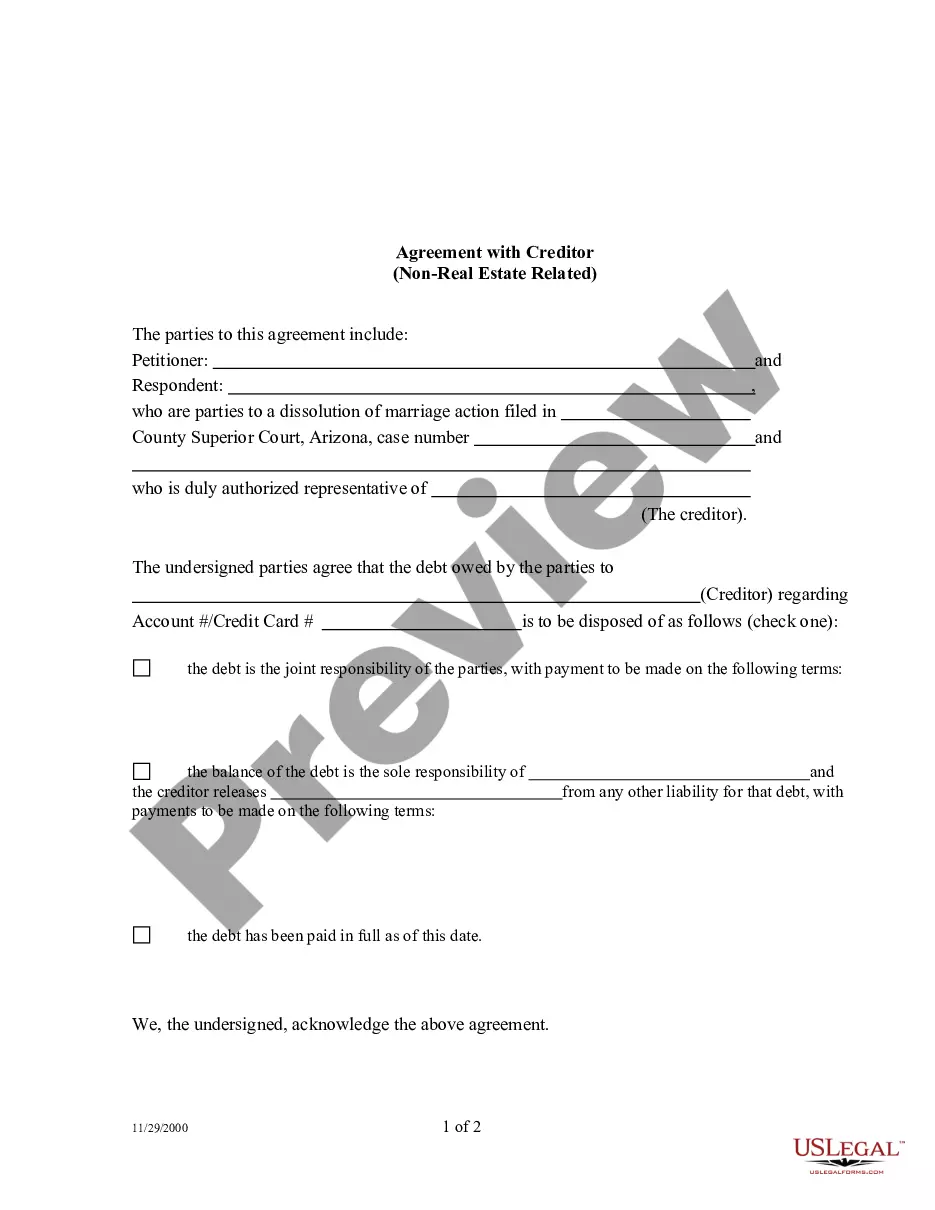

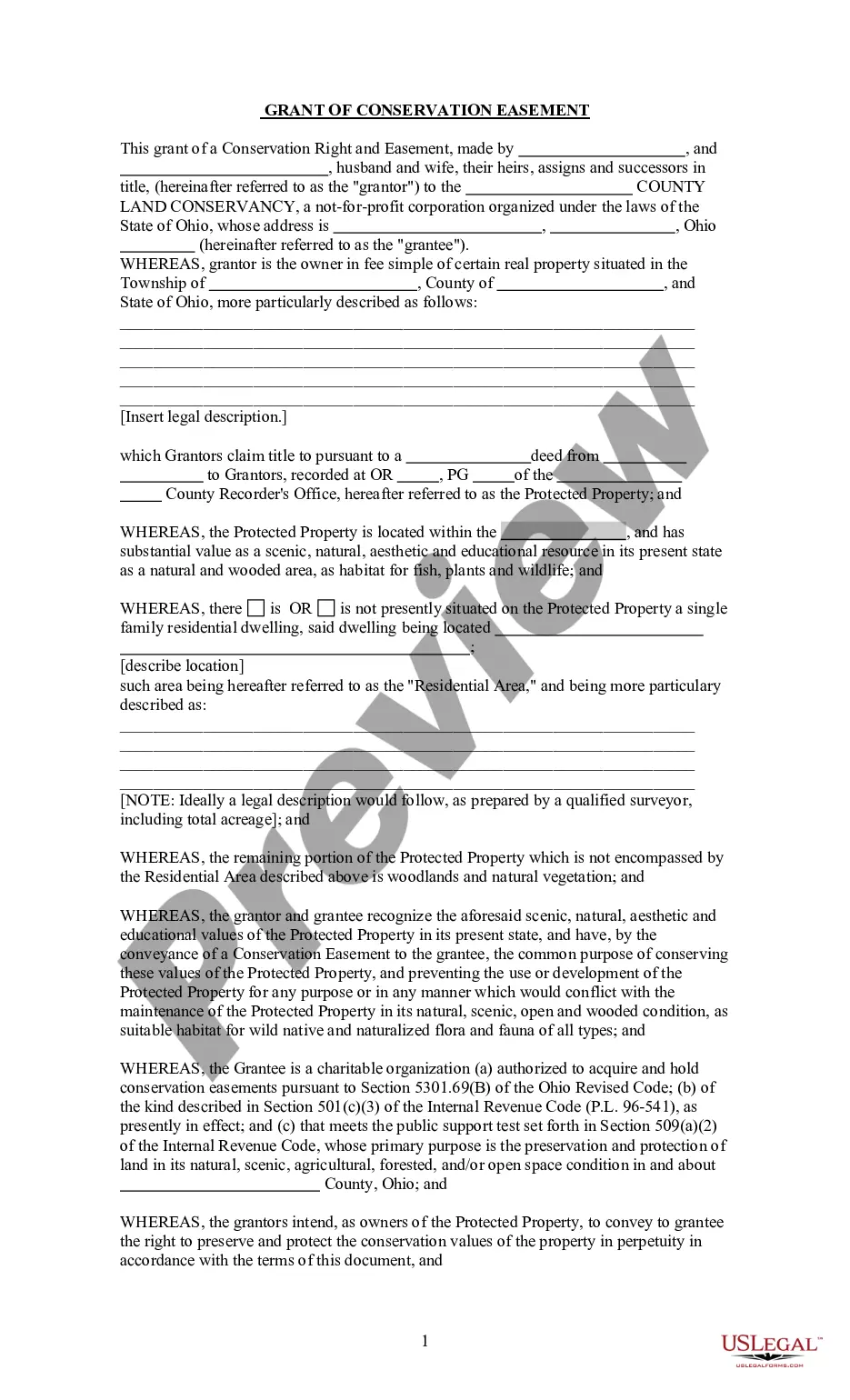

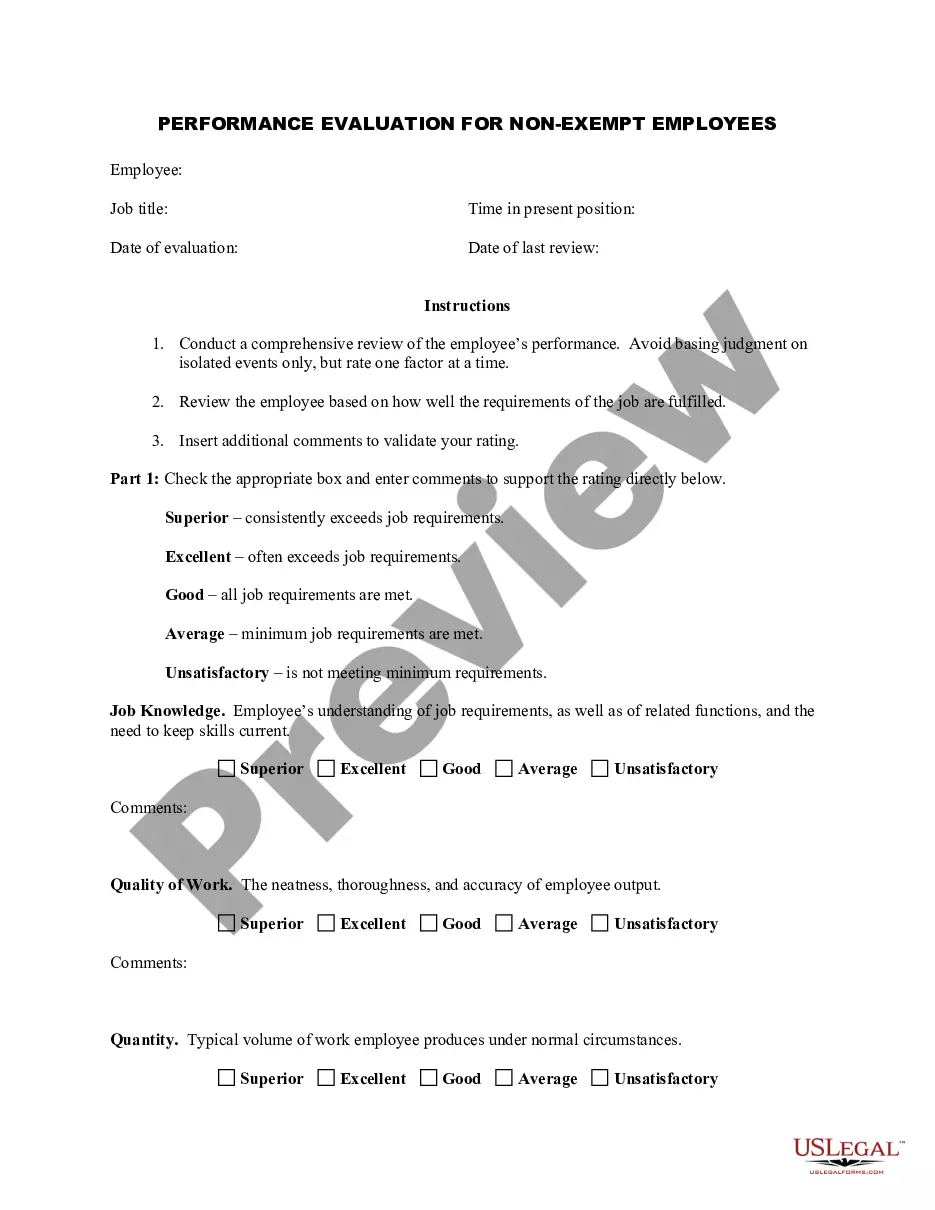

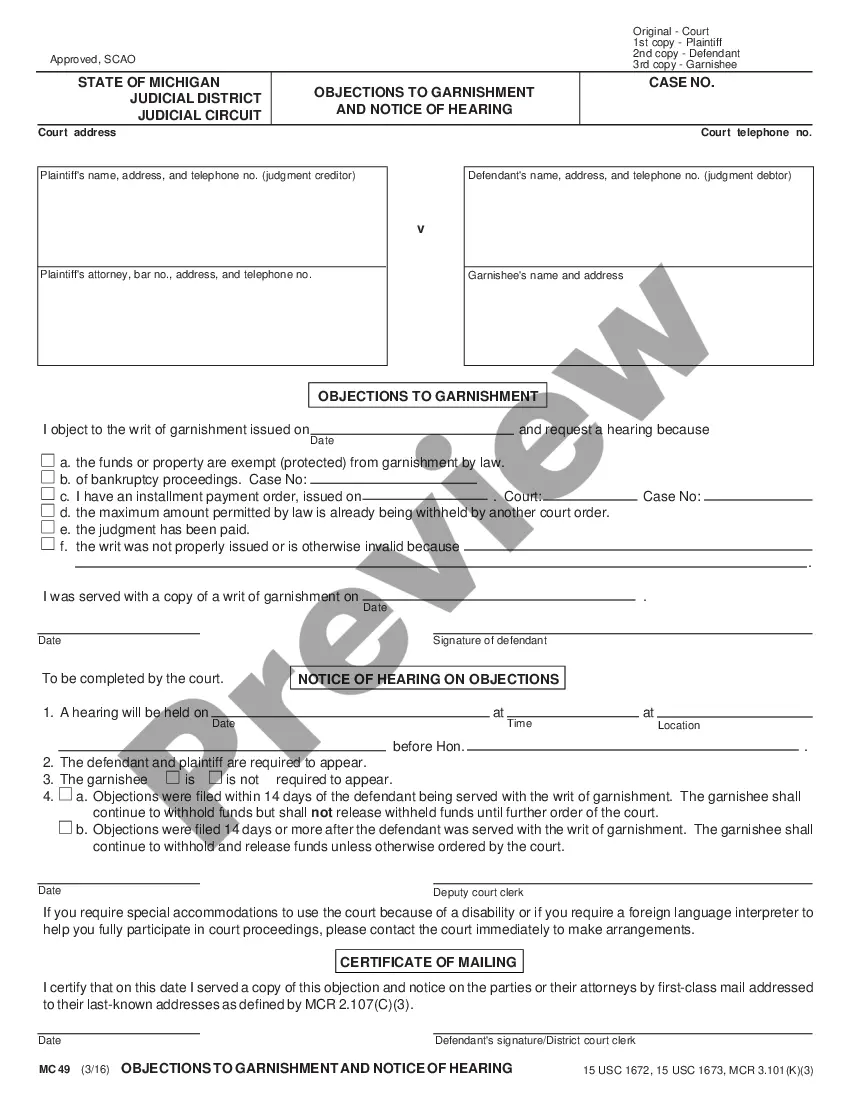

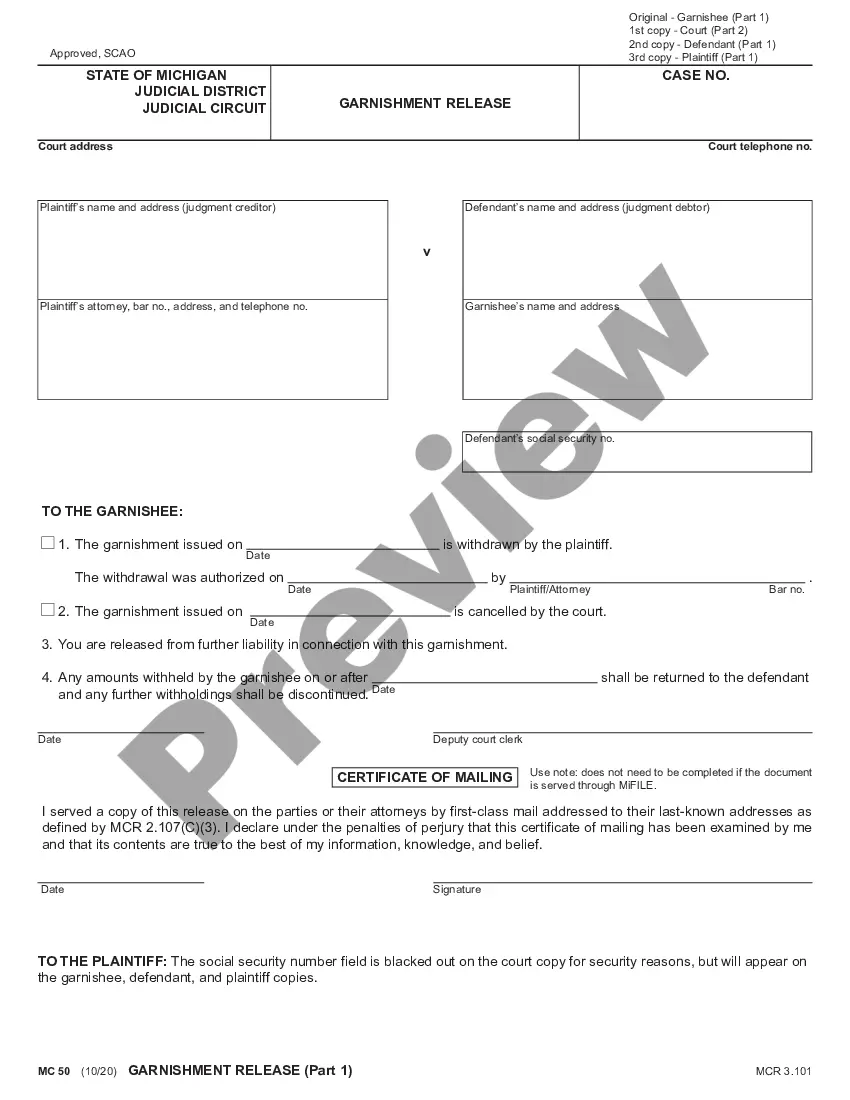

An Agreement with Creditor on Real Estate matters is a form used by both parties to a dissolution of marriage cause of action. It seeks to modify and/or reaffirm all non-real estate related debts.

Phoenix Arizona Agreement with Creditor - Debt Not Related to Real Estate

Description

How to fill out Arizona Agreement With Creditor - Debt Not Related To Real Estate?

If you are looking for a suitable form template, it’s challenging to discover a superior platform than the US Legal Forms website – likely the largest online repositories.

Here you can obtain a vast array of form samples for organizational and individual purposes categorized by types and states, or keywords.

