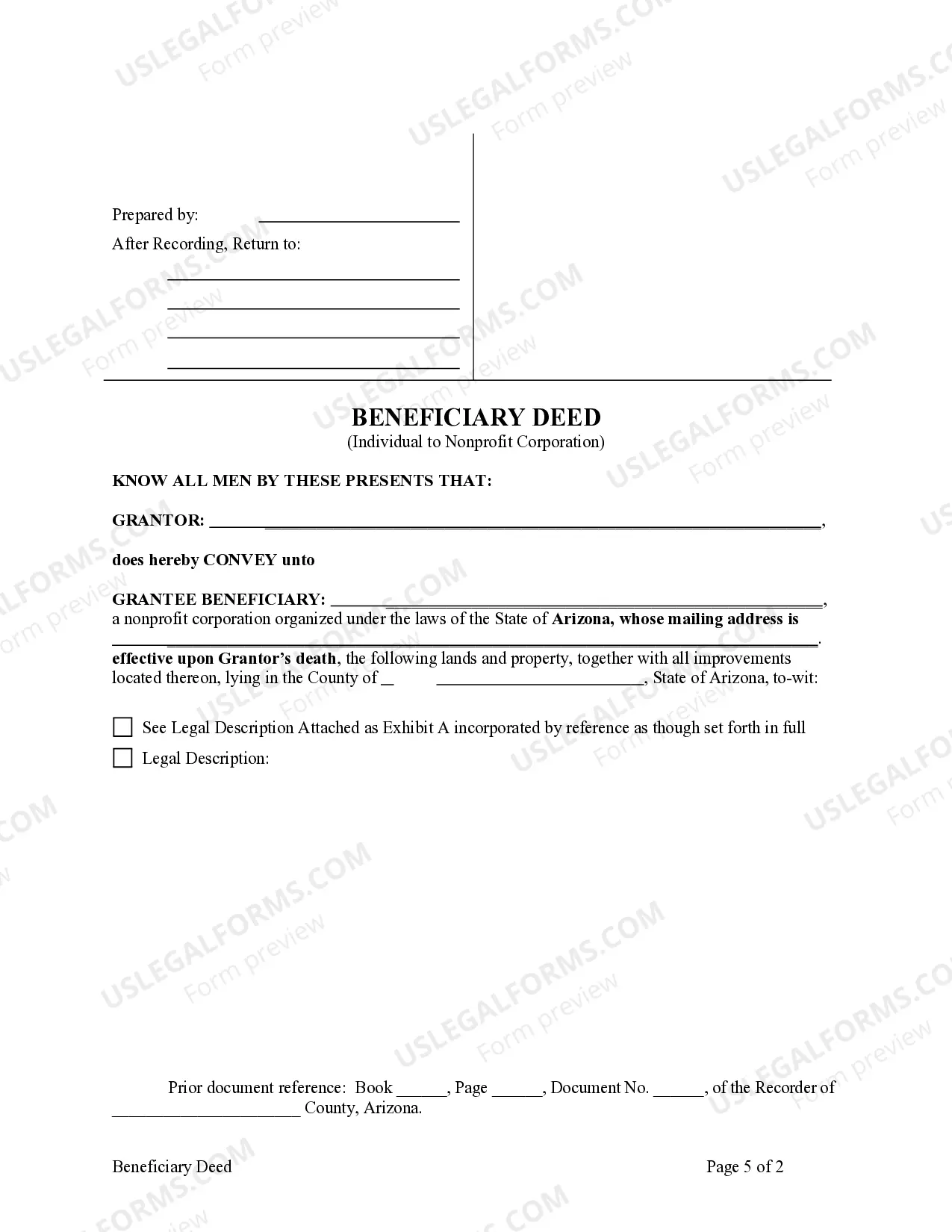

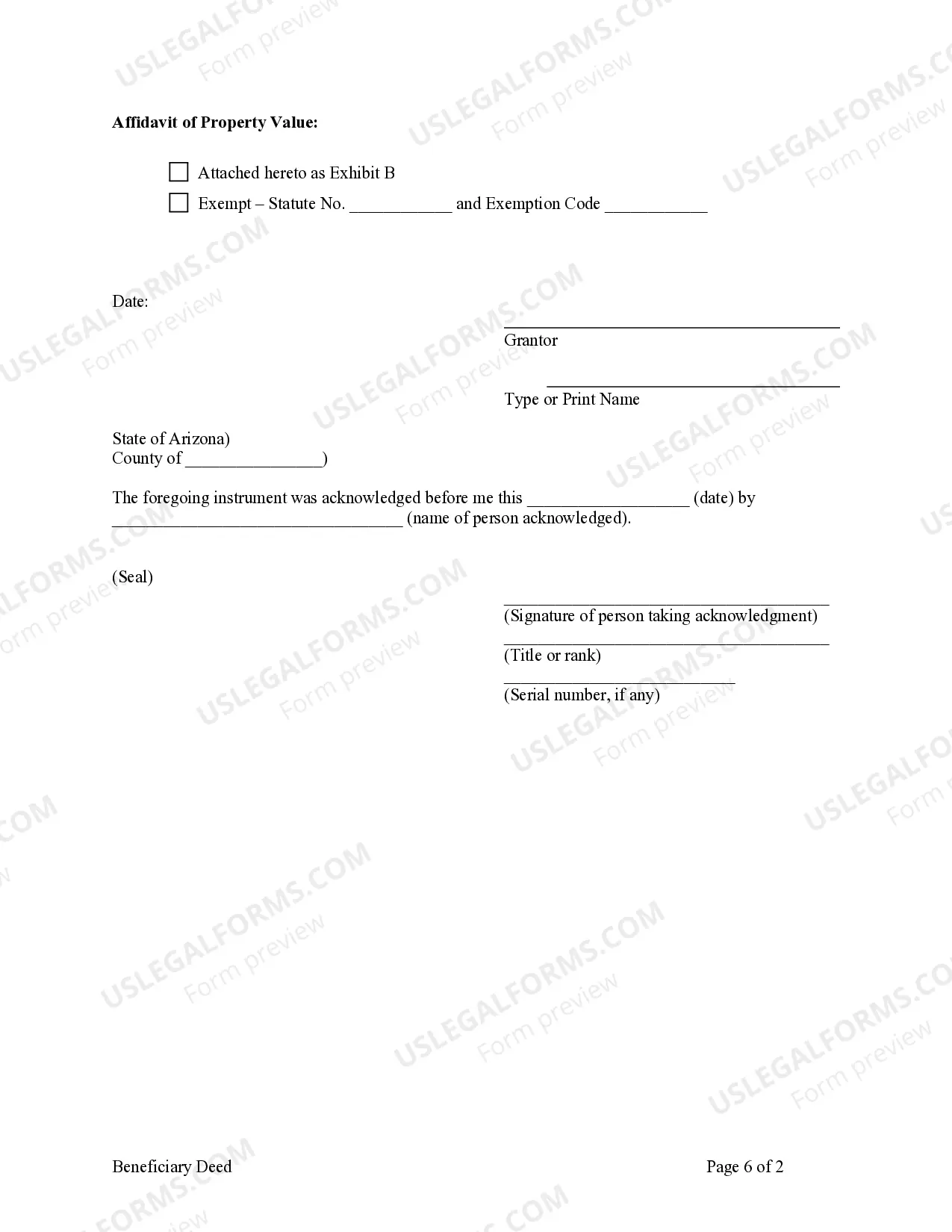

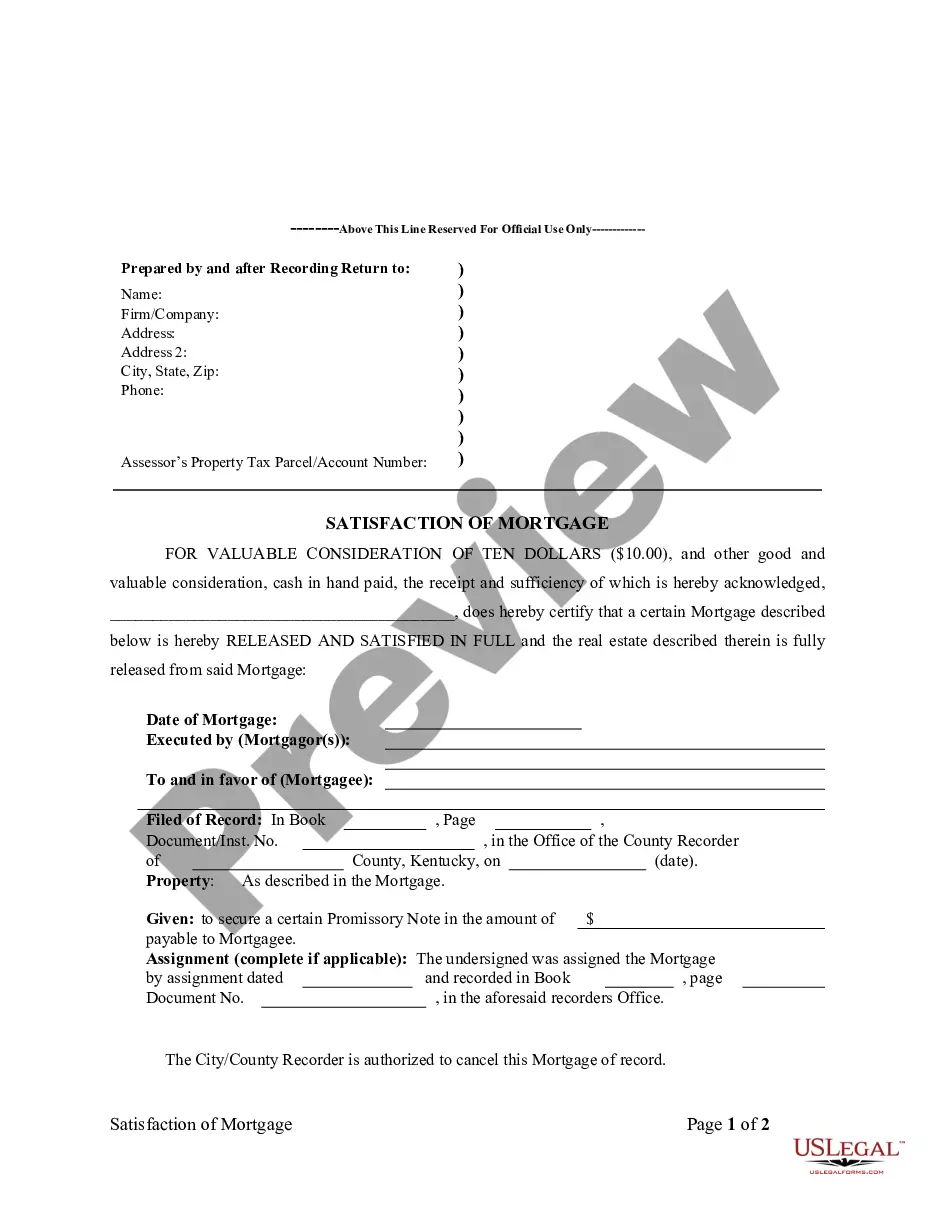

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee \ Beneficiary is a Nonprofit Corporation. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Phoenix Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary

Description

How to fill out Arizona Beneficiary Or Transfer On Death Deed From An Individual Owner To A Nonprofit Corporation As Beneficiary?

We consistently aim to minimize or avert legal harm when navigating intricate legal or financial issues.

To achieve this, we enroll in legal services that are generally very expensive.

Nonetheless, not every legal issue is equally complicated; the majority can be managed independently.

