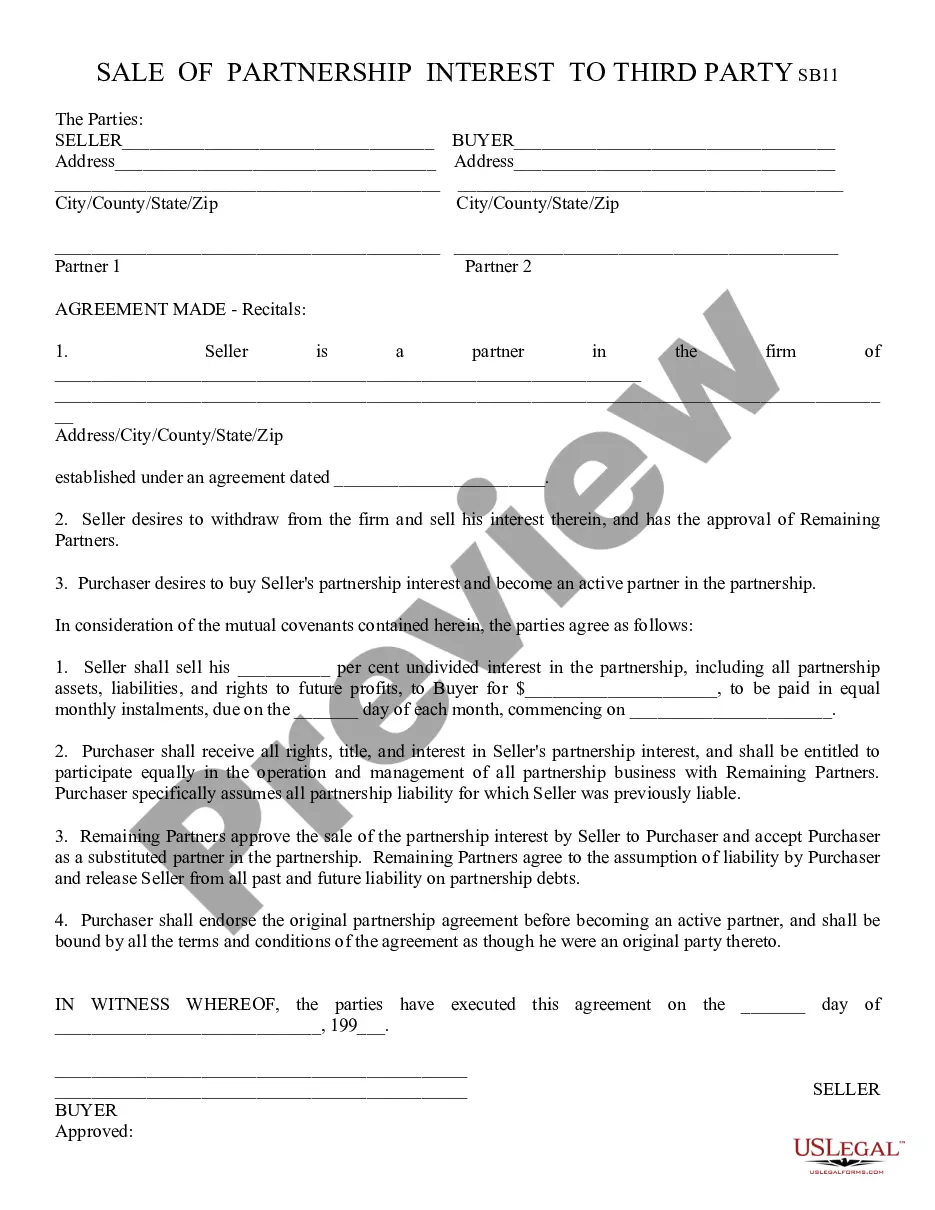

This is a contract between a Partner in a business and an intended Purchaser of his/her interest in the company. When a Partner wishes to sell his/her interest in a company, he/she must seek the approval of the remaining Partners. If they agree to the sell, the Partner may sell his/her interest to a Third Party. Both the Partner/Seller and the Third Party Purchaser must sign this form in front of a Notary Public, in order to be a valid agreement. This form is available in both Word and Rich Text formats.

Tucson Arizona Sale of Partnership Interest to Third Party

Description

How to fill out Arizona Sale Of Partnership Interest To Third Party?

Locating authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms collection.

It’s an online resource featuring over 85,000 legal documents for both personal and business requirements and various real-world situations.

