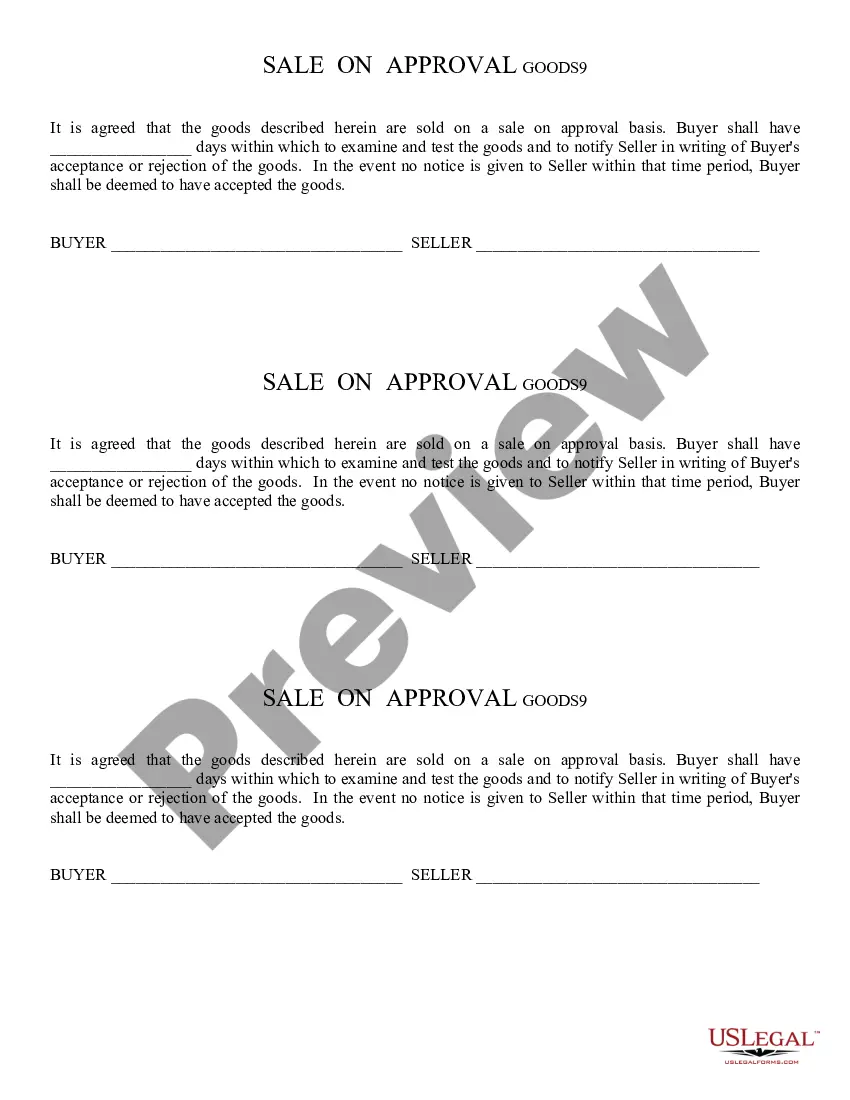

Sale of Approval: This is a Sales Contract between the Buyer and Seller of any type of merchandise. It details the responsibilities to eachother, which includes allowing the Buyer a few days after delivery to inspect the goods for his/her satisfaction. If after the allotted time has past the Seller has received nothing in writing from the Buyer rejecting said goods, acceptance will be presumed. This form is available for download in both Word and Rich Text formats.

