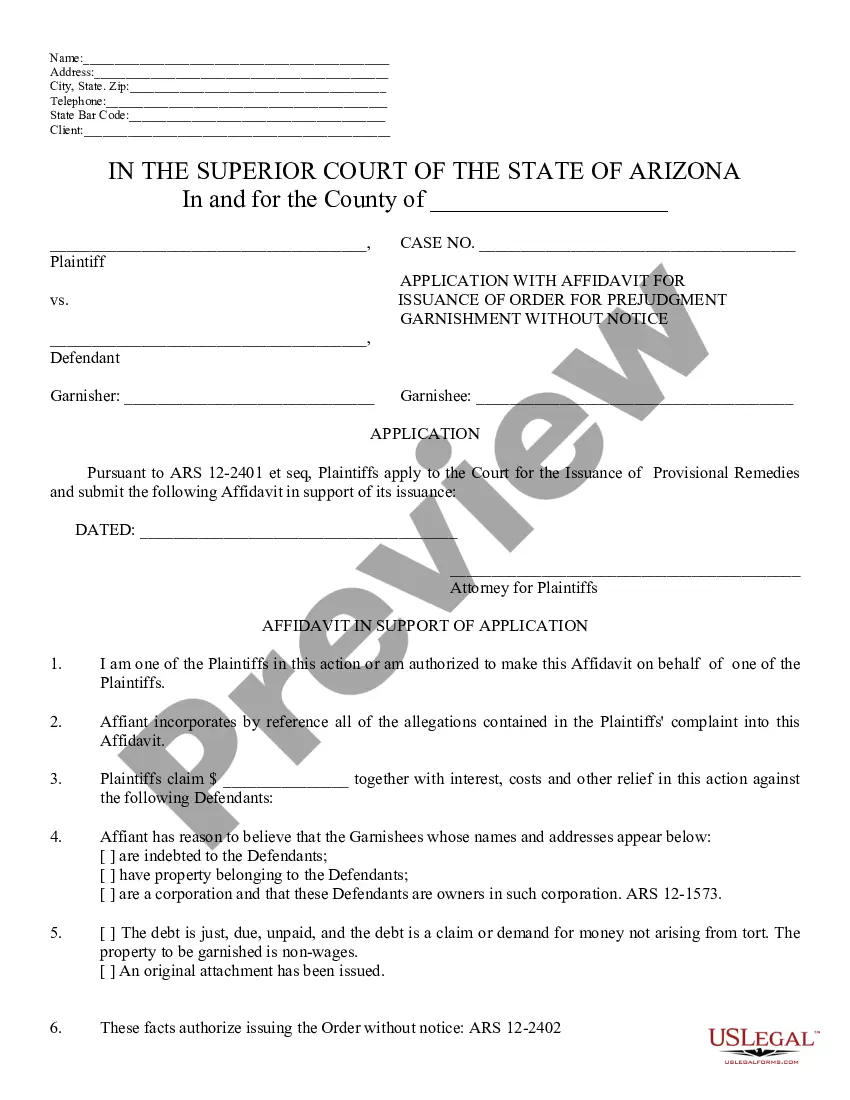

Application for Writ of Garnishment Earnings: This Application requests that the court issue an Order, garnishing the wages of a Judgment Debtor, who is currently not paying the Creditor. The motion states both the Debtor's and Creditor's name, as well as the Debtor's place of business. This form is available for download in both Word and Rich Text formats.

Phoenix Arizona Application for Writ of Garnishment

Description

How to fill out Arizona Application For Writ Of Garnishment?

Do you require a reliable and economical provider of legal forms to purchase the Phoenix Arizona Application for Writ of Garnishment Earnings? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish rules for living together with your partner or a collection of forms to progress your divorce in court, we have you covered. Our site offers over 85,000 current legal document templates for personal and business use. All templates we provide are not generic and are tailored according to the stipulations of specific states and regions.

To obtain the document, you must Log In to your account, locate the required form, and click the Download button next to it. Please note that you can access your previously purchased form templates at any time in the My documents section.

Are you a newcomer to our website? No problem. You can create an account in just a few minutes, but first, ensure to do the following.

Now, you can register your account. After that, select the subscription plan and proceed with the payment. Once the payment is completed, download the Phoenix Arizona Application for Writ of Garnishment Earnings in any available format. You can revisit the website whenever you need and redownload the document free of charge.

Obtaining current legal forms has never been simpler. Try US Legal Forms today, and say goodbye to spending hours searching for legal documents online.

- Confirm that the Phoenix Arizona Application for Writ of Garnishment Earnings meets the regulations of your state and local area.

- Review the form’s specifics (if available) to understand the intended user and purpose of the document.

