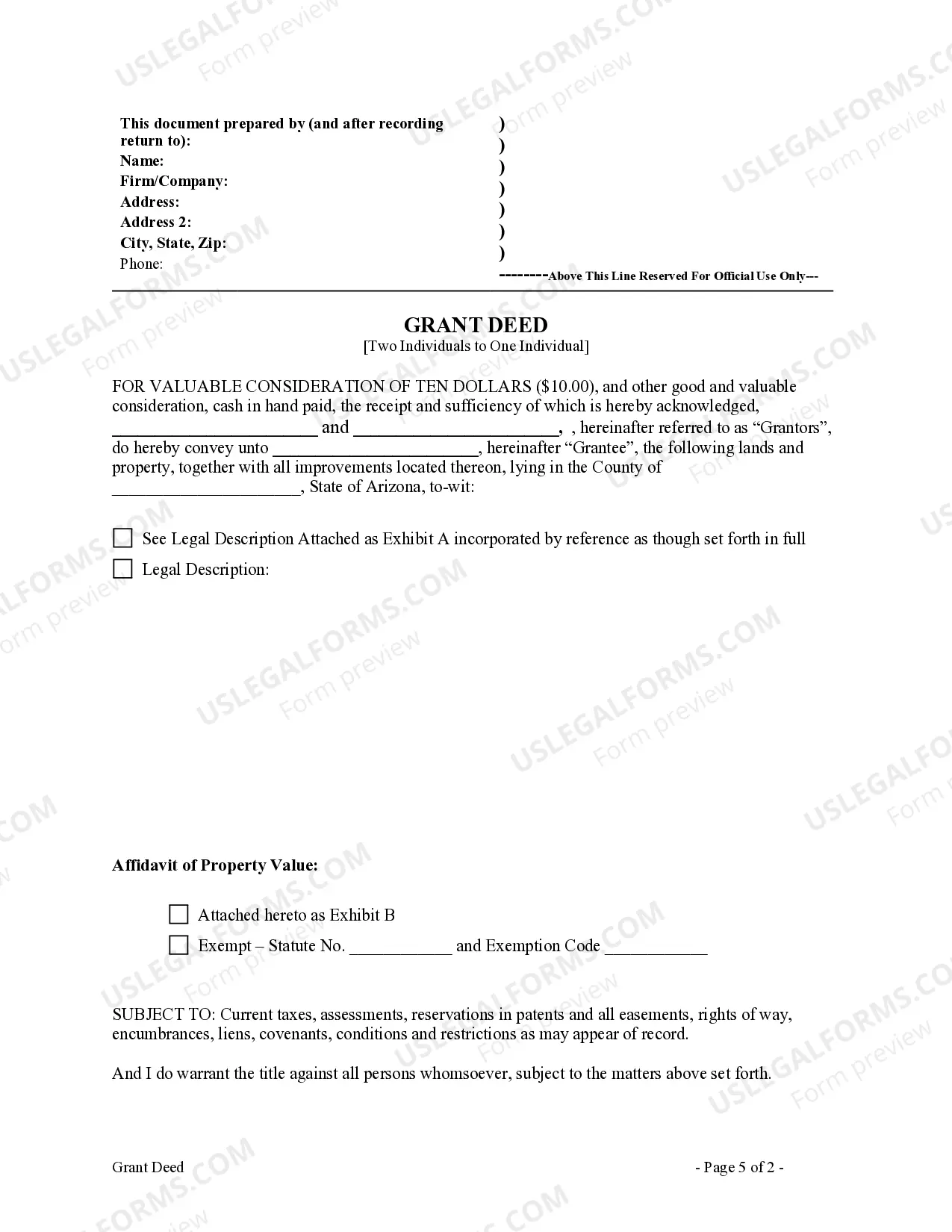

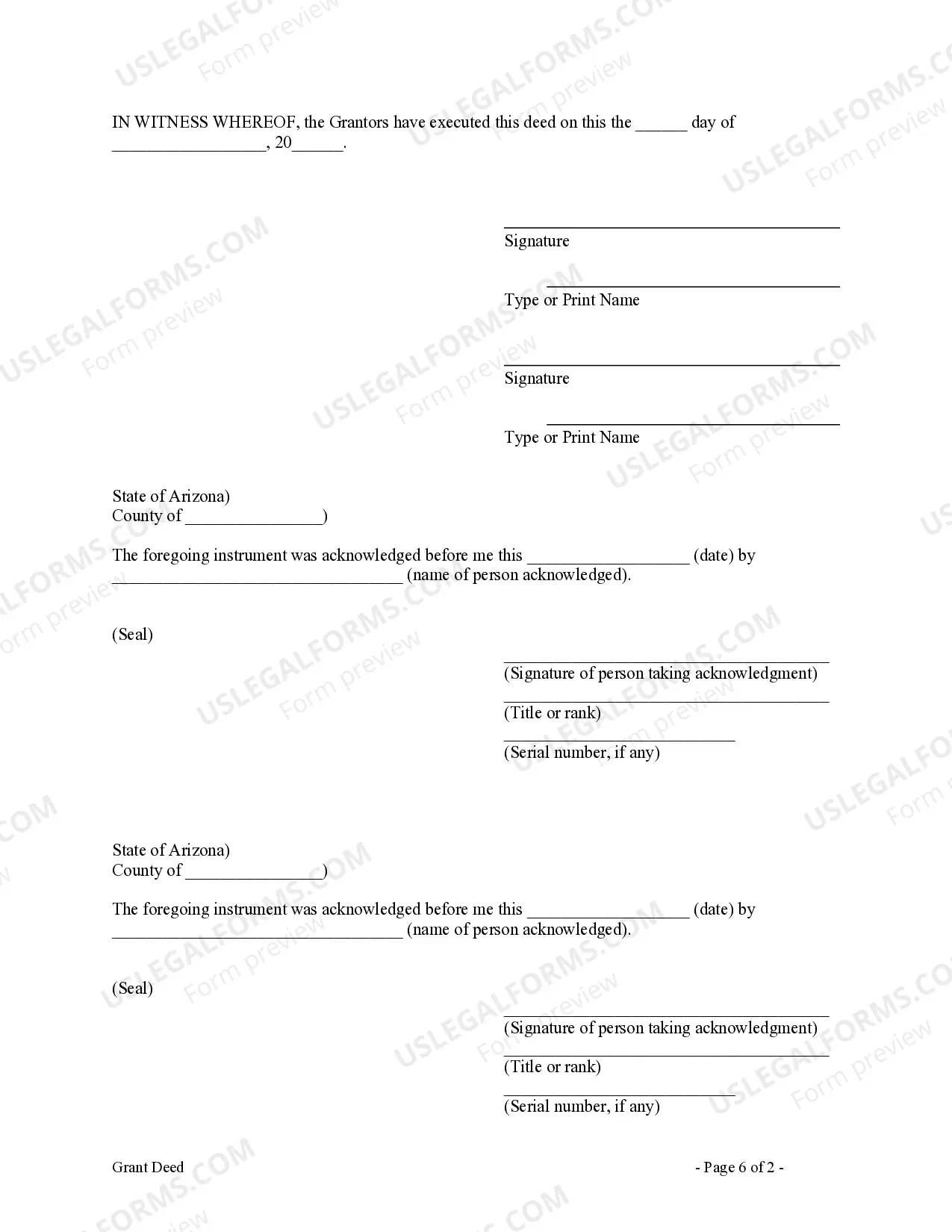

This form is a Grant Deed where the Grantors are two individuals and the Grantee is an individual. Grantors convey and grant the described property to the Grantee. This deed complies with all state statutory laws.

