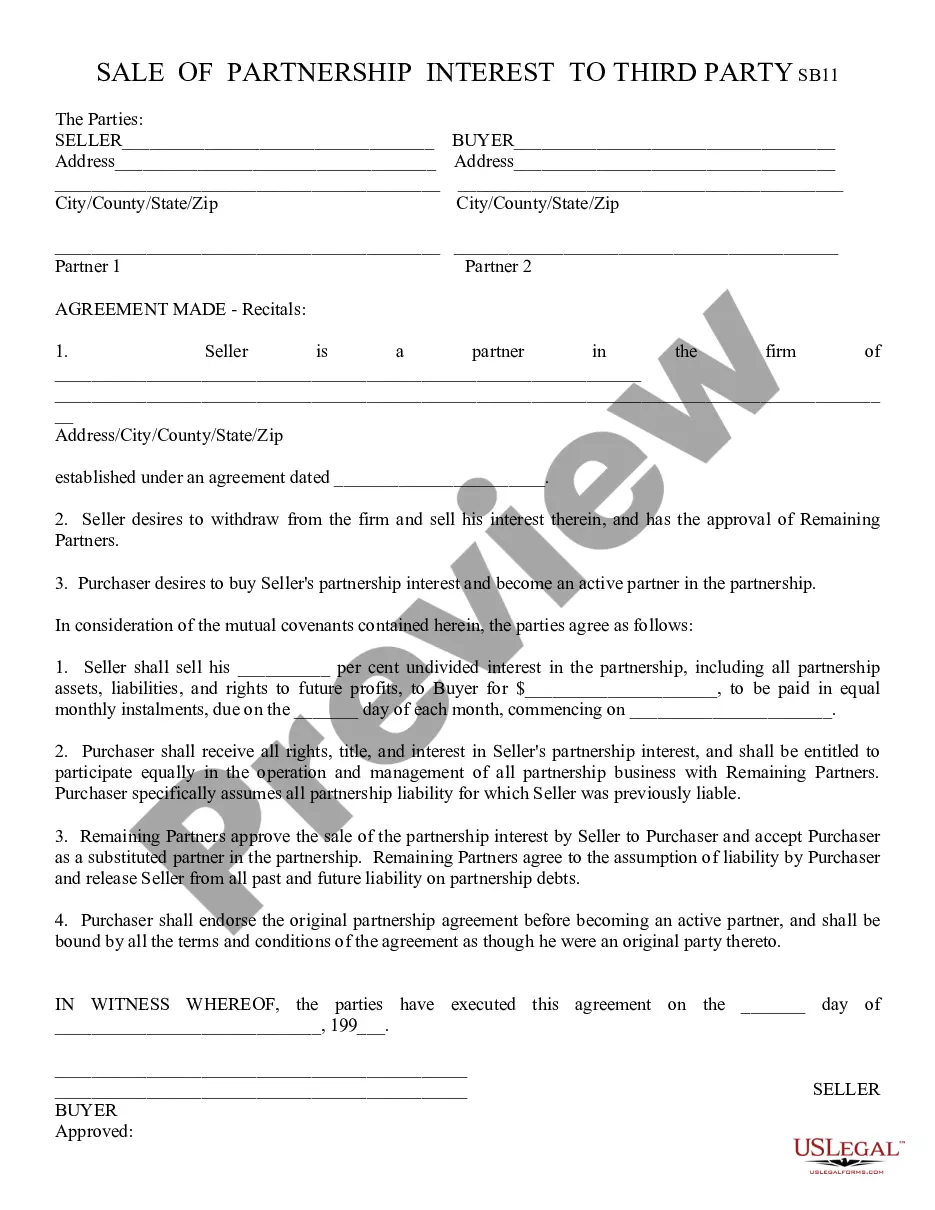

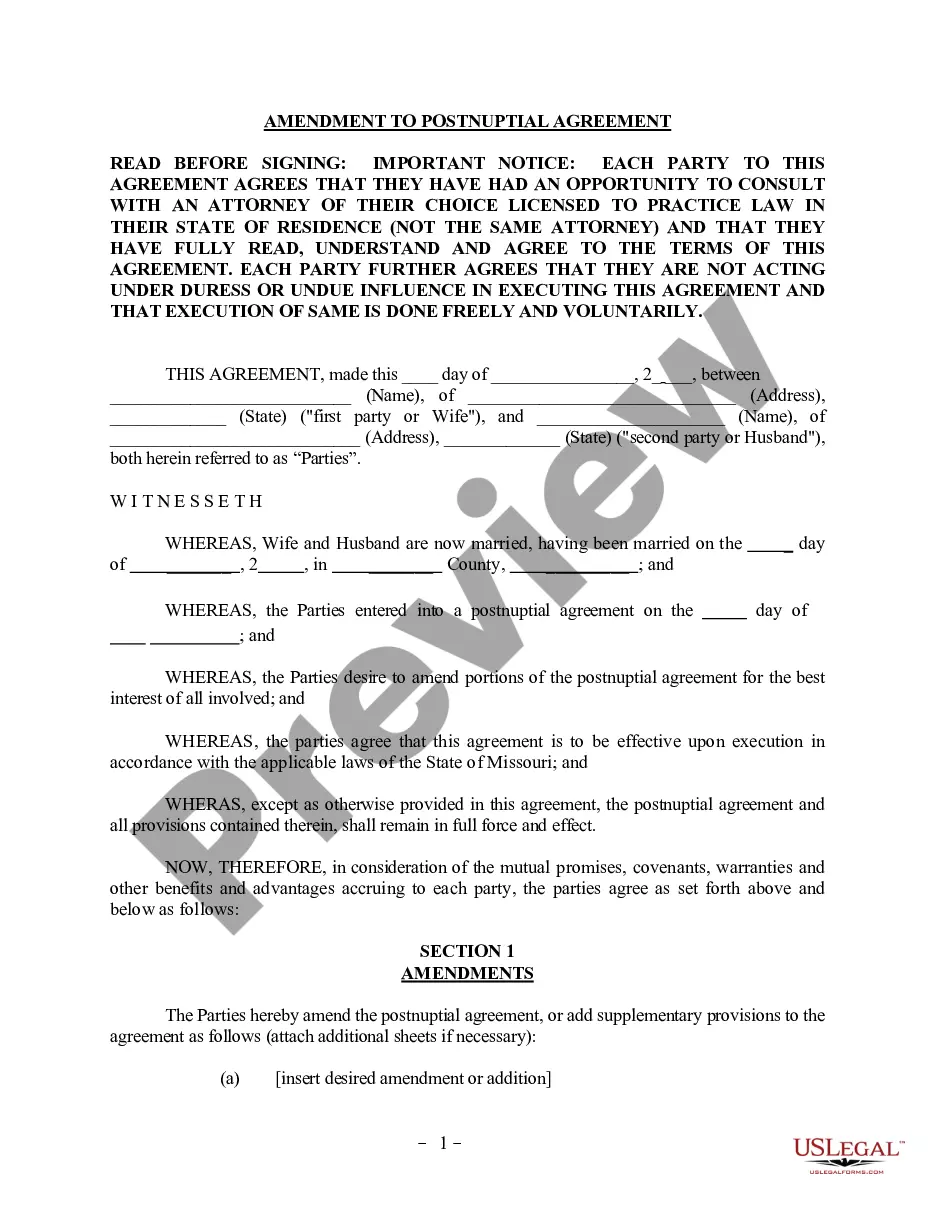

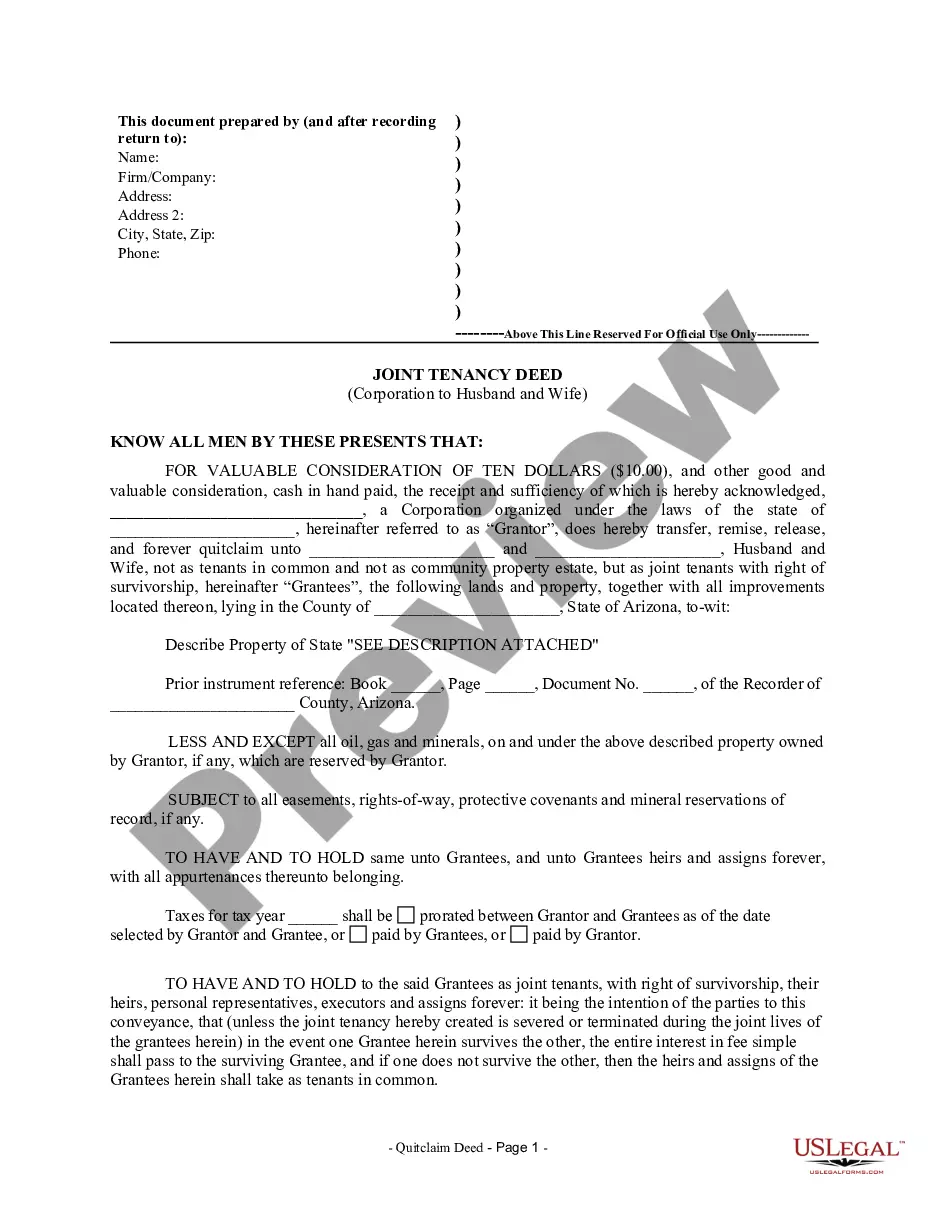

This is a contract between a Partner in a business and an intended Purchaser of his/her interest in the company. When a Partner wishes to sell his/her interest in a company, he/she must seek the approval of the remaining Partners. If they agree to the sell, the Partner may sell his/her interest to a Third Party. Both the Partner/Seller and the Third Party Purchaser must sign this form in front of a Notary Public, in order to be a valid agreement. This form is available in both Word and Rich Text formats.

Maricopa Arizona Sale of Partnership Interest to Third Party

Description

How to fill out Arizona Sale Of Partnership Interest To Third Party?

Locating authenticated templates tailored to your regional regulations can be tough unless you utilize the US Legal Forms repository.

It’s an internet collection of over 85,000 legal documents for both personal and professional purposes and various real-world situations.

All the files are appropriately categorized by usage area and jurisdiction, making it as simple as 123 to search for the Maricopa Arizona Sale of Partnership Interest to Third Party.