- If the form is unsuitable for your legal situation, begin the search anew.

Form popularity

FAQ

You can STOP the garnishment any time by paying the Clerk's Office what you owe. The Clerk will give you a receipt. Take the receipt to your employer right away. They should stop taking money from your pay as soon as they get the receipt.

The wage garnishment laws in Arizona are generally the same as federal wage garnishment laws, with a few added protections. The creditor will continue to garnish your wages until the debt is paid off, or you take some measure to stop the garnishment, such as claiming an exemption with the court.

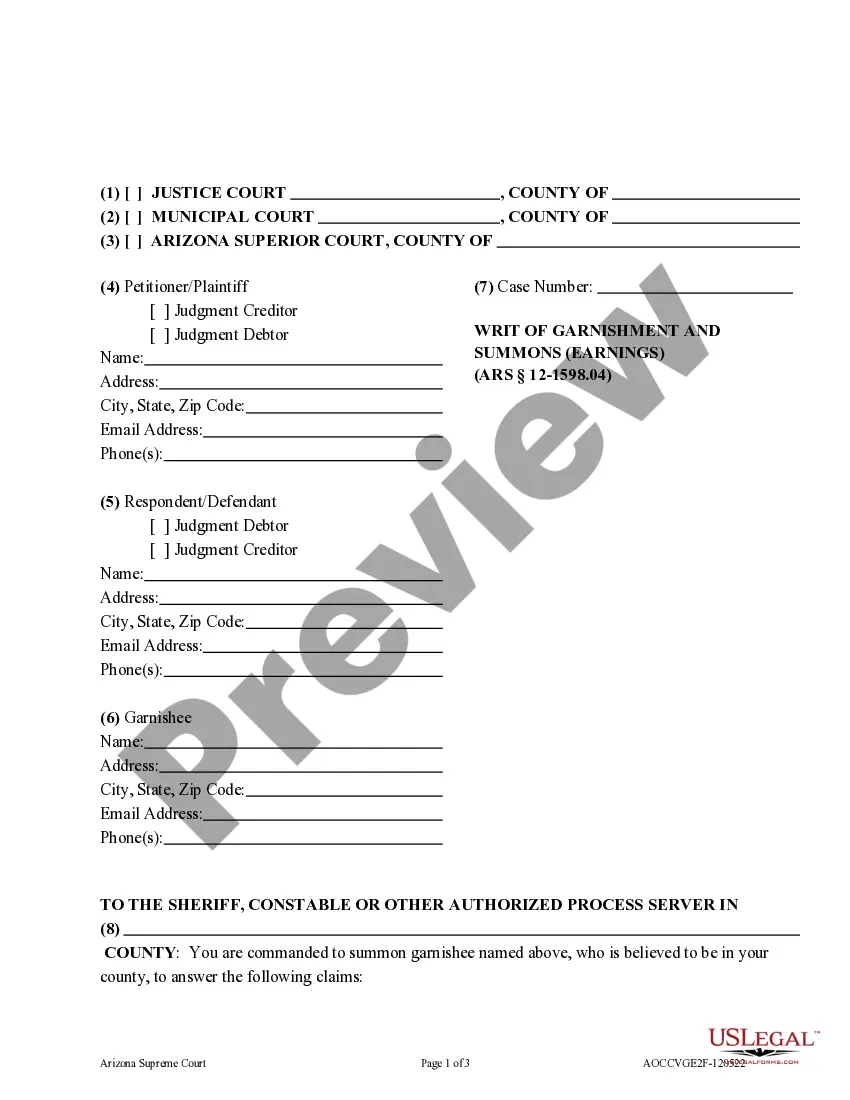

This means that the creditor must file a lawsuit in court and win that lawsuit. After that, the creditor has to apply to the court for a garnishment order, called a ?writ of garnishment,? and after the court signs this order, the garnishment can proceed.

Garnishment procedures are governed by Arizona law and are extremely complicated. All parties involved must follow these procedures correctly. The Court may issue an order for monetary penalties against any party who does not proceed properly, including the judgment creditor.

Filing for bankruptcy is the most flexible option when it comes to stopping wage garnishment, since it can be initiated before your creditor secures a money judgment or after your wages have already been subject to garnishment.

Typically, judgment creditors collect outstanding debts through wage garnishments, but our laws do allow for levying bank accounts and/or non-exempt property.

Up to 25% of Wages Are Garnished Until Debt is Repaid Wage garnishment in Arizona is limited in accordance with the federal Consumer Credit Protection Act (CCPA). This means that garnishees may withhold no more than 25% of your non-exempt disposable earnings to be paid to a single judgment creditor.

Even after a garnishment has started, you can still try and negotiate a resolution with the creditor, especially if your circumstances change.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less.