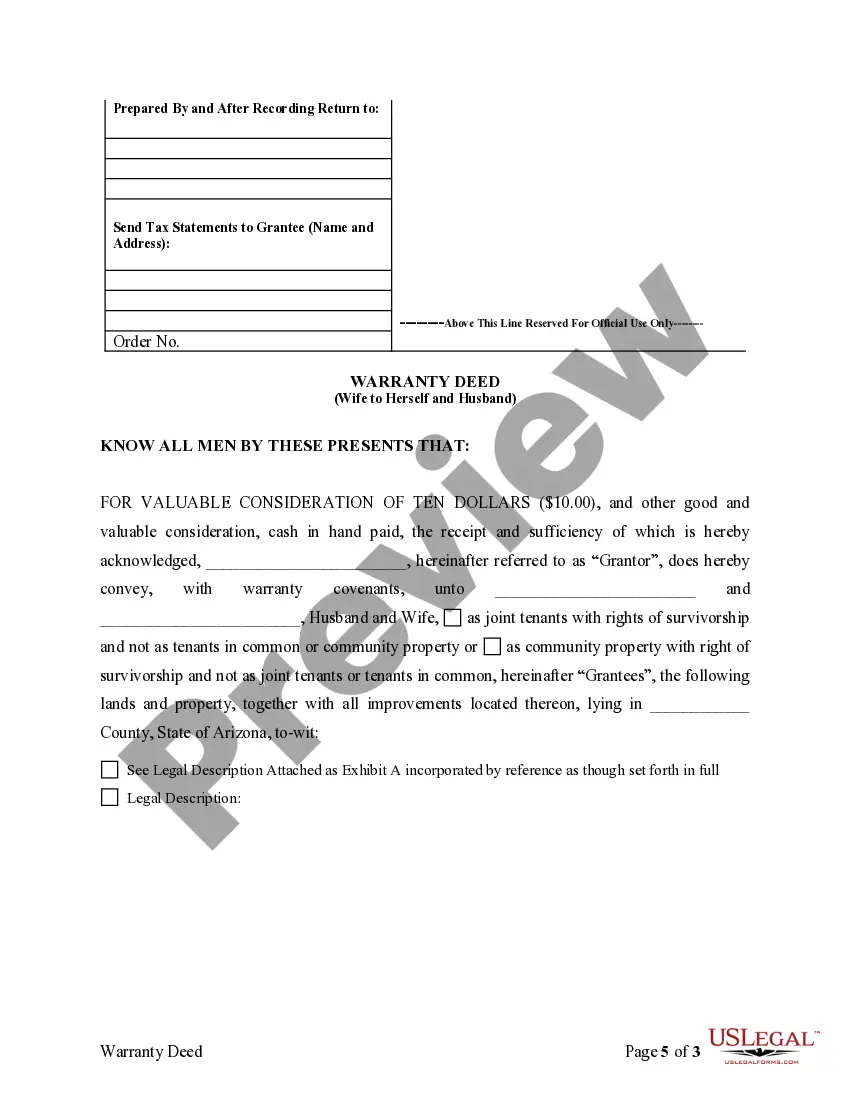

This form is a Warranty Deed where a wife transfers property to herself and her husband.

Phoenix Arizona Warranty Deed to Separate Property of one Spouse to both as Joint Tenants or as Community Property with Right of Survivorship

Description

How to fill out Arizona Warranty Deed To Separate Property Of One Spouse To Both As Joint Tenants Or As Community Property With Right Of Survivorship?

Do you require a reliable and affordable supplier of legal templates to obtain the Phoenix Arizona Warranty Deed for Separate Property of one Spouse, to both as Joint Tenants or as Community Property with Right of Survivorship? US Legal Forms is your ideal solution.

Whether you seek a basic contract to establish guidelines for living together with your partner or a collection of documents to progress your separation or divorce through the legal system, we have you covered. Our site provides over 85,000 current legal document templates for both personal and business purposes.

All the templates we offer are not generic and are tailored to meet the needs of specific states and counties.

To access the document, you need to Log In to your account, find the required template, and click the Download button adjacent to it. Please remember that you can download your previously purchased document templates at any time from the My documents section.

Now you can establish your account. Afterward, select a subscription choice and proceed with payment. Once the payment has been processed, download the Phoenix Arizona Warranty Deed for Separate Property of one Spouse, to both as Joint Tenants or as Community Property with Right of Survivorship in any format that is available. You can revisit the site at any time and redownload the document without incurring additional charges.

