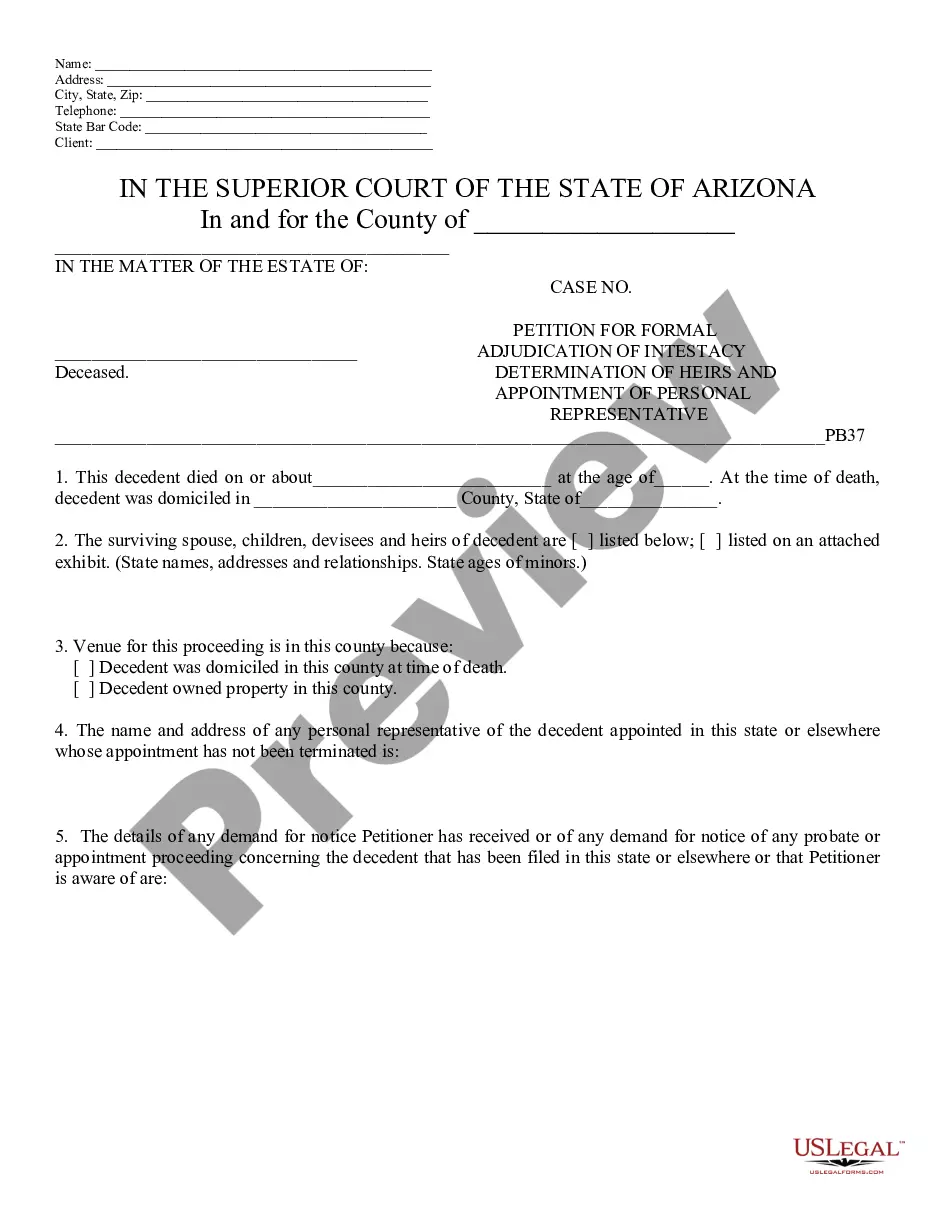

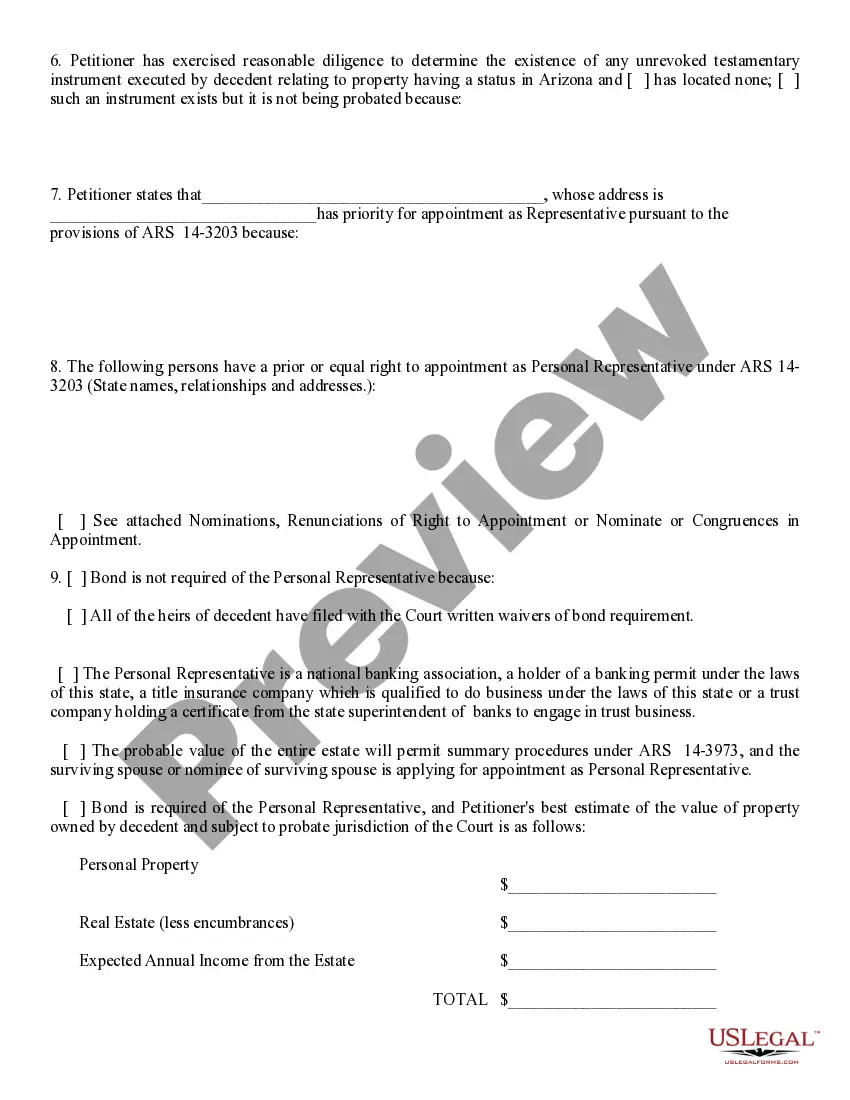

This model form, a Petition for Formal Adjunction of Intestacy Debt of Heirs and; Appt. of Personal Rep. - Arizona, is intended for use to initiate a request to the court to take the stated action. The form can be easily completed by filling in the blanks and/or adapted to fit your specific facts and circumstances. Available in for download now, in standard format(s).

Mesa Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative

Description

How to fill out Arizona Petition For Formal Adjunction Of Intestacy Debt Of Heirs And Appointment Of Personal Representative?

We consistently aim to minimize or evade legal complications when engaging with intricate legal or financial issues. In pursuit of this goal, we often retain attorney services that are generally prohibitively expensive. However, not every legal situation is equally intricate. Many can be handled independently.

US Legal Forms is a digital collection of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our collection empowers you to manage your affairs without the necessity of legal counsel. We provide access to legal document templates that aren’t always readily available to the public. Our templates are tailored to specific states and regions, which significantly simplifies the searching process.

Utilize US Legal Forms whenever you need to obtain and download the Mesa Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative or any other document swiftly and securely. Simply Log In to your account and click the Get button adjacent to it. If you happen to misplace the document, you can always download it again from the My documents section.

The procedure is just as simple if you’re not familiar with the website! You can establish your account in just a few minutes.

For over 24 years, we’ve assisted millions of individuals by providing ready-to-customize and current legal documents. Take advantage of US Legal Forms now to conserve time and resources!

- Ensure that the Mesa Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative complies with the laws and regulations of your specific state and area.

- Additionally, it’s essential that you review the form’s outline (if available), and if you find any inconsistencies with what you needed in the first place, look for another form.

- Once you’ve verified that the Mesa Arizona Petition for Formal Adjunction of Intestacy Debt of Heirs and Appointment of Personal Representative is suitable for your situation, you can select a subscription plan and proceed to payment.

- Then you can download the document in any of the available formats.

Form popularity

FAQ

For closed installment accounts, the statute of limitations runs 6 years after the final payment date. For open accounts, such as credit cards, the statute of limitations begins 6 years from the first uncured missed payment, whether or not there is an acceleration clause.

