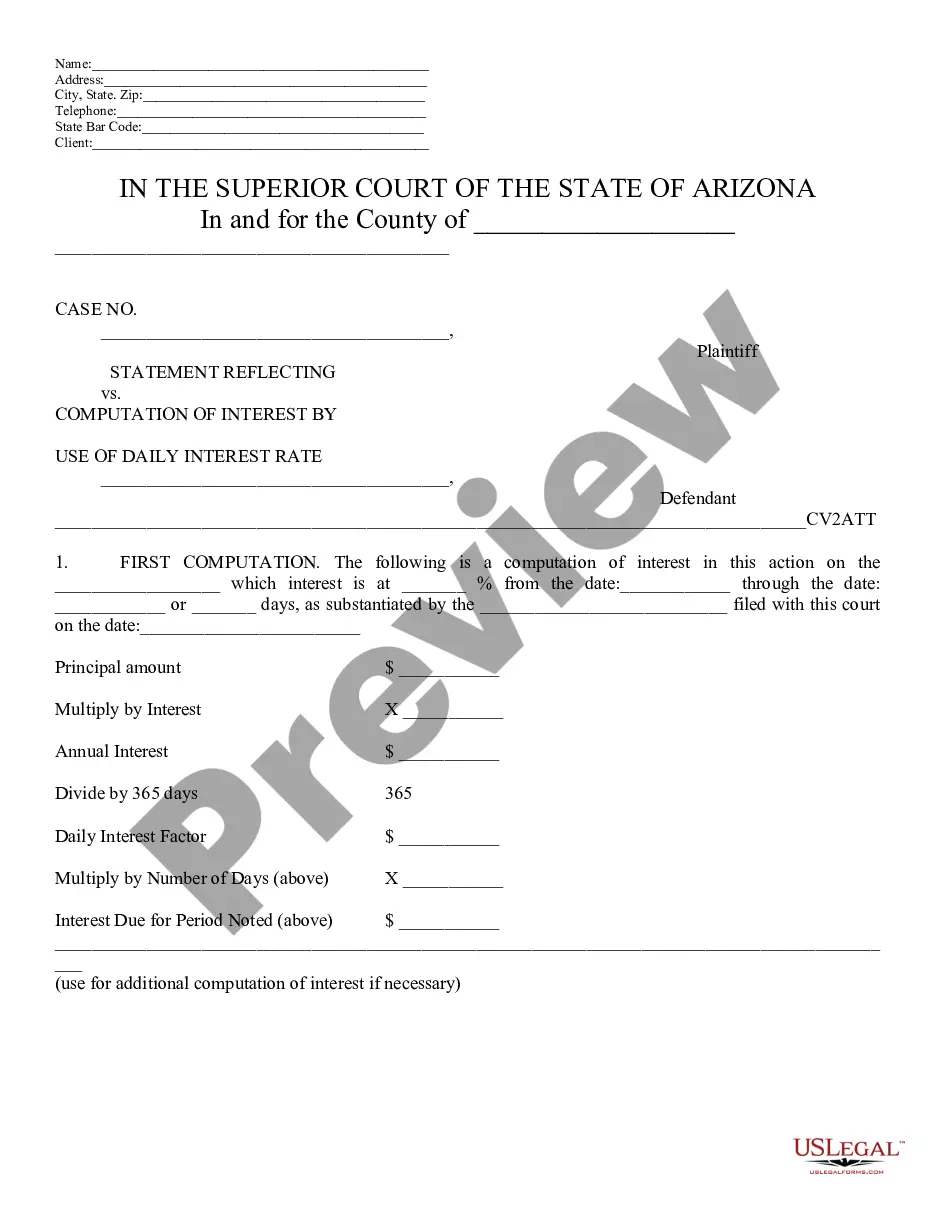

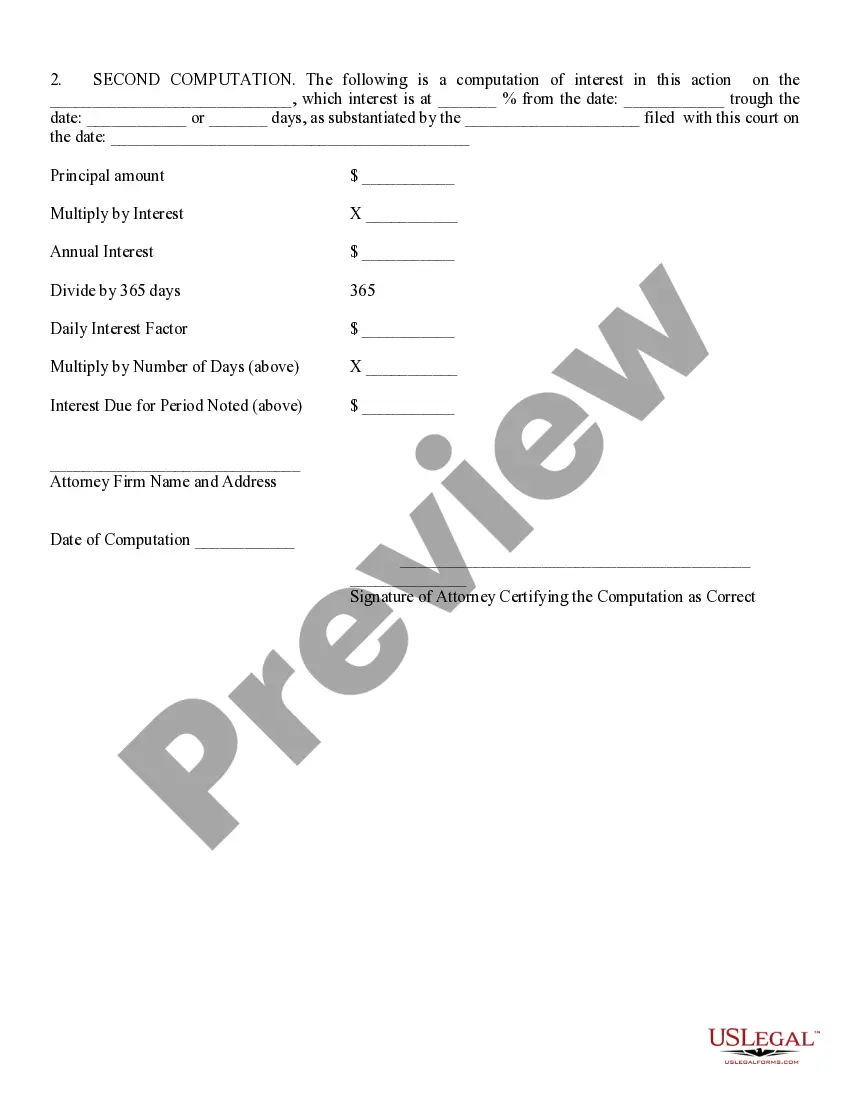

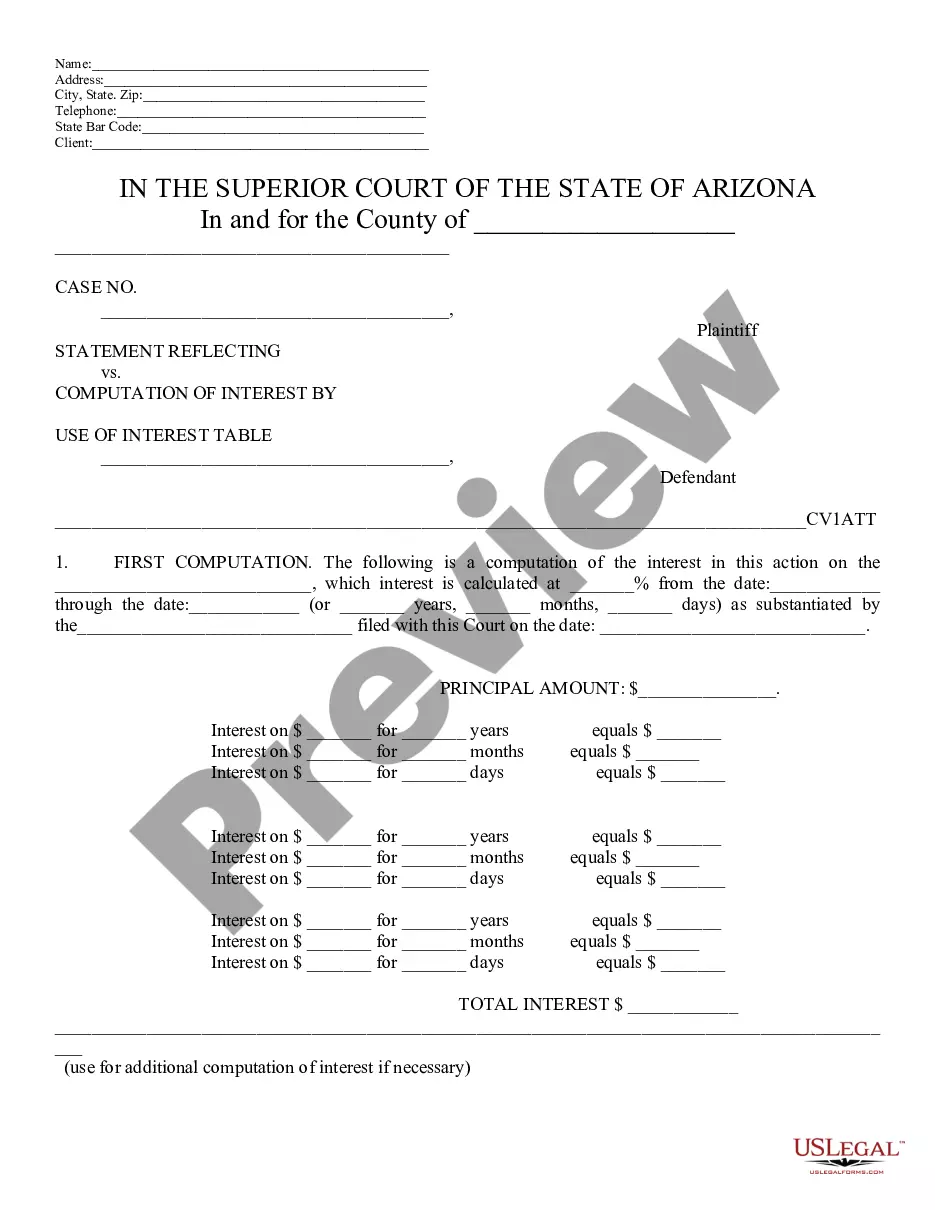

Statement Reflecting Computation of Interest By Daily Interest Rate: This statement reflects the way an attorney arrived at the total amount for damages, attorney's fees,e tc. It displays his/ her mathmatical equation, as well as the exact interest rate he/ she used in their findings. This form is available in both Word and Rich Text formats.

Tucson Arizona Statement Reflecting Computation of Interest By Daily Interest Rate

Description

How to fill out Arizona Statement Reflecting Computation Of Interest By Daily Interest Rate?

Acquiring verified templates that adhere to your local statutes can be challenging unless you utilize the US Legal Forms repository.

This digital resource comprises over 85,000 legal documents catering to both personal and professional requirements as well as various real-life situations.

All documents are systematically organized by usage area and jurisdiction, making the search for the Tucson Arizona Statement Reflecting Computation of Interest By Daily Interest Rate as simple as 1-2-3.

Ensure your documentation is organized and adheres to legal requirements by leveraging the US Legal Forms library to have crucial document templates readily available to you!

- Check the Preview mode and document description.

- Ensure you have chosen the correct document that fulfills your requirements and aligns with your local jurisdiction specifications.

- Seek an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the correct one. If it meets your needs, proceed to the next step.

- Complete the document purchase.

Form popularity

FAQ

You can calculate the total interest payable by dividing the unpaid invoice total by 365 (being the number of days in a year), then multiply this amount by the number of days the payment is overdue. Multiply this figure by the per cent of interest you are charging.

