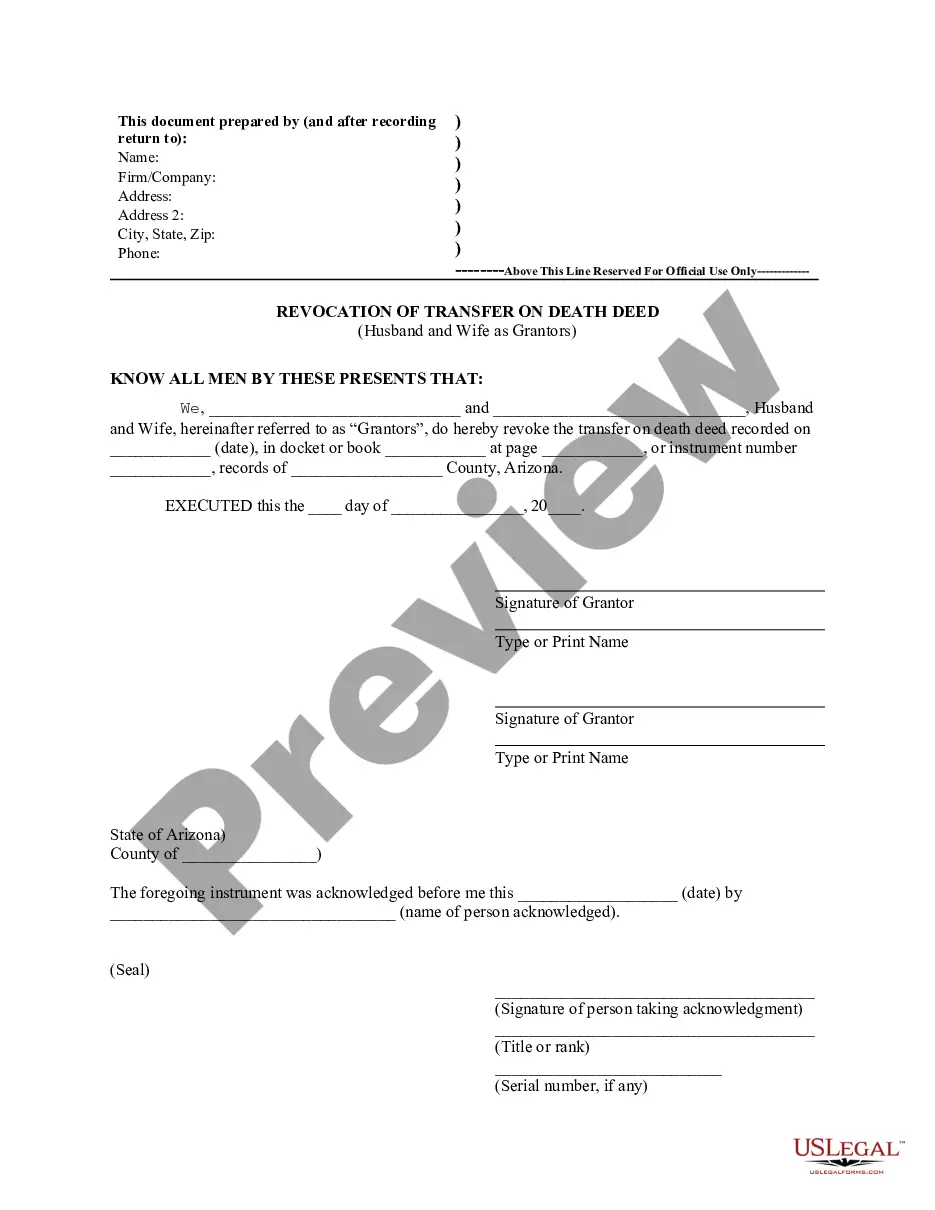

Revocation of Transfer on Death Deed - Arizona - Husband and Wife as Grantors: This form is a revocation of a transfer on death or beneficiary deed. It must be executed and recorded as provided by law in the office of the county recorder of the county in which the real property is located before the death of the owners who executed the deed and the revocation. A propertly executed, acknowledged, and recorded beneficiary deed may not be revoked by the provisions of a will.

Mesa Arizona Revocation of Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife Grantors

Description

How to fill out Arizona Revocation Of Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife Grantors?

We constantly aim to reduce or evade legal complications when handling intricate legal or financial issues.

To achieve this, we enroll in lawyer services that are typically very costly.

However, not every legal issue is similarly complicated.

Many can be managed independently.

Utilize US Legal Forms whenever you need to locate and download the Mesa Arizona Revocation of Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife Grantors or any other document with ease and safety. Simply Log In to your account and click the Get button next to it. If you misplace the document, you can always retrieve it again in the My documents section. The procedure is just as simple if you are new to the site! You can set up your account in just a few minutes. Ensure that the Mesa Arizona Revocation of Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife Grantors complies with the laws and regulations of your state and region. Additionally, it’s essential to review the form’s outline (if available), and if you observe any inconsistencies with what you initially sought, look for a different form. Once you’ve confirmed that the Mesa Arizona Revocation of Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife Grantors is appropriate for you, you can select a subscription plan and proceed with the payment. Afterwards, you can download the document in any desired format. For over 24 years, we’ve assisted millions by providing ready-to-personalize and current legal forms. Make the most of US Legal Forms today to conserve both effort and resources!

- US Legal Forms is a web-based repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our collection empowers you to take control of your affairs without resorting to legal advice.

