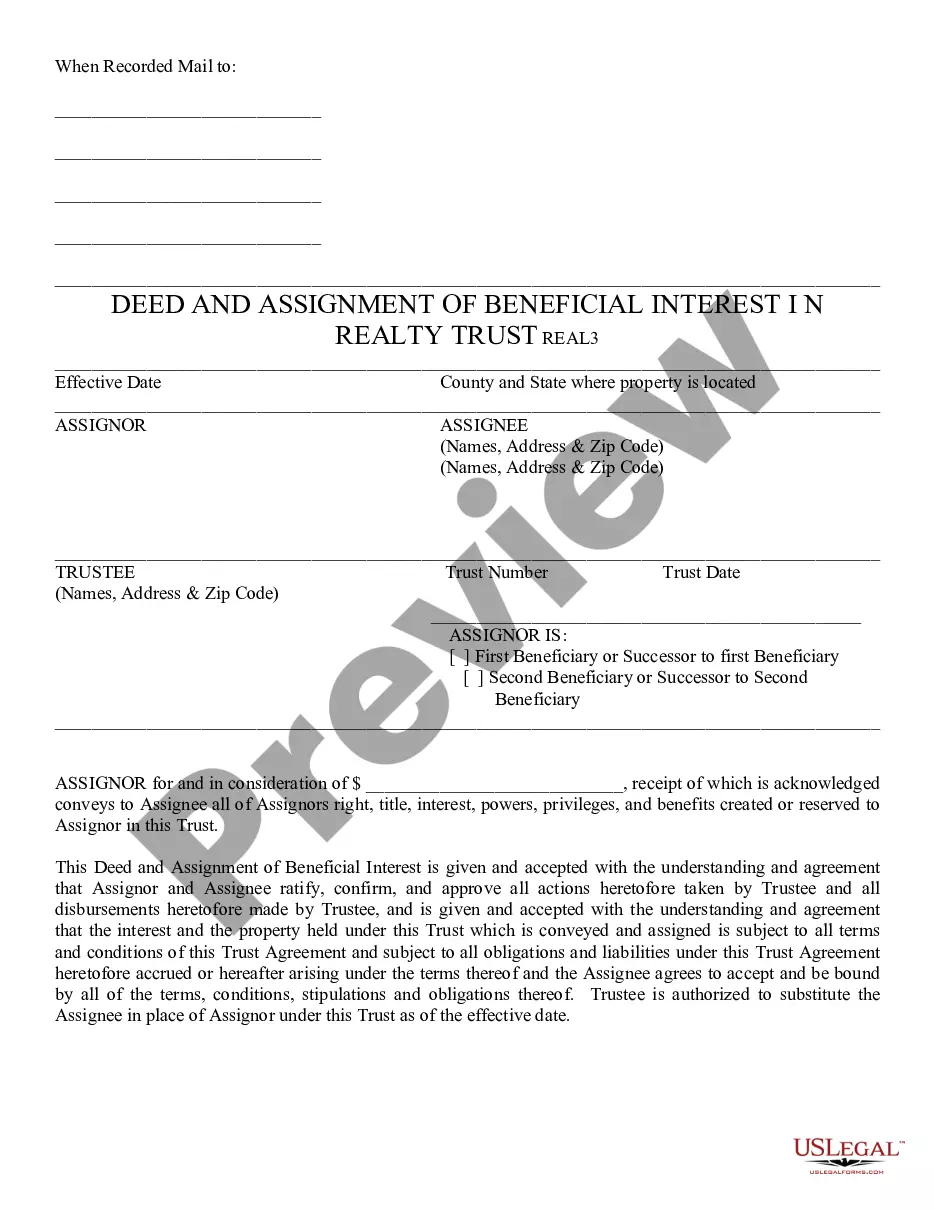

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed & Assignment of Beneficial Interest in Realty Trust, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Tucson Arizona Deed and Assignment of Beneficial Interest in Realty Trust

Description

How to fill out Arizona Deed And Assignment Of Beneficial Interest In Realty Trust?

Irrespective of one’s societal or occupational position, completing legal paperwork is an unfortunate requirement in today’s occupational landscape.

Frequently, it’s nearly unfeasible for individuals without legal expertise to create such documents from scratch, largely due to the intricate terminology and legal nuances involved.

This is where US Legal Forms proves to be useful.

If you are new to our collection, ensure you follow these preliminary steps before securing the Tucson Arizona Deed and Assignment of Beneficial Interest in Realty Trust.

Confirm that the template you have selected is suitable for your region as the regulations of one state or area do not apply to another.

- Our service provides an extensive repository with more than 85,000 ready-to-use state-specific templates applicable to nearly any legal matter.

