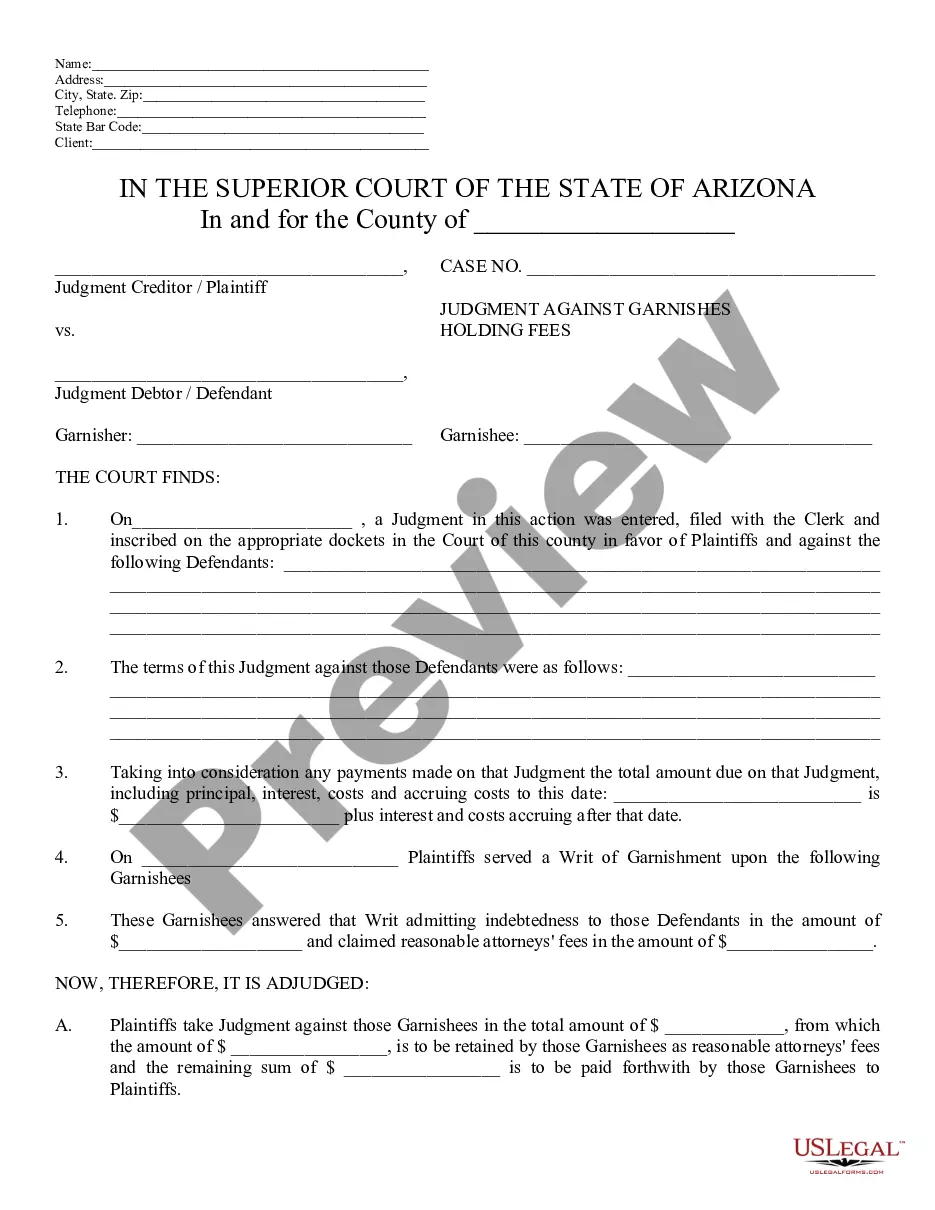

This is a model Judgment form, a Judgment Against Garnishee Holding Funds. The form must be completed to fit the facts and circumstances of whatever judgment the court has rendered. When signed by the Judge, the judgment becomes binding.

Tempe Arizona Judgment Against Garnishee Holding Funds

Description

How to fill out Arizona Judgment Against Garnishee Holding Funds?

If you have previously made use of our service, Log In to your account and retrieve the Tempe Arizona Judgment Against Garnishee Holding Funds onto your device by selecting the Download button. Ensure your subscription remains active. If not, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to obtain your document.

You have lifetime access to every document you have purchased: you can locate it in your profile within the My documents section whenever you need to use it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional requirements!

- Confirm you’ve located the correct document. Browse the description and utilize the Preview option, if accessible, to determine if it satisfies your requirements. If it does not suit you, use the Search tab above to discover the correct one.

- Acquire the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and process the payment. Input your credit card details or choose the PayPal option to finalize the purchase.

- Obtain your Tempe Arizona Judgment Against Garnishee Holding Funds. Choose the file format for your document and store it on your device.

- Complete your form. Print it out or utilize professional online editors to complete it and sign it electronically.

Form popularity

FAQ

The most someone can garnish from your paycheck is 25% of your disposable earnings, but different rules may apply based on the type of debt. In Tempe, Arizona, understanding how many garnishments you face is essential, especially if you are dealing with a judgment against garnishee holding funds. It's advisable to seek legal advice to determine the maximum amount and explore your options.

To stop wage garnishment in Arizona, one can file a motion with the court that issued the judgment. You can contest the garnishment by demonstrating financial hardship or disputing the validity of the debt. Consulting with a legal expert could provide guidance on the process, especially if a judgment against garnishee holding funds is involved in your case.

The maximum garnishment amount for an employee is typically determined by federal and state laws, which allow up to 25% of disposable income to be garnished. In Tempe, Arizona, you may also consider how the nature of your debt affects this amount. Understanding your rights and obligations can assist in managing any judgments against garnishee holding funds.

Creditors can garnish your wages, and the maximum amount they can take is similar to IRS garnishments, at 25% of your disposable income. However, for some specific debts, such as child support or student loans, the garnishment could be higher. If you have a judgment against garnishee holding funds in Tempe, Arizona, it's a good idea to consult with a legal professional to understand your options.

In Tempe, Arizona, your paycheck can be garnished up to 25% of your income after taxes. This amount may vary depending on the specific nature of the debt and any existing judgments against you. When facing a judgment against garnishee holding funds, it's crucial to stay informed about the total deductions that can be made from your earnings.

The IRS can garnish your wages to collect unpaid taxes, but it is limited to 25% of your disposable income. This means that if you live in Tempe, Arizona, and receive a judgment against garnishee holding funds, it's important to know your rights. The IRS can also take a larger amount if a court arranges for it based on your financial situation, so understanding how this works is essential.

This happens when a debt collector secures a court order requiring your employer to subtract wages from your paycheck to cover an unpaid debt. Four states?North Carolina, Pennsylvania, South Carolina and Texas?don't allow wage garnishment for consumer debt.

Arizona's garnishment laws provide for the garnishment of wages, funds in a bank account, certificates of deposit, stocks, bonds, and other personal property. In Arizona, the garnishment of monies or property is governed by A.R.S. §§ 12-1570 - 12-1597.

Except for child support and spousal maintenance garnishments, no more than 25% of your wages can be garnished at one time. If you are being garnished for a debt such as your taxes or student loans at 15% and another creditor wants to garnish you as well.

The Arizona Supreme Court Confirms that Judgment Liens Attach to Homestead Property. The Arizona Supreme Court recently clarified that a judgment lien does, in fact, attach to the proceeds of the sale of a homestead property.