Utilizing our advanced search feature, locating the latest Phoenix Arizona Agreement with Creditor - Debt Not Associated with Real Estate is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration.

Acquire the template. Choose the file format and save it to your device. Edit as necessary. Complete, modify, print, and sign the obtained Phoenix Arizona Agreement with Creditor - Debt Not Related to Real Estate.

- Moreover, the relevance of each document is validated by a team of experienced attorneys who regularly evaluate the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to acquire the Phoenix Arizona Agreement with Creditor - Debt Not Related to Real Estate is to Log In to your profile and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the guidelines outlined below.

- Ensure you have located the template you require. Review its details and use the Preview function (if available) to inspect its contents. If it does not satisfy your requirements, make use of the Search field at the top of the page to find the suitable document.

- Verify your choice. Click the Buy now button. Following that, select your desired pricing plan and provide your information to create an account.

Form popularity

FAQ

Household Goods ? Arizona law protects essential household goods up to $6,000 in value. This includes furniture and furnishings, appliances, and personal items. See A.R.S. 33-1123.

Arizona's list of exempt assets, which is available to Arizona residents, includes: Homestead: Debtor's equity interest in real property (e.g., house, condominium or cooperative, mobile home) in which debtor resides, in the amount of $250,000 A.R.S.

In addition, the new law expressly authorizes a judgment creditor to force an involuntary sheriff's execution sale of homestead property if the equity in the property exceeds $250,000.