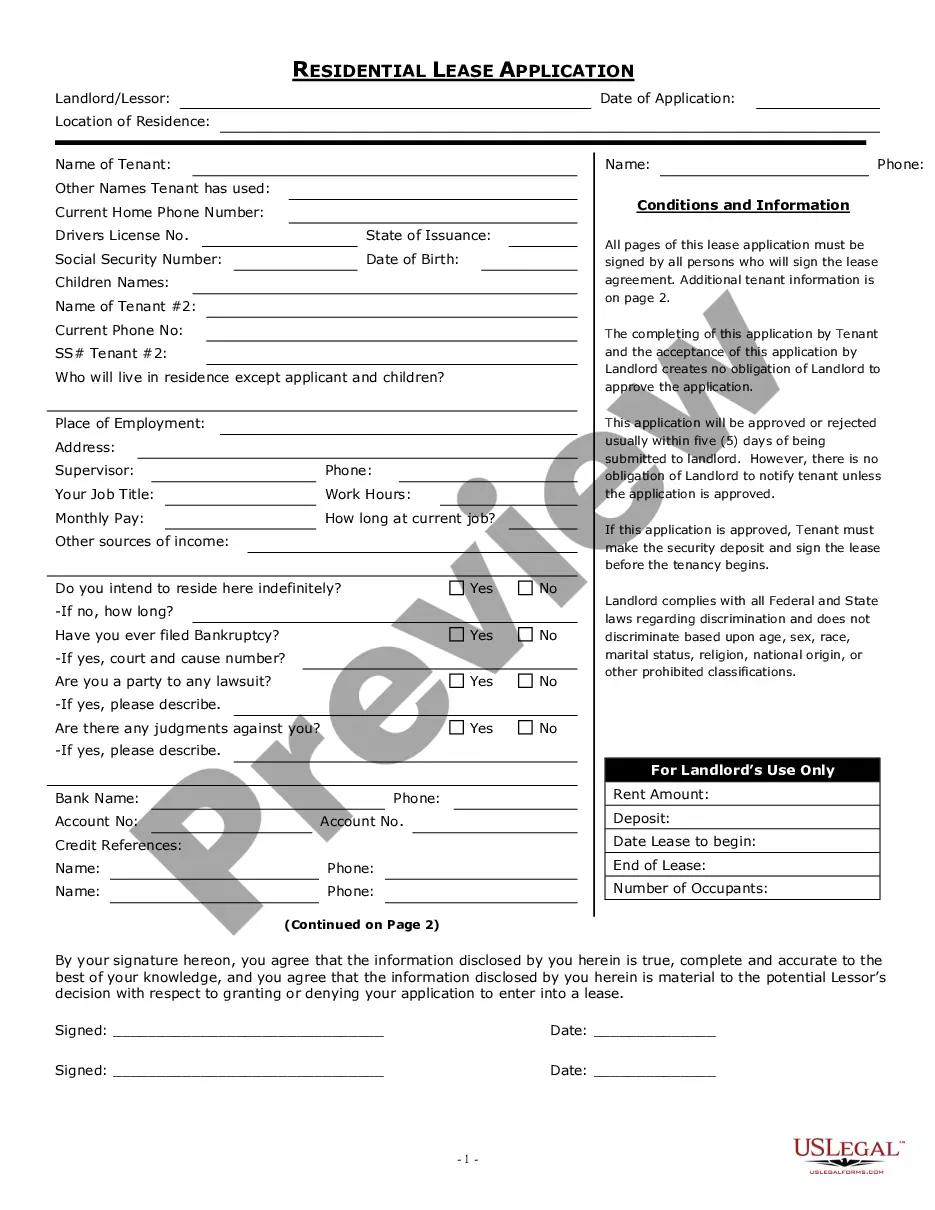

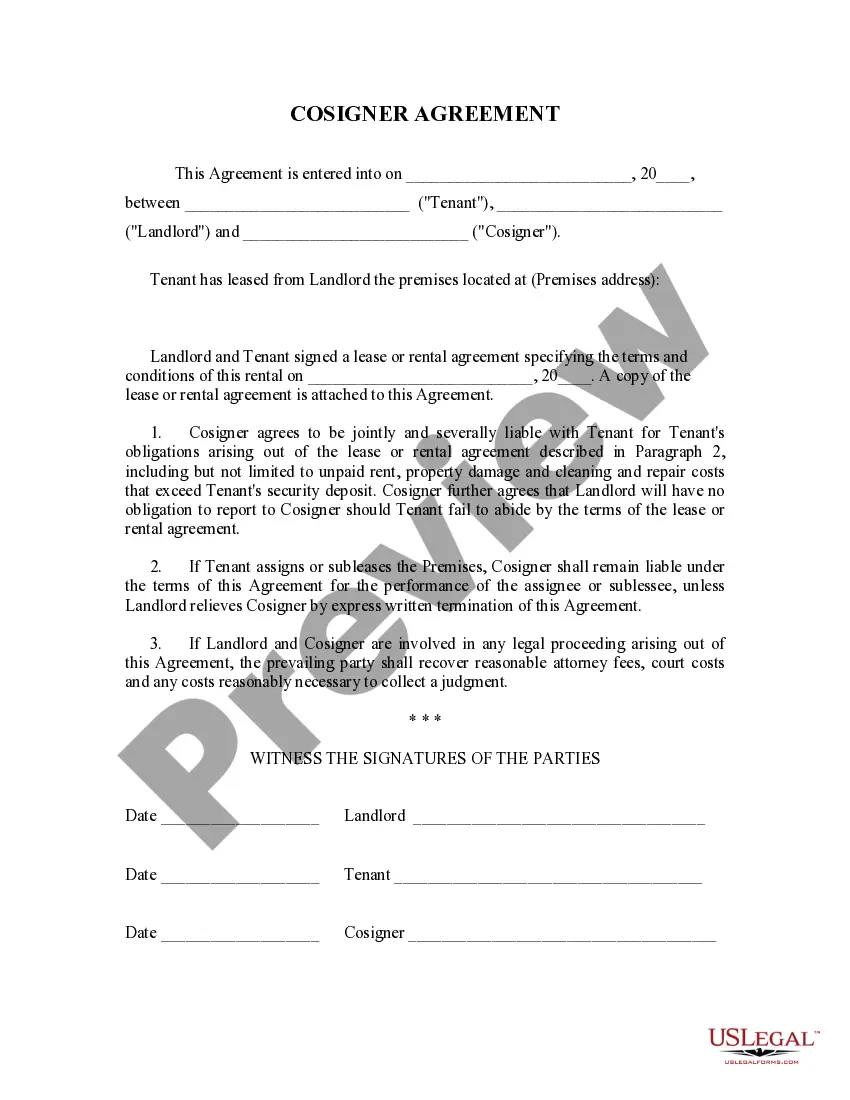

US Legal Forms is an online compilation of current DIY legal documents that cover everything from wills and power of attorneys to articles of incorporation and petitions for termination.

Simply Log In to your account and hit the Get button beside it. If you misplace the document, you can always re-download it from the My documents section. The method is just as simple if you are new to the platform! You can set up your account in a matter of minutes. Ensure that the Phoenix Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary complies with the laws and regulations of your state and locality. Additionally, it is crucial to review the form's description (if present), and if you discover any inconsistencies with what you were originally seeking, look for an alternative form. Once you have confirmed that the Phoenix Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary suits your needs, you can select the subscription plan and process the payment. Subsequently, you can download the document in any preferred file format. For over 24 years in the field, we have assisted millions by providing ready-to-modify and contemporary legal forms. Take advantage of US Legal Forms today to conserve time and resources!

- Our platform empowers you to handle your situations independently without needing to engage legal counsel.

- We grant access to legal form templates that may not always be publicly available.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- Utilize US Legal Forms whenever you wish to locate and download the Phoenix Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary or any other form effortlessly and securely.