Finding current legal forms has never been simpler. Give US Legal Forms a try now, and stop wasting your precious time searching for legal documents online once and for all.

- Are you new to our site? No problem.

- You can set up an account with great ease, but before you do that, ensure to take the following steps.

- Verify that the Phoenix Arizona Warranty Deed for Separate Property of one Spouse, to both as Joint Tenants or as Community Property with Right of Survivorship adheres to the regulations of your state and locality.

- Review the document's description (if provided) to understand who the document is for and its intended purpose.

- Start the search again if the template doesn't suit your legal circumstances.

Form popularity

FAQ

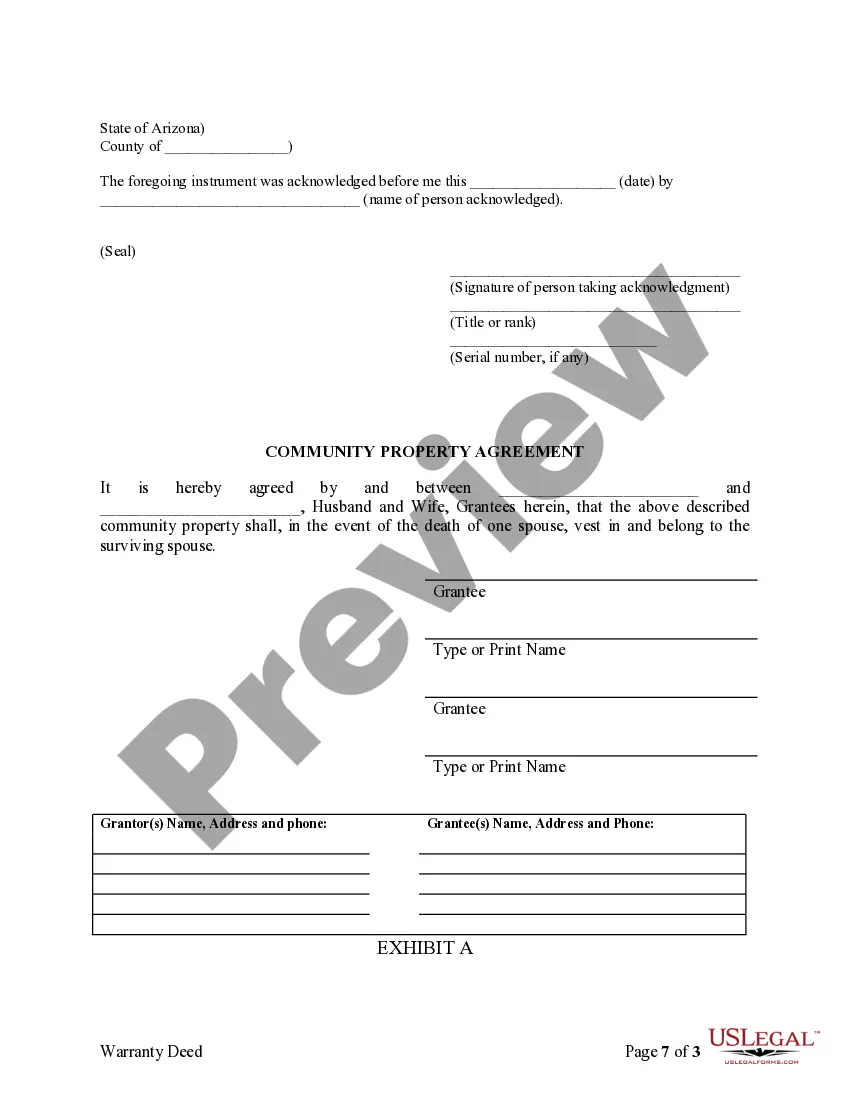

In a Joint Tenancy with Right of Survivorship, if one of the owners dies, his or her share will pass equally to each of the other Joint Tenants, regardless of who would otherwise inherit the deceased owner's estate.

In Arizona, there are different ways to title property, including: A Joint Tenancy with Right of Survivorship involves two or more owners who each have an equal and undivided interest. If one owner dies, the surviving partners take the deceased owner's share in the property.

What is a joint tenancy? This is where 2 or more joint owners hold the whole of the property together and in equal shares. On the death of any one or more of the owners, those shares pass automatically to surviving joint tenants by something called the right of survivorship.

