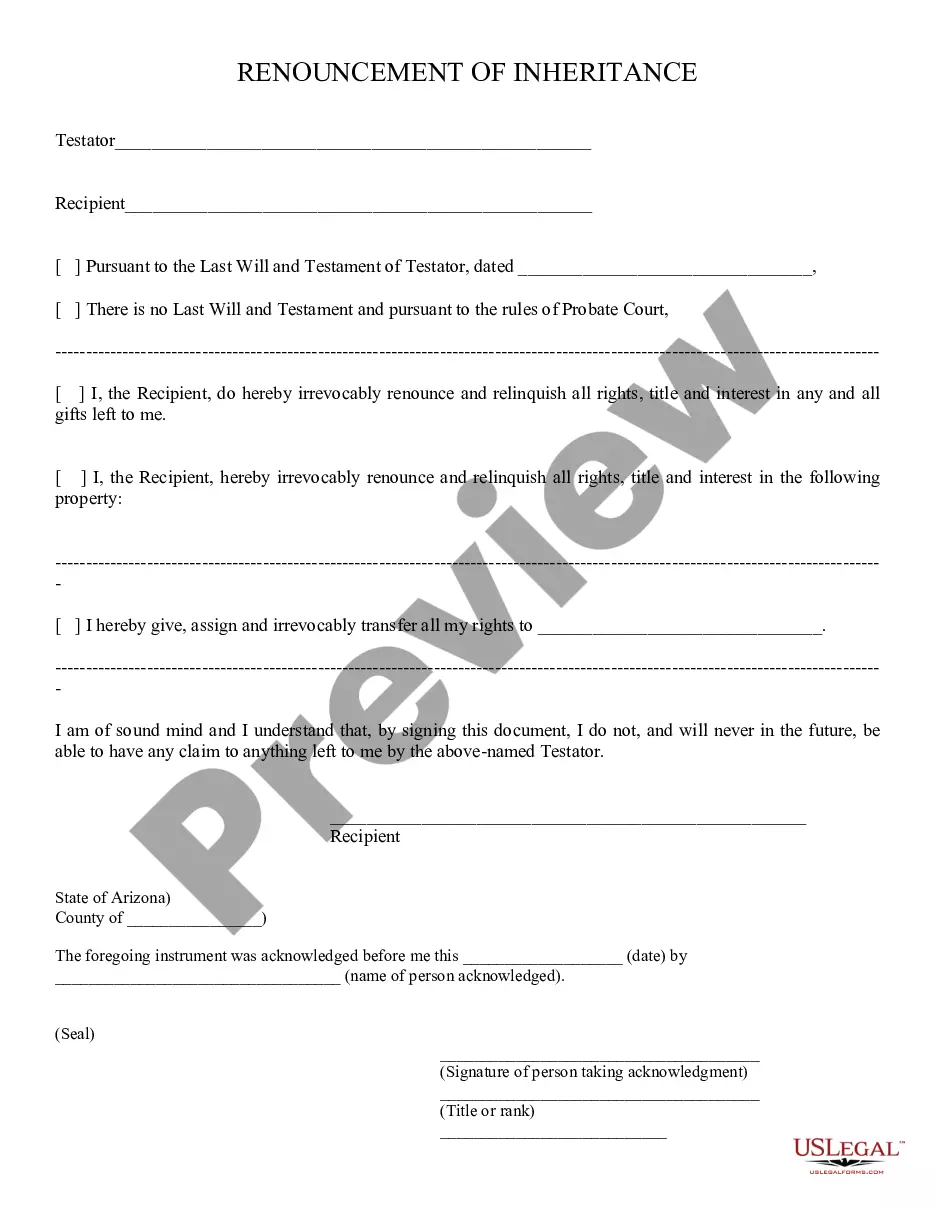

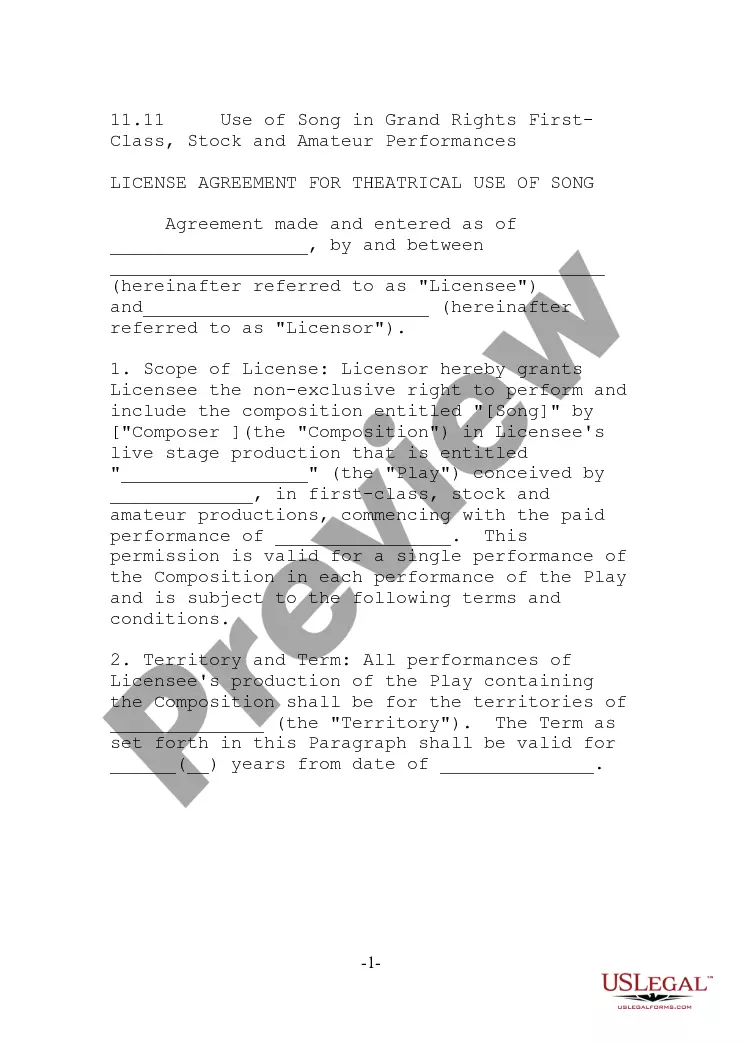

Renouncement of Inheritance - Arizona: This is a form, which allows for the renouncing, or relinquishing, of an inheritance. The intended heir, may willingly give up his/her rights to any property, or money, which would have been given to them otherwise. This form is to be signed in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Phoenix Arizona Renouncement of Inheritance

Description

How to fill out Arizona Renouncement Of Inheritance?

We consistently aim to minimize or avert legal complications when managing intricate legal or financial matters.

To achieve this, we seek legal assistance that is typically very high-priced.

However, not all legal problems are similarly convoluted. A majority of them can be addressed independently.

US Legal Forms is an online repository of contemporary DIY legal forms encompassing a range of documents from wills and power of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. In case you misplace the document, you can always re-download it in the My documents tab.

- Our platform empowers you to manage your affairs without relying on a lawyer.

- We offer access to legal document templates that may not always be publicly available.

- Our templates are specific to states and regions, which significantly eases the search process.

- Utilize US Legal Forms whenever you require to locate and obtain the Phoenix Arizona Renouncement of Inheritance or any other document swiftly and securely.

Form popularity

FAQ

To be valid under Arizona law, a disclaimer of a bequest or inheritance must be in writing, signed by the person disclaiming, and delivered (or recorded) according to the statute.

Spouses, Descendants, Parents, and Siblings Descendants are the deceased's offspring and their offspring's children or grandchildren, continuing through generations. Arizona is a community property state, so that system contributes to this succession order.

According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

In Arizona, spouses have significant inheritance rights and usually have a right to at least partial inheritance. Arizona is a community property state. This means that property acquired during the marriage is considered the property of both spouses, regardless of whose name is on the title or deed.

If the decedent left a will and named you as a beneficiary and you decline the bequest, most states treat the event the same as if you had predeceased him. The executor must probate the will as if you had died and were no longer available to accept your inheritance. Your bequest will then revert back to the estate.

Arizona Inheritance Tax and Gift Tax Arizona also has no gift tax. The federal gift tax exemption is $15,000 per person each year for 2021 and $16,000 per person each year for 2022.

Arizona inheritance laws specify that a decedent's property passes to their spouse and/or descendants. Qualifying descendants could include: Children, including adopted children or ones conceived before marriage. Grandchildren and great-grandchildren.

One way for an asset to avoid gift tax liability is if it is a qualified disclaimed gift. The government does not consider a gift or inheritance to be a gift, and it subject to the gift tax if the original recipient refused or disclaimed it.

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate?usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.

Intestate Succession That is unless the decedent excluded or limited the rights of an heir through a will. In the unlikely event that there is no one qualified to claim the estate ? there is no spouse and there are no heirs, then the intestate estate will pass to the State of Arizona.