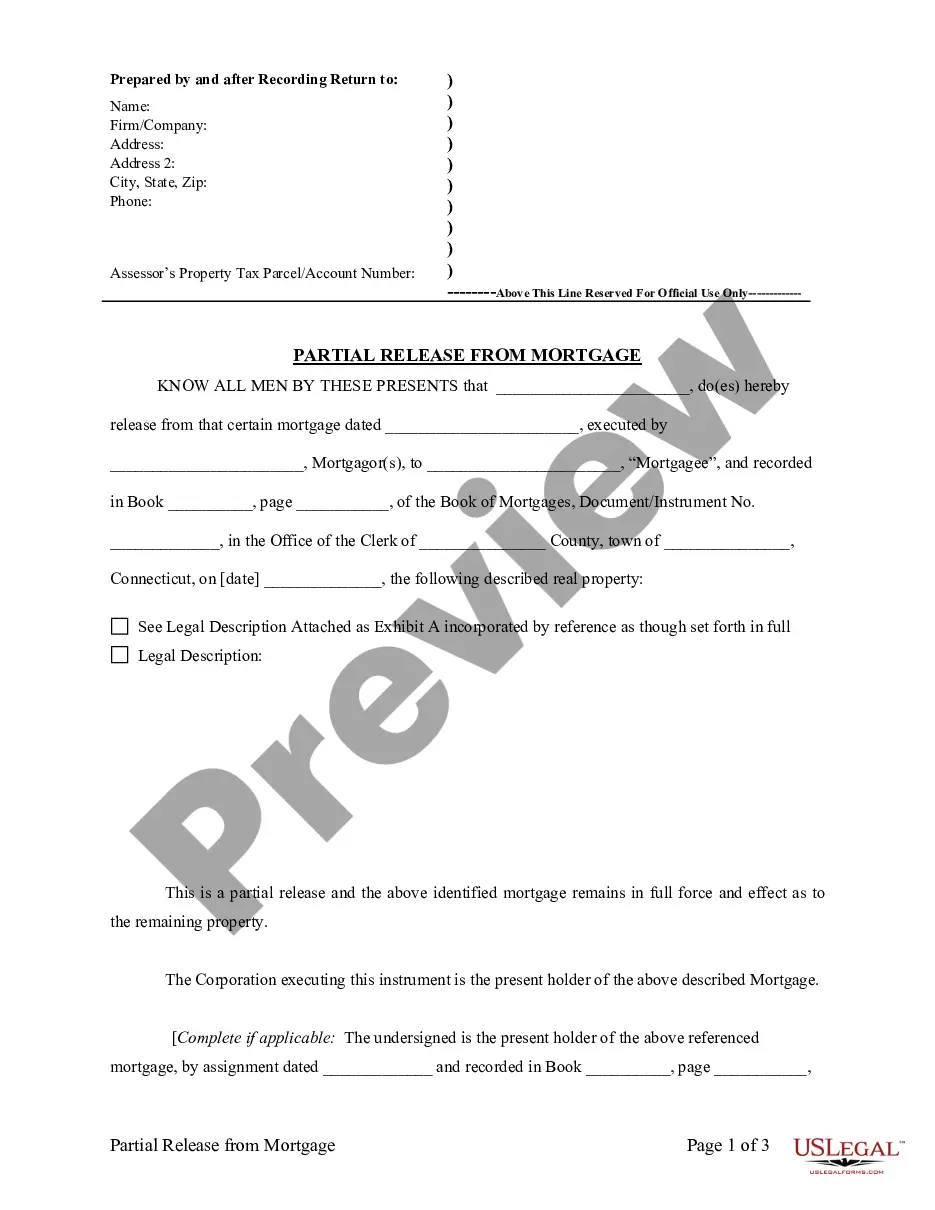

This is an official Workers' Compensation form for the state of Arizona.

Surprise Arizona Annual Taxes for Workers' Compensation

Description

How to fill out Arizona Annual Taxes For Workers' Compensation?

Regardless of your societal or occupational position, filling out law-related documents is a regrettable requirement in the modern world.

Often, it's nearly unfeasible for individuals lacking legal education to create such documents independently, primarily due to the complex terminology and legal nuances that accompany them.

This is where US Legal Forms can be a lifesaver.

