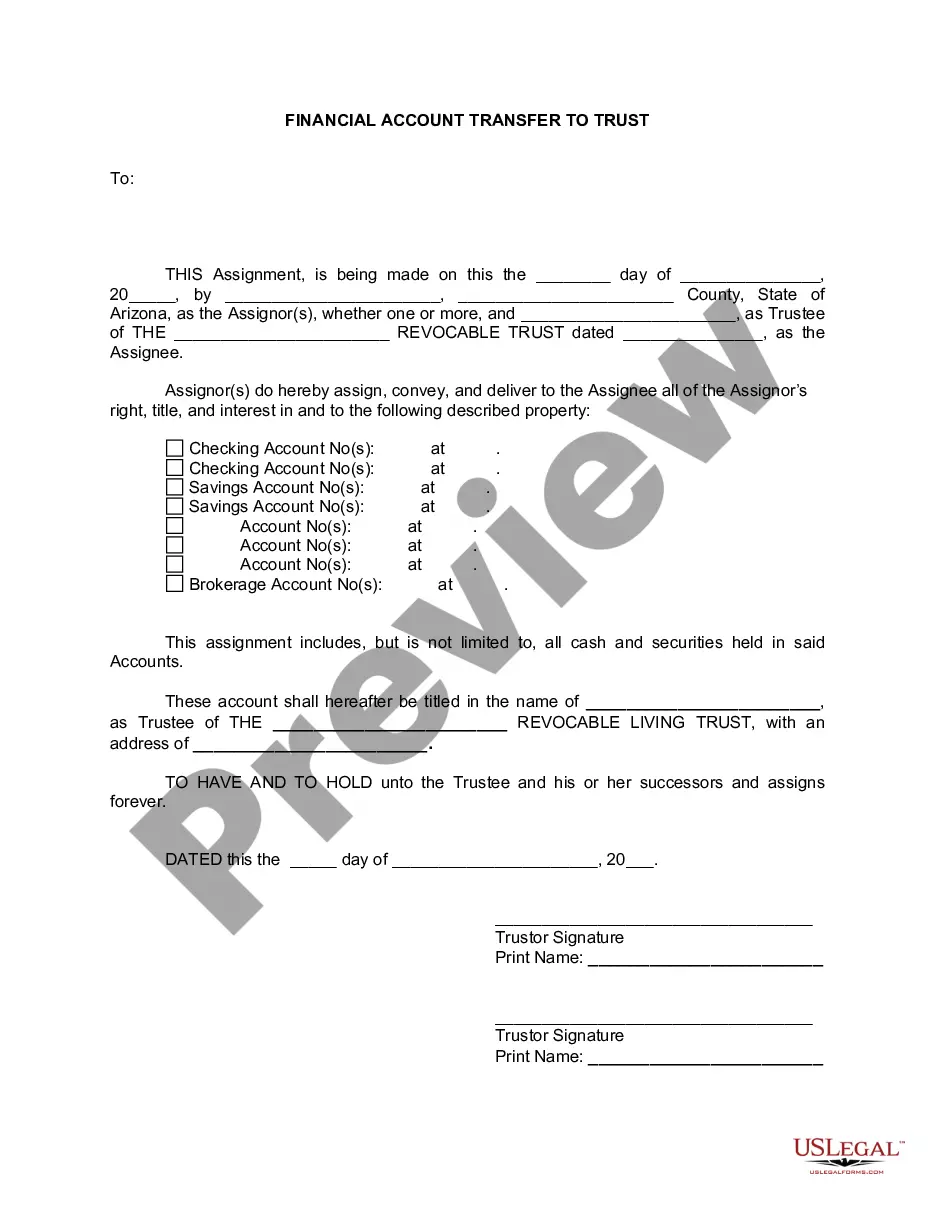

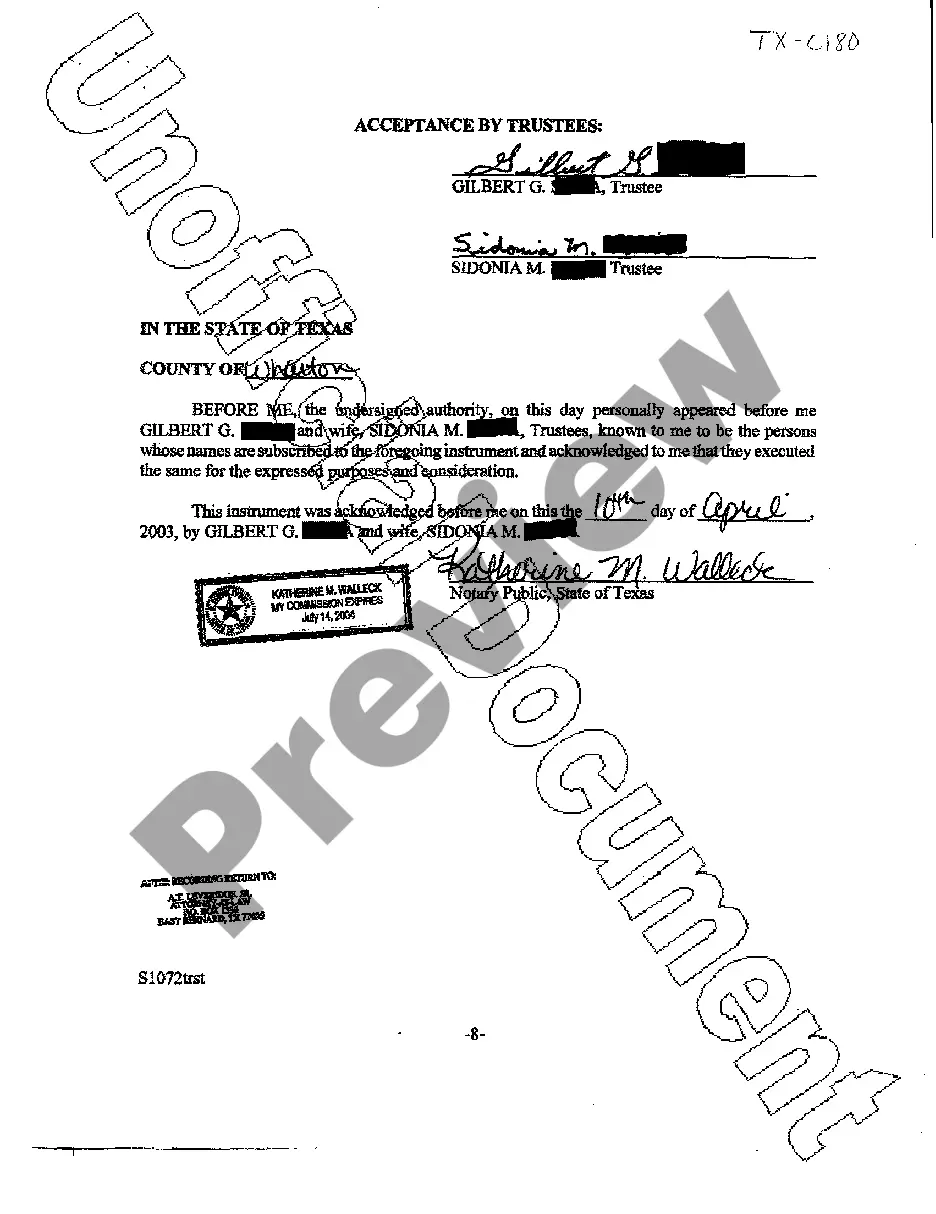

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Phoenix Arizona Financial Account Transfer to Living Trust

Description

How to fill out Arizona Financial Account Transfer To Living Trust?

Regardless of social or professional standing, completing legal documents is an unfortunate requirement in today’s society.

Frequently, it’s nearly impossible for someone without any legal education to draft such documents from the ground up, primarily because of the intricate jargon and legal subtleties they entail.

This is where US Legal Forms proves to be beneficial.

Verify the form you’ve located is appropriate for your area, as the rules of one state or county may not apply to another.

Review the form and read a brief summary (if available) of situations for which the document can be utilized.

- Our service features a vast repository with over 85,000 ready-to-utilize state-specific documents suitable for nearly any legal situation.

- US Legal Forms also acts as an excellent resource for associates or legal advisors wishing to save time by using our DIY paperwork.

- Whether you require the Phoenix Arizona Financial Account Transfer to Living Trust or any other documentation applicable in your state or county, with US Legal Forms, everything is readily accessible.

- Here’s how you can swiftly acquire the Phoenix Arizona Financial Account Transfer to Living Trust through our dependable service.

- If you are already a subscriber, feel free to Log In to your account to fetch the relevant form.

- However, if you are unfamiliar with our library, be sure to follow these instructions before obtaining the Phoenix Arizona Financial Account Transfer to Living Trust.

Form popularity

FAQ

Pertaining to the types of asset you put in a living trust: generally speaking, all of your assets should be transferred into your trust. However, there are some assets that you may not want or cannot be transferred into the trust. You cannot put a 401(k) in a living trust or other tax-deferred plans, for that matter.