All the forms are accurately sorted by purpose and jurisdiction, making it as simple as 1-2-3 to find the Tucson Arizona Sale of Partnership Interest to Third Party.

Make certain your paperwork is organized and adheres to legal standards. Utilize the US Legal Forms collection to consistently have crucial document templates at your fingertips!

- Review the Preview mode and form details.

- Ensure you’ve chosen the right one that fulfills your requirements and aligns with your local jurisdiction standards.

- Look for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the correct one. If it fits your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

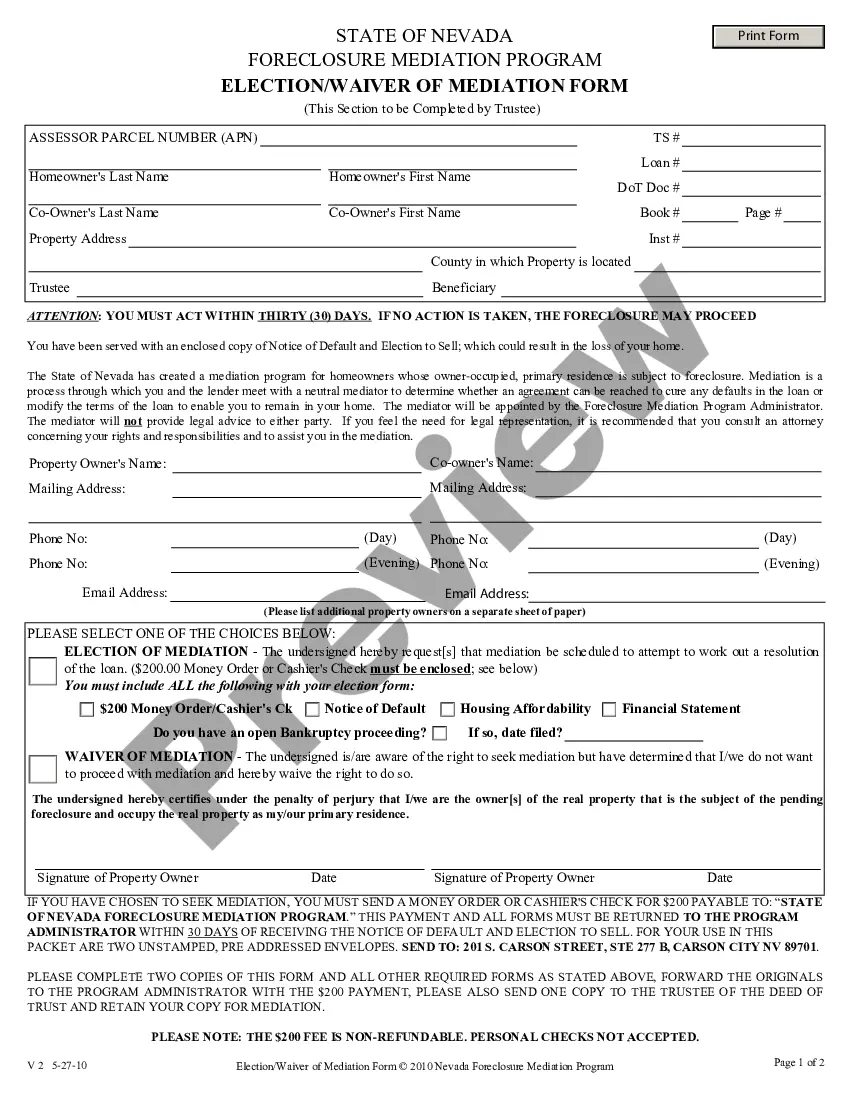

These, according to , are the five steps to take when dissolving your partnership: Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.

This means the ownership interest a partner has in a partnership is treated as a separate asset that can be purchased and sold. The general rule is the selling partner treats the gain or loss on the sale of the partnership interest as the sale of a capital asset (see IRC 741).

Partnerships file Form 8308 to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange).

In general, as noted earlier, the transferee of a partnership interest must withhold a tax equal to 10% of the amount realized by the transferor on any transfer of a partnership interest unless an applicable exception applies (as discussed below).

Summary. The sale of a partnership interest is generally treated as the sale of a capital asset. As a result, the sale of a partnership interest will generally generate capital gain or loss for the difference between the amount realized on the sale and the partner's adjusted basis in the partnership interest.

The gift of a partnership interest generally does not result in the recognition of gain or loss by the donor or the donee. A gift is, however, subject to gift tax unless the gift qualifies for the annual gift tax exclusion or reduces the donor's lifetime gift tax applicable exclusion amount.