Form popularity

FAQ

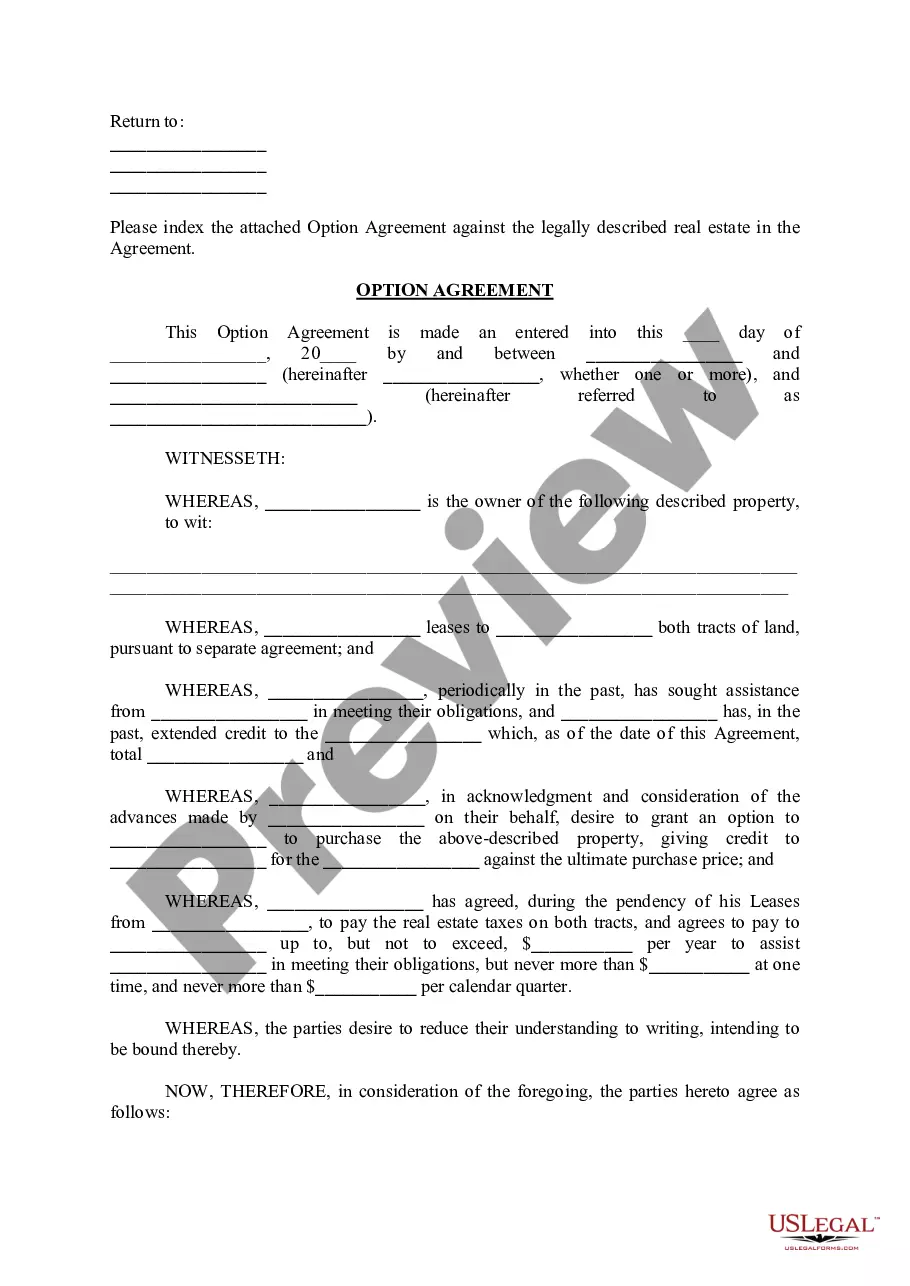

A beneficiary deed allows for the avoidance of probate. Arizona allows for the transfer of real estate by affidavit if the equity of all the real property in the estate is not greater than $100,000.

The second important point is that a beneficiary deed supersedes a will, so if the documents contradict one another, the beneficiary deed takes precedence.

To establish a beneficiary deed in Arizona, the deed must: Grant the real estate property to a beneficiary designated by the owner of said property. Be recorded in the office of the county where the property is located. Be recorded in the county office before the property owner's death.

An Arizona beneficiary deed form?also known as an Arizona transfer-on-death deed form or Arizona TOD deed form?is a type of deed authorized by statute to pass Arizona real estate to designated beneficiaries on the death of an owner.

A Beneficiary Deed has to be signed by the property owner and notarized, recorded in the county where the property is located during the owner's lifetime, and must accurately state the property's legal description. While an Arizona Beneficiary Deed has many advantages, it is not for everyone.

In Maricopa County, Arizona, you can do this at either the main office in Phoenix, at 111 S. Third Avenue, or in Mesa at 222 E. Javelina Avenue. The recorder will need your original deed or a legible copy with original signatures.

