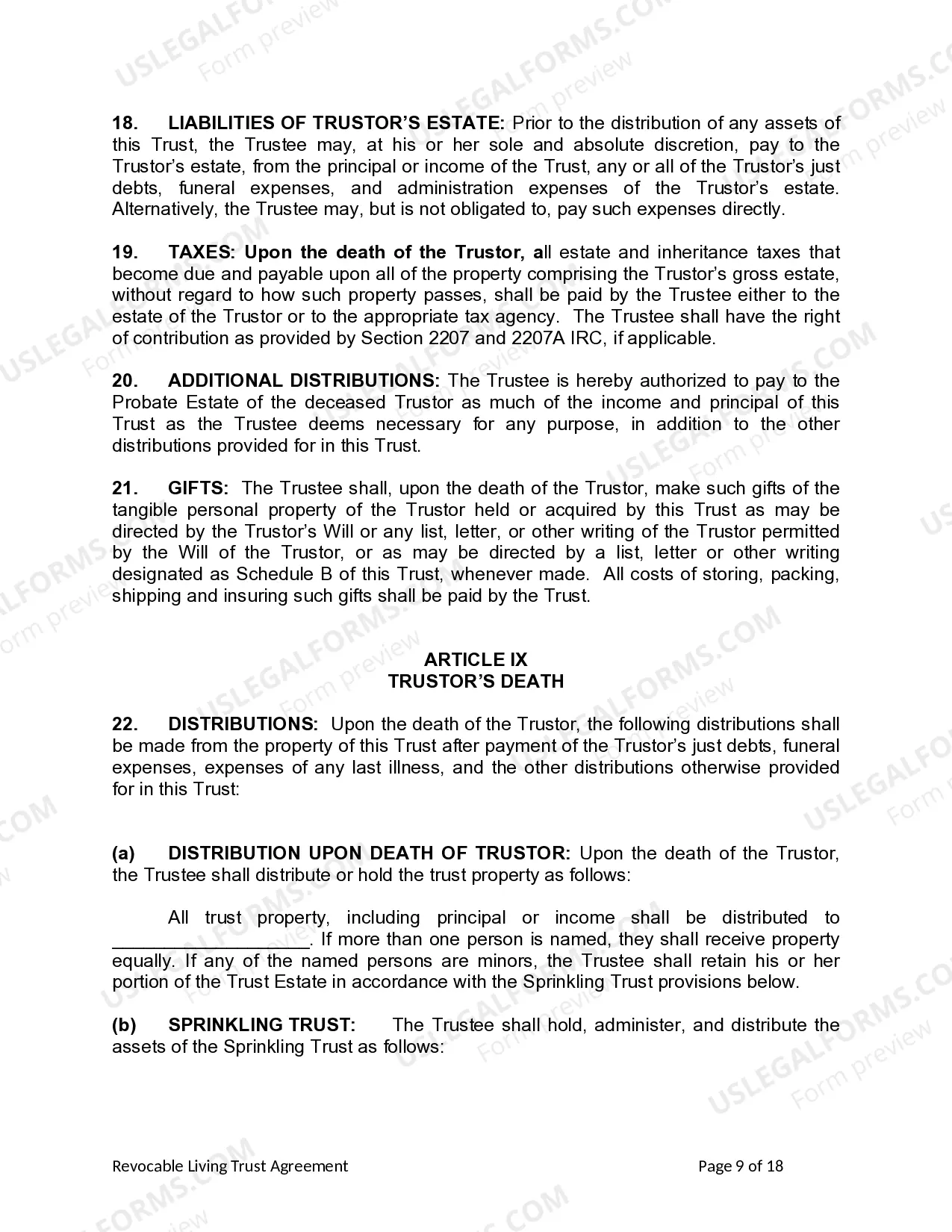

This Living Trust for Individual as single, divorced or widow(er) with No Children form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Chandler Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children

Description

How to fill out Arizona Living Trust For Individual As Single, Divorced Or Widow Or Widower With No Children?