Scottsdale Arizona Grant Deed from Two Individuals to One Individual

Description

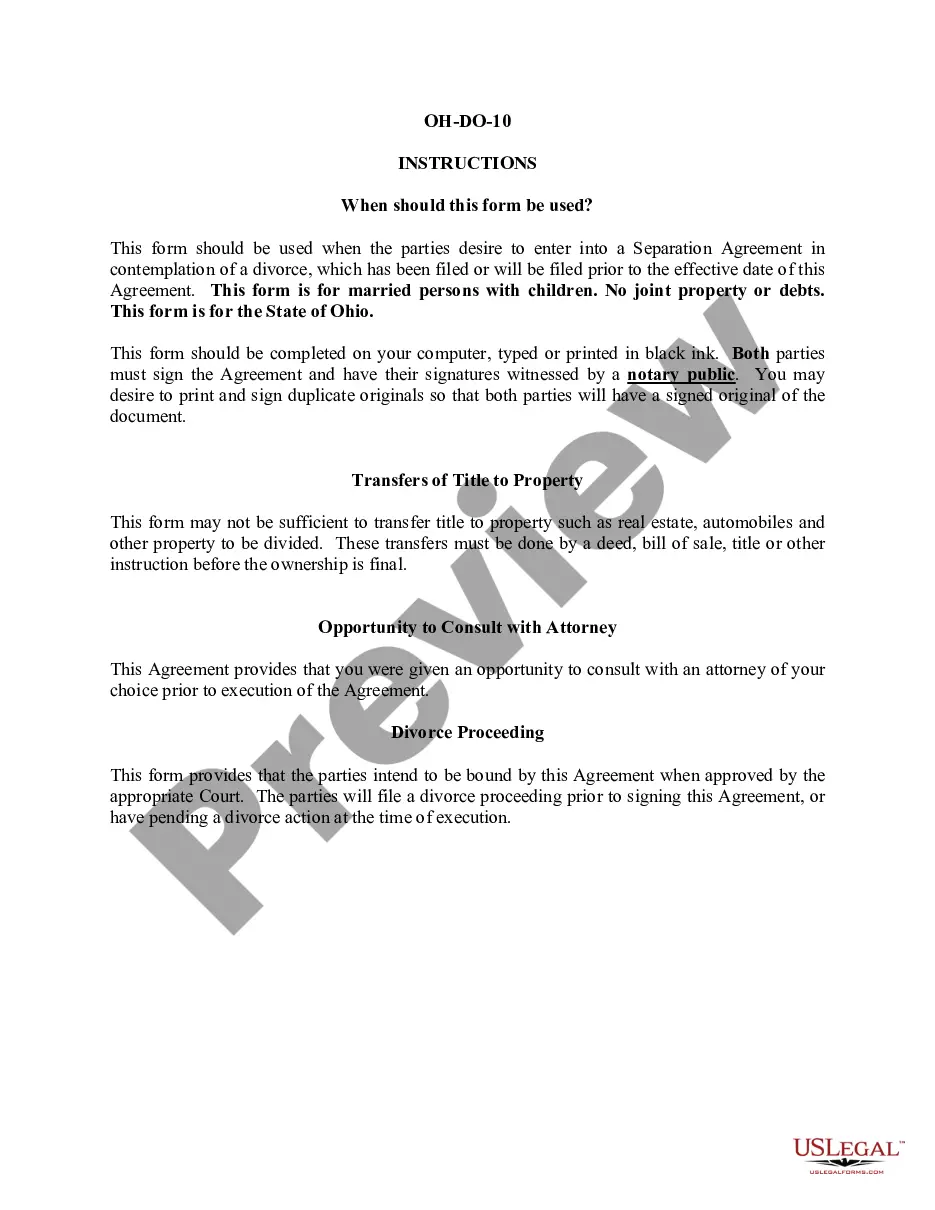

How to fill out Arizona Grant Deed From Two Individuals To One Individual?

Take advantage of the US Legal Forms and gain immediate access to any form template you need.

Our valuable website featuring thousands of document templates makes it simple to locate and obtain nearly any document sample you seek.

You can save, fill out, and validate the Scottsdale Arizona Grant Deed from Two Individuals to One Individual in just a few minutes instead of spending hours online searching for a suitable template.

Utilizing our collection is an excellent way to enhance the security of your document submissions.

