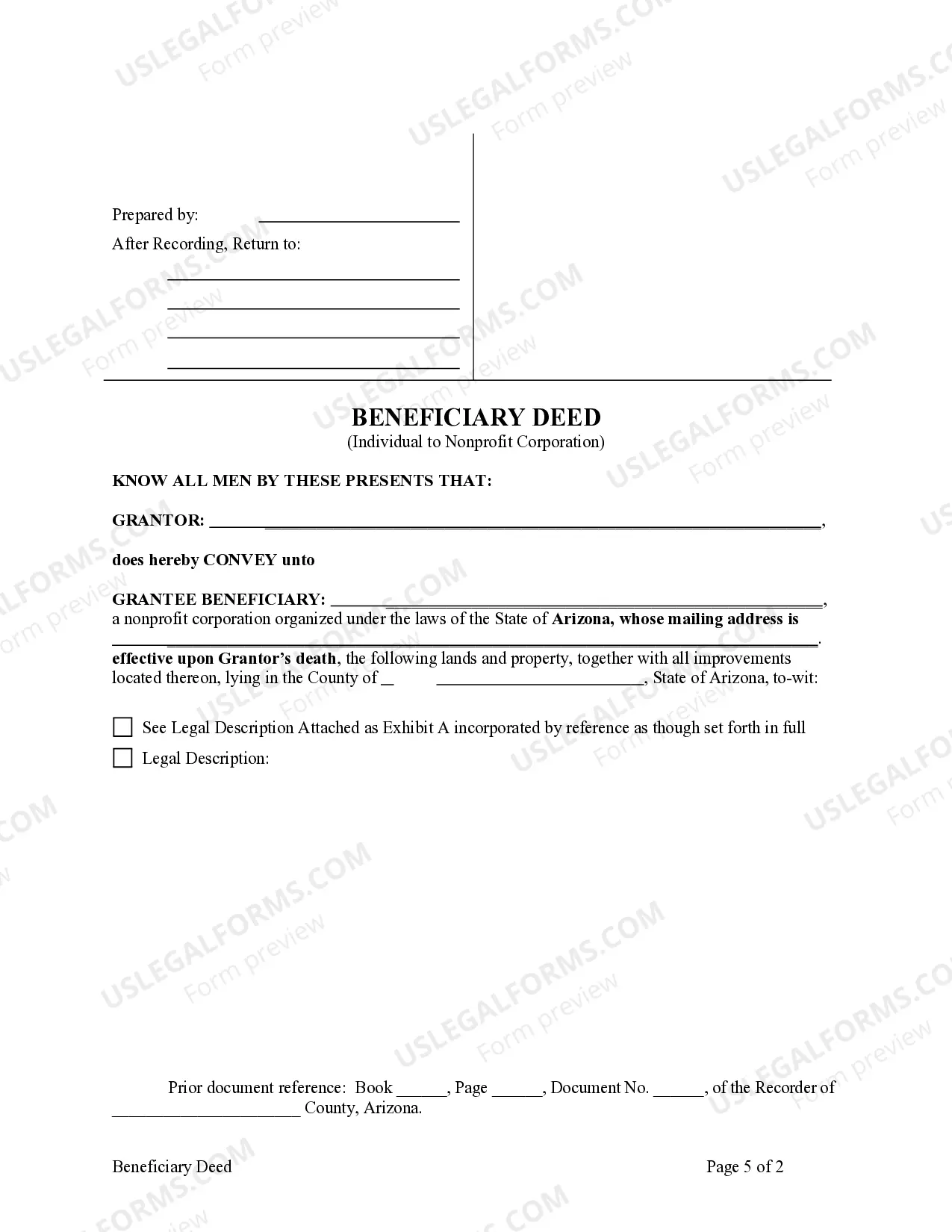

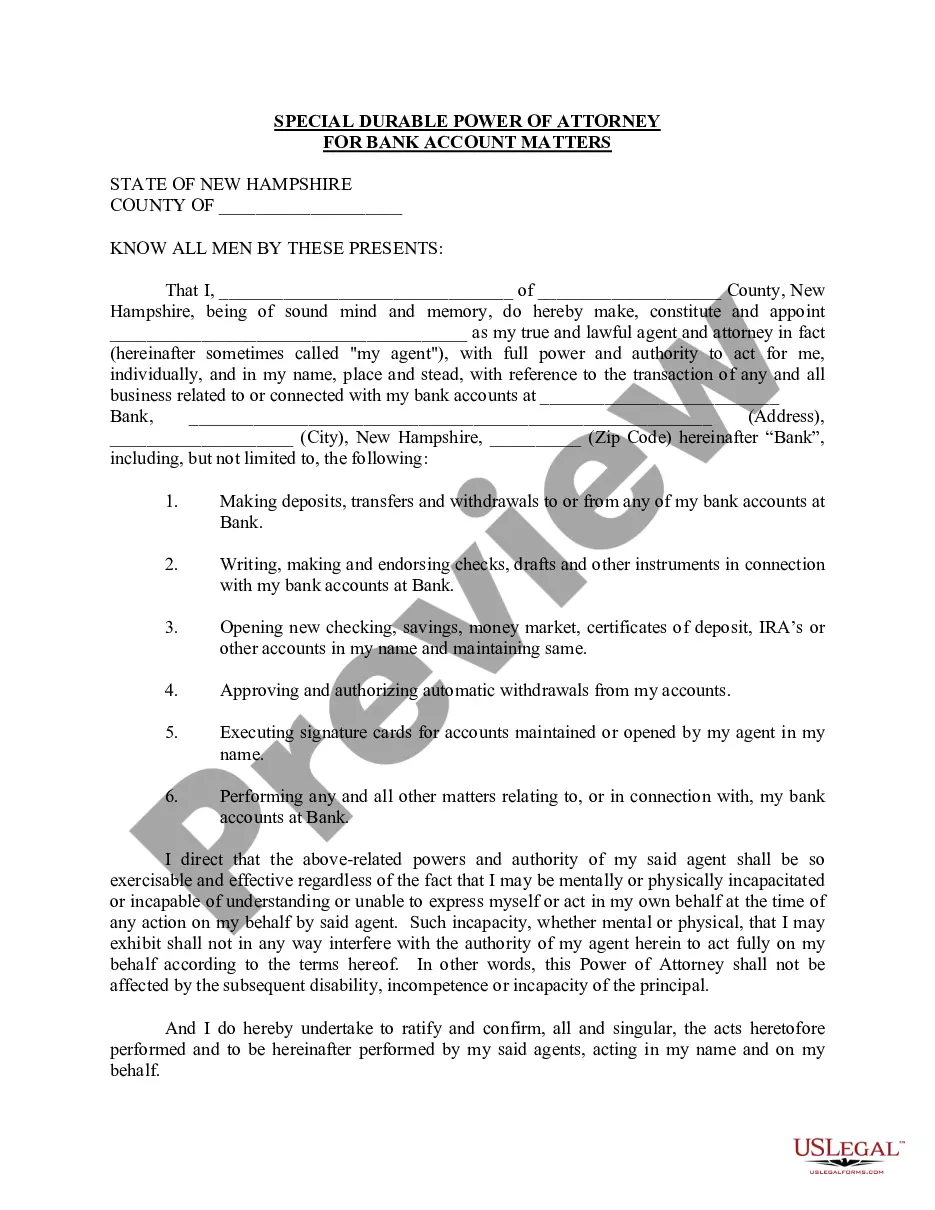

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee \ Beneficiary is a Nonprofit Corporation. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Surprise Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary

Description

How to fill out Arizona Beneficiary Or Transfer On Death Deed From An Individual Owner To A Nonprofit Corporation As Beneficiary?

Take advantage of the US Legal Forms and gain immediate access to any document you require.

Our user-friendly website featuring thousands of template documents streamlines the process of locating and acquiring nearly any document sample you need.

You can quickly export, fill out, and sign the Surprise Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation serving as Beneficiary in just a few minutes instead of spending hours searching the internet for a suitable template.

Utilizing our collection is a smart approach to enhance the security of your document filing.

If you have not yet registered an account, follow these steps.

Access the page with the template you need. Confirm that it is the document you are looking for: review its title and description, and utilize the Preview option when available. If not, employ the Search bar to find the correct one.

- Our qualified attorneys regularly assess all the documents to ensure that they are suitable for specific states and adhere to new laws and regulations.

- How can you obtain the Surprise Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation serving as Beneficiary.

- If you possess an account, simply Log In to your profile.

- The Download feature will be available for all the samples you access.

- Additionally, you can locate all previously saved documents in the My documents section.

Form popularity

FAQ

Various states allow the use of a Transfer on Death (TOD) deed, with Arizona being one of them. It's important to know that the Surprise Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary is recognized and can facilitate smooth property transitions in Arizona. Other states that allow similar deeds include California, Florida, and Illinois, each with their own specific regulations and requirements.

To transfer title on death in Arizona, you need to file a Transfer on Death (TOD) deed, designating your chosen beneficiary. If you have decided on the Surprise Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary, ensure that the deed is recorded with the county recorder's office prior to your passing. This ensures that the property goes directly to your specified beneficiary without complications, streamlining the overall process.