Scottsdale Arizona Sale of Approval

Description

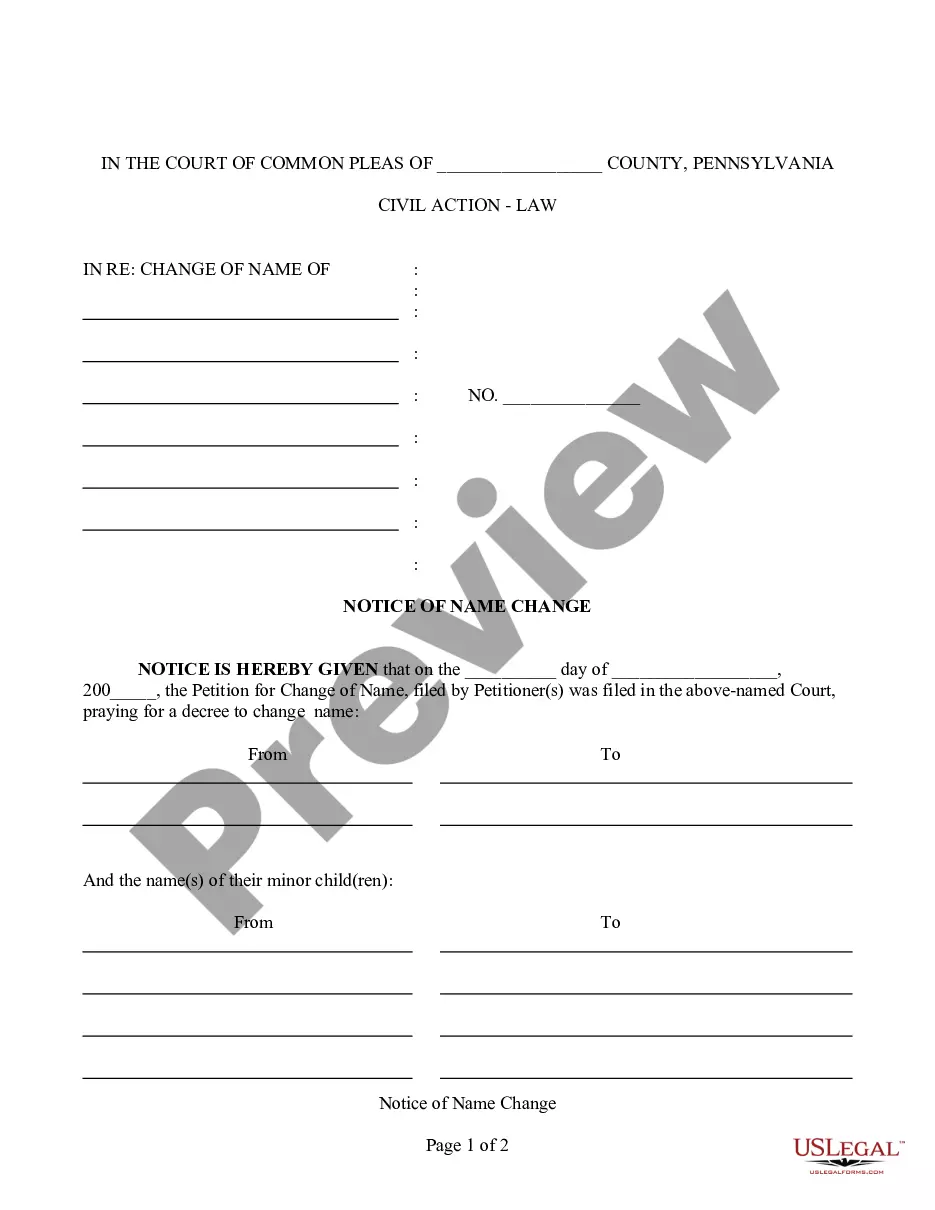

How to fill out Arizona Sale Of Approval?

