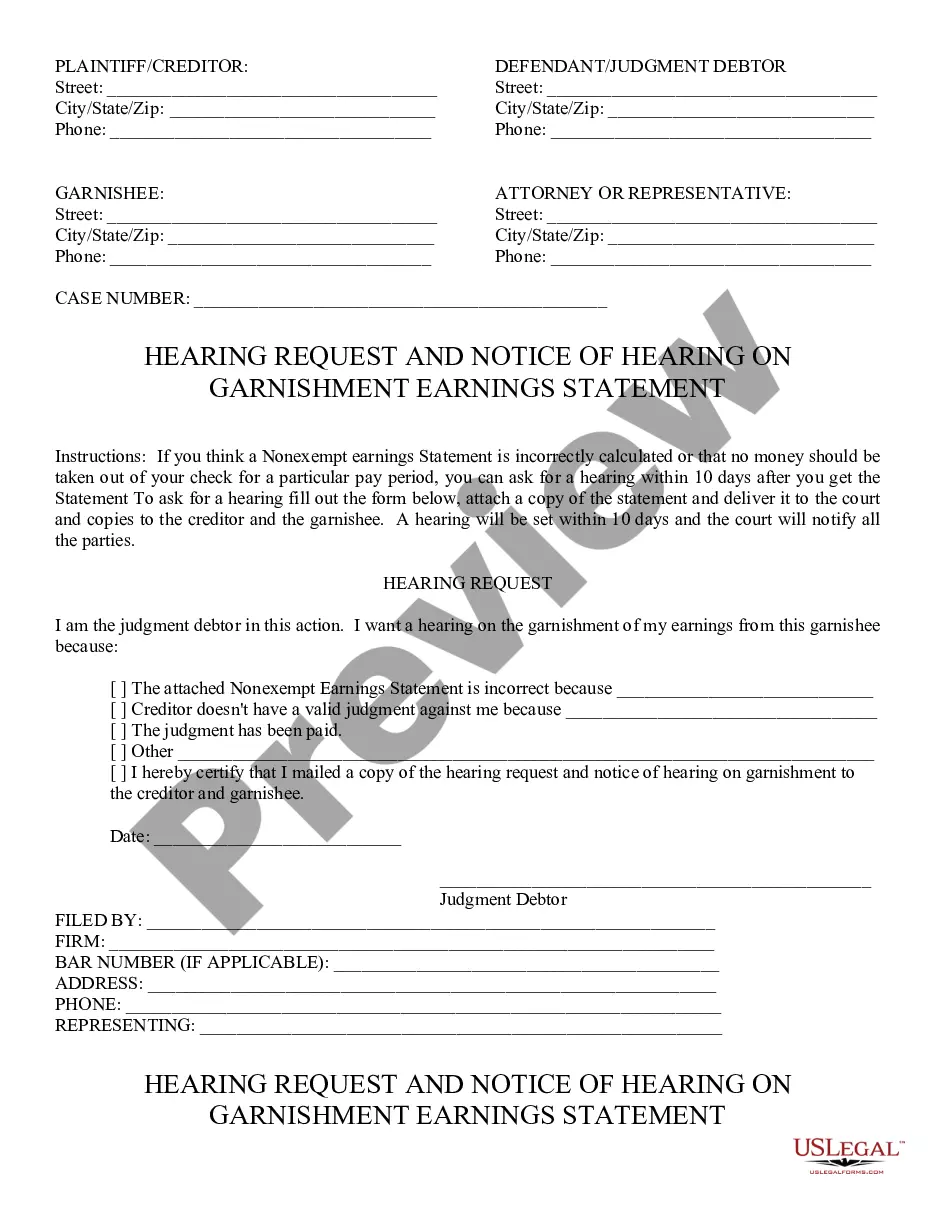

Request; Notice of Hearing on Garnishment Earnings Statement: If a debtor feels the amount garnished is incorrect, he/she files this request for a hearing on the matter. Upon filing the request for a hearing, he/she then files a notice of said hearing, including both the date and time. This form is available for download in both Word and Rich Text formats.

Mesa Arizona Request and Notice of Hearing on Garnishment Earnings Statement

Description

How to fill out Arizona Request And Notice Of Hearing On Garnishment Earnings Statement?

If you are searching for a pertinent document, it’s challenging to locate a superior resource than the US Legal Forms website – one of the most comprehensive collections on the web.

Here you can acquire thousands of templates for professional and personal needs by categories and states, or keywords.

Using our premium search functionality, locating the most recent Mesa Arizona Request and Notice of Hearing on Garnishment Earnings Statement is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Specify the format and download it onto your device.

- Furthermore, the significance of each document is validated by a team of skilled attorneys who routinely examine the templates on our platform and update them in line with the latest state and county requirements.

- If you are already familiar with our platform and possess a registered account, all you need to obtain the Mesa Arizona Request and Notice of Hearing on Garnishment Earnings Statement is to Log In to your profile and select the Download option.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have located the form you require. Review its details and use the Preview feature (if available) to examine its content. If it doesn’t meet your requirements, use the Search function at the top of the page to find the suitable document.

- Verify your choice. Click the Buy now button. After that, select your desired subscription plan and provide the necessary credentials to set up an account.

