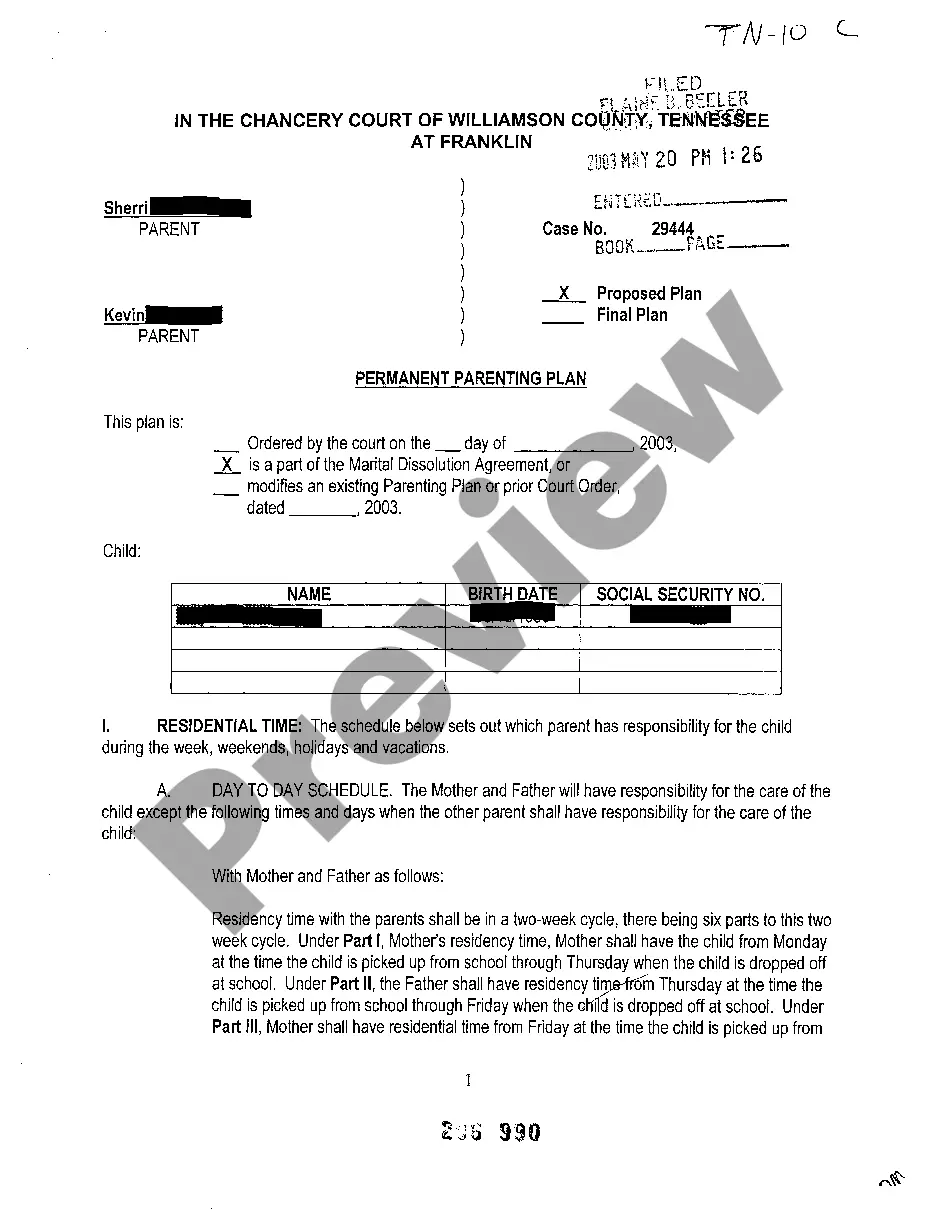

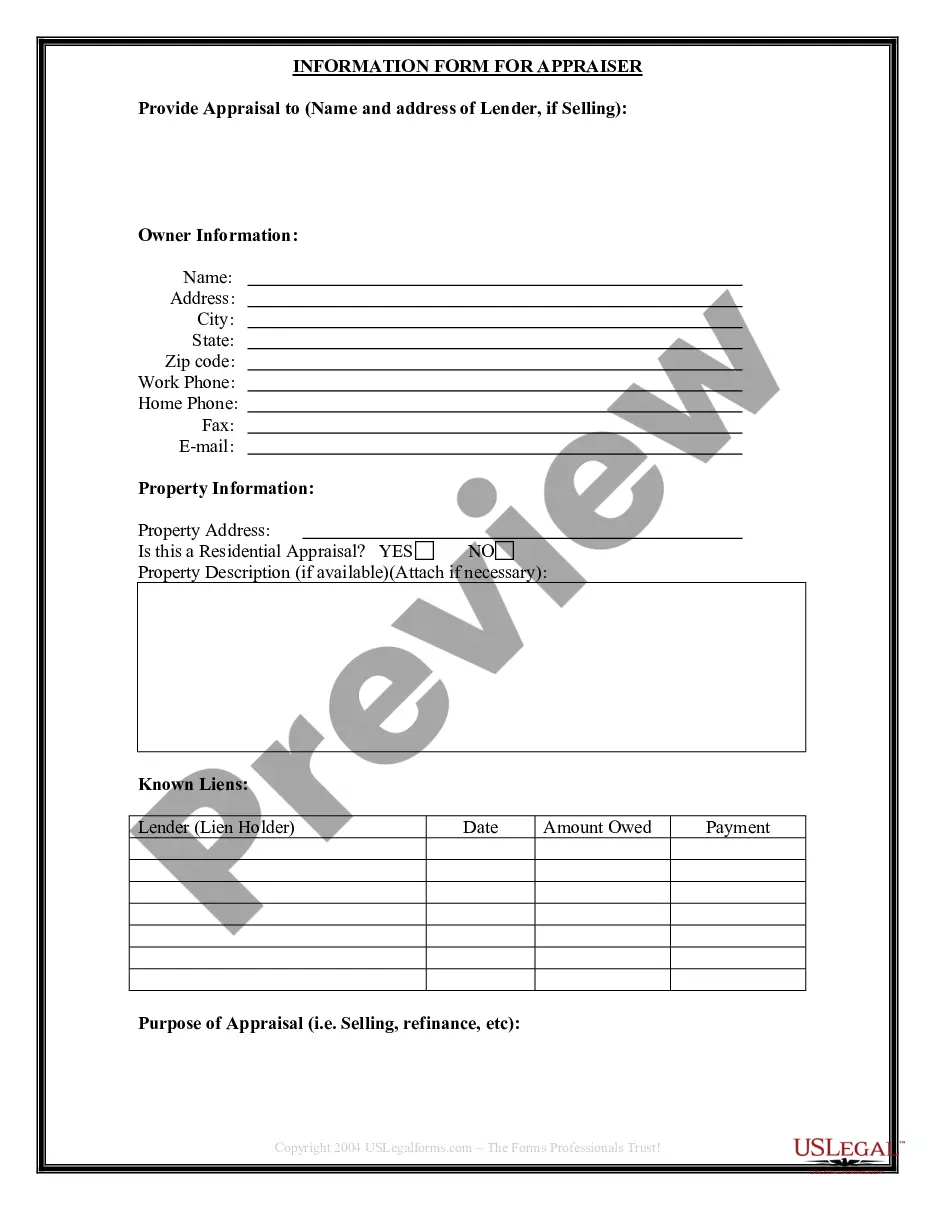

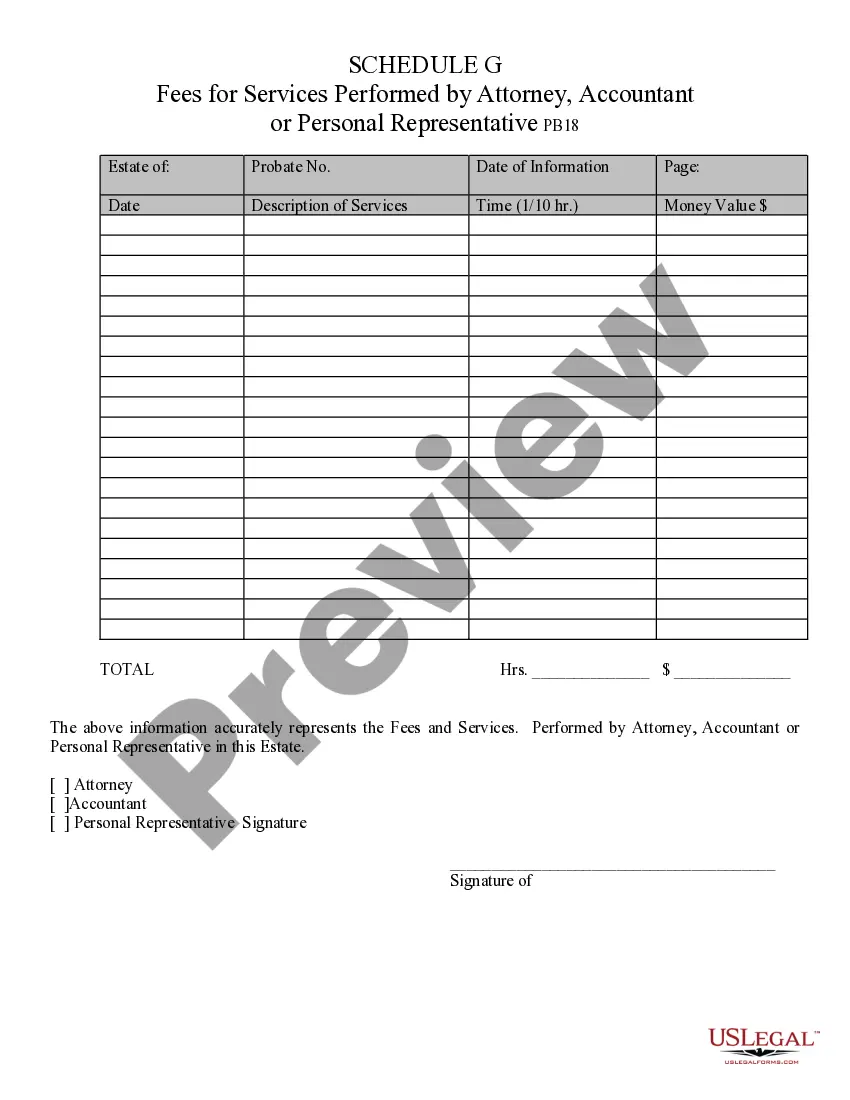

Fees for Services Performed by Attorney, Accountant, or Personal Representative - Arizona: This form is used when an administrator of an estate is called upon to list all the fees of any professional services, such as attorney or accountant fees, paid by the estate. It states the amount of the fee, as well as the duties performed for that amount. It is available for download in both Word and Rich Text formats.

Scottsdale Arizona Fees for Services Performed by Attorney, Accountant, or Personal Representative

Description

How to fill out Arizona Fees For Services Performed By Attorney, Accountant, Or Personal Representative?

If you are looking for a legitimate form template, it’s hard to discover a superior service than the US Legal Forms website – perhaps the most comprehensive collections on the web.

Here you can discover thousands of document examples for business and personal purposes categorized by type and region, or keywords.

With our improved search feature, obtaining the latest Scottsdale Arizona Fees for Services Rendered by Lawyer, Accountant, or Personal Representative is as simple as 1-2-3.

Confirm your selection. Click the Buy now button.

Then, choose your desired payment plan and provide the information to create an account.

- Additionally, the accuracy of each document is confirmed by a team of expert attorneys who consistently review the templates on our site and update them in accordance with the latest state and municipal regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Scottsdale Arizona Fees for Services Rendered by Lawyer, Accountant, or Personal Representative is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply refer to the following steps.

