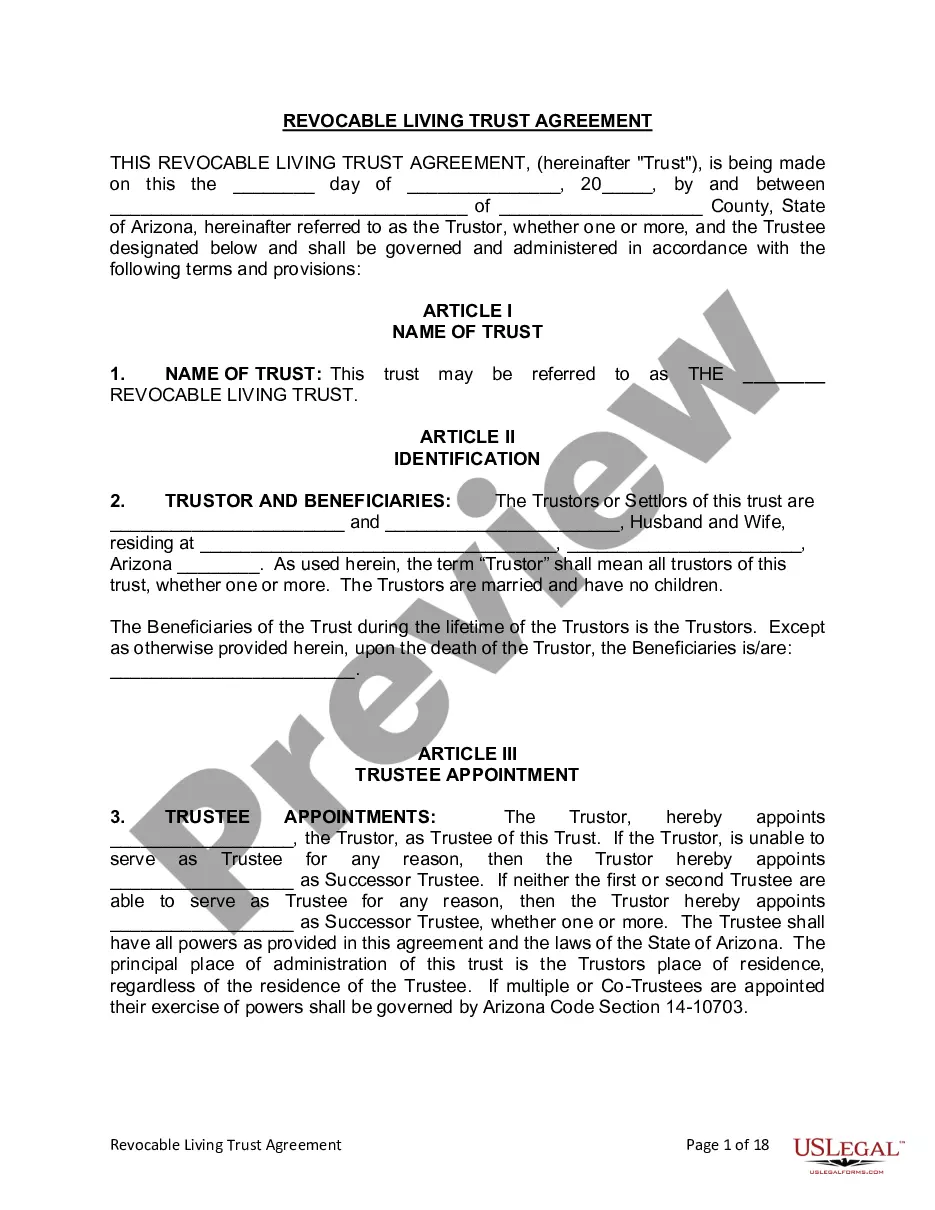

This Living Trust form is a living trust prepared for your state. It is for a Husband and Wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Gilbert Arizona Living Trust for Husband and Wife with No Children

Description

How to fill out Arizona Living Trust For Husband And Wife With No Children?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s a digital compendium of over 85,000 legal documents for both personal and professional purposes and various real-world scenarios.

