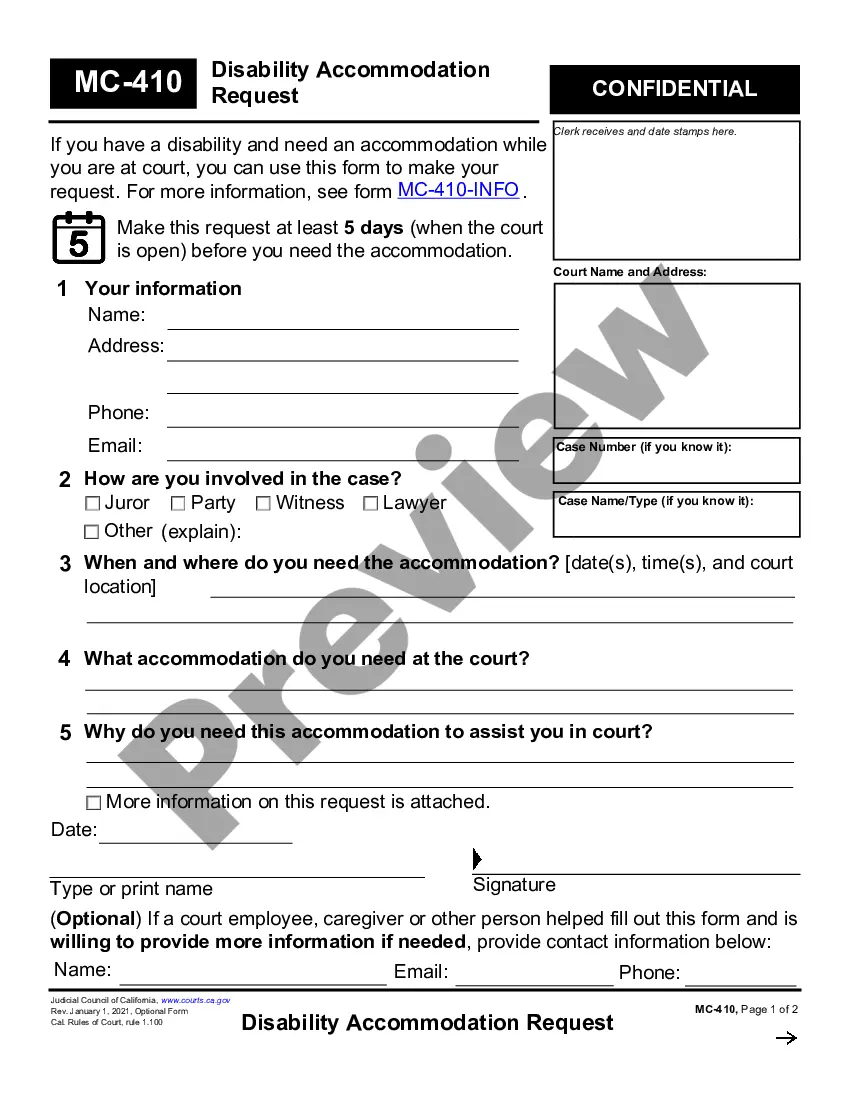

How to fill out California Promissory Note In Connection With Sale Of Vehicle Or Automobile?

If you are looking for a legitimate form template, it’s challenging to find a superior service than the US Legal Forms website – arguably the largest online collections.

With this collection, you can locate a vast array of form samples for commercial and personal uses by category and state, or keywords. Utilizing our enhanced search feature, uncovering the latest Anaheim California Promissory Note related to the sale of a vehicle is as simple as 1-2-3.

Furthermore, the validity of each document is validated by a team of knowledgeable lawyers who consistently evaluate the templates on our site and update them according to the latest state and county regulations.

Obtain the form. Choose the format and download it to your device.

Edit as needed. Fill out, modify, print, and sign the acquired Anaheim California Promissory Note related to the sale of a vehicle.

