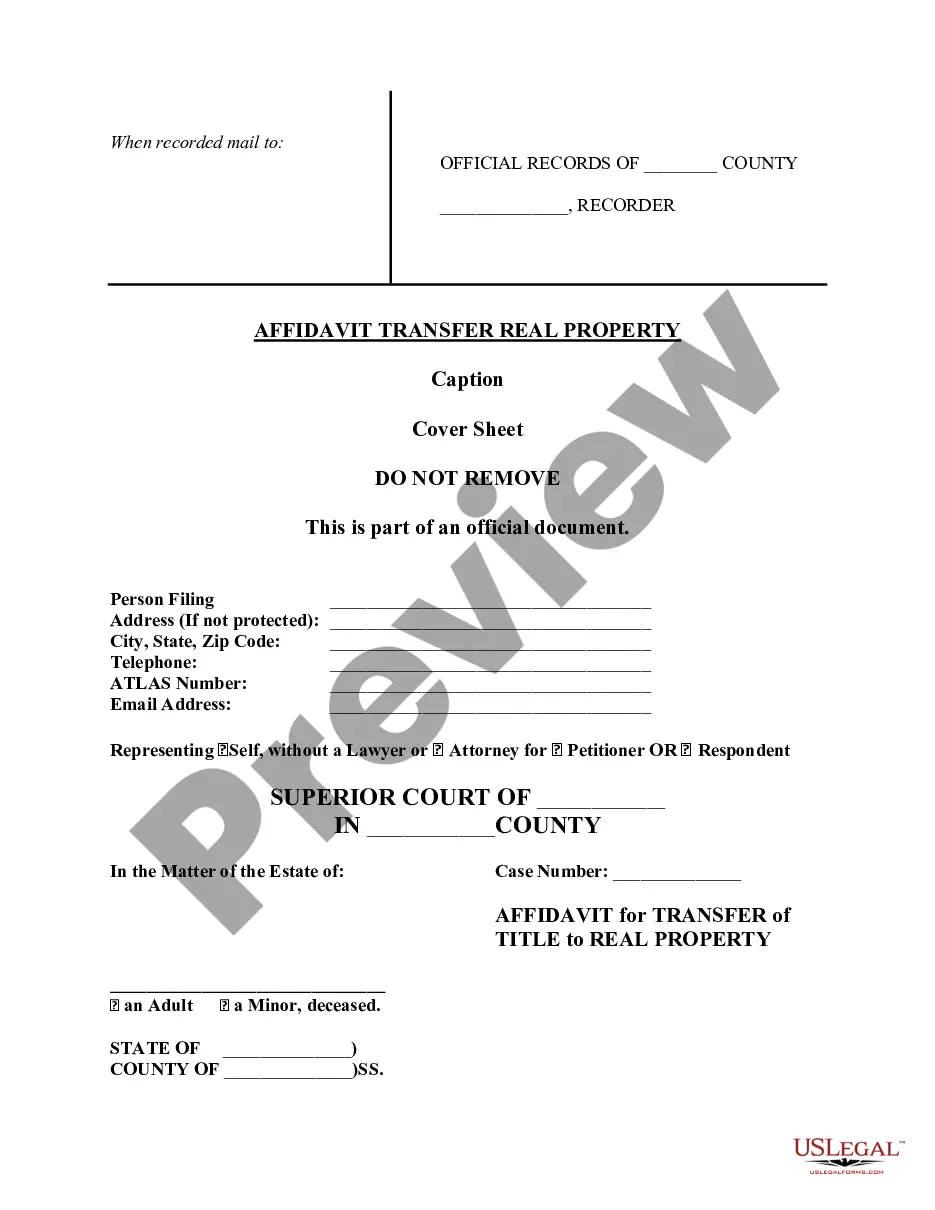

Tucson Arizona Affidavit for Transfer of Title of Real Property

Description

How to fill out Arizona Affidavit For Transfer Of Title Of Real Property?

Regardless of social or professional standing, completing law-related paperwork is an unfortunate obligation in today's society.

Often, it's nearly impossible for someone without legal education to draft such documents independently, primarily due to the intricate language and legal subtleties they encompass.

This is where US Legal Forms can come to the rescue.

Confirm that the form you have selected is applicable for your area since the laws of one state or county may not apply to another.

Scrutinize the document and review a brief overview (if accessible) of situations for which the paper may be applicable.

- Our platform offers an extensive collection of over 85,000 ready-to-use state-specific documents suitable for nearly any legal circumstance.

- US Legal Forms also acts as an excellent resource for associates or legal advisors seeking to enhance their time efficiency using our DIY forms.

- Whether you require the Tucson Arizona Affidavit for Transfer of Title of Real Property or any other document valid in your jurisdiction, US Legal Forms puts everything at your disposal.

- Here’s how you can swiftly obtain the Tucson Arizona Affidavit for Transfer of Title of Real Property using our dependable platform.

- If you are currently a member, feel free to Log In to your account to access the necessary form.