We consistently endeavor to minimize or evade legal repercussions when engaging with intricate legal or financial matters.

To achieve this, we seek attorney services that are typically highly expensive.

However, not every legal concern is equally complicated. Many can be managed independently.

US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our collection empowers you to handle your matters independently without resorting to legal advice. We offer access to legal form templates that are not always publicly available. Our templates are tailored to specific states and regions, which significantly eases the search process.

Ensure to verify if the Chandler Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children complies with the laws and regulations of your specific state and locality. Additionally, it is essential to review the form's outline (if provided), and if you notice any inconsistencies with what you were originally seeking, look for a different document. Once you’ve confirmed that the Chandler Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children is suitable for you, you can select the subscription plan and proceed with the payment. Afterward, you can download the document in any appropriate format. Over more than 24 years of operation, we’ve assisted millions of individuals by providing customizable and up-to-date legal documents. Take advantage of US Legal Forms today to conserve time and resources!

- Capitalize on US Legal Forms anytime you require to locate and procure the Chandler Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children or any other document effortlessly and securely.

- Simply Log In to your account and click the Get button adjacent to it.

- If you happen to misplace the form, you can always retrieve it again in the My documents section.

- The procedure is just as straightforward if you are not familiar with the platform!

- You can set up your account within a few minutes.

Form popularity

FAQ

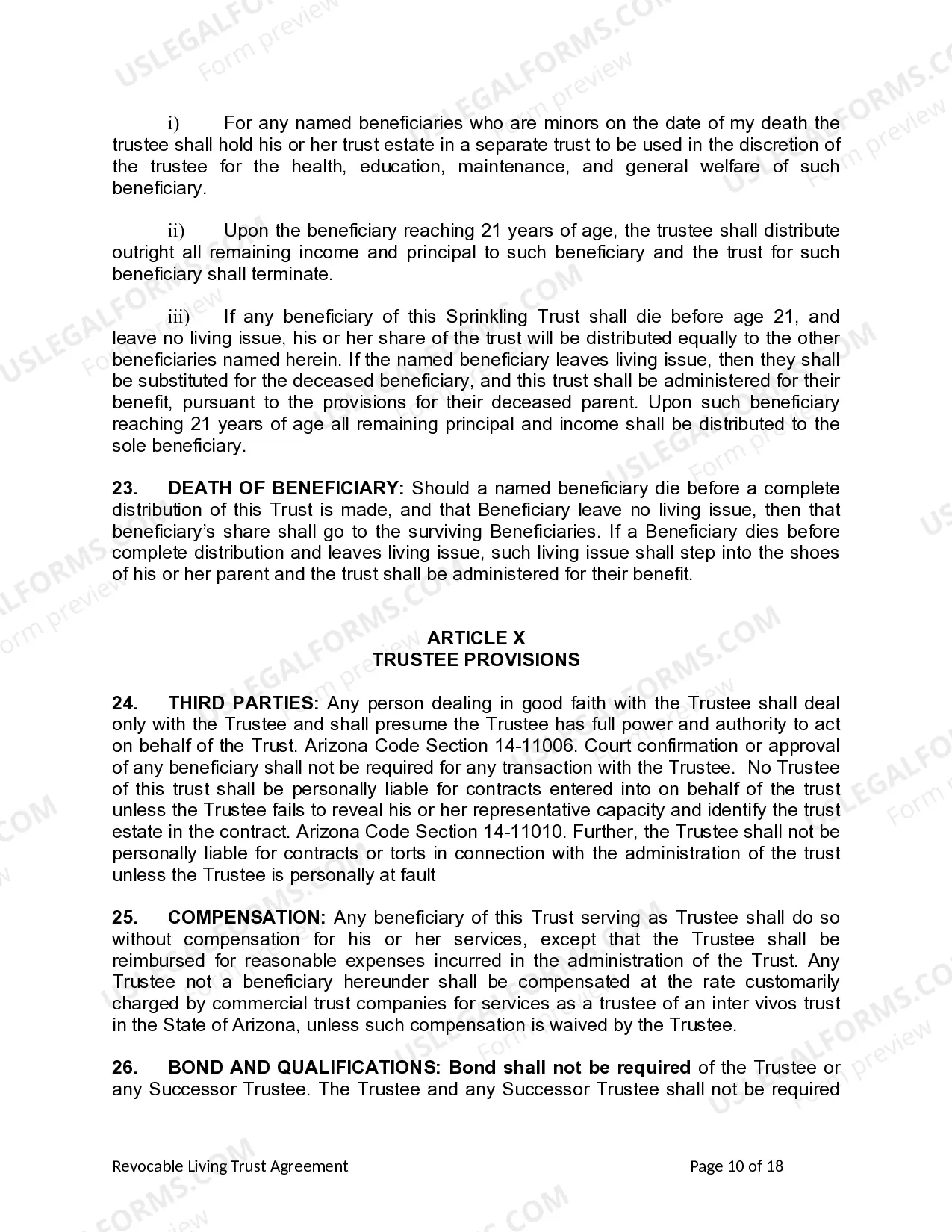

When a husband dies, the wife should begin by reviewing any estate planning documents, including a Chandler Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children. It’s important to determine how assets are handled and what steps need to be taken for distribution. Additionally, the wife should consider reaching out to an attorney for guidance and support during this emotional time. Being informed can lead to better decision-making.

After a spouse passes, it is crucial not to rush into making significant financial decisions or changes to existing estate plans, such as a Chandler Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children. Avoid discussing finances with others until you have a clear understanding of your situation. It's important to take the time to grieve, assess the trust, and understand its implications. Consulting with professionals can help you navigate this difficult time.

