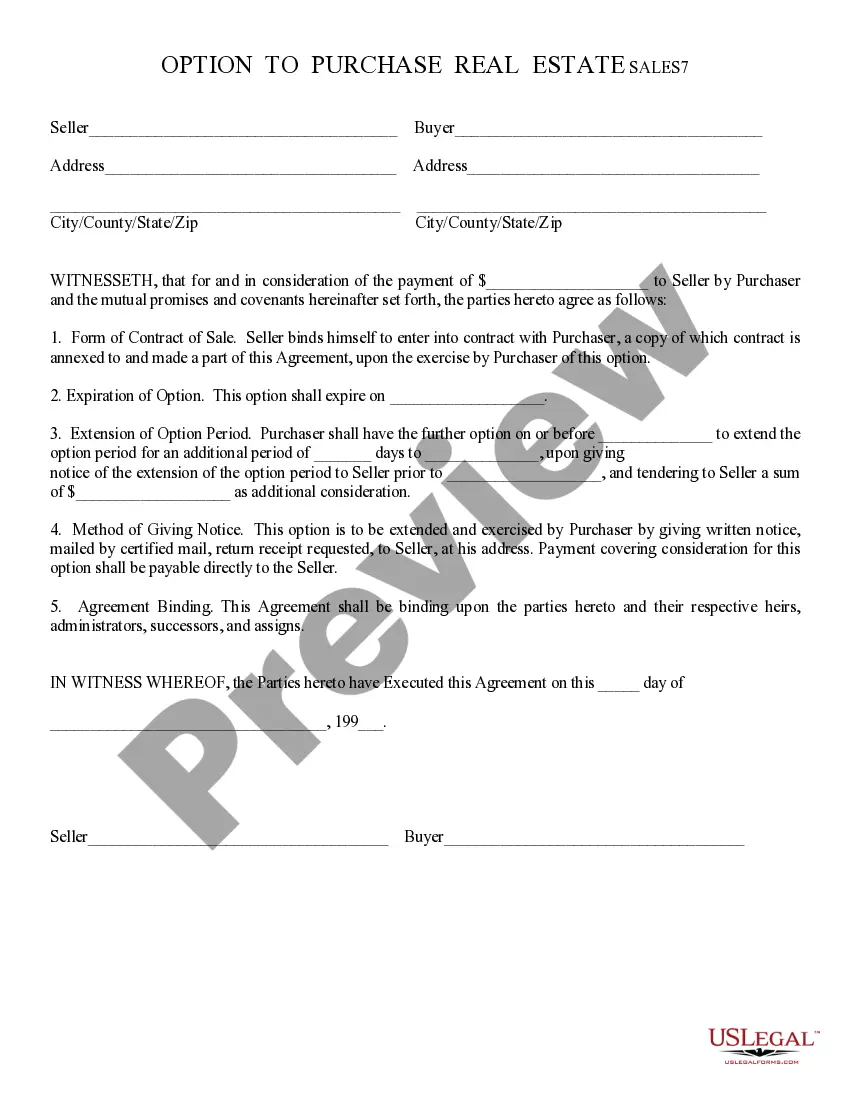

Option to Purchase - Short Form: This agreement is between an Owner of land and an Optionee. A contract such as this, states that the Owner gives the opportunity, or option, to the Optionee of purchasing his/her land for a specific amount, and during a specific time period. Both parties must sign this agreement in front of a Notary Public, in order to be valid. This form is available in both Word and Rich Text formats.

Scottsdale Arizona Option to Purchase - Short Form

Description

How to fill out Arizona Option To Purchase - Short Form?

We consistently endeavor to diminish or evade legal repercussions when handling intricate law-related or financial matters.

To achieve this, we enlist costly legal solutions as a standard practice.

However, not every legal predicament is equally intricate, as most can be managed independently.

US Legal Forms is an online resource providing a current collection of DIY legal documents ranging from wills and powers of attorney to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button next to it. Should you lose the document, you can re-download it from the My documents section. The procedure is equally simple if you are a newcomer to the site! You can create your account in a few minutes. Ensure that the Scottsdale Arizona Option to Purchase - Short Form complies with your state and local laws. Additionally, it's imperative that you review the form's outline (if provided), and if you notice any inconsistencies with your original requirements, look for an alternative form. Once you've verified that the Scottsdale Arizona Option to Purchase - Short Form meets your needs, you can select a subscription plan and proceed with payment. After that, you can download the document in any preferred file format. Over the past 24 years, we have assisted millions by offering customizable and current legal forms. Leverage US Legal Forms today to conserve time and resources!

- Our repository empowers you to manage your affairs independently without seeking an attorney's assistance.

- We offer access to legal document templates that are not universally available.

- Our templates are specific to states and regions, which greatly eases the search process.

- Utilize US Legal Forms whenever you need to quickly and securely locate and download the Scottsdale Arizona Option to Purchase - Short Form or any other document.

Form popularity

FAQ

Both parties have to agree on the price before the purchase agreement is signed. Furthermore, terms such as earnest money, escrow company, down payment, financing, warranties and contingencies, and the closing date will be outlined in the contract.

8.6% Sales Tax Chart - Combined (State of Arizona + Maricopa County +? City of Phoenix) tax due on Retail Sales from $0.01 to $100.00. 8.3% Sales Tax Chart ? Combined (State of Arizona + Maricopa County + City of Phoenix) tax due on Retail Sales from $0.01 to $100.

A purchase agreement is a legal document that is signed by both the buyer and the seller. Once it is signed by both parties, it is a legally binding contract. The seller can only accept the offer by signing the document, not by just providing the goods.

The 8.05% sales tax rate in Scottsdale consists of 5.6% Arizona state sales tax, 0.7% Maricopa County sales tax and 1.75% Scottsdale tax. There is no applicable special tax. You can print a 8.05% sales tax table here.

Generally, Arizona courts have strictly construed options in lease agreements because such provisions allow the optionee freedom to exercise or not exercise the option, whereas the optionor is bound by the option.

The City of Scottsdale tax rate for real property rentals is 1.75% of taxable rental income.

An Arizona residential real estate purchase and sale agreement is a legal document with terms and conditions for a buyer's purchase of property from a seller. The seller and buyer (or their attorneys) will negotiate the terms of the agreement including purchase price, closing date, property condition, and so on.

In Arizona, sellers are required to complete a real estate purchase agreement and the following disclosures in order for it to be considered legally binding: Buyer Inquiry.Comprehensive Loss Underwriting Exchange (CLUE).Swimming Pool Barrier Disclosure.Condo Disclosure Information.Notice of Soil Remediation.

What is the total tax rate? The combined tax rate for the State of Arizona, Maricopa County, and the city of Scottsdale for most taxable activities is 8.05%. The combined rate consists of 5.6% for the State, .7% for the County, and 1.75% for the city of Scottsdale.

In most Arizona real estate purchase contracts, the buyer will require the seller to deposit earnest money ? typically with the escrow company ? to demonstrate good faith. The deposit amount can be a percentage of the home sale price or an amount dictated by the seller.