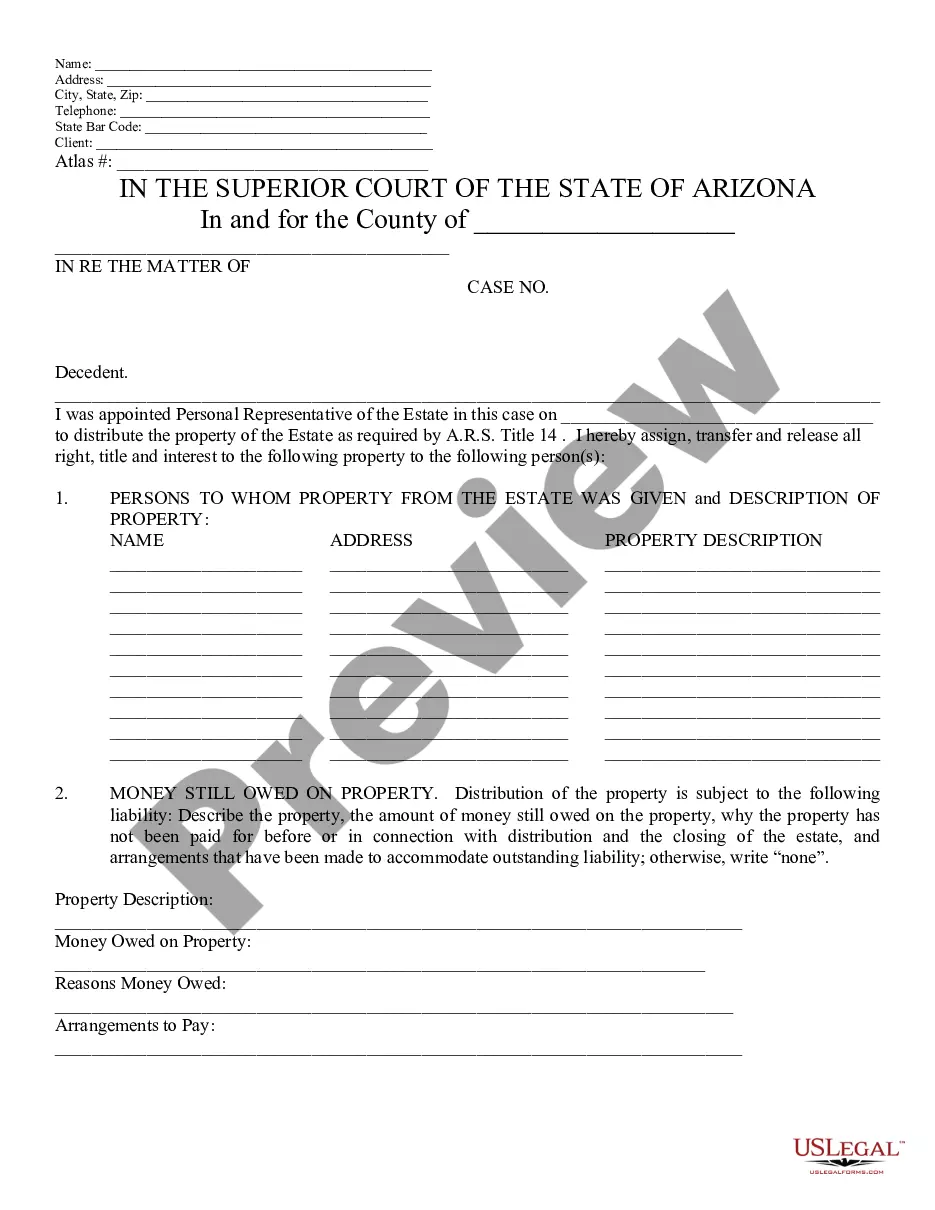

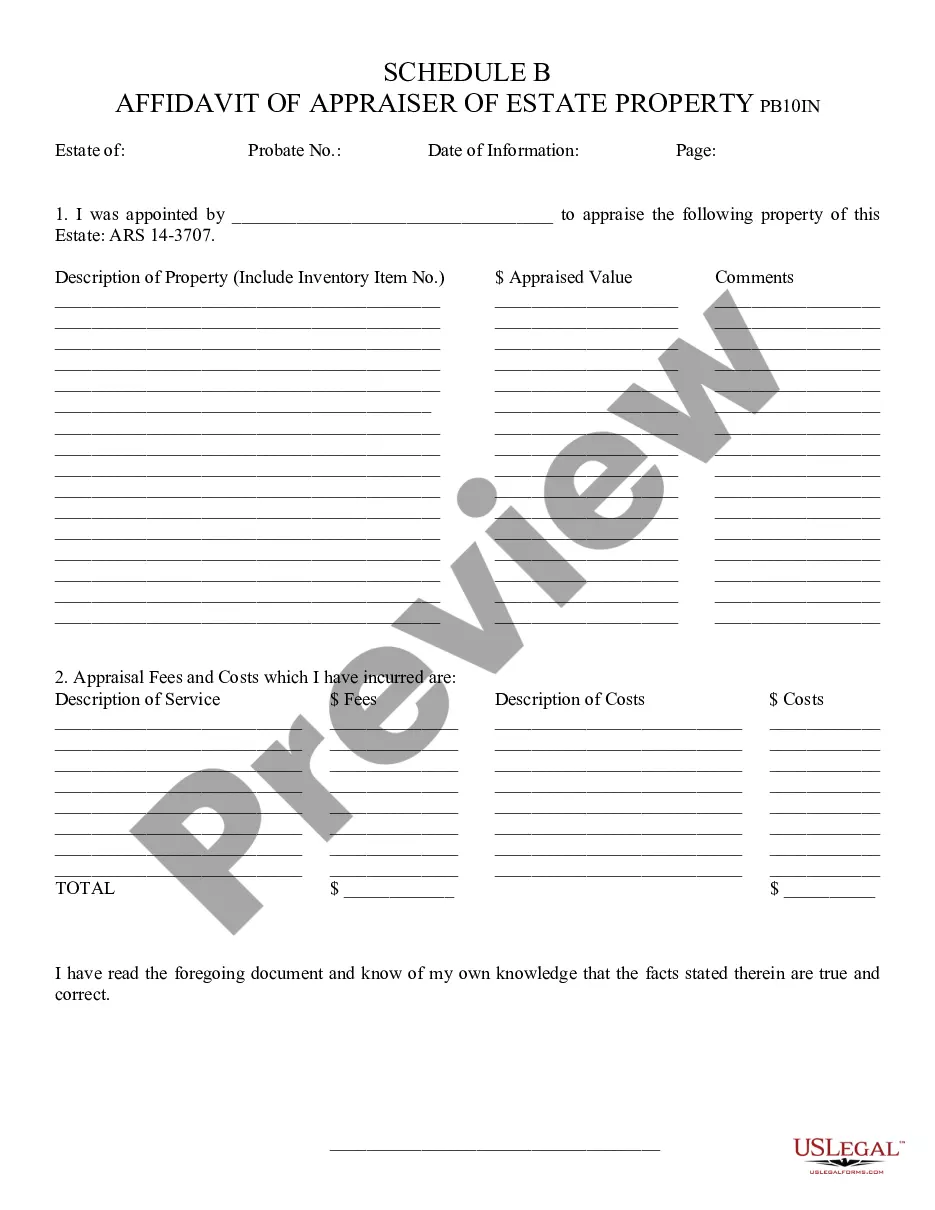

Proposed Distribution of Money and Property of Probate Estate - Schedule H - Arizona: A Proposed Distribution of Estate Property is signed by the Administrator. It fully lists all property in an estate and how he/she sugests it should be divided. It is available for download in both Word and Rich Text formats.

Glendale Arizona Proposed Distribution of Money and Property of Probate Estate - Schedule H

Description

How to fill out Arizona Proposed Distribution Of Money And Property Of Probate Estate - Schedule H?

If you have previously utilized our service, Log In to your account and download the Glendale Arizona Proposed Distribution of Funds and Assets of Probate Estate - Schedule H onto your device by clicking the Download button. Ensure your subscription is current. If not, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have acquired: you can find it in your profile under the My documents menu whenever you need to access it again. Take advantage of the US Legal Forms service to quickly find and download any template for your personal or professional requirements!

- Ensure you’ve located the correct document. Read the description and use the Preview feature, if available, to verify if it satisfies your requirements. If it does not suit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Enter your credit card information or select the PayPal option to finalize the transaction.

- Obtain your Glendale Arizona Proposed Distribution of Funds and Assets of Probate Estate - Schedule H. Select the file format for your document and store it on your device.

- Finalize your sample. Print it out or utilize professional online editors to complete it and sign it electronically.

Form popularity

FAQ

The best way to distribute estate assets in Glendale Arizona is to follow the guidelines outlined in the Probate Estate - Schedule H. This approach ensures transparency, fairness, and compliance with state laws. It's advisable to consult a legal professional to navigate the distribution process, as they can help clarify the specifics based on the estate’s unique circumstances.