If someone dies without a will, their estate assets will pass by intestate succession. Intestate succession means that any part of the estate not covered by the decedent's will goes to the decedent's spouse and/or other heirs under Arizona law.

How Long Do You Have to File Probate After Death in Arizona? According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

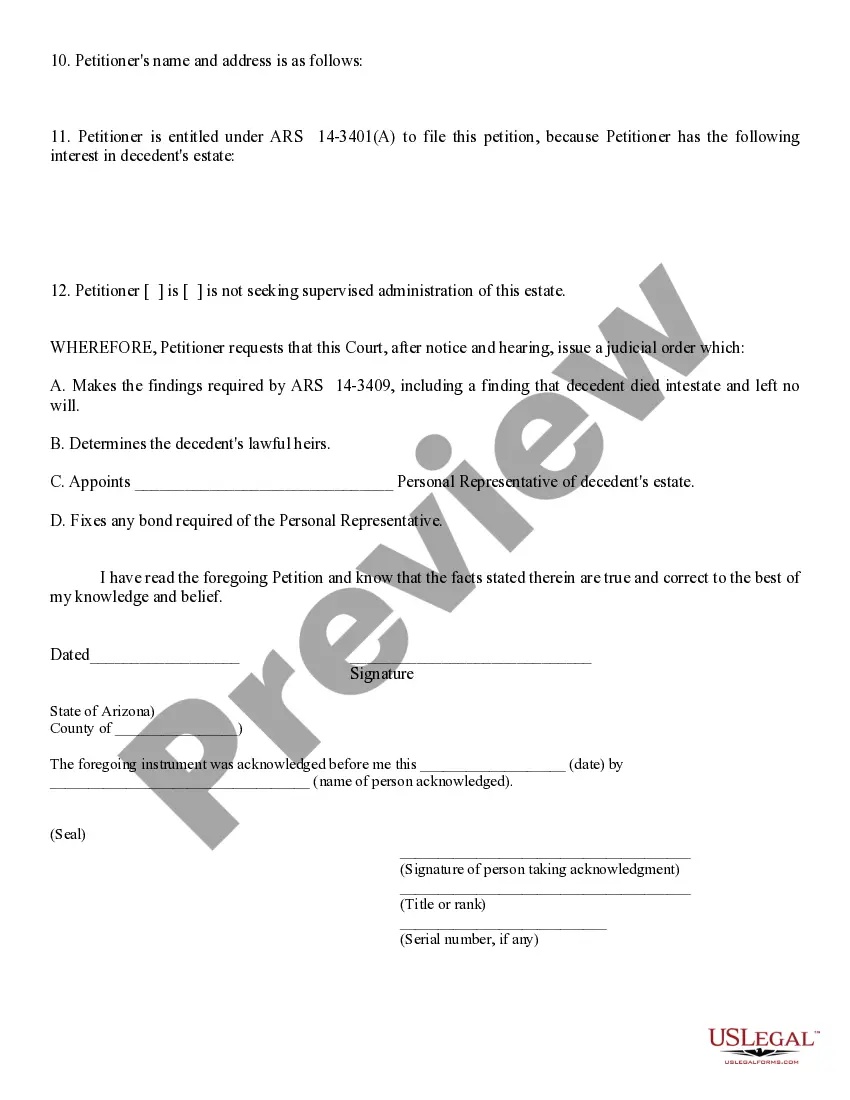

Compensation for an Arizona Personal Representative Generally personal representatives receive reasonable compensation paid at $25 to $50 per hour.

Whether you have been named the executor or you're petitioning to be the administrator, the path to becoming a personal representative is the same?you'll need to submit a petition with the county court. A hearing will be scheduled to validate the will (if the decedent has one) and appoint the personal representative.

According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

For those claims, under ARS §14-3803(C)(2), the creditor must present a claim within four months after it arises or ?two years after the decedent's death plus the time remaining in the period commenced by an actual or published notice pursuant to § 14-3801, subsection A or B,? whichever is later.

Once the Grant has been received the personal representative has a duty to collect in the assets of the deceased, pay the liabilities and distribute the estate to the beneficiaries. They have many powers to assist them when dealing with an estate e.g. power to sell property, insure property and invest monies, etc.

Whether you have been named the executor or you're petitioning to be the administrator, the path to becoming a personal representative is the same?you'll need to submit a petition with the county court. A hearing will be scheduled to validate the will (if the decedent has one) and appoint the personal representative.