What Type of Assets Go into a Trust? Bonds and stock certificates. Shareholders stock from closely held corporations. Non-retirement brokerage and mutual fund accounts. Money market accounts, cash, checking and savings accounts. Annuities. Certificates of deposit (CD) Safe deposit boxes.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

Retirement accounts definitely do not belong in your revocable trust ? for example your IRA, Roth IRA, 401K, 403b, 457 and the like. Placing any of these assets in your trust would mean that you are taking them out of your name to retitle them in the name of your trust. The tax ramifications can be disastrous.

Real Estate ? Real estate which is to be transferred into a trust must be conveyed in an Arizona Deed. The document must be signed by all parties in front of a Notary Public and filed with the County Recorder's Office.

Trusts can hold many different types of assets, including cash, stocks, bonds, mutual funds, real estate and other property. Once the account is opened, you can transfer assets into the trust.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

Using a revocable trust can help you avoid probate Assets that don't pass directly to heirs (such as a bank account, brokerage account, home, etc.) will go through probate before being distributed according to your will (if you had one) or at the court's discretion. Probate is an expensive, time-consuming process.

You cannot put your individual retirement account (IRA) in a trust while you are living. You can, however, name a trust as the beneficiary of your IRA and dictate how the assets are to be handled after your death. This applies to all types of IRAs, including traditional, Roth, SEP, and SIMPLE IRAs.

Retirement plans themselves cannot be transferred into a trust; those assets must be distributed from the plan first, which triggers income tax on the distribution. If you are older than 72 when you die, money generally must come out of your retirement plan according to the schedule that was required before your death.