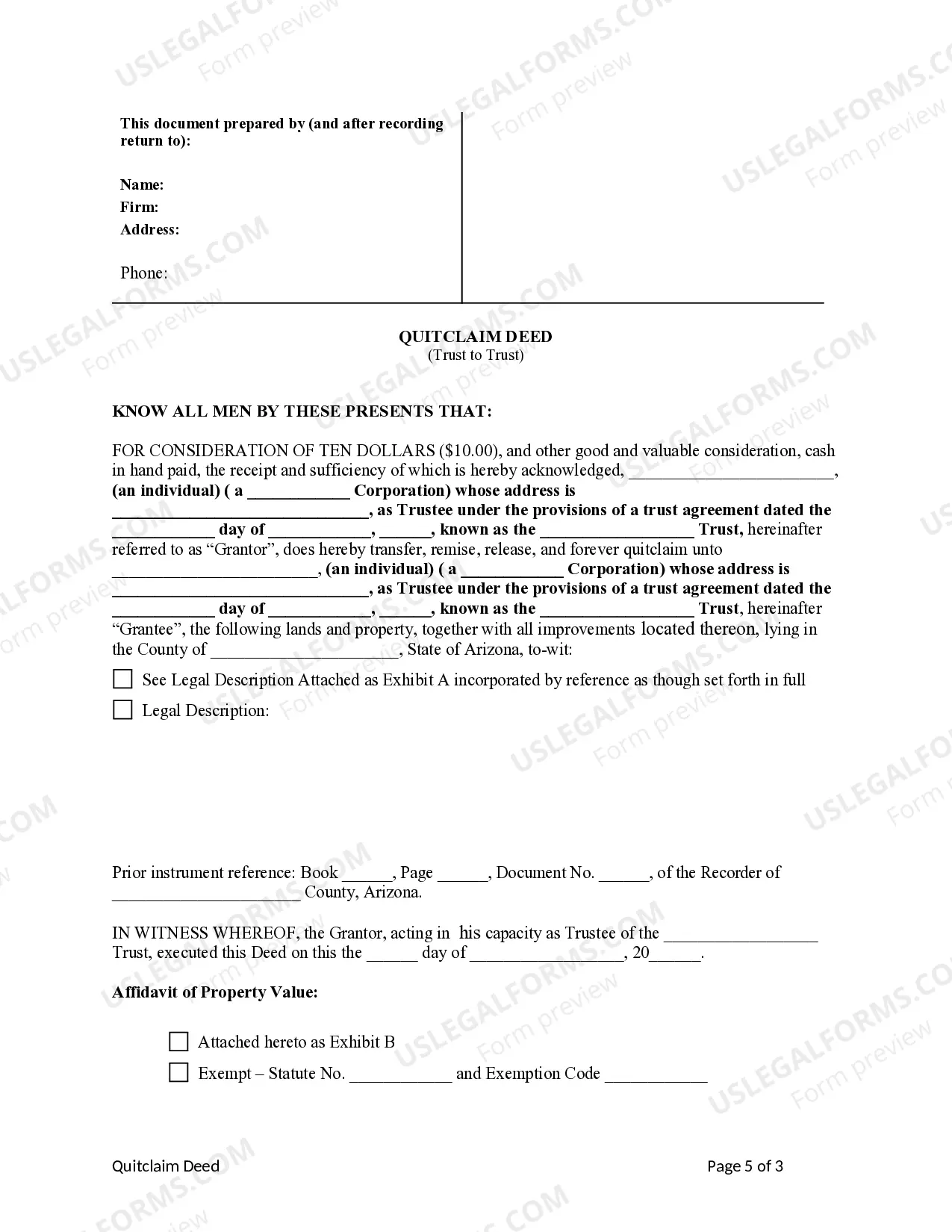

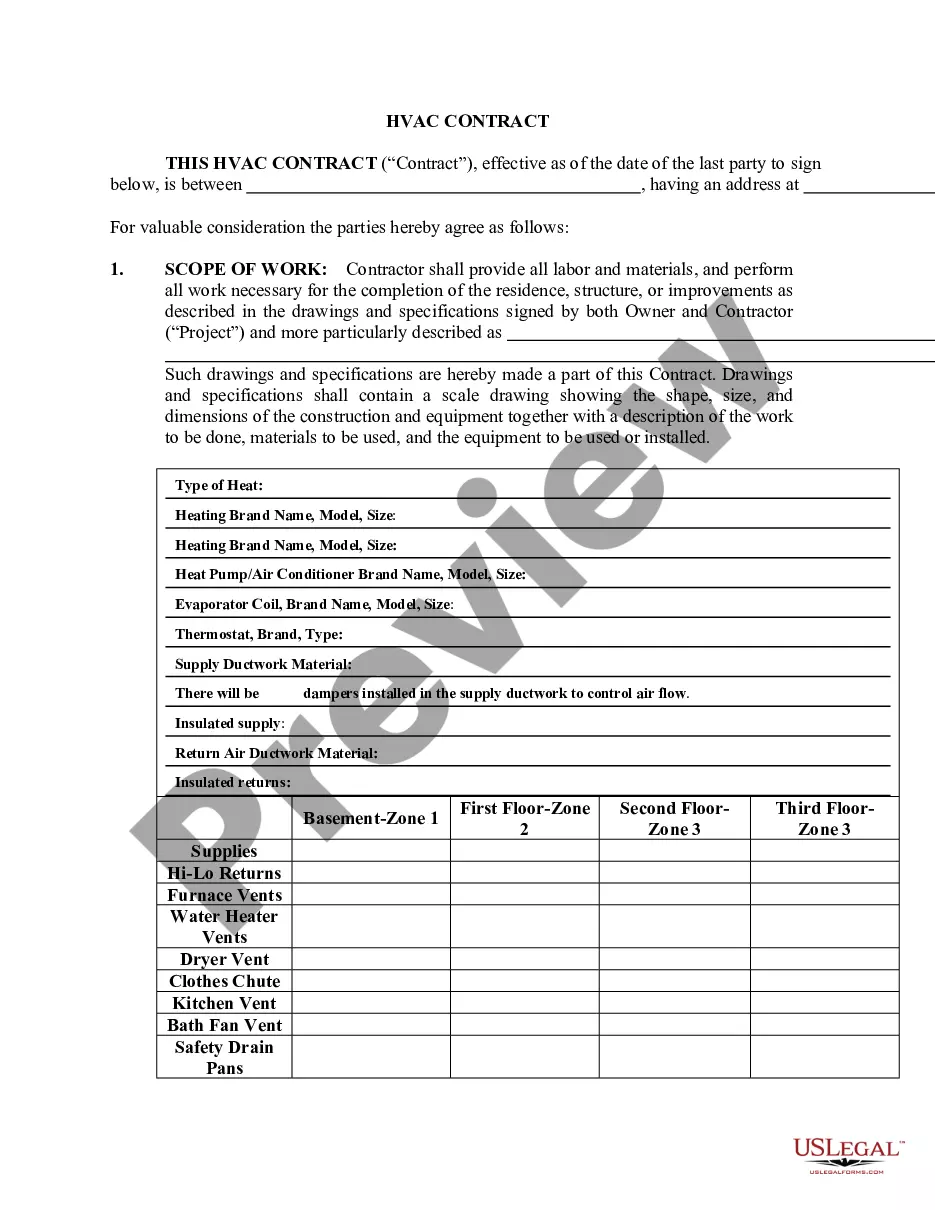

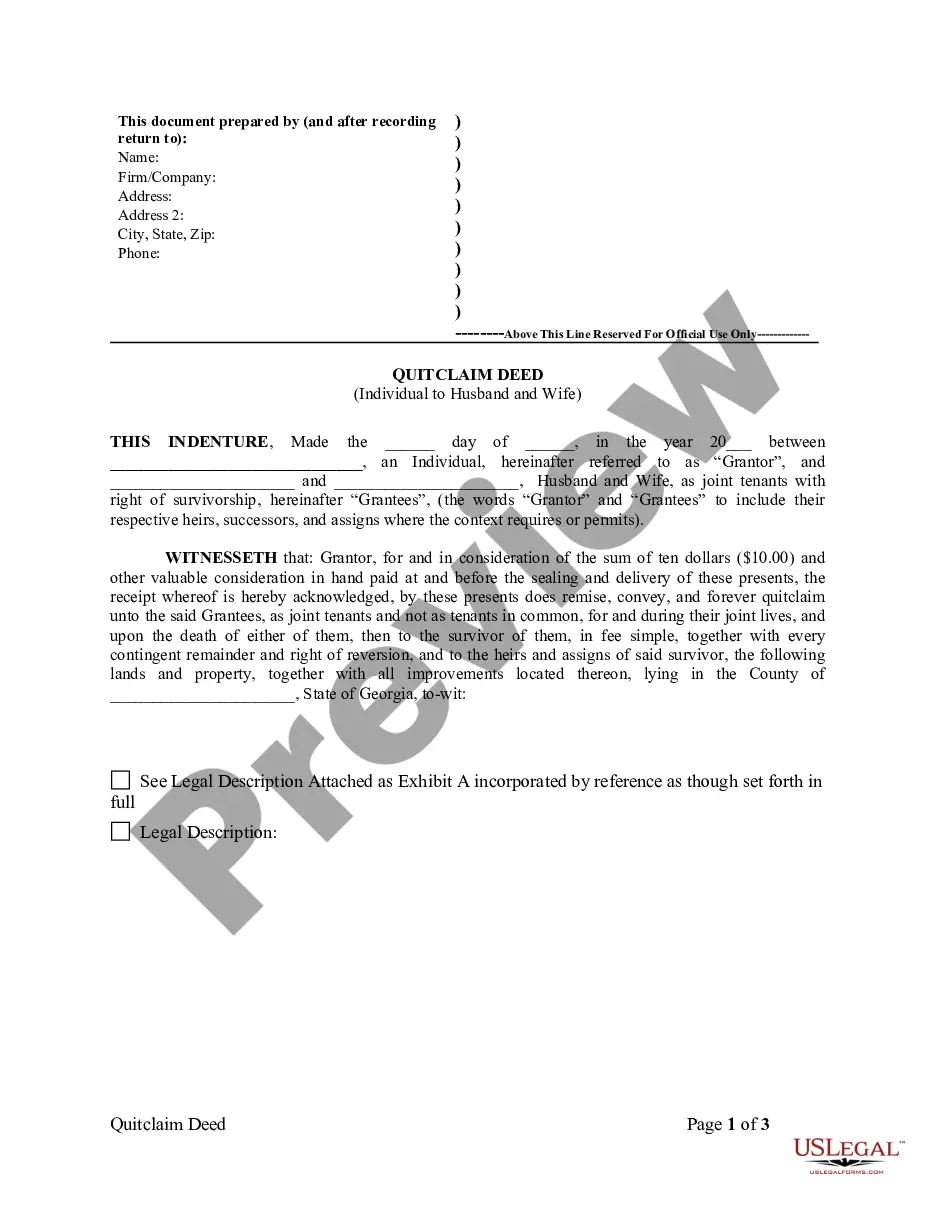

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Surprise Arizona Quitclaim Deed from Trust to Trust

Description

How to fill out Arizona Quitclaim Deed From Trust To Trust?

Regardless of societal or occupational standing, completing legal documents is a regrettable requirement in today’s society.

Frequently, it’s nearly unfeasible for an individual lacking any legal education to create this type of paperwork from scratch, largely due to the intricate language and legal nuances they entail.

This is where US Legal Forms proves to be useful.