- We provide access to legal document templates that aren't always readily accessible.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

An estate attorney may prepare a Beneficiary Deed for approximately $250 to $750. There will also be a nominal recording fee in the county where the property is located. Thomas J. Bouman provides legal counsel in the areas of estate planning, estate settlement, and asset protection.

In most states, you must notify the lender that your spouse has passed away. Other than this notice, you don't have to take any action. The loan will automatically become your responsibility. One exception is if your spouse had a mortgage life insurance policy.

A Beneficiary Deed has to be signed by the property owner and notarized, recorded in the county where the property is located during the owner's lifetime, and must accurately state the property's legal description. While an Arizona Beneficiary Deed has many advantages, it is not for everyone.

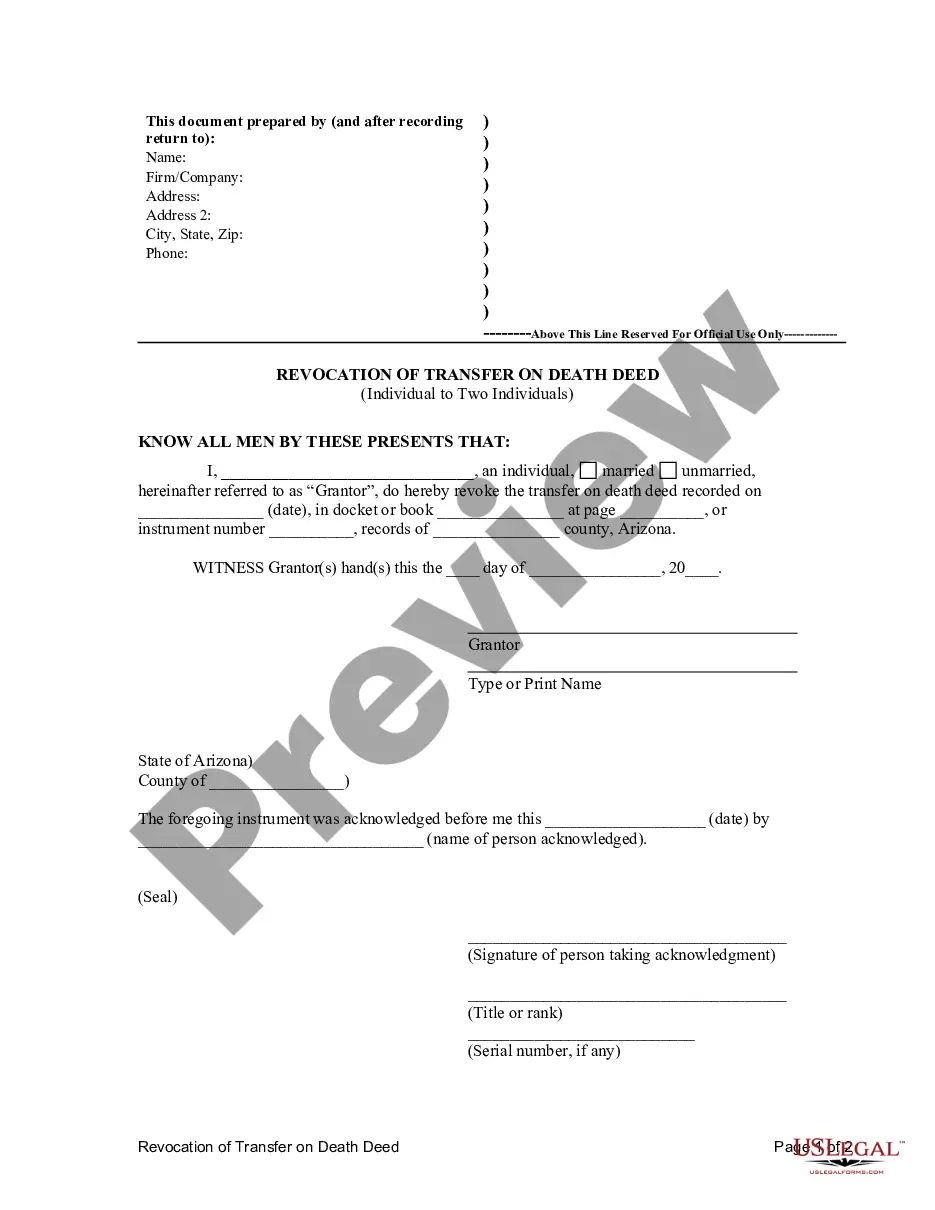

A beneficiary deed is easily revoked by the owner, or if there is more than one owner by any of the owners who executed the beneficiary deed, by executing and recording the revocation as provided by law in the office of the county recorder in the county in which the property is located.

Requirements for Arizona Beneficiary Deed Forms The deed must be recorded in the office of the county recorder of the county where the property is located before the death of the owner (or, with multiple owners, before the death of the last surviving owner).

In order to remove the name of the deceased, Form DJP (Deceased Joint Proprietor) must be completed and filed along with a copy of the death certificate. There is no requirement to show the Grant of Representation to the Land Registry, which means updating the title deed can be done soon after death.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

You will have to file an application to the land registry. They will require evidence of death, i.e. death certificate or a will. You will have to go to the office of revenue officer and submit an application to transfer title in the surviving co-owners name or surviving heirs name.

Even though the transfer of ownership rights is, in theory, automatic, it makes sense to formalize the change in title. One way to accomplish this is by completing and recording an affidavit of surviving joint tenant, accompanied by an official copy of the deceased owner's death certificate.