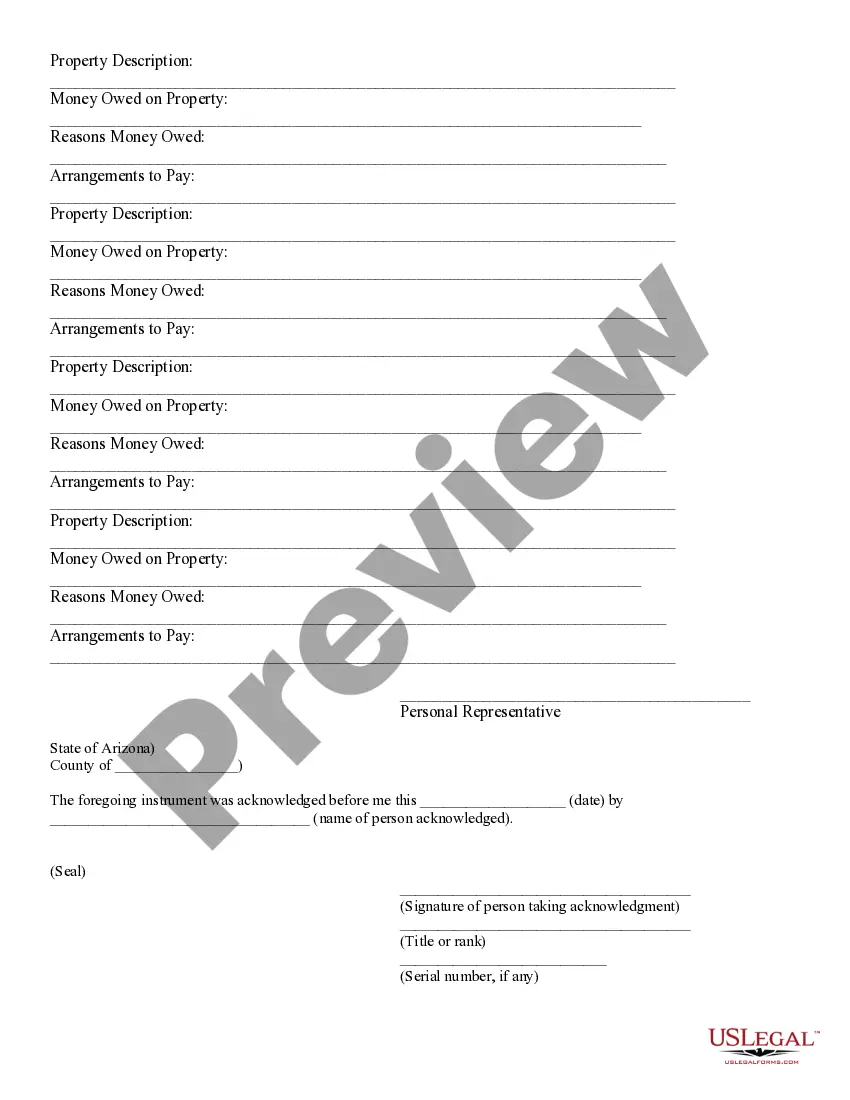

Deed of Distribution: The DEED OF DISTRIBUTION must be used to transfer any real estate/real property. After all claims have been settled and you are ready to transfer the property to someone, you need to fill out the DEED OF DISTRIBUTION and record it with the County Recorder.

In the state of Arizona, probate is only required if the decedent has any assets that did not transfer automatically upon their death. These assets tend to be titled individually in the decedent's name and will require a probate court to transfer the title of ownership to the intended beneficiary.

According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

Types of Assets That Are Subject to Probate Examples include: Real estate, vehicles, and other titled assets owned solely by a decedent or assets owned by the decedent with other individuals as tenants in common. Personal possessions, including artwork, jewelry, clothing, collectibles, and furniture.

Executors must not unreasonably delay distributing the estate for their own gain or any other party. However, even after the executor's year, the court will not order a distribution of the estate if the executors can show there is good reason to wait.

Since every estate is different, the time it takes to settle the estate may also differ. Most times, an executor would take 8 to 12 months. But depending on the size and complexity of the estate, it may take up to 2 years or more to settle the estate.

A Personal Representative, or executor, has 365 days in which to administer the estate of the deceased and to distribute their assets to the Beneficiaries. As complex estates can take longer than a year to wind up, this isn't a strict deadline.

There are several statutes of limitations and general time limits regarding wills and probate in Arizona, and each of them depends on the circumstances. Generally speaking, probate needs to be opened within two years of the decedent's death, and objections to the will should be submitted within the same two years.

Which Assets are Not Considered Probate Assets? Life insurance or 401(k) accounts where a beneficiary was named. Assets under a Living Trust. Funds, securities, or US savings bonds that are registered on transfer on death (TOD) or payable on death (POD) forms. Funds held in a pension plan.