Arizona law defines sole and separate property as property acquired prior to the date of marriage, after the date of service in a divorce, gifts to one spouse, one spouse's inheritance, and pain and suffering damages.

Arizona is a community property state. Community property generally means that spouses equally share ownership of anything purchased, acquired, or paid for during the marriage no matter who uses the property, who paid for the property, or whose name is on the title to the property.

A common example of this is when a spouse signs a disclaimer deed and places real property (i.e. a home or land) into the other spouse's name. Arizona cases have held that it may enforce such disclaimer deed, and thus recognize the property as sole and separate.

Under Arizona's community property laws, all assets and debts a couple acquires during marriage belong equally to both spouses. Unlike some community property states, Arizona does not require the division of marital property in divorce to be exactly equal, but it must be fair and will usually be approximately equal.

Arizona is a community property state, which means that all property acquired by either spouse during the marriage is considered to be jointly owned. Upon a divorce, it will be divided approximately equally.

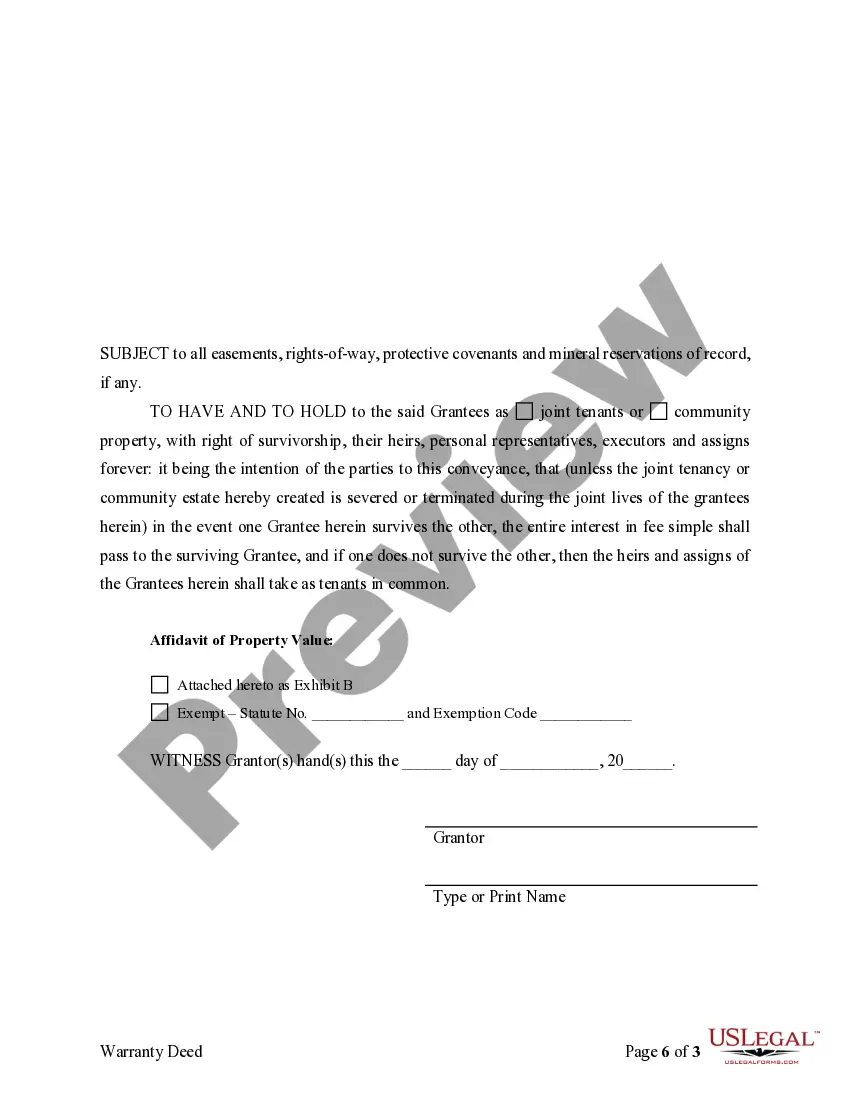

Arizona law recognizes four types of legal title to real property when it is owned by two or more persons: Tenants in Common, Joint Tenancy with Right of Survivorship, Community Property, and Community Property with Right of Survivorship.

Community Property with Right of Survivorship is co-ownership by married persons providing for the surviving spouse to retain full title after the death of the other spouse. Allows for a stepped-up tax basis for Capital Gains Taxes to a surviving spouse.