In Arizona, a Chandler Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children offers benefits not found in a will. Trusts avoid probate, ensuring a faster and more private distribution of assets. Additionally, trusts can provide better control over when and how beneficiaries receive their inheritances. Depending on individual circumstances, a trust may be a more effective estate planning solution.

When a spouse dies, a Chandler Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children can address how the assets are to be managed and distributed. The surviving spouse should refer to the trust document for specific instructions on asset distribution. If the trust includes provisions for managing the deceased spouse's share, those will need to be followed. Consulting with an estate planning attorney can offer guidance on this complex issue.

When the last person dies, a Chandler Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children typically becomes irrevocable. This means that the trust assets will be distributed according to the trust document's terms. It is essential to have clear instructions in the trust to ensure a smooth transfer of assets. Engaging with a knowledgeable estate planning professional can help clarify these steps.

In Arizona, for a trust to be valid, you need to have a clear intent to create a trust, identifiable beneficiaries, and a lawful purpose for the trust. Additionally, the trust must be properly funded with assets to be effective. If you're interested in a Chandler Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children, meeting these requirements ensures your trust functions as intended.

Yes, one of the key benefits of establishing a living trust in Arizona is that it helps you avoid probate. Since the assets in the trust are managed according to the terms you set, they do not go through the probate process after your passing. If you need a streamlined solution, consider the Chandler Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children to ensure your estate is handled efficiently.

To obtain a recorded living trust document in Arizona, you generally need to prepare the trust document and then have it signed and notarized. Once complete, the next step is to file the document with the Clerk of the Superior Court in your county. Utilizing services like US Legal Forms can simplify this process, especially when creating a Chandler Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children.

Certain assets typically cannot be held in a trust, including personal items like vehicles, art, and collectibles that are not specifically titled to the trust. Additionally, some types of accounts, like retirement accounts, may have restrictions. If you are considering a Chandler Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children, it’s essential to understand which of your assets are appropriate for inclusion.

A living trust in Arizona allows you to manage your assets during your lifetime and specify how they will be distributed after your death. You, as the trustee, retain control over the assets while you are alive. In terms of the Chandler Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children, this means you can avoid probate and ensure your wishes are honored without unnecessary complications.