Form popularity

FAQ

6 Options If Your Wages Are Being Garnished Try To Work Something Out With The Creditor.File a Claim of Exemption.Challenge the Garnishment.Consolidate or Refinance Your Debt.Work with a Credit Counselor to Get on a Payment Plan.File Bankruptcy.

Garnishment procedures are governed by Arizona law and are extremely complicated. All parties involved must follow these procedures correctly. The Court may issue an order for monetary penalties against any party who does not proceed properly, including the judgment creditor.

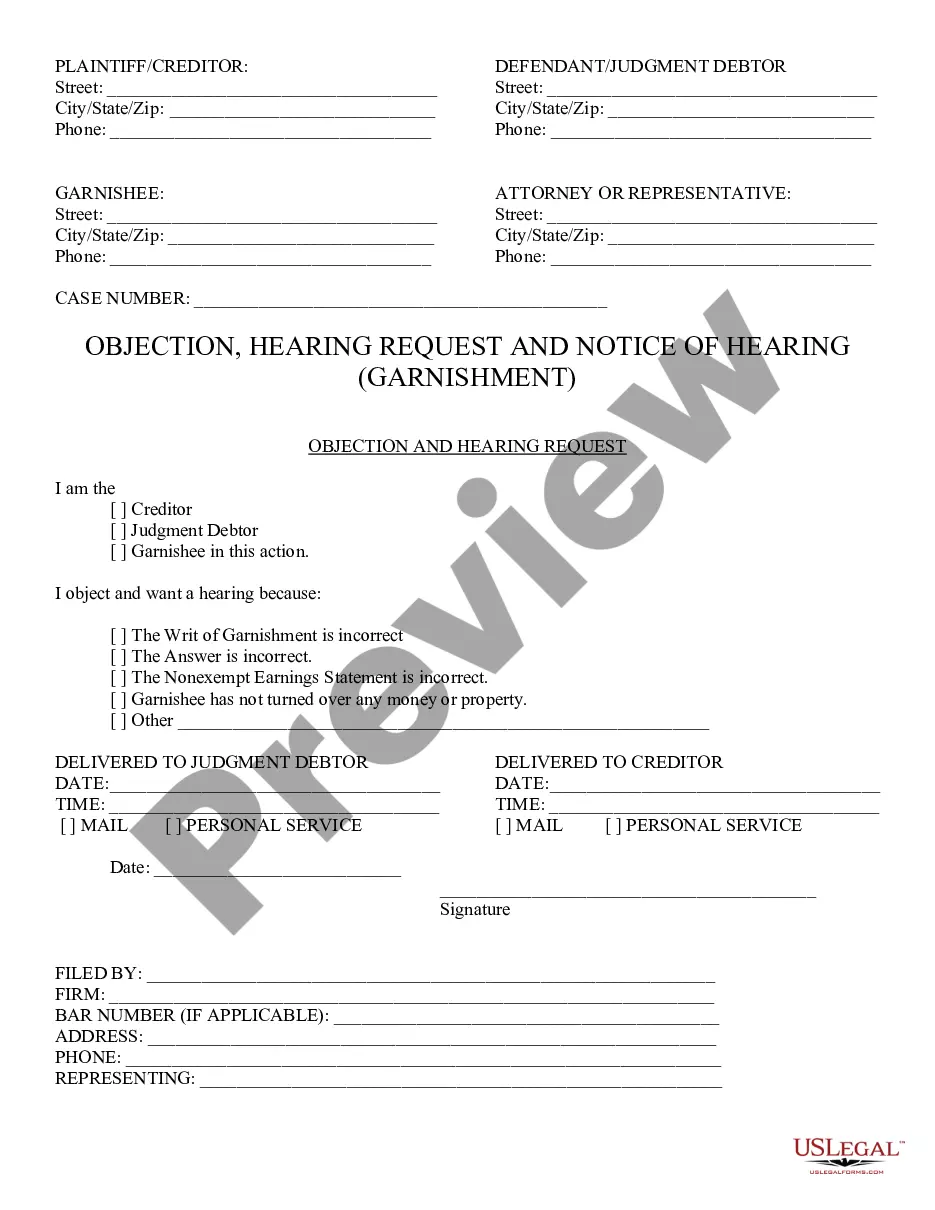

Ways to Stop A Garnishment Paying off the debt in full. Filing an objection to the garnishment with the court if you have legal basis, such debt was a result of fraud or identity theft. Filing for court protection and debt resolution through Chapter 13 or Chapter 7 bankruptcy.

The wage garnishment laws in Arizona are generally the same as federal wage garnishment laws, with a few added protections. The creditor will continue to garnish your wages until the debt is paid off, or you take some measure to stop the garnishment, such as claiming an exemption with the court.

You do this by submitting a request for hearing to the court, on a form that you should have received with the garnishment paperwork. You will have to show that a garnishment of 25% of your disposable income will subject you or your family to extreme economic hardship.

Wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt such as child support.

Most garnishments affect defendants' wages. For example, a court might garnish a defendant's wages to pay child support, student loans, or back taxes.

The letter will say that a court or government agency is requiring you to withhold part of an employee's salary or wages until the debt is paid off.

You should file any objections you have to the garnishment, in writing, with the court and and request a hearing. The garnishment papers might contain forms that you can fill in and request a hearing. If not, you'll have to complete and file something separately.

A garnishment judgment will stay on your credit reports for up to seven years, affecting your credit score. But there are a few easy ways to bolster your credit, both during and after wage garnishment.