- However, if you are new to our collection, make sure you follow these guidelines before acquiring the Tucson Arizona Affidavit for Transfer of Title of Real Property.

Form popularity

FAQ

Arizona statutes offer an alternative to avoiding probate by using an Affidavit of Succession to Real Property in cases in which the real property value does not exceed a certain value. The estate value must be less than $100,000 minus all the liens and any other encumbrances when the decedent passed away.

A beneficiary deed allows for the avoidance of probate. Arizona allows for the transfer of real estate by affidavit if the equity of all the real property in the estate is not greater than $100,000.

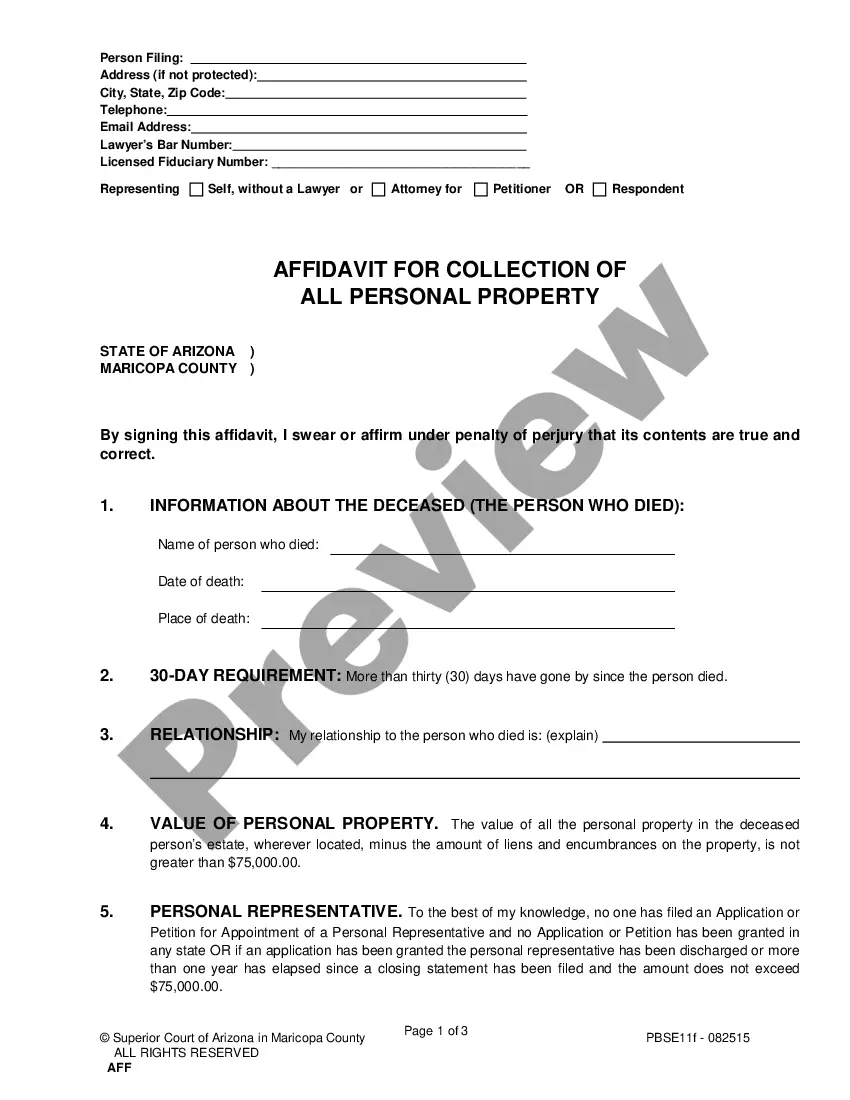

Under current Arizona law, small estates are defined as those in which the deceased owned less than $100,000 in real estate equity or less than $75,000 worth of personal property. For estates over this size, probate is typically required, and those estates will not be eligible for the small estate affidavit process.

estate affidavit is a procedure available under Arizona estate law that allows heirs and beneficiaries to bypass the probate process, which can be lengthy and expensive.

Cost Of The Small Estate Affidavit Procedure The clerks filing fee for this procedure is usually about $350. That is generally the only court expense.

When is a probate action required in Arizona? Under Arizona law, the general rule is that if the deceased person owned more than $100,000 of equity in real estate, or more than $75,000 of personal property (including physical possessions and money), then a probate action is required to transfer the assets to the heirs.

It is a sworn statement, in which the affiant attests under oath to the inheritance right and certain other facts relating to the estate. The heir or devise files the affidavit with the probate court registrar in the county where the real estate is located.

Typically, you need the property ownership document and the Will, or the Will with probate or succession certificate. In the absence of a Will, you may also need to prepare an affidavit along with a no-objection certificate from other legal heirs or their successors.

If seeking personal property, it is not necessary to file the small estate affidavit with the court. Instead, give the completed, signed, notarized form to the person or entity holding the asset to be transferred.

The Arizona beneficiary deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.