- Ensure you have selected the form you require. Review its details and utilize the Preview feature to examine its content.

- If it does not satisfy your needs, use the Search option located at the top of the page to find the suitable document.

Form popularity

FAQ

The priority of a personal representative in Arizona includes ensuring the estate is properly managed and distributed according to the law and the wishes of the deceased. This responsibility involves paying debts and taxes, managing assets, and communicating with beneficiaries. Fulfilling these duties effectively will help you navigate the complexities of Scottsdale Arizona fees for services performed by an attorney, accountant, or personal representative.

In Arizona, a personal representative generally has one year to settle an estate, but this timeline can vary depending on specific circumstances. If complications arise, such as disputes among beneficiaries or unresolved debts, additional time may be necessary. The key is to stay informed about the process and to account for Scottsdale Arizona fees for services performed by attorneys and accountants as part of the overall estate settlement.

In Arizona, a personal representative can be an adult who is either a resident of the state or a person related to the deceased. Additionally, a trust company or a bank may serve as a personal representative. By selecting a qualified individual or entity, you ensure that the estate is managed properly, addressing Scottsdale Arizona fees for services performed by a personal representative when settling the estate.

A personal representative in Arizona holds significant authority in managing a deceased person's estate. This includes collecting assets, paying debts, and distributing the remaining assets to beneficiaries. Their role involves navigating the Scottsdale Arizona fees for services performed by attorney, accountant, or personal representative for tasks required during the probate process. Having knowledgeable legal assistance can ensure that all actions are carried out correctly and efficiently.

Yes, in many cases, attorney fees are recoverable in Arizona. If you win your case or settle, you may be able to recover these costs as part of your legal expenses. The Scottsdale Arizona fees for services performed by attorney, accountant, or personal representative can often be included in a settlement agreement. It’s essential to consult with your attorney to understand your specific situation and any applicable laws.

While it is not legally required to hire a probate lawyer in Arizona, it is highly advisable. A probate lawyer can help navigate the complexities of estate laws, manage court filings, and address any disputes that arise. Engaging with an expert can streamline the process and clarify any Scottsdale Arizona fees for services performed by attorneys, accountants, or personal representatives. This assistance can save you time and prevent costly mistakes.

In Arizona, an estate generally must be valued at over $75,000 to require probate. However, even lower-valued estates may need to go through the process under certain circumstances. Understanding the Scottsdale Arizona fees for services performed by attorneys, accountants, or personal representatives can greatly impact the overall financial planning for your estate. Consulting with professionals can help ensure you navigate these details effectively.