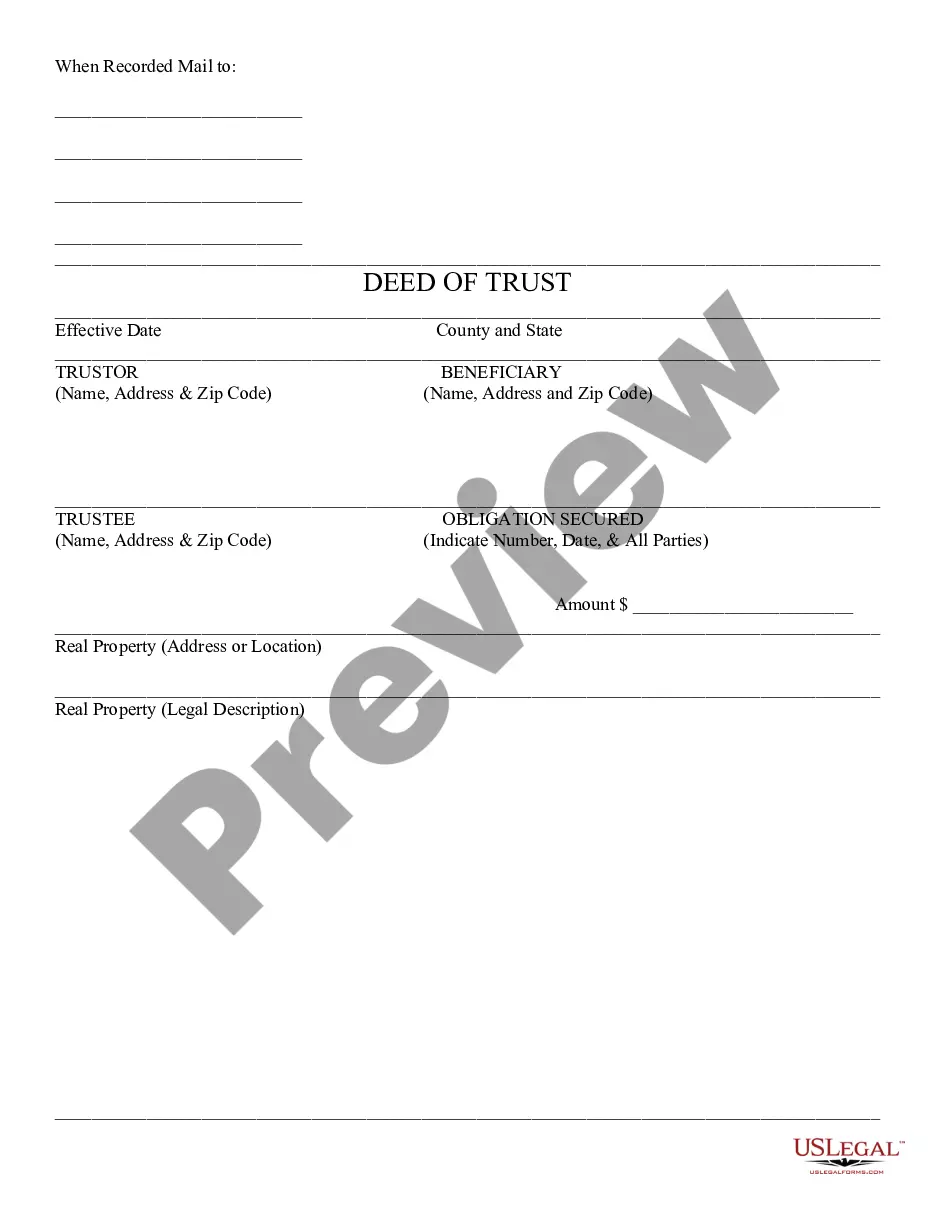

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed of Trust - Arizona, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Chandler Arizona Deed of Trust

Description

How to fill out Arizona Deed Of Trust?

If you are in search of a legitimate document, it’s exceedingly difficult to locate a superior platform than the US Legal Forms website – likely the most extensive collections available online.

With this collection, you can acquire thousands of templates for corporate and personal use categorized by types and areas, or keywords.

Utilizing our sophisticated search functionality, retrieving the latest Chandler Arizona Deed of Trust is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Retrieve the template. Choose the file format and download it to your device.

- Additionally, the accuracy of each file is verified by a group of professional attorneys who consistently review the templates on our site and refresh them to meet the latest state and county regulations.

- If you are already familiar with our site and possess an account, all you need to do to obtain the Chandler Arizona Deed of Trust is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the directives below.

- Ensure you have accessed the sample you require. Review its details and utilize the Preview option to view its contents. If it doesn’t satisfy your needs, employ the Search feature at the top of the page to find the desired document.

- Confirm your selection. Click the Buy now button. After that, select your desired subscription plan and provide the necessary information to create an account.

