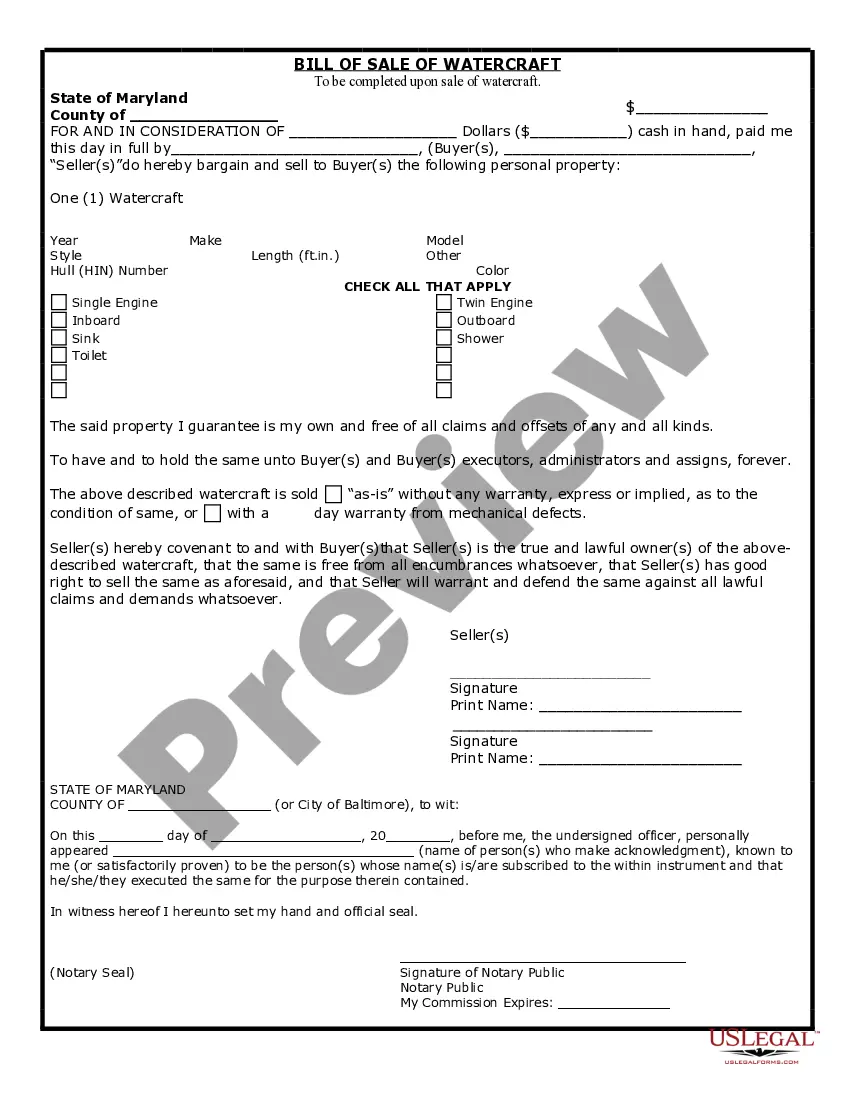

Writ of Garnishment Earnings and Summons: This Writ of Garnishment is issued to the Garnishee, or presumed employer of the Judgment Debtor. The Writ states that at the time of the original Writ of Garnishment, the Judgment Debtor was employed by the Garnishee; however, the Garnishee never paid an amount to the Judgment Creditor and that amount owed is due. This form is available for download in both Word and Rich Text formats.

Phoenix Arizona Writ of Garnishment and Summons

Description

How to fill out Arizona Writ Of Garnishment And Summons?

We consistently aim to reduce or avert legal complications when navigating intricate legal or financial matters.

To achieve this, we engage in legal services that are typically quite costly.

Nonetheless, not every legal issue is equally intricate.

Many of them can be managed independently by us.

Utilize US Legal Forms whenever you need to obtain and download the Phoenix Arizona Writ of Garnishment Earnings and Summons or any other document quickly and safely. Just Log In to your account and click the Get button next to it. If you misplace the form, you can always retrieve it again from the My documents section. The procedure is equally straightforward if you are new to the website! You can set up your account in just a few minutes. Ensure that the Phoenix Arizona Writ of Garnishment Earnings and Summons adheres to the laws and regulations of your state and locality. Additionally, it is crucial to review the form’s outline (if available), and if you find any inconsistencies with what you initially required, look for an alternative form. Once you confirm that the Phoenix Arizona Writ of Garnishment Earnings and Summons is suitable for your situation, you can select the subscription option and complete the payment. Then you can download the form in any preferred format. For over 24 years in the industry, we have assisted millions of individuals by providing ready-to-customize and current legal forms. Take advantage of US Legal Forms today to conserve time and resources!

- US Legal Forms is a web-based repository of current DIY legal documents covering various topics from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our collection empowers you to take control of your affairs without relying on an attorney.

- We offer access to legal document templates that are not always publicly available.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

Filing for bankruptcy is the most flexible option when it comes to stopping wage garnishment, since it can be initiated before your creditor secures a money judgment or after your wages have already been subject to garnishment.

A garnishee summons is another term for a Garnishment Order. The Application form requests a great deal of information to help identify the correct federal employee whose wages are to be garnished. You may not know some of the required information. Complete the form with as much information as you can.

The statute of limitations for credit card debt is three years. For car loans, mortgages and medical debts it's six years, and for unpaid taxes it's 10 years. The timeframe indicates the amount of time a debt collector has to collect a debt.

The wage garnishment laws in Arizona are generally the same as federal wage garnishment laws, with a few added protections. The creditor will continue to garnish your wages until the debt is paid off, or you take some measure to stop the garnishment, such as claiming an exemption with the court.

Unfortunately a garnishee order can only be stopped by bringing an application to court to have the order stopped, or, if the judgment creditor informs the employer or garnishee that he no longer needs to deduct money from your salary.

Typically, judgment creditors collect outstanding debts through wage garnishments, but our laws do allow for levying bank accounts and/or non-exempt property.

Here's how you may be able to stop a garnishee order Pay the debt in full.Make alternative repayment arrangements.Apply to pay by instalments through the court.Use the Bankruptcy Act.

Garnishment procedures are governed by Arizona law and are extremely complicated. All parties involved must follow these procedures correctly. The Court may issue an order for monetary penalties against any party who does not proceed properly, including the judgment creditor.

This means that the creditor must file a lawsuit in court and win that lawsuit. After that, the creditor has to apply to the court for a garnishment order, called a ?writ of garnishment,? and after the court signs this order, the garnishment can proceed.

How do I stop a garnishment? Option 1: Don't allow a judgment to be entered against you. Option 2: Challenge the judgment. Option 3: Don't expose assets to garnishment. Option 4: Reduce the amount that is being garnished (wage garnishments only) Option 5: Settlement. Option 6: Bankruptcy.