Here's how to buy out your partner in a way that's straightforward and fair for everyone. Review Your Operating Agreement and Other Documents for Buy-Out Procedures.Get a Buyout Agreement in Place.Establish a Fair Value for the Business and Your Partner's Stake.

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

In most cases, the non-performing partner can be ousted from the company through litigation, but this can be expensive. Another way to get rid of your partner is by negotiating a buyout. It is important to understand the rules associated with removing a business partner to protect your business interests.

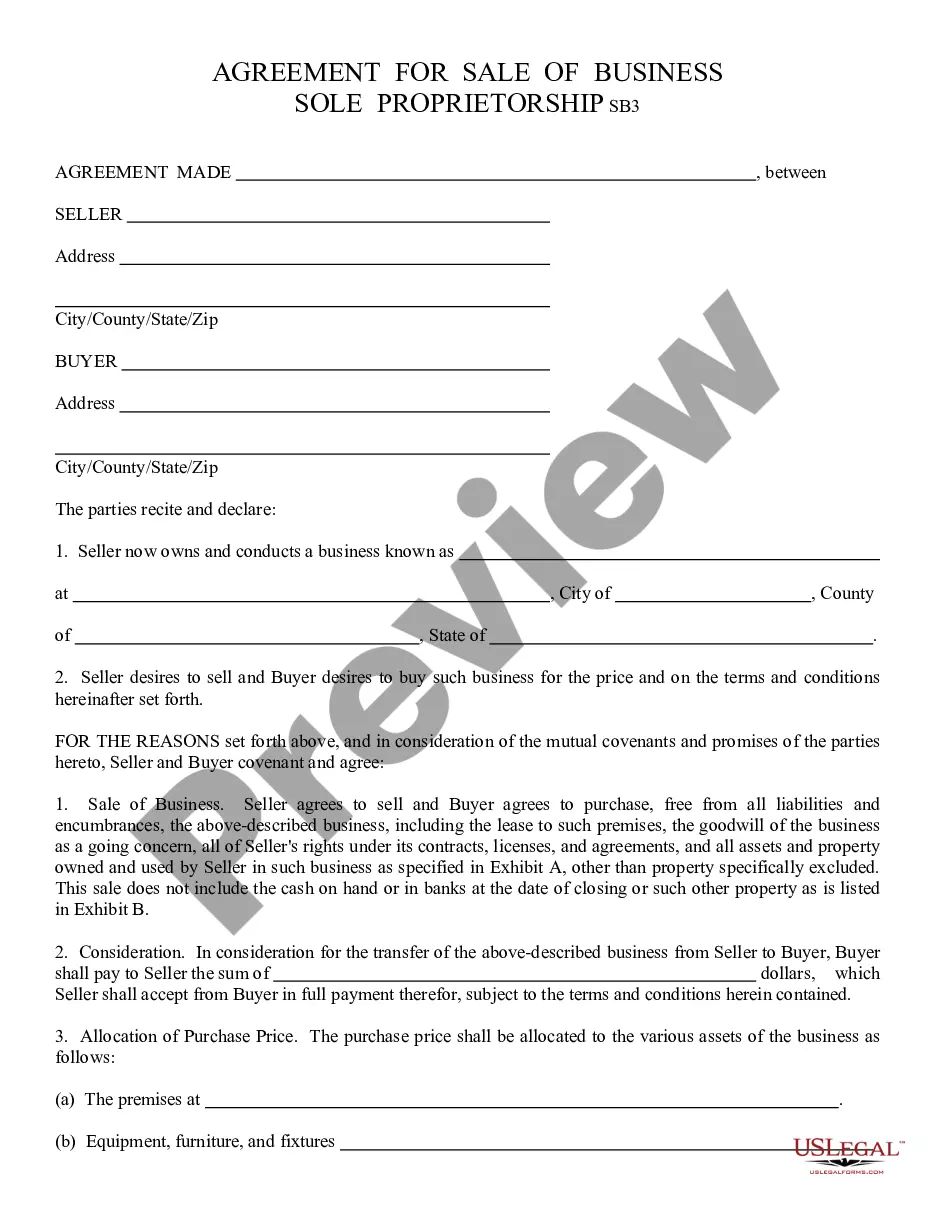

The sale of an entire partnership business generally takes one of two forms: the partners sell all of their partnership interests, or. the partnership sells some or all of its assets, and distributes the cash and any remaining property to the partners.