- If you’re already familiar with our platform and possess a registered account, all you need to obtain the Anaheim California Promissory Note related to the sale of a vehicle is to Log In to your account and click the Download option.

- If you are using US Legal Forms for the first time, simply follow the guidelines below.

- Ensure you have located the form you need. Review its description and utilize the Preview function to inspect its contents. If it doesn’t meet your requirements, use the Search field at the top of the page to find the necessary document.

- Confirm your choice. Click the Buy now option. Then, select your preferred subscription plan and provide the information to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

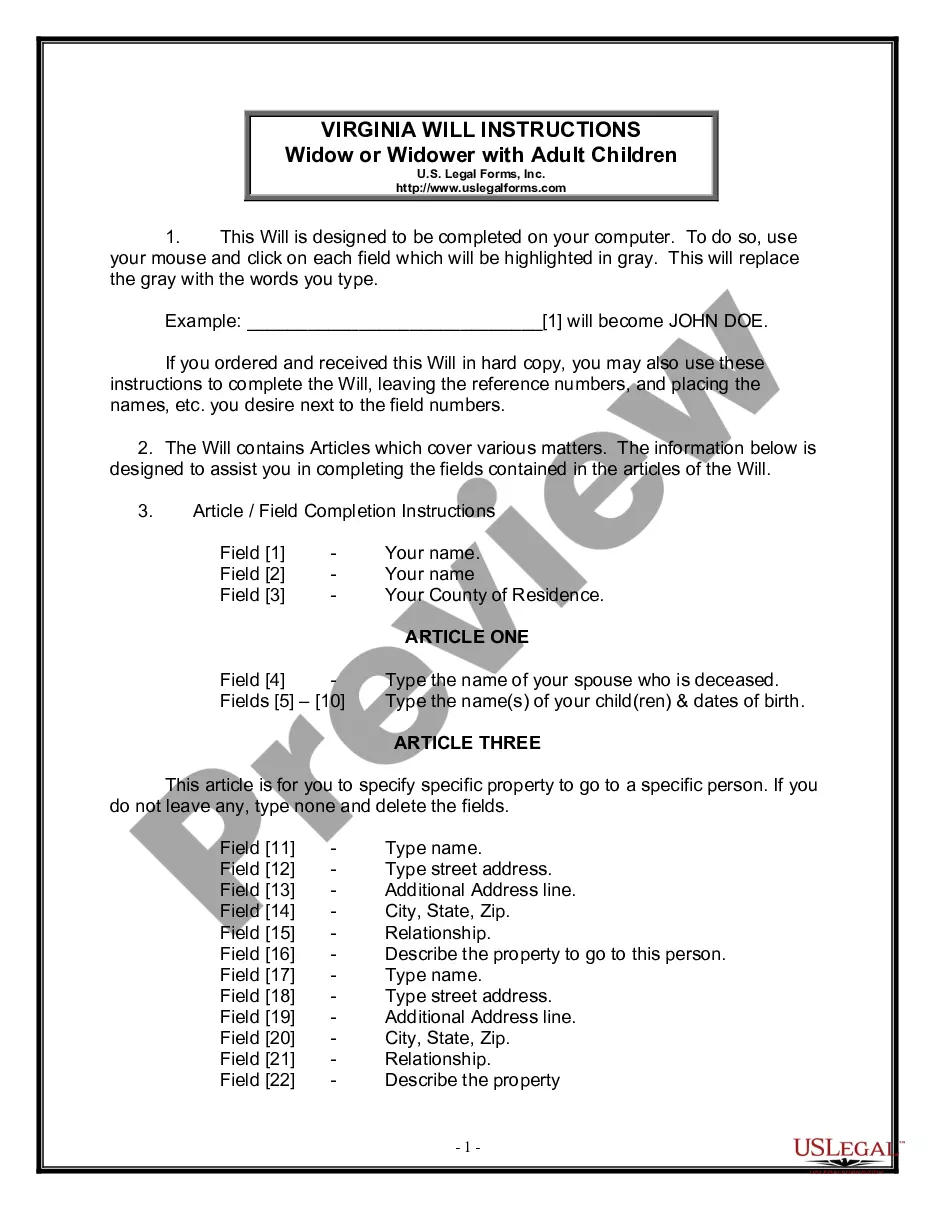

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

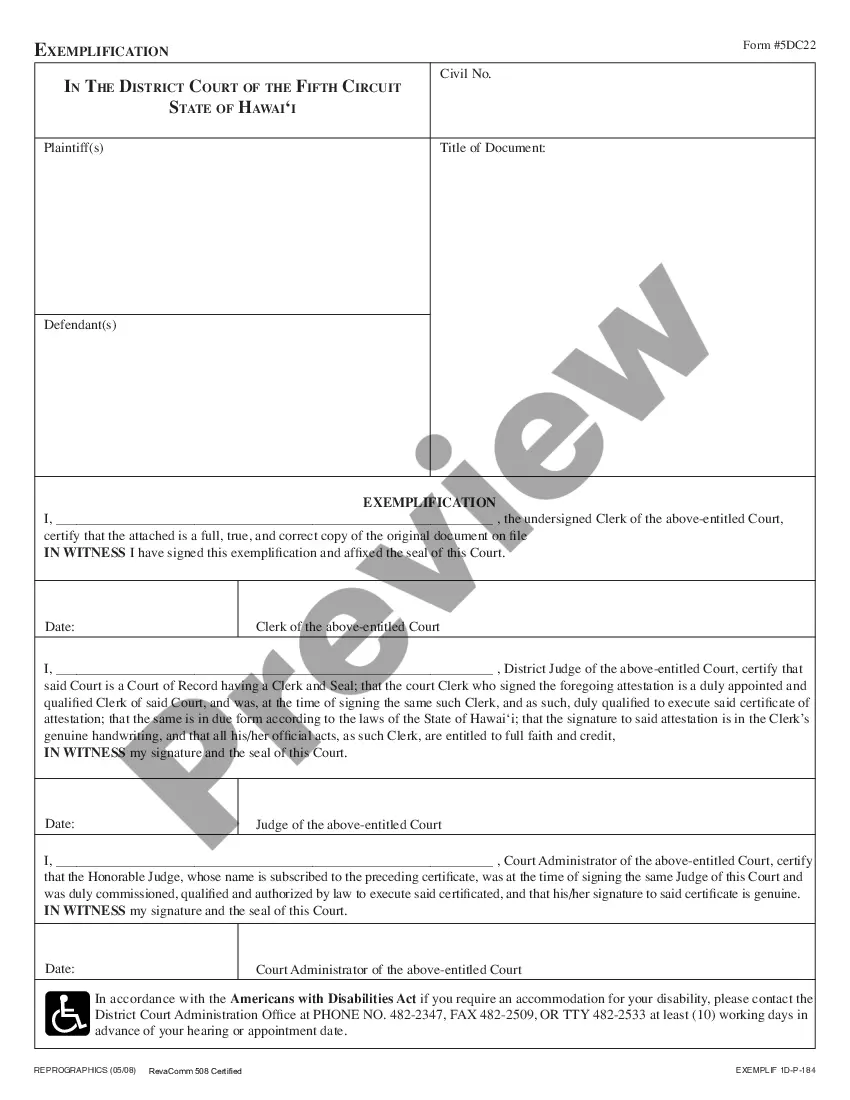

A promissory note is used for mortgages, student loans, car loans, business loans, and personal loans between family and friends. If you are lending a large amount of money to someone (or to a business), then you may want to create a promissory note from a promissory note template.

California Promissory Note Requirements A promissory note, although the name suggests is a promise, has the same legal consequences as a legally binding contract. In other words, a ?promissory note? is a type of contract.