Form popularity

FAQ

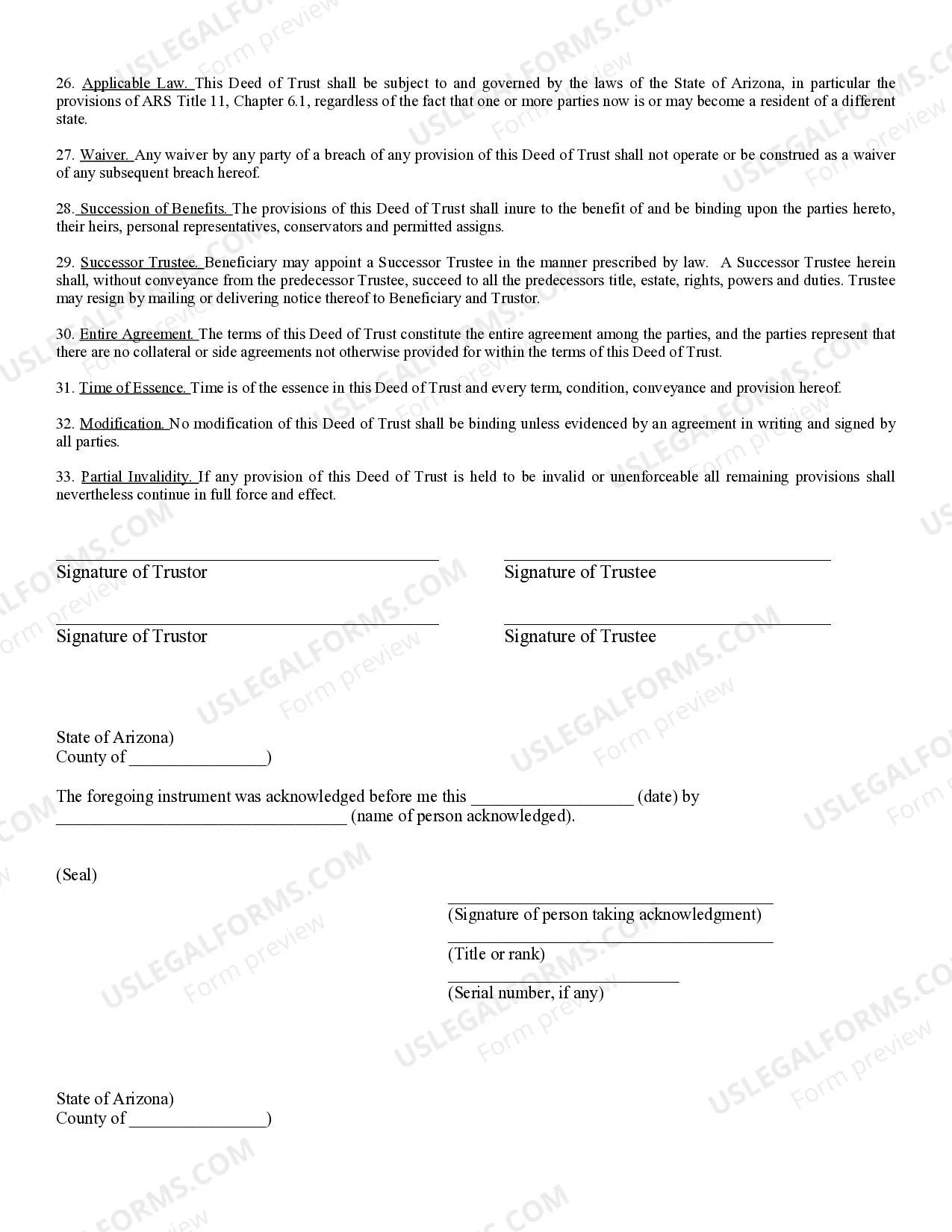

Transferring a deed to a trust in Arizona involves drafting a new deed that names the trust as the property owner. You will need to sign and notarize this deed, followed by recording it with the county recorder's office. This step is integral when establishing the Chandler Arizona Deed of Trust, as it helps secure your real estate within your overall estate plan.

To file a trust in Arizona, you typically do not need to register the trust document with a court unless you are contesting its validity. Instead, keep the trust document in a secure location and make copies as needed for banks or asset transfer. However, understanding how a Chandler Arizona Deed of Trust fits into your overall estate plan is essential, so consider legal assistance for this process.

To record a deed in Arizona, you must take the completed deed to the county recorder's office where the property is located. Ensure that the deed is properly signed and notarized before submission. Recording the deed establishes a public record, which is especially important for documents like the Chandler Arizona Deed of Trust that affect property ownership.

To transfer items into a trust, you need to change the title or ownership of the items, including real estate, bank accounts, and personal property. This process often involves drafting a deed, such as a Chandler Arizona Deed of Trust, for real estate and completing necessary paperwork for other assets. Consulting with a legal expert can ensure this process aligns with your estate planning goals.

A trust is a legal arrangement that allows you to manage your assets during your lifetime and decide how they are distributed after you pass away. In contrast, a beneficiary deed specifically allows you to transfer real estate to a designated beneficiary upon your death, avoiding probate. Understanding these differences is crucial, especially when considering the Chandler Arizona Deed of Trust for estate planning.

Yes, Arizona is indeed a Deed of Trust state. This means that instead of using mortgages in all cases, many lenders utilize deeds of trust for securing loans on real property. Homeowners in Arizona should familiarize themselves with the concept of the Chandler Arizona Deed of Trust as it can provide distinct advantages in property financing.

Statute 33-707 in Arizona relates to the process of non-judicial foreclosure for deeds of trust. This statute outlines the requirements that lenders must follow to complete a foreclosure in compliance with state laws. A clear understanding of statute 33-707 is important for both borrowers and lenders engaged with Chandler Arizona Deed of Trust agreements.

The statute of limitations on a mortgage in Arizona is also six years, similar to the Chandler Arizona Deed of Trust. This applies to actions that seek repayment or enforcement of the mortgage's terms. Being informed about this limitation is essential for borrowers to understand their rights and obligations.

The time limit to enforce a Deed of Trust in Arizona is also governed by the six-year statute of limitations. Thus, lenders must initiate any enforcement actions within this timeframe to avoid losing their claims. Understanding this detail can help both borrowers and lenders navigate their legal rights linked to the Chandler Arizona Deed of Trust.

In Arizona, the statute of limitations on a deed of trust is typically six years. This means that if there is a breach of obligation linked to the Chandler Arizona Deed of Trust, the lender or beneficiary has six years to bring a lawsuit to enforce their rights. Being aware of this timeframe can help you take timely action if you encounter any issues.