Keep in mind that maintaining documents orderly and in compliance with legal standards is vital. Take advantage of the US Legal Forms library to always access essential document templates for your various requirements immediately!

- Examine the Preview mode and form details.

- Ensure you have selected the correct one that suits your requirements and fully aligns with your regional jurisdiction standards.

- Seek out another template, if necessary.

- If you identify any discrepancies, use the Search tab above to locate the accurate one. If it fits your needs, proceed to the next stage.

- Acquire the document.

Form popularity

FAQ

Yes, the sale of partnership interest must be reported on Schedule K-1, which the partnership provides to each partner and the IRS. This document outlines each partner's share of the profits, losses, and distributions related to the sale. Proper reporting ensures that both the partnership and the receiving partner fulfill their tax obligations. For help with accurate reporting for the sale of partnership interest to third parties, consider using US Legal Forms to access the necessary templates and guidelines.

Accounting for the sale of partnership interest involves recognizing the transaction in the partnership’s financial records. You will typically record the sale amount against the partner's capital account and any gain or loss must be reflected accordingly. It's crucial to follow the IRS guidelines for proper accounting treatment. Leveraging the US Legal Forms platform can simplify your accounting process, providing forms and guidance specific to Maricopa, Arizona sale of partnership interest to third parties.

To report the sale of partnership interest in Maricopa, Arizona, you should file Form 1065, U.S. Return of Partnership Income. Additionally, each partner gets a Schedule K-1, which details their share of the income, deductions, and credits. It’s important to maintain accurate records throughout the process to ensure compliance with state and federal regulations. Using a platform like US Legal Forms can guide you in preparing and submitting the necessary documentation for the sale of partnership interest to third parties.

Treating the sale of partnership interest properly is crucial to avoid issues down the line. In the Maricopa Arizona Sale of Partnership Interest to Third Party, consider both tax implications and legal aspects. Using a platform like uslegalforms can provide you with tailored guidance and necessary legal documentation to support a compliant and efficient sale process.

In the event of a sale of partnership interest, your capital account will usually adjust based on the sale proceeds and your share of partnership liabilities. Specifically, the Maricopa Arizona Sale of Partnership Interest to Third Party often leads to a reallocation of capital among remaining partners. Understanding this dynamic helps you evaluate the financial impact of your sale.

Yes, the sale of partnership interest can affect Form 4797, as it allows taxpayers to report gains from the Maricopa Arizona Sale of Partnership Interest to Third Party. If you sell your partnership interest, you may need to report the transaction when filing taxes. This form helps ensure that your income is correctly documented, which is crucial for tax accuracy.

When engaging in the Maricopa Arizona Sale of Partnership Interest to Third Party, it's essential to recognize that the transaction typically involves both capital gains and ordinary income components. You must assess the nature of your partnership interest and how the sale proceeds relate to it. Proper treatment influences your tax responsibilities, so consulting a legal expert can ensure you comply with local regulations.

Reporting a sale or exchange of partnership interests requires detailed documentation. The seller must report the transaction on IRS Form 8949, Sales and Other Dispositions of Capital Assets, along with any applicable supporting documents. For a smooth process related to the Maricopa Arizona Sale of Partnership Interest to Third Party, it's advisable to use resources from uslegalforms. This platform can provide you with templates and guidelines tailored to your specific transaction needs.

Yes, partnership interests can qualify for a 1031 exchange under certain conditions. However, the qualifying interest must typically be held for investment or business purposes, as per IRS guidelines. If you are considering a Maricopa Arizona Sale of Partnership Interest to Third Party and want to explore a 1031 exchange, working with a knowledgeable advisor is essential. Uslegalforms can assist in providing the right documentation and guidance for your exchange.

To report the sale of partnership interest, you must file IRS Form 1065, U.S. Return of Partnership Income. This form outlines the financial activities of the partnership during the tax year. Additionally, you’ll need to provide Schedule K-1, which reports each partner's share of income, deductions, and credits for the Maricopa Arizona Sale of Partnership Interest to Third Party. Using a platform like uslegalforms can simplify this reporting process, ensuring you have the necessary documents in order.