Ensure the form you’ve found is appropriate for your area, as the regulations of one state or county do not apply to another.

Review the form and read through a brief description (if available) of scenarios the document may be utilized for.

- Our service offers an extensive assortment of over 85,000 pre-prepared state-specific documents that are suitable for nearly any legal circumstance.

- US Legal Forms is also a valuable resource for associates or legal advisors who wish to conserve time using our DIY documents.

- Whether you need the Surprise Arizona Quitclaim Deed from Trust to Trust or any other documentation applicable in your state or county, with US Legal Forms, everything is readily accessible.

- Here’s how to obtain the Surprise Arizona Quitclaim Deed from Trust to Trust in just minutes by utilizing our dependable service.

- If you are already a registered customer, you can simply Log In to your account to access the required form.

- However, if you are a newcomer to our platform, please ensure to follow these instructions before downloading the Surprise Arizona Quitclaim Deed from Trust to Trust.

Form popularity

FAQ

Yes, you can transfer a deed without an attorney in Arizona, but it's important to understand the process thoroughly. You will need to fill out a Surprise Arizona Quitclaim Deed from Trust to Trust accurately and file it with the county. However, using services like uslegalforms can simplify this task and ensure that all legal requirements are met, reducing the risk of errors during the transfer.

While putting your house in trust can offer benefits like avoidance of probate, it also has disadvantages. One major concern is the upfront costs associated with setting up the trust. Additionally, transferring your property using a Surprise Arizona Quitclaim Deed from Trust to Trust can affect your eligibility for certain tax benefits. Weigh these factors carefully before making a decision.

Deciding whether to gift a house or put it in a trust depends on your specific goals. Gifting a house can have immediate tax implications, while placing it in a trust allows for greater control over the property and its management after your passing. Using a Surprise Arizona Quitclaim Deed from Trust to Trust can help streamline the process of transferring ownership while retaining decision-making power. Evaluate your long-term objectives to choose the best option.

To transfer your property into a trust in Arizona, you will need to create a trust document that outlines the terms. After that, you must execute a Surprise Arizona Quitclaim Deed from Trust to Trust, which transfers the property title to the trust. You can file this deed with the county recorder's office to finalize the transfer. It's a straightforward process that ensures your property is managed according to your wishes.

To remove someone from a deed of trust, you will need their consent and a formal release agreement, which typically includes a quitclaim deed. This legal document should clearly state the changes in ownership. After signing, you must record the new deed with the county recorder's office to ensure the changes are legally binding. For managing your Surprise Arizona quitclaim deed from trust to trust effectively, using a service like uslegalforms can simplify the documentation process.

Creating a trust for your property in Arizona involves drafting a trust document that clearly outlines your instructions and appoints someone as the trustee. Once the trust is established, you need to transfer the title of your property into the trust using a quitclaim deed. Considering a Surprise Arizona quitclaim deed from trust to trust can simplify this process. Seek assistance from professionals or platforms like uslegalforms to ensure everything is executed correctly.

In Arizona, the statute of limitations for a deed of trust is generally six years. This means that legal action related to the deed must occur within this timeframe, whether it pertains to foreclosure or other claims. Understanding this limitation is crucial for effective property management and financial planning. Stay informed to preserve your rights concerning your Surprise Arizona quitclaim deed from trust to trust.

Exiting a trust deed typically involves either refinancing or paying off the debt associated with the deed. Alternatively, you may consider a Surprise Arizona quitclaim deed from trust to trust to transfer ownership to another party. Make sure to consult with a legal professional to understand the best course of action for your situation. This can help ensure a smooth transition.

To release a deed of trust, you first need to obtain a release document from the lender or the beneficiary of the trust. This document confirms that the obligation secured by the deed is fulfilled. After obtaining it, you must record the release with the county recorder's office where the property is located. By following these steps, you can effectively manage your Surprise Arizona quitclaim deed from trust to trust.