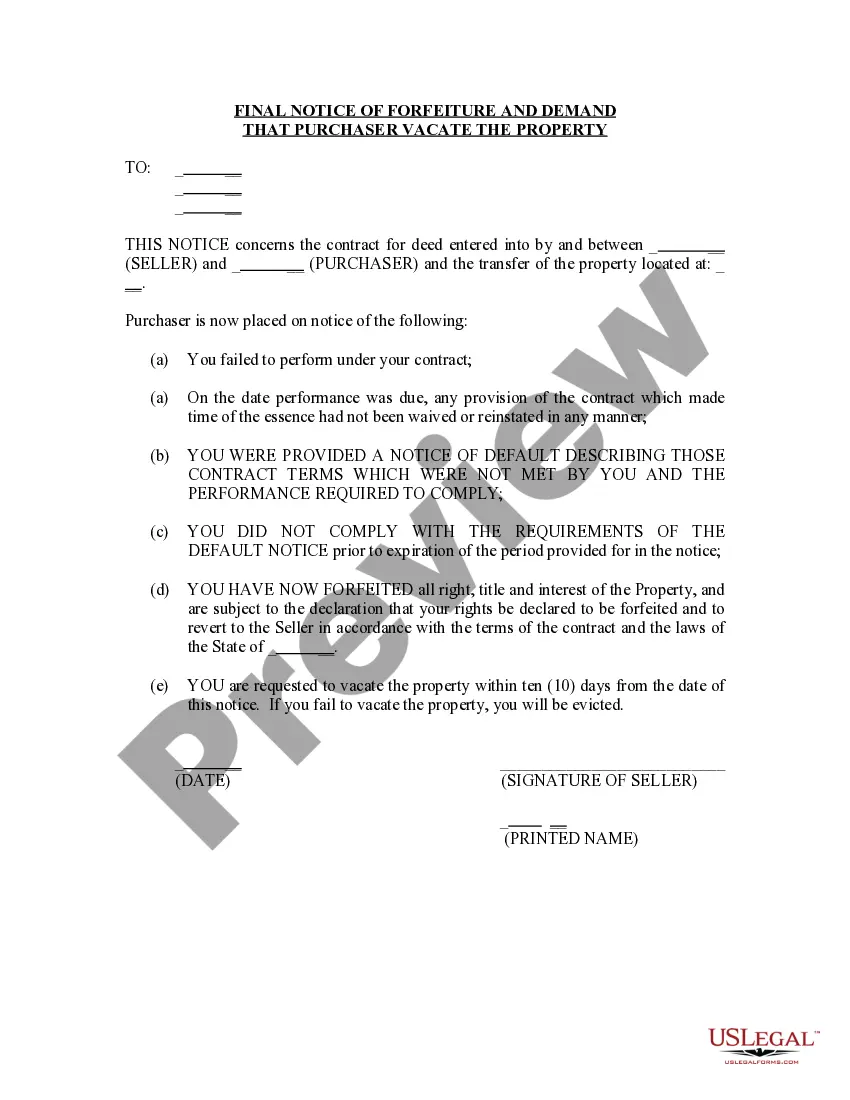

Confirm that the form you have selected is suitable for your jurisdiction, as the regulations of one state or region do not apply to another.

Review the document and read a brief summary (if available) of scenarios in which the document can be utilized.