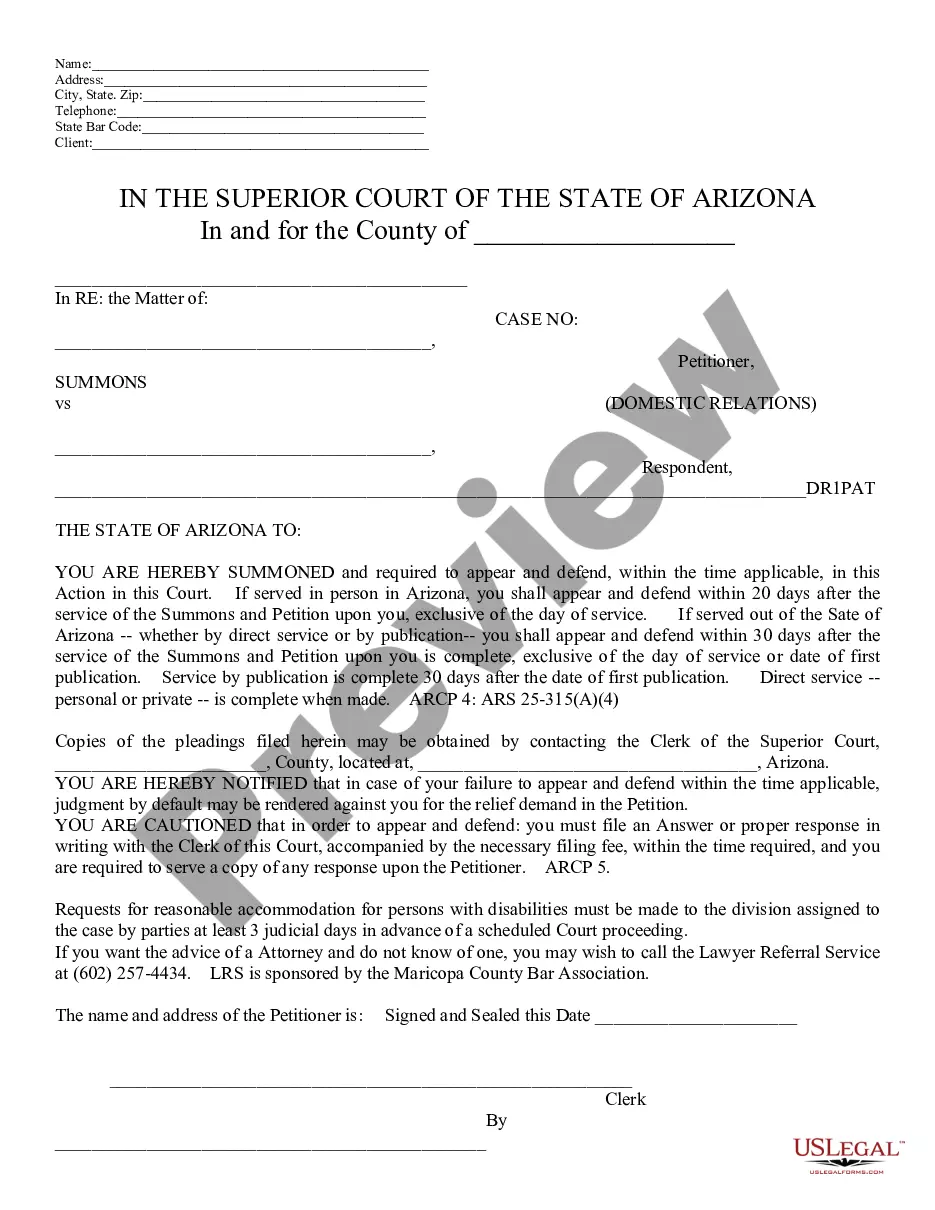

Locating verified templates that adhere to your local regulations can be difficult unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal forms catering to both personal and professional requirements and various real-life scenarios.

All the documents are accurately classified by area of use and jurisdiction, making it simple and quick to find the Scottsdale Arizona Sale of Approval.

Maintaining organized paperwork that complies with legal standards is of great significance. Leverage the US Legal Forms library to always have vital document templates readily available for any requirements!

- Examine the Preview mode and document description.

- Confirm that you've selected the correct one that meets your requirements and is fully aligned with your local jurisdiction criteria.

- Look for an alternative template if necessary.

- If you notice any discrepancies, use the Search tab above to find the accurate one. If it's suitable, continue to the next step.

- Proceed to purchase the document.

Form popularity

FAQ

The city privilege tax in Scottsdale is a tax levied on businesses for the privilege of conducting business within the city limits. This tax applies to various types of businesses and is calculated based on gross income. For those considering the Scottsdale Arizona Sale of Approval, understanding this tax is vital, as it can impact your overall costs and financial planning. Using platforms like US Legal Forms can help you navigate the specifics of this tax and ensure compliance.

Scottsdale offers a vibrant environment for new businesses, with a supportive community and strong economic indicators. Entrepreneurs benefit from a growing market and a diverse customer base. If you are considering the Scottsdale Arizona Sale of Approval, you will find many resources and networks that can assist you in successfully launching and growing your business.

In Scottsdale, a business license is mandatory for most businesses. This regulation not only supports local governance but also fosters a transparent environment for businesses and consumers. If you are exploring options related to the Scottsdale Arizona Sale of Approval, acquiring this license is essential for a smooth and compliant operation.

Yes, Arizona generally requires businesses to have a license to operate within the state. This requirement helps ensure businesses adhere to state and local regulations, promoting a trustworthy marketplace. For those interested in the Scottsdale Arizona Sale of Approval, securing a business license is vital for maintaining your business's legitimacy and appeal.

Maricopa County requires most businesses to obtain a business license to operate legally. This license ensures that your business complies with local regulations, contributing positively to the community. If you're considering the Scottsdale Arizona Sale of Approval, obtaining a business license is a crucial step that may enhance your business credibility.

Arizona's sales tax for shopping encompasses both state and local taxes, making the rate roughly 6.1% with additional local taxes based on the city. These rates can impact consumers directly, influencing their purchasing decisions. Having a solid understanding of these tax requirements can enhance your Scottsdale Arizona Sale of Approval process, reinforcing your position as a trustworthy seller.

Scottsdale, AZ sales tax includes the state's base rate along with additional local taxes, bringing the total tax rate to approximately 8.05%. This rate varies depending on the nature of the product or service sold. If you are looking to navigate these rates effectively, the Scottsdale Arizona Sale of Approval can help guide you through compliance.

As of now, Arizona's state sales tax rate is 5.6%. However, local jurisdictions, including cities, may impose additional taxes, which means the overall rate could be higher in specific areas. Therefore, understanding the sales tax implications within the Scottsdale Arizona Sale of Approval framework is vital to your business's financial planning.

Yes, in Arizona, you typically need a license to sell goods or provide services. Depending on your business type, there may be specific licensing requirements to consider. By obtaining your Scottsdale Arizona Sale of Approval, you ensure your business is recognized and adheres to required regulations.

If you are engaged in business in Arizona and make taxable sales, you do need a sales tax permit. This permit allows you to collect state sales tax from your customers, which is then remitted to the state. Securing a Scottsdale Arizona Sale of Approval can streamline your business operations, ensuring compliance with tax laws.