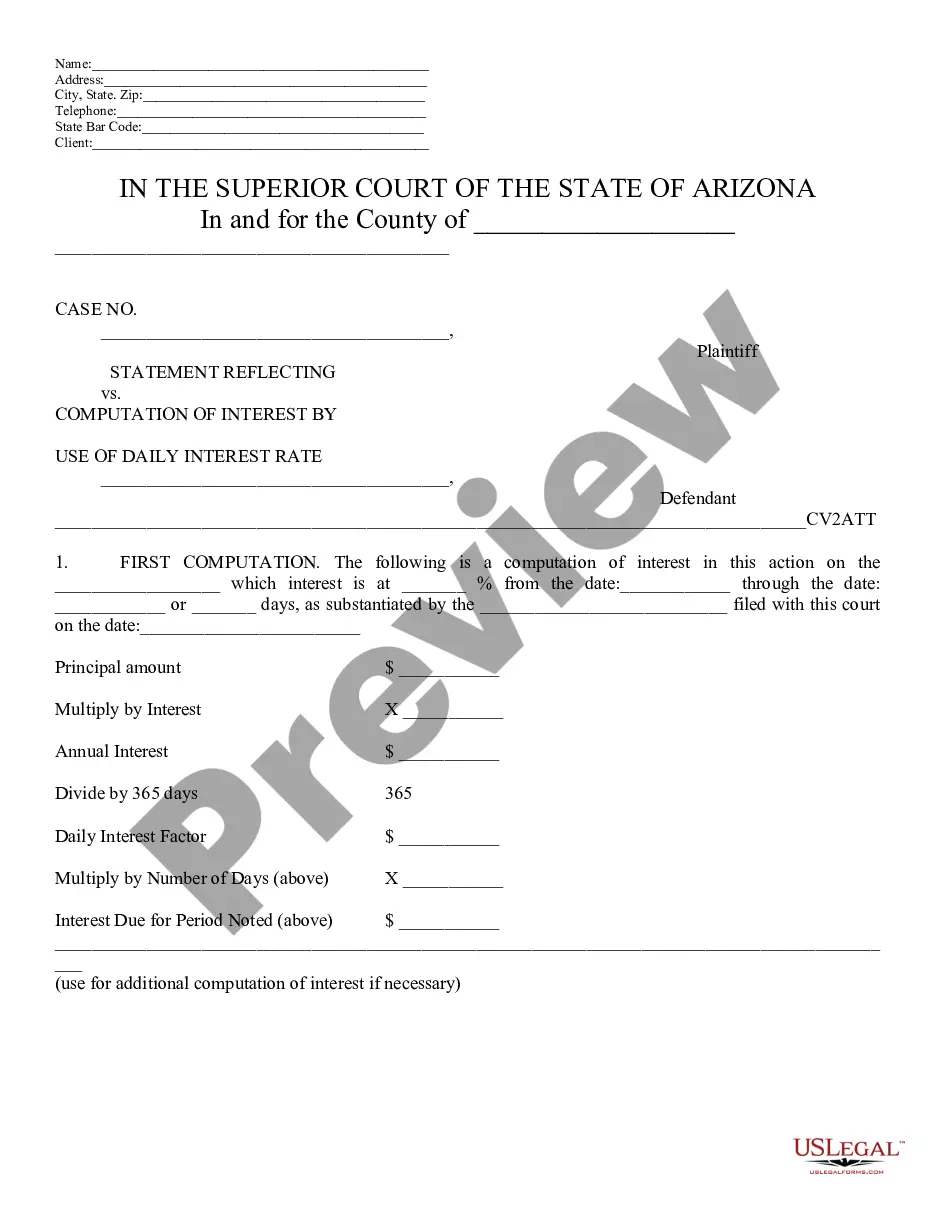

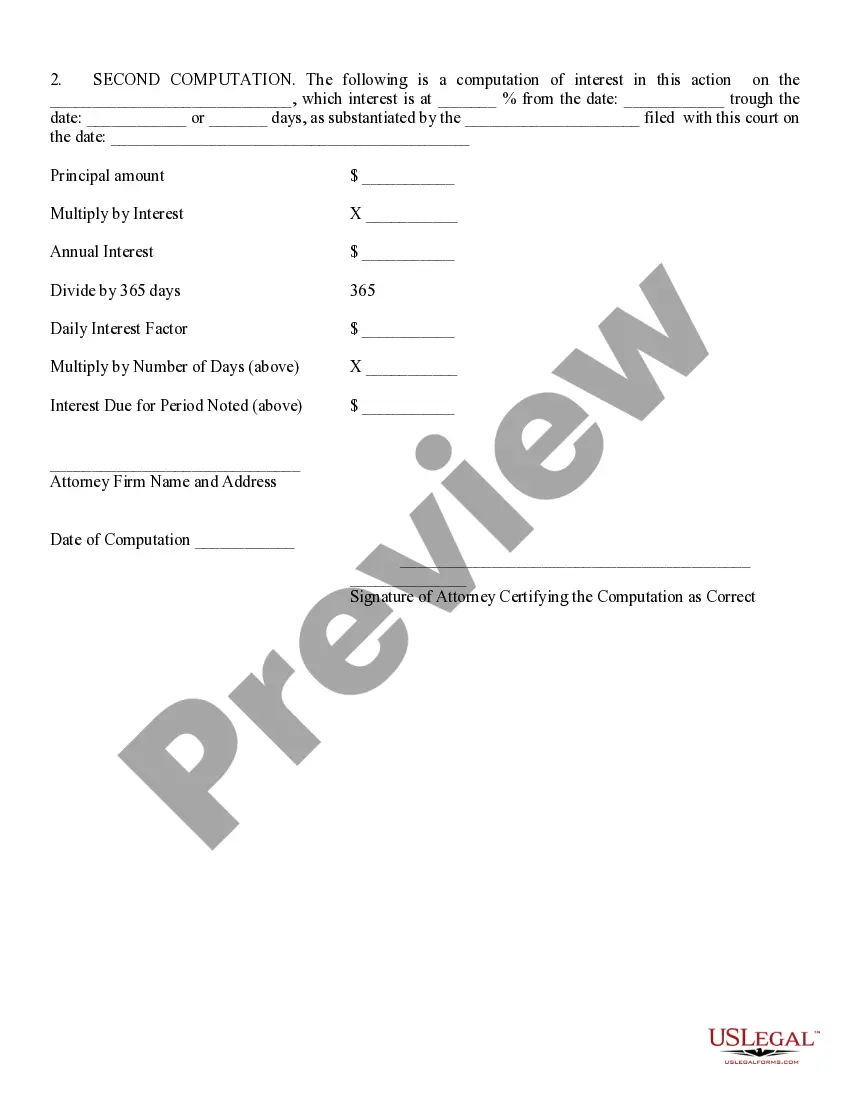

Statement Reflecting Computation of Interest By Daily Interest Rate: This statement reflects the way an attorney arrived at the total amount for damages, attorney's fees,e tc. It displays his/ her mathmatical equation, as well as the exact interest rate he/ she used in their findings. This form is available in both Word and Rich Text formats.

Tempe, Arizona is a vibrant city located in Maricopa County, known for its diverse culture and thriving economy. As part of its financial services, Tempe offers a statement reflecting the computation of interest in daily interest rate. This statement is commonly utilized by financial institutions, lenders, and borrowers to assess the accrued interest on a loan or investment over a specific period. It provides a detailed breakdown of how interest is computed on a daily basis, ensuring transparency and accuracy in financial transactions. The computation of interest in daily interest rate is particularly beneficial for individuals and businesses seeking to manage their finances effectively. By understanding how interest is calculated using daily rates, borrowers can make informed decisions about loan repayments or investments. In Tempe, there are different types of statements reflecting the computation of interest in daily interest rate, depending on the specific financial product or service. Some of these include: 1. Mortgage Statements: Mortgage lenders in Tempe provide borrowers with statements that reflect the computation of interest on their home loans. These statements help homeowners track their interest payments, principal balance, and remaining loan term. 2. Savings Account Statements: Banks and credit unions in Tempe issue statements to their customers with savings accounts. These statements detail the interest earned on the account balance by using the daily interest rate method. They allow individuals to monitor their savings growth and evaluate the effectiveness of their financial strategies. 3. Credit Card Statements: Credit card issuers in Tempe provide monthly statements that outline the computation of interest charges accrued on outstanding balances. These statements reflect the daily interest rate applied to the average daily balance, giving cardholders insight into the cost of their credit card usage. 4. Student Loan Statements: Educational institutions and loan services in Tempe offer statements reflecting the computation of interest for student loans. These statements are crucial for students and their families to understand the interest accrued during their educational journey and plan for repayment accordingly. When reviewing a Tempe Arizona statement reflecting computation of interest in daily interest rate, it is important to pay attention to the interest rate applied, the calculation method, and any additional fees or charges that may be included. These details can help borrowers and investors make informed financial decisions, manage their debts effectively, and optimize their savings and investments. Overall, the availability of statements reflecting the computation of interest in daily interest rate in Tempe Arizona demonstrates the city's commitment to financial transparency, accountability, and empowering individuals and businesses to make informed financial choices.