Property exemptions. Household furniture and furnishings, household goods, including consumer electronic devices, and household. appliances personally used by the debtor or a. dependent of a debtor and not otherwise specifically.

In Arizona, the statute of limitations for credit card debt is three years. The statute for mortgages and medical debts is six years. The statute for car loans is four years. Unpaid state taxes have a statute of 10 years.

In Arizona, your statute of limitations ?clock? begins when the creditor ?accelerates the debt,? or demands payment in full. The statute of limitations on written contracts, which includes most debt, is six years.

There is no clear statute regarding limitations for a lawsuit to collect a credit card debt in Arizona. At least two relevant statutes may be applicable in this state: One for ?open accounts? (three years from default) and one for ?written contracts? (six years from default).

DO THE ARIZONA BANKRUPTCY EXEMPTIONS APPLY? Vehicles. Homestead. Retirement/Pension. Tools of the Trade. Household Goods and Furnishings. Money in One Bank Account. Jewelry. Social Security.

The statute of limitations for credit card debt is three years. For car loans, mortgages and medical debts it's six years, and for unpaid taxes it's 10 years. The timeframe indicates the amount of time a debt collector has to collect a debt.

Personal Property ? Arizona law protects many personal items such as (1) $300 cash, (2) clothing up to $500 in value, (3) musical instruments up to $400 in value, (4) domestic pets, (5) a wedding ring up to $2,000 in value, (6) books up to $250 in value, (7) a bicycle up to $1,000 in value, (8) a firearm up to $1,000