All the files are appropriately categorized by usage area and jurisdiction, making it as straightforward as pie to search for the Gilbert Arizona Living Trust for Husband and Wife with No Children.

Submit your credit card information or use your PayPal account to complete the subscription process. Download the Gilbert Arizona Living Trust for Husband and Wife with No Children and save the template on your device to fill it out, ensuring you can access it again anytime through the My documents menu in your profile. Maintaining organized paperwork that adheres to legal standards is crucial. Leverage the US Legal Forms library to always have vital document templates readily available for any needs!

- Explore the Preview mode and document description.

- Verify you’ve selected the correct version that aligns with your needs and entirely meets your local jurisdictional criteria.

- Look for an alternative template if necessary.

- If you encounter any discrepancies, utilize the Search tab above to find the correct one. If it meets your requirements, proceed to the next step.

- Acquire the document.

Form popularity

FAQ

The best living trust for a married couple often is a Gilbert Arizona Living Trust for Husband and Wife with No Children. This type of trust is specifically designed to meet the unique needs of couples without children, streamlining the management of joint assets and facilitating a clear plan for asset distribution. To create an effective trust, it's wise to consult with a legal expert or utilize platforms like uslegalforms, which can guide you through the process.

While joint trusts, like a Gilbert Arizona Living Trust for Husband and Wife with No Children, offer dual management benefits, they also have drawbacks. If one spouse faces legal troubles or creditor claims, joint assets may be at risk. Additionally, complications can arise during divorce or separation, making it essential to consider both the pros and cons.

It is common for both spouses to serve as co-trustees of a Gilbert Arizona Living Trust for Husband and Wife with No Children. This arrangement fosters collaboration and allows both partners to have a say in trust management and asset distribution. Moreover, if one spouse passes away, the surviving spouse can easily take over the role without the need for additional legal processes.

Choosing between one trust and two often depends on your unique circumstances. A Gilbert Arizona Living Trust for Husband and Wife with No Children offers simplicity and joint management of assets, which can streamline administration. On the other hand, maintaining separate trusts allows each spouse flexibility in managing individual assets and can provide tailored control over distribution.

Filling out a Gilbert Arizona Living Trust for Husband and Wife with No Children involves providing information about your assets and beneficiaries, and specifying your wishes for asset distribution. After detailing all relevant assets, you must sign the trust document in front of a notary. It’s advisable to regularly review and update the trust to reflect any changes in your financial situation or family structure.

Certain assets, like retirement accounts or life insurance policies, often should remain outside a Gilbert Arizona Living Trust for Husband and Wife with No Children. These assets typically have their own beneficiary designations and may not benefit from trust protection. Keeping such assets separate can simplify matters and maintain tax efficiency.

It often makes sense for a husband and wife to create a joint trust, especially when considering a Gilbert Arizona Living Trust for Husband and Wife with No Children. However, separate trusts can offer certain advantages, such as individualized control over separate assets. In many cases, combining assets into one trust simplifies management and ensures a smoother transfer of assets upon death.

The decision between a will and a trust in Arizona often comes down to your specific situation. A Gilbert Arizona Living Trust for Husband and Wife with No Children generally provides more flexibility and privacy than a will. While a will is effective for simpler estates, a trust can manage assets both during and after your lifetime, ensuring your wishes are honored without probate delays. It is essential to evaluate your goals with a professional to determine the best approach for you.

Setting up a Gilbert Arizona Living Trust for Husband and Wife with No Children involves several key steps. First, you must choose the right type of trust that fits your needs, typically a revocable living trust. Next, you will need to transfer your assets into the trust, which may include real estate and financial accounts. Lastly, you may want to consult with a legal professional to ensure that your trust meets all requirements and reflects your wishes.

When considering estate planning in Arizona, a Gilbert Arizona Living Trust for Husband and Wife with No Children often offers distinct advantages over a traditional will. Trusts can help you avoid probate, which is the legal process that can delay asset distribution. Additionally, trusts provide privacy since they do not go through public probate records. Therefore, if you want a streamlined process for your family, a trust may be the better option.