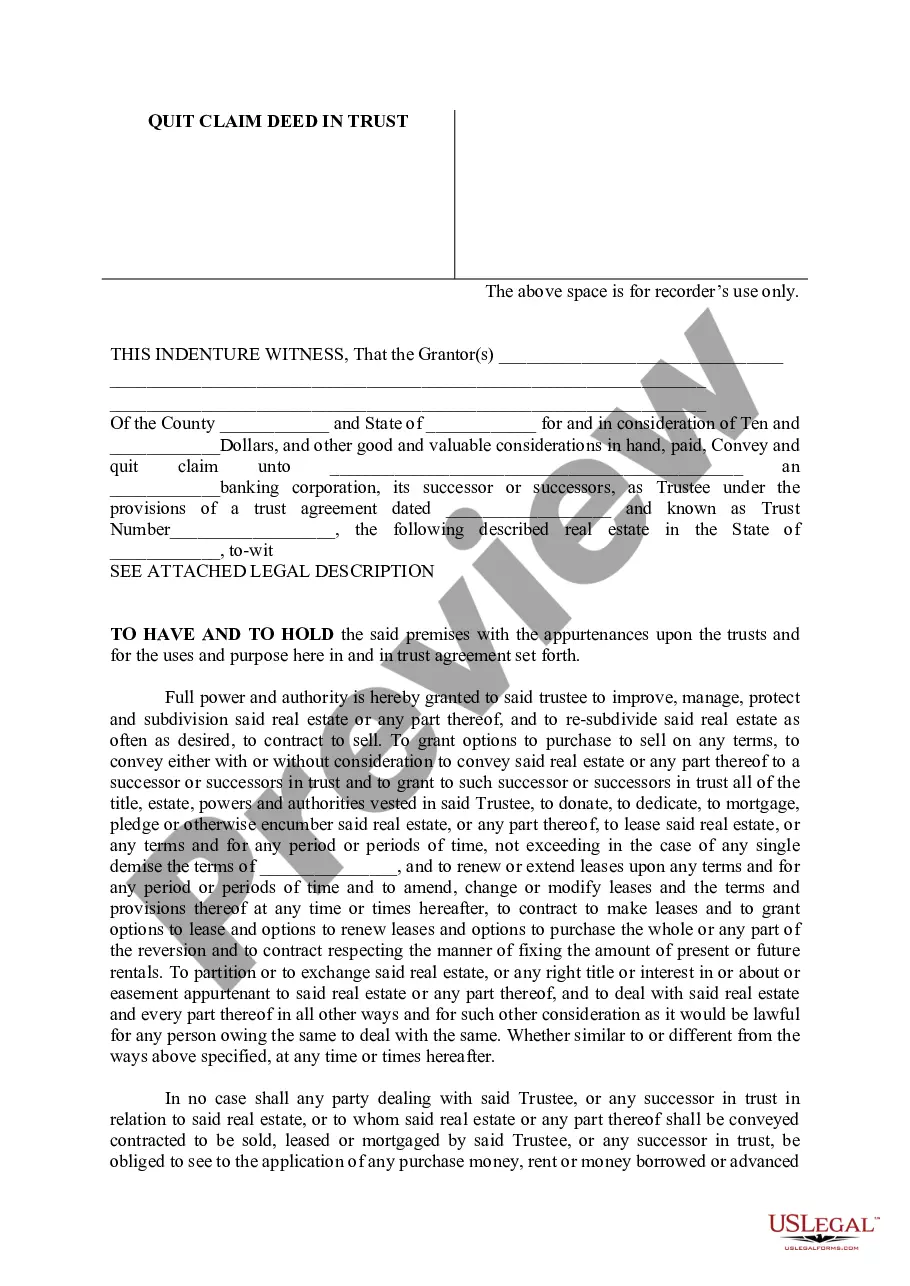

You may create life estates or any other form of ownership recognized in Arizona. Beneficiary deeds work well when the title will pass to a single individual or to a few individuals all of whom share a common vision of what to do with the property.