If you haven’t created a profile yet, follow the steps outlined below.

Access the page with the form you need. Ensure that it is the template you were searching for: check its title and description, and use the Preview option if it's available. Otherwise, use the Search field to find the required one.

- Our experienced attorneys routinely review all documents to guarantee that the templates are suitable for a specific state and adhere to the latest laws and regulations.

- How can you acquire the Scottsdale Arizona Grant Deed from Two Individuals to One Individual.

- If you have a subscription, simply Log In to your account. The Download option will be available on all the documents you view.

- Furthermore, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

In Arizona, if a jointly owned property is held as joint tenants with right of survivorship, the property automatically transfers to the surviving owner upon the death of one owner. This means that the surviving owner becomes the sole owner without the need for probate. However, if the property is held as tenants in common, the deceased owner's share will pass according to their will or state laws. Understanding these nuances can clarify how a Scottsdale Arizona Grant Deed from Two Individuals to One Individual works in such situations.

To add a name to a deed in Arizona, you need to prepare a new Scottsdale Arizona Grant Deed from Two Individuals to One Individual. This deed must include the current owners and the new individual's name. After preparing this document, you should sign it in front of a notary public and then file it with the county recorder's office. Utilizing a platform like US Legal Forms can simplify the process by providing you with the necessary templates and guidance.

The primary beneficiaries of a quitclaim deed are often family members or parties who know each other well, as this type of deed transfers ownership without warranties. It is a quick method for transferring property interests and is commonly used among relatives during estate planning or in divorce settlements. While a quitclaim deed may seem simple, it's crucial to understand how it relates to a Scottsdale Arizona Grant Deed from Two Individuals to One Individual, especially in regard to ownership rights.

In Arizona, the time it takes to record a deed can vary by county, but it generally takes one to three business days for the recorder's office to process your filing. After you submit your deed, it will be reviewed for accuracy before being recorded. Once recorded, you will receive a copy as proof of the transaction. This timeline is important to consider when handling a Scottsdale Arizona Grant Deed from Two Individuals to One Individual.

To transfer property to a family member in Arizona, you typically use a deed, such as a quitclaim deed or a warranty deed. Begin by completing the appropriate deed form, making sure to include the property description and the names of both the giver and receiver. After signing the deed, you must record it with the local county recorder's office to make the transfer official. This step is essential for executing a Scottsdale Arizona Grant Deed from Two Individuals to One Individual.

To file a quitclaim deed in Arizona, start by preparing the deed form with the necessary information, including the names of the parties and a legal description of the property. Next, sign the deed in the presence of a notary public. Finally, submit the signed deed to the county recorder's office in the county where the property is located. This process is crucial when you need to execute a Scottsdale Arizona Grant Deed from Two Individuals to One Individual.

When you add someone to a deed in Arizona, there might be tax implications, particularly regarding gift tax. If you transfer a portion of the property to another individual, it could be viewed as a gift, potentially triggering tax responsibilities. However, it's critical to consult with a tax advisor to understand the specifics. Using the Scottsdale Arizona Grant Deed from Two Individuals to One Individual can help streamline this process while addressing legal requirements.

Transferring a property title to a family member in Arizona involves preparing a new grant deed. In this case, you can utilize the Scottsdale Arizona Grant Deed from Two Individuals to One Individual to accomplish this transfer. Once the deed is filled out and signed, you should submit it to the county recorder's office. This simple process legalizes the new ownership and protects both parties' interests.

To add someone to the deed of your house in Arizona, you need to fill out a new Arizona Grant Deed from Two Individuals to One Individual. This document officially transfers partial ownership of the property. After completing the deed, you must file it with the county recorder's office. This process ensures that the new owner's name appears on the property title.

To transfer ownership of a house in Arizona, start by preparing a deed that outlines the new ownership details. This deed must be signed by the current owner and ideally notarized. Afterward, you will need to file it with the county recorder's office to complete the transfer legally. Using US Legal Forms can ensure a smooth process for a Scottsdale Arizona Grant Deed from Two Individuals to One Individual.