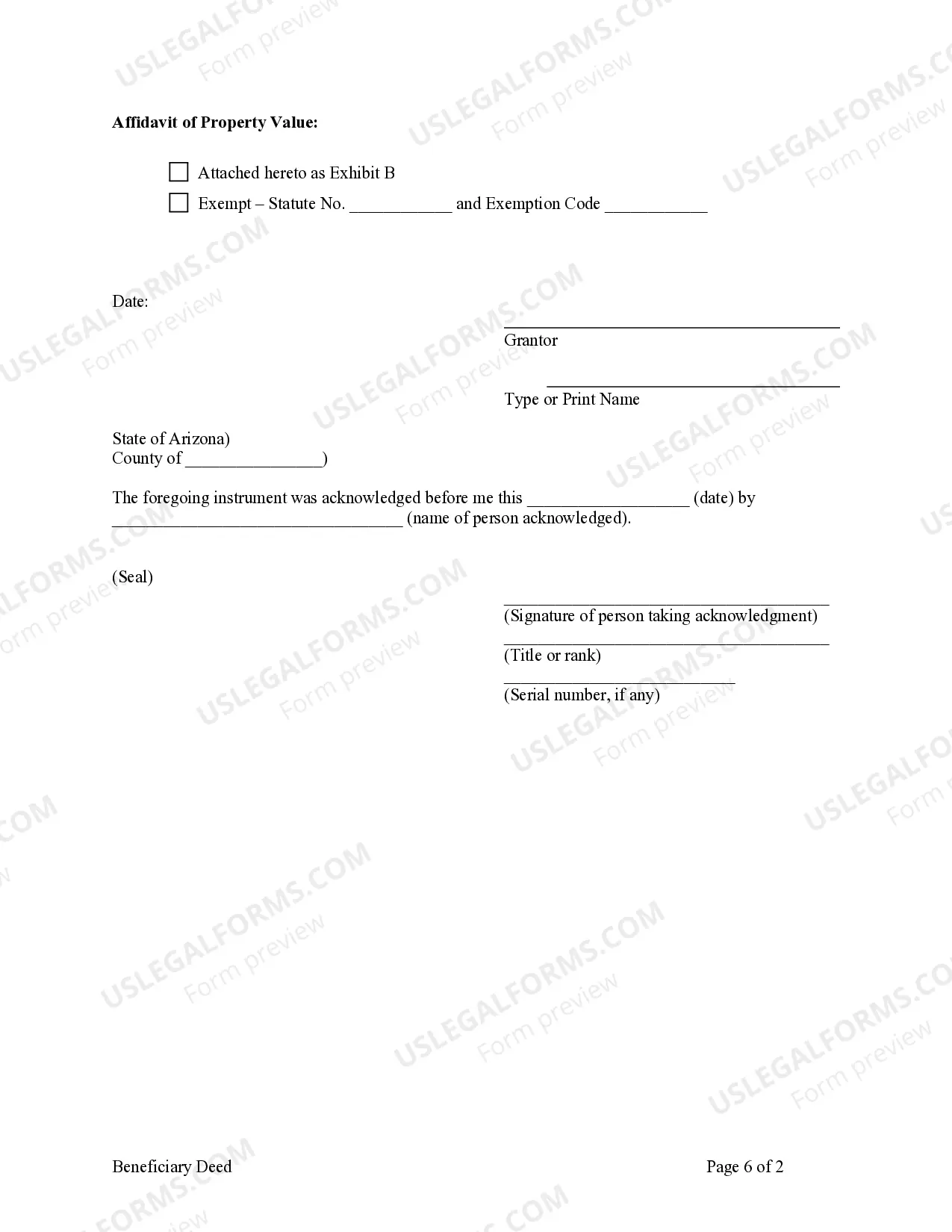

Writing a beneficiary deed involves a few key components, including the legal description of the property, the names of the beneficiaries, and your signature. It is important to clearly state that the deed is a Transfer on Death Deed to avoid confusion in the future. With uslegalforms, you can access the right templates and instructions to successfully draft a Surprise Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary.

While it is not legally required to involve a lawyer when creating a beneficiary deed, doing so can provide valuable guidance. A legal professional can help ensure that the document is properly executed and specify your wishes accurately. Utilizing platforms like uslegalforms can also assist you in navigating through the creation of a Surprise Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary without legal complications.

Yes, Arizona officially recognizes transfers on death deeds, allowing individuals to transfer properties directly to beneficiaries upon their death. This means that through a Surprise Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary, you can simplify the transfer process and avoid probate court. Understanding these provisions can enhance your estate planning strategy.

Transferring a property deed from a deceased relative in Arizona often requires obtaining the death certificate and consulting local property records. You will typically need to complete an affidavit of heirship or a similar document, depending on the property's value. Using the services of uslegalforms can simplify this process, providing you with the necessary forms and guidance to ensure all steps are executed correctly.

Yes, in most cases, a beneficiary deed will override a will when it comes to the property specified in the deed. This means that if you have named a nonprofit corporation as the beneficiary in a Surprise Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary, that deed takes precedence over the will. Thus, it is important to understand how these documents interact to ensure your wishes are followed.

One key disadvantage of a beneficiary deed, also known as a Transfer on Death Deed, is that it may not cover certain debts or obligations associated with the property. Additionally, it could potentially lead to complications if the property is sold or if disputes arise among beneficiaries. Furthermore, maintaining clear communication is essential as misunderstandings may lead to family conflicts after the owner’s passing.

While it's not a requirement to have a lawyer for a Transfer on Death Deed, it is often advisable. An experienced attorney can help you navigate the complexities involved in designating a nonprofit corporation as the beneficiary and ensure all documents are compliant with Arizona law. Using platforms like uslegalforms can also simplify the process, offering essential tools for creating legally sound documents.

Some disadvantages include limited control over the property after your death, as the beneficiary inherits it outright. Also, any liens or claims against the property will still apply, which could complicate the transfer. Understanding these aspects is crucial when opting for a Transfer on Death Deed in Surprise, Arizona, especially when a nonprofit corporation is involved.