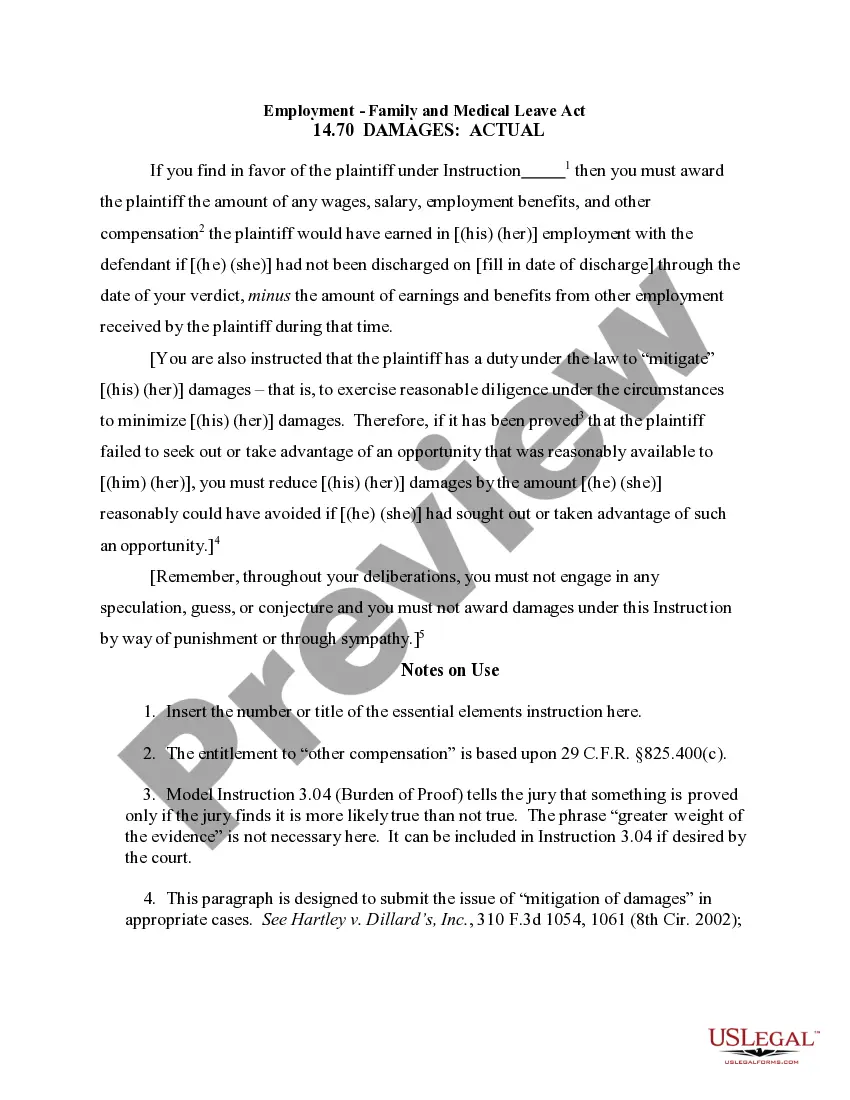

It's not uncommon to see provisions for late fees and interest charges in contracts. Typically a provision for a late fee may add 5% of the payment after a grace period of 10 to 20 days. Also, an interest charge of 18% or 1.5% per month is often found in contracts.

Yes, there is nothing stopping a vendor from charging interest on overdue invoices. The practice is legal. However, the real question is whether the clients are obligated to pay it. If a vendor doesn't have an agreement with a client on the payment terms and late fee, then that means the client doesn't have to pay it.

Daily Periodic Rate Example Calculation You can figure out the daily periodic rate by dividing the APR by 365?or by 360, depending on which number your issuer uses. If you divide 19.99% by 365, you get 0.0548%.

You can calculate simple interest in a savings account by multiplying the account balance by the interest rate by the time period the money is in the account. Here's the simple interest formula: Interest = P x R x N.

To compute daily interest for a loan payoff, take the principal balance times the interest rate, and divide by 12 months, which will give you the monthly interest. Then divide the monthly interest by 30 days, which will equal the daily interest.

Divide your interest rate by the number of payments you'll make that year. If you have a 6 percent interest rate and you make monthly payments, you would divide 0.06 by 12 to get 0.005. Multiply that number by your remaining loan balance to find out how much you'll pay in interest that month.

To calculate the interest due on a late payment, the amount of the debt should be multiplied by the number of days for which the payment is late, multiplied by daily late payment interest rate in operation on the date the payment became overdue.

You first take the annual interest rate on your loan and divide it by 365 to determine the amount of interest that accrues on a daily basis. Say you owe $10,000 on a loan with 5% annual interest. You'd divide that rate by 365 (i.e., 0.05 ÷ 365) to arrive at a daily interest rate of 0.000137.

How do I calculate my daily periodic rate? Confirm the current APR rate on your credit card: Look at your monthly statements to find your current Annual Percentage Rate. Divide this percentage by 365: Once you have found the APR, divide it by 365 (the number of days in a year) to find out your daily periodic rate.