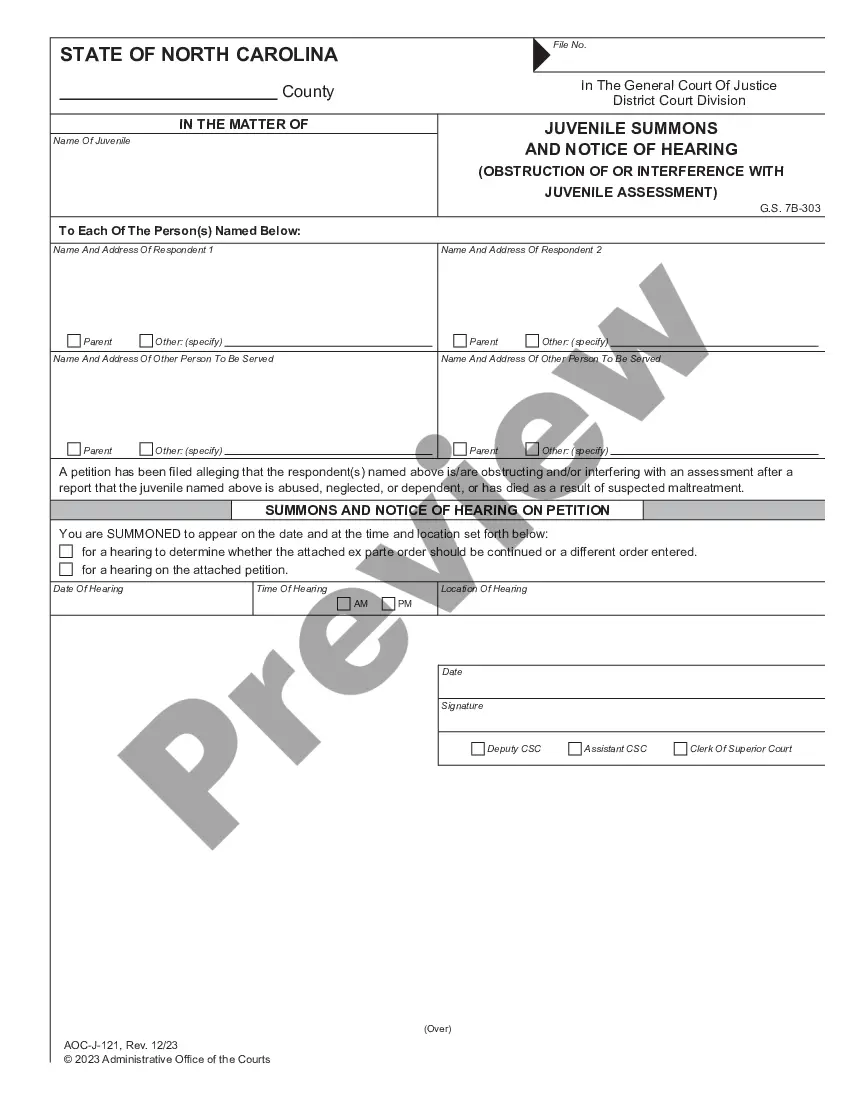

- Our platform offers an extensive database with over 85,000 ready-to-use forms tailored for nearly every legal situation.

- US Legal Forms is also a valuable tool for associates or legal advisers looking to save time with our DIY papers.

- Whether you need the Surprise Arizona Annual Taxes for Workers' Compensation or any other document that will be applicable in your jurisdiction, with US Legal Forms, everything is readily accessible.