- US Legal Forms is also a commendable asset for associates or legal advisors who wish to conserve time by utilizing our DIY forms.

- Whether you require the Tucson Arizona Deed and Assignment of Beneficial Interest in Realty Trust or any other documents pertinent to your state or locality, with US Legal Forms, everything is readily accessible.

- Here’s how to acquire the Tucson Arizona Deed and Assignment of Beneficial Interest in Realty Trust in moments using our reliable service.

- For existing customers, feel free to proceed to Log In to your account to obtain the necessary form.

Form popularity

FAQ

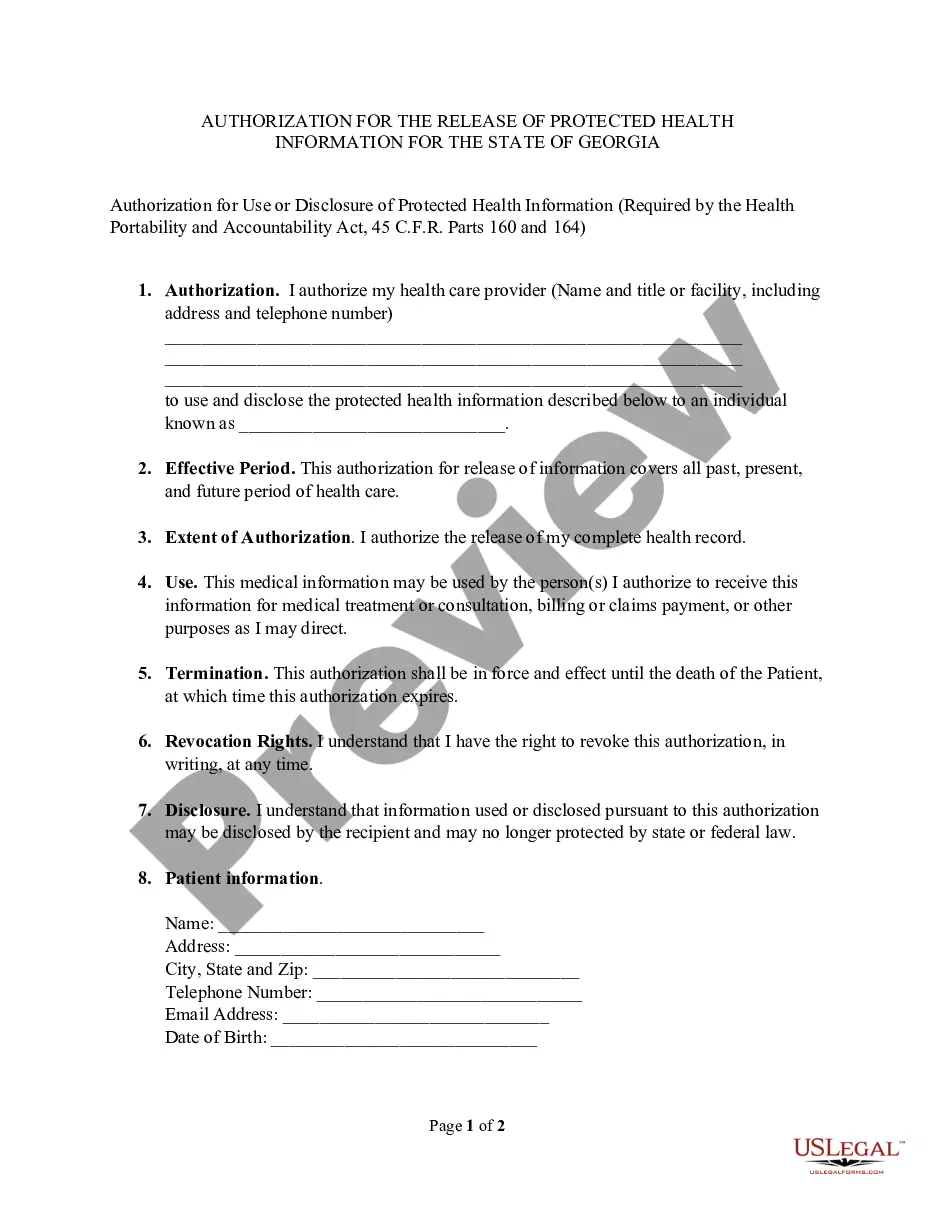

The Arizona beneficiary deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

You may create life estates or any other form of ownership recognized in Arizona. Beneficiary deeds work well when the title will pass to a single individual or to a few individuals all of whom share a common vision of what to do with the property.