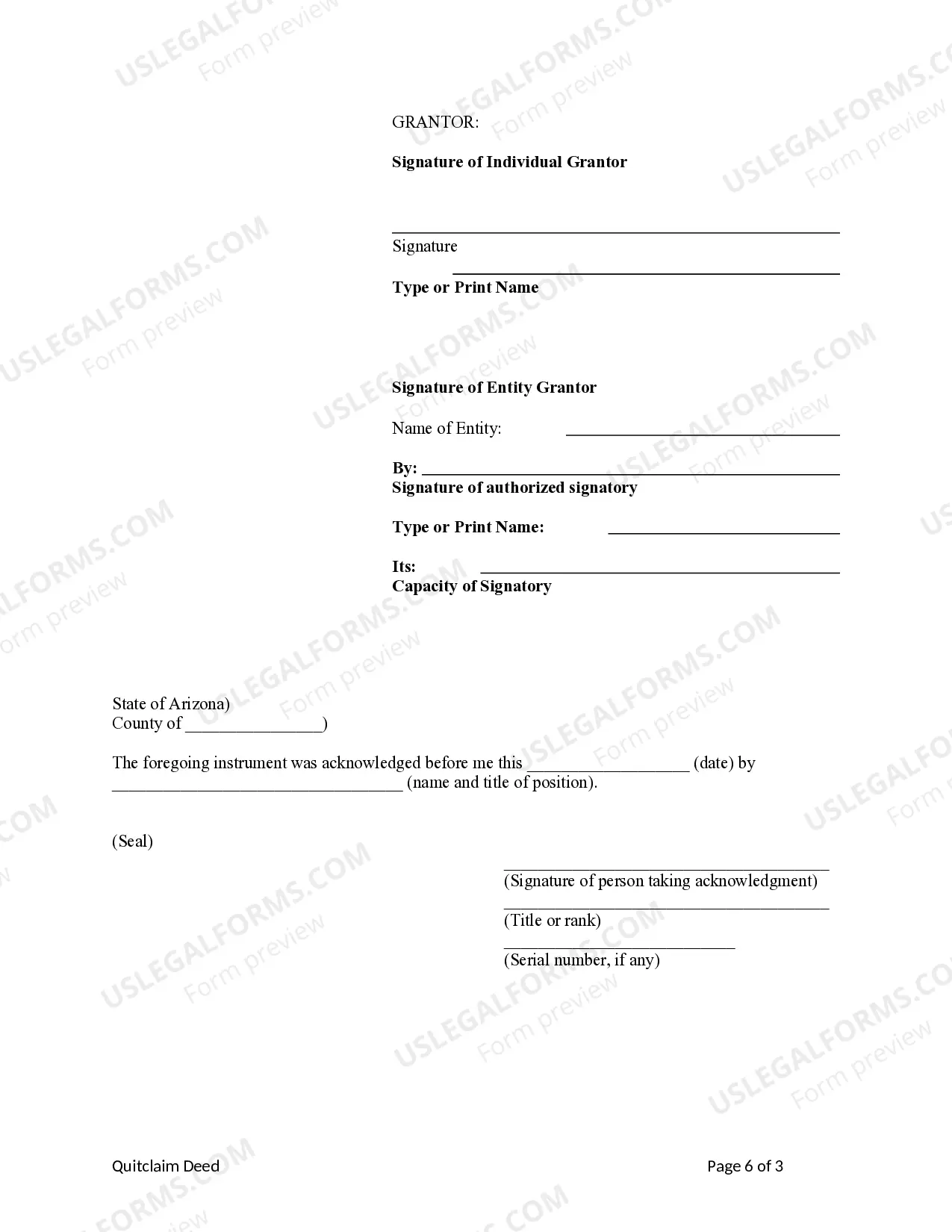

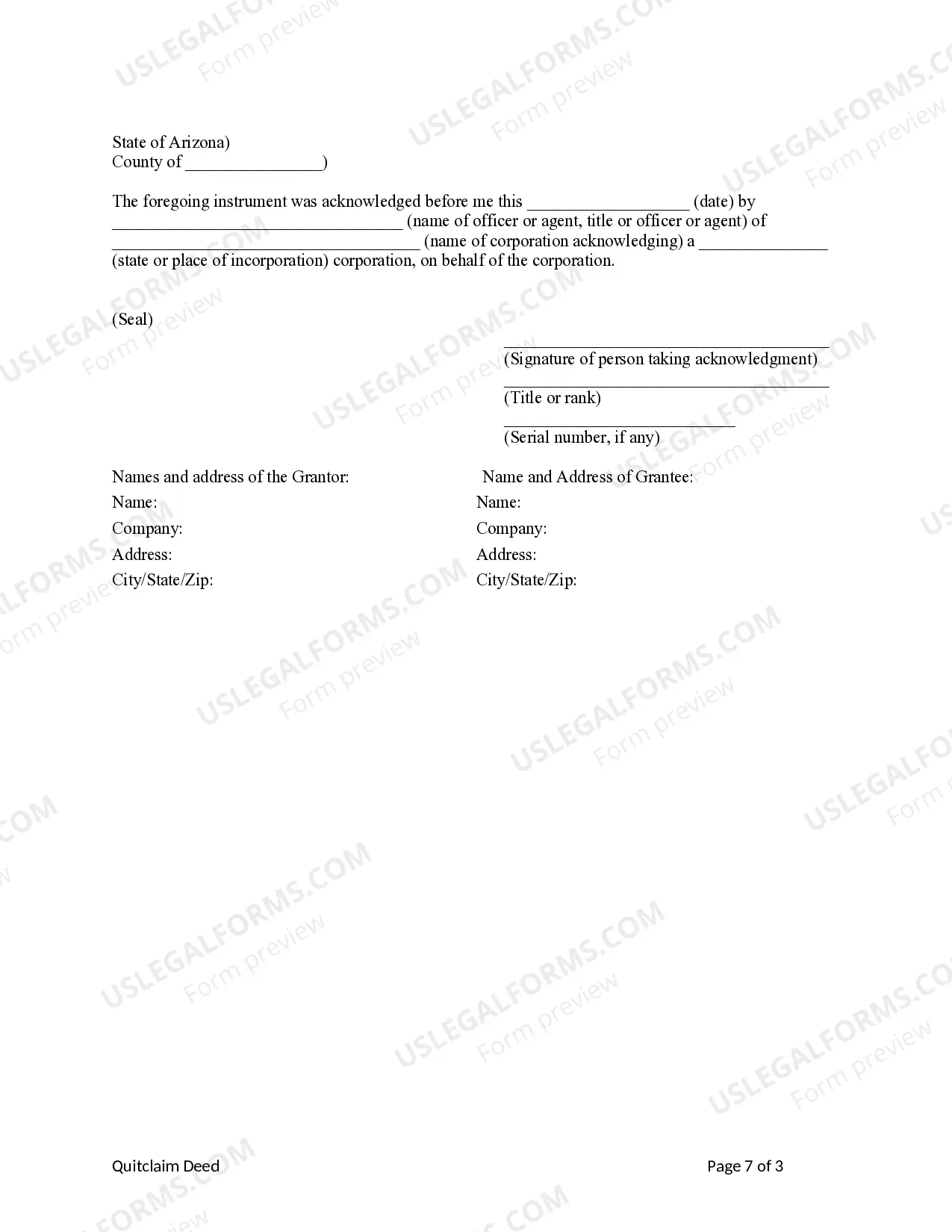

The requirements for a quitclaim deed in Arizona include a clear identification of the property being transferred, the names of the grantor and grantee, and a legal description of the property. Additionally, the deed must be signed by the grantor, notarized, and recorded with the county recorder's office. It's essential to ensure that no errors exist within the deed to prevent future disputes. Consider using US Legal Forms to access templates that meet Arizona's legal standards.