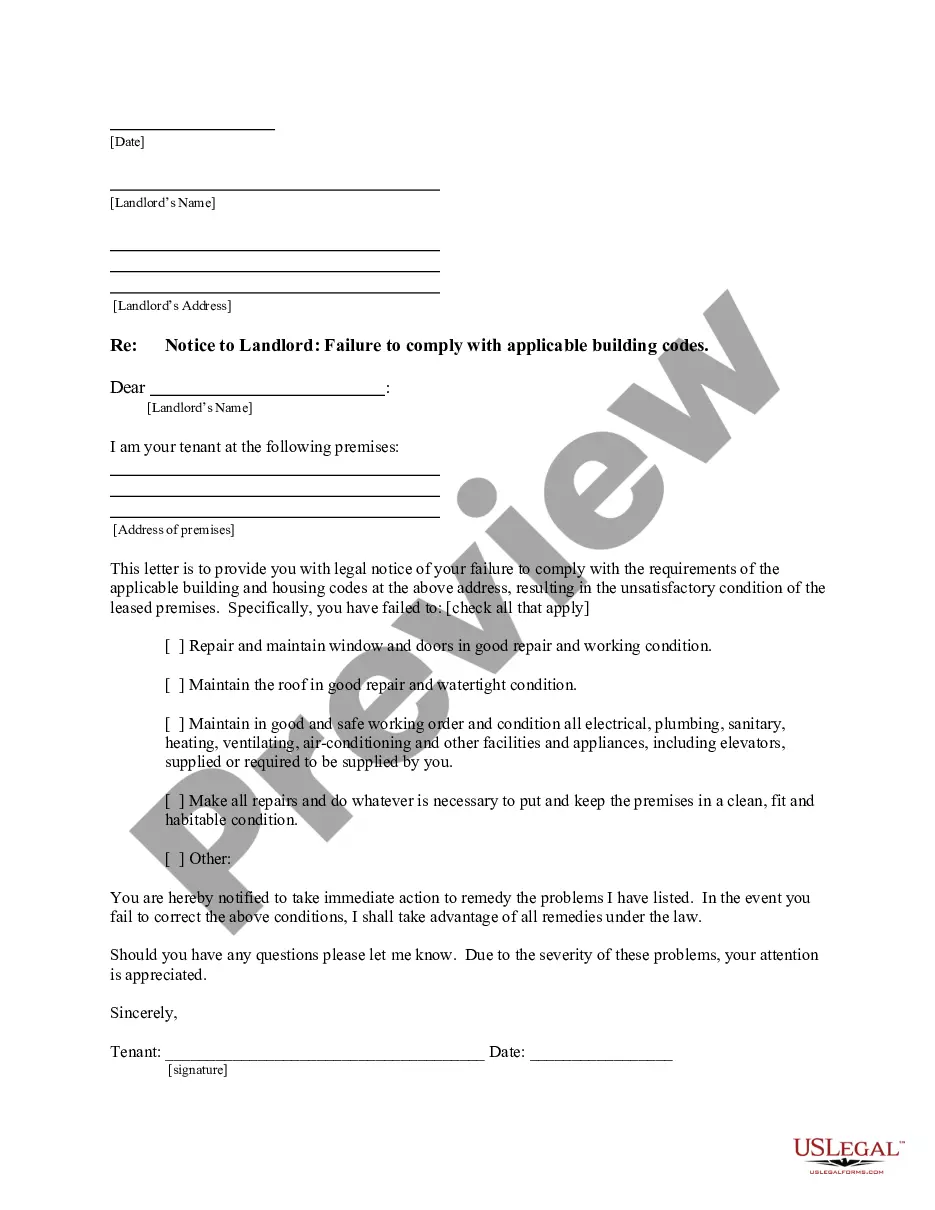

- Here’s how you can promptly acquire the Surprise Arizona Annual Taxes for Workers' Compensation using our reliable service.

- If you are already a subscriber, you can go ahead and Log In to your account to obtain the necessary form.

- However, if you are new to our service, make sure to follow these steps before retrieving the Surprise Arizona Annual Taxes for Workers' Compensation.

Form popularity

FAQ

How much does workers' compensation insurance cost in Arizona? Estimated employer rates for workers' compensation in Arizona are $0.78 per $100 in covered payroll.

In Arizona, workers' comp covers all medical expenses to heal the work-related injury or illness. It can also provide some of the missed wages when injured workers need time off to recover. Coverage requirements in Arizona say you must provide workers' comp for full-time and part-time workers.

Employers usually pay premiums to an insurance company, which then pays out workers' compensation claims. Employees don't need to pay anything toward their coverage. If employers have failed to secure coverage, the Industrial Commission of Arizona (ICA) has a special fund to give benefits to workers.

In general, Worker's Compensation benefits and settlements will not be taxed at either the state or federal level in Arizona.

Temporary Total Benefits Min: $200/month Max: $5161.12 per month effective 1/1/2022 7 day waiting period with retro benefits paid if more than 14 days lost. Benefits paid bi-weekly. Unlimited benefits.

I'm attorney Matt Fendon and one of the questions I get asked on a regular basis is, how long do Arizona Workers' Compensation benefits last? Well, the short answer to that is, in most cases, there's no time limit. Essentially, you can have that claim for the rest of your life.

In general, you should receive written notice that your claim was either approved or denied within a few weeks. If you haven't heard from the insurance company, you should contact your insurance adjuster or claims administrator directly.

If it is determined that you have a loss of wages because of your injury, the carrier will pay 662/3% of the difference between the wages you are now able to earn and your established average monthly wage. This compensation is paid once a month instead of every two weeks.

Employers usually pay premiums to an insurance company, which then pays out workers' compensation claims. Employees don't need to pay anything toward their coverage. If employers have failed to secure coverage, the Industrial Commission of Arizona (ICA) has a special fund to give benefits to workers.