Arizona allows individuals to transfer property to a beneficiary through what is known as a beneficiary deed. A beneficiary deed is sometimes referred to as a ?transfer on death deed,? or TOD deed. It is a legal document that grants a residential property to a designated beneficiary upon the death of an individual.

A beneficiary deed allows for the avoidance of probate. Arizona allows for the transfer of real estate by affidavit if the equity of all the real property in the estate is not greater than $100,000.

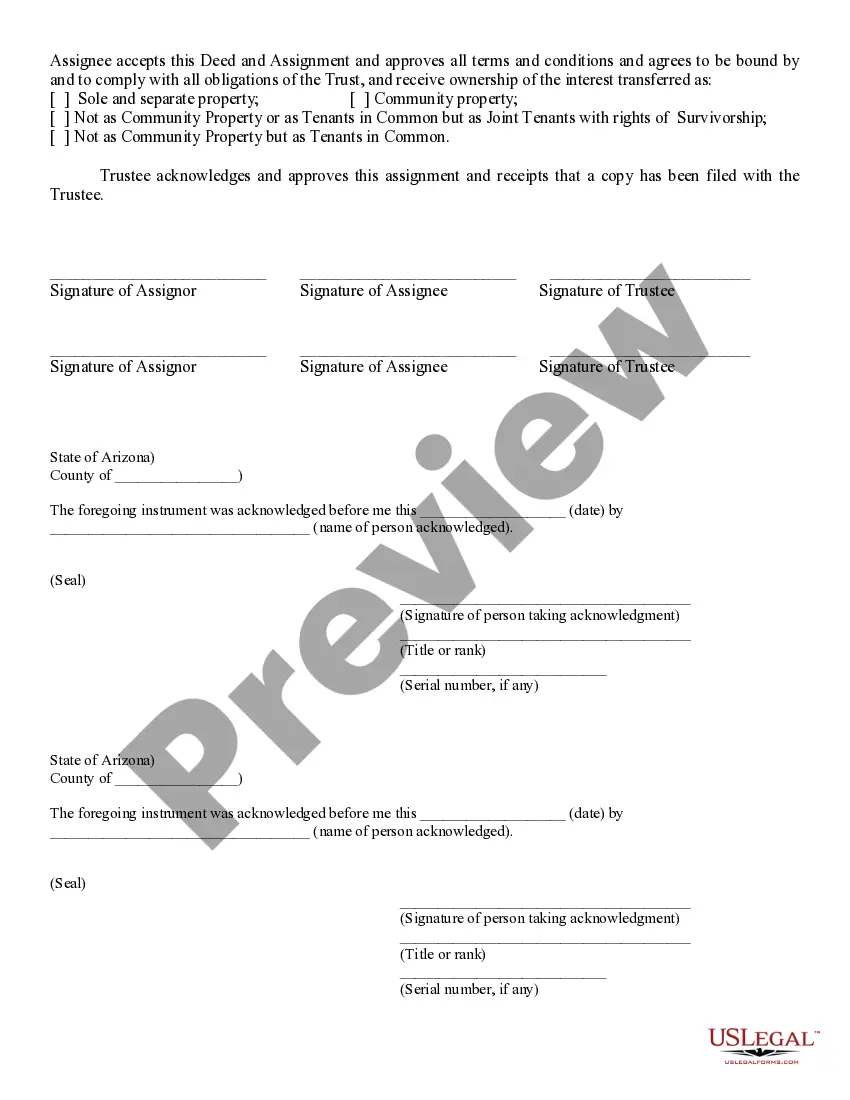

Real Estate ? Real estate which is to be transferred into a trust must be conveyed in an Arizona Deed. The document must be signed by all parties in front of a Notary Public and filed with the County Recorder's Office.

A Beneficiary Deed has to be signed by the property owner and notarized, recorded in the county where the property is located during the owner's lifetime, and must accurately state the property's legal description. While an Arizona Beneficiary Deed has many advantages, it is not for everyone.

A transfer on death deed can name a beneficiary to inherit your real estate when you die, while a living trust can name beneficiaries for many other types of property as well (like bank accounts and physical belongings).

Four Ways to Avoid Probate in Arizona Establish a Trust.Title Property with Rights of Survivorship.Make Accounts Payable on Death or Transfer of Death.Provisions for Small Estates.

In Maricopa County, Arizona, you can do this at either the main office in Phoenix, at 111 S. Third Avenue, or in Mesa at 222 E. Javelina Avenue. The recorder will need your original deed or a legible copy with original signatures.

Arizona inheritance laws specify that a decedent's property passes to their spouse and/or descendants. Qualifying descendants could include: Children, including adopted children or ones conceived before marriage. Grandchildren and great-grandchildren.