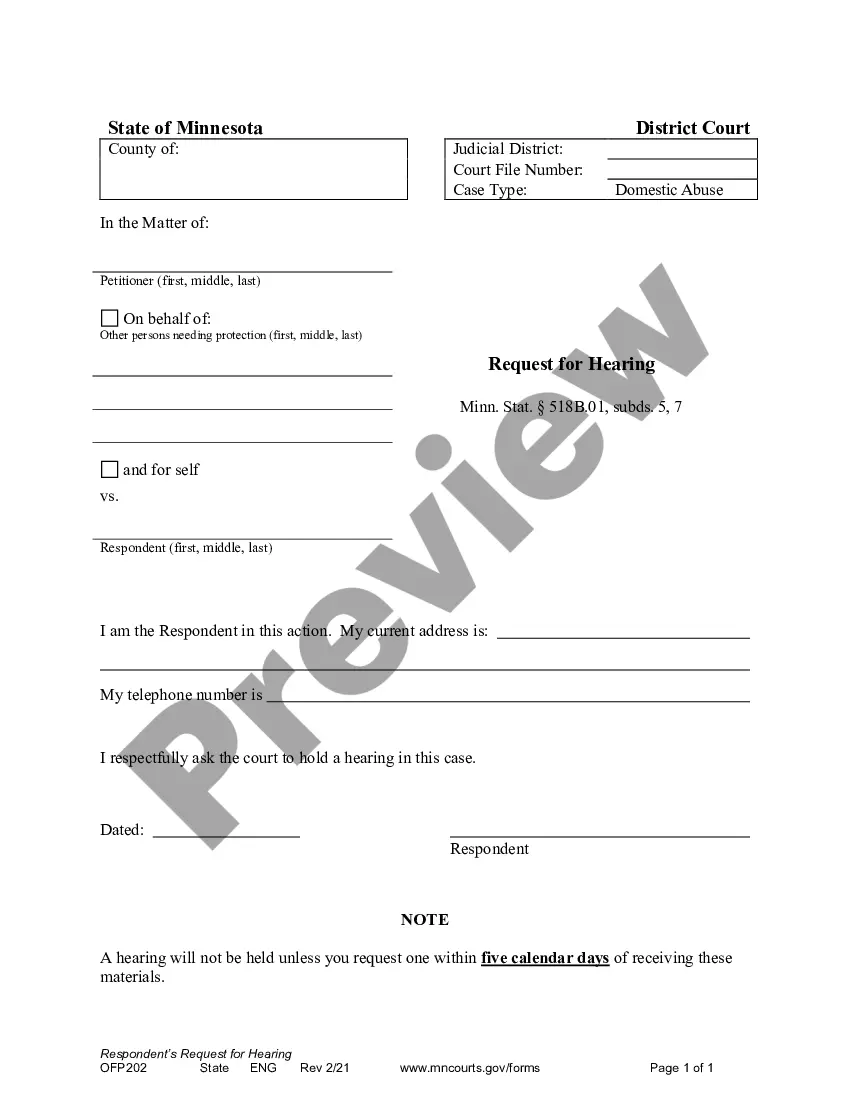

The promissory note should only be used if the buyer intends to make a down payment at the time of purchase and pay the remainder over time.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Yes, a promissory note is a legal, binding agreement, even if it's a handwritten note signed by both parties on a cocktail napkin. ?However, it would be foolish to sign a handwritten promissory note as it is easier to add language to a handwritten note after the fact as opposed to a typewritten one,? said Vincent J.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note. This time period starts from the due date that's listed on the note.

Information contained in a basic vehicle promissory note should include: The amount of the loan. How payment will be made. What the interest rate will be. What the payment schedule will be. What the grace period on payments is, if any. What defaulting and missed payment penalties will be.

A car promissory note is an agreement where a borrower promises to make payments in exchange for a vehicle. It typically has even terms throughout the loan, but often also includes a lump sum down payment at the beginning of the loan term. It also should include information about the make and model of the vehicle.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.