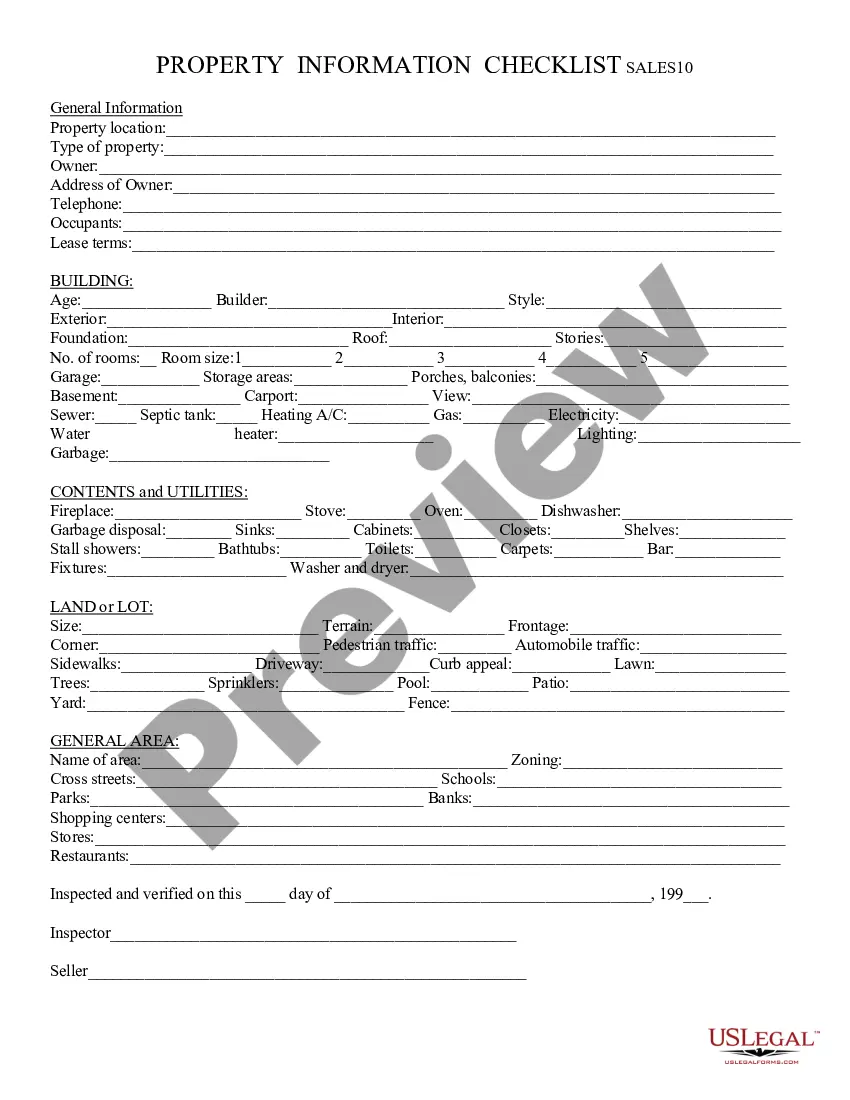

Property Information CheckList - Residential: A Property Information Checklist details any and all information pertaining to the property for sale. Property details include the owner's name, size of the lot/parcel, utilities involved with the land, etc. It is available for download in both Word and Rich Text formats.

Phoenix Arizona Property Information CheckList - Residential

Description

How to fill out Arizona Property Information CheckList - Residential?

Take advantage of the US Legal Forms and gain immediate access to any form template you need.

Our advantageous website featuring thousands of templates streamlines the process of locating and acquiring nearly any document sample you require.

You can export, complete, and validate the Phoenix Arizona Property Information CheckList - Residential in just minutes instead of spending hours online trying to find a suitable template.

Utilizing our collection is an excellent approach to enhance the security of your document filing.

If you do not have an account yet, follow these steps.

Access the page with the template you need. Ensure that it is the form you are looking for: verify its name and description, and utilize the Preview option if available. If not, use the Search field to find the correct one.

- Our knowledgeable attorneys routinely review all the documents to ensure that the templates are suitable for a specific region and comply with current laws and regulations.

- How can you obtain the Phoenix Arizona Property Information CheckList - Residential.

- If you have a subscription, simply Log In to your account.

- The Download button will appear on all the samples you examine.

- Additionally, you can access all the previously saved documents in the My documents menu.

Form popularity

FAQ

Homeowners and renters may eligible if: Your total household income was less than $3,751 if you lived alone, or less than $5,501 if others lived with you. You paid property taxes or rent on your main home in Arizona during 2021. You may also have paid both property taxes and rent for the whole year of 2021.

A purchase agreement is a legal document that is signed by both the buyer and the seller. Once it is signed by both parties, it is a legally binding contract. The seller can only accept the offer by signing the document, not by just providing the goods.

Both parties have to agree on the price before the purchase agreement is signed. Furthermore, terms such as earnest money, escrow company, down payment, financing, warranties and contingencies, and the closing date will be outlined in the contract.

(See also A.R.S. 15-972(K)(2) ). A Primary Residence is defined as residential property that is used by the owner or owners as their principal or usual place of residence, or leased or rented to a qualified relative of the owner, as provided in A.R.S. 42-12053 , and used as the relative's usual and principal residence.

An Arizona residential real estate purchase and sale agreement is a legal document with terms and conditions for a buyer's purchase of property from a seller. The seller and buyer (or their attorneys) will negotiate the terms of the agreement including purchase price, closing date, property condition, and so on.

Are Seniors in Arizona entitled to some property tax relief? Yes. The relief comes in several forms. First, there is an exemption for widows, widowers and totally disabled persons.

In most Arizona real estate purchase contracts, the buyer will require the seller to deposit earnest money ? typically with the escrow company ? to demonstrate good faith. The deposit amount can be a percentage of the home sale price or an amount dictated by the seller.

The Senior Property Valuation Protection Option (Senior Freeze) is available to residential homeowners, 65 years of age or older, who meet specific guidelines based on income, ownership, and residency (Arizona Constitution, Article 9, Section 18.)

In Arizona, sellers are required to complete a real estate purchase agreement and the following disclosures in order for it to be considered legally binding: Buyer Inquiry.Comprehensive Loss Underwriting Exchange (CLUE).Swimming Pool Barrier Disclosure.Condo Disclosure Information.Notice of Soil Remediation.

To apply for an Organizational Exemption you must file an application (Form 82514A) with the County Assessor in the county where your property is located. This form can only be obtained by contacting the County Assessor's office.