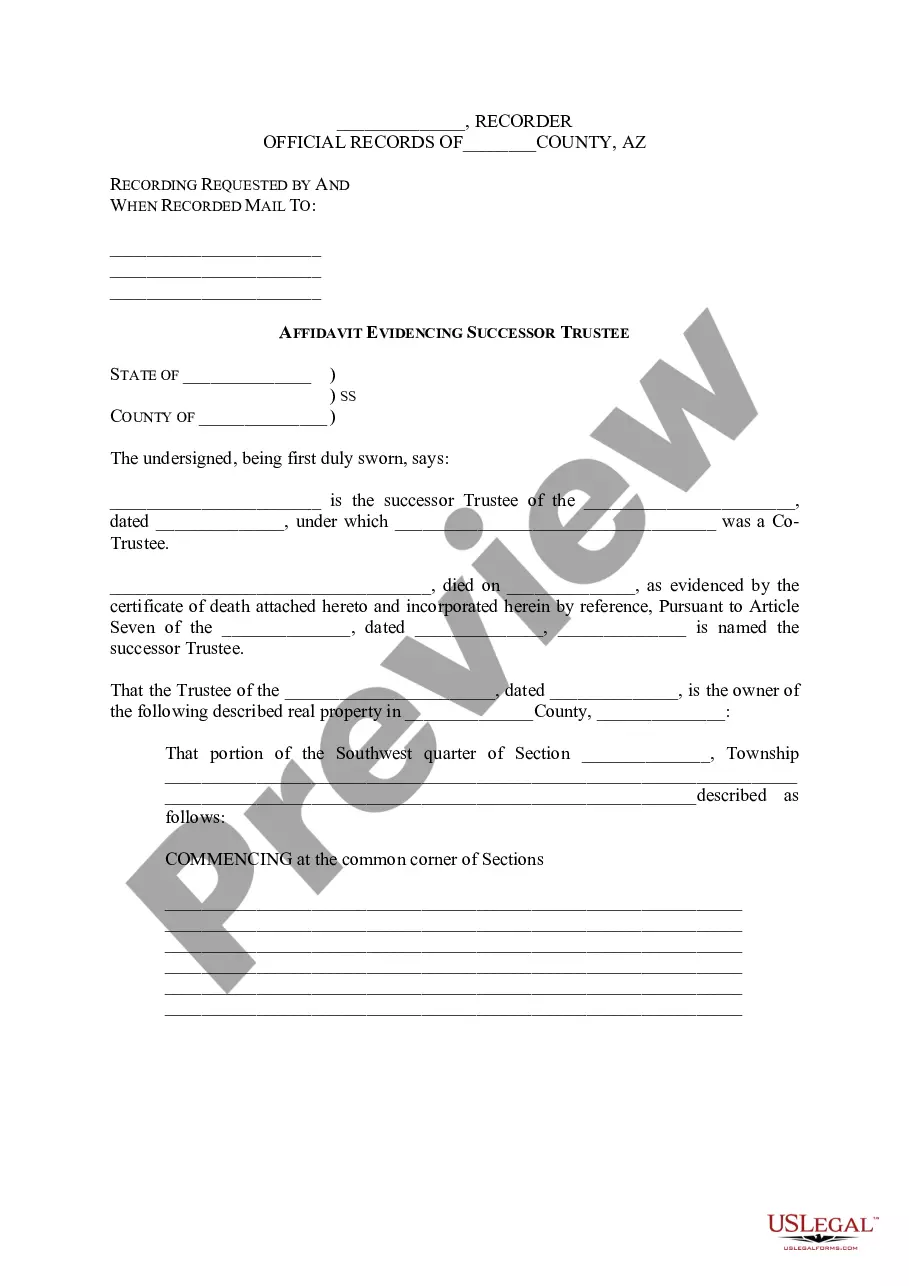

Tucson Arizona Affidavit Evidencing Successor Trustee

Description

pursuant to the terms of the trust.

How to fill out Arizona Affidavit Evidencing Successor Trustee?

Take advantage of the US Legal Forms and gain immediate access to any form template you desire.

Our user-friendly platform with thousands of document templates streamlines the process of locating and securing almost any document sample you require.

You can save, fill out, and sign the Tucson Arizona Affidavit Evidencing Successor Trustee in just minutes instead of spending hours searching the internet for a suitable template.

Utilizing our collection is an excellent way to enhance the security of your form submissions.

If you haven’t created a profile yet, follow the steps below.

Open the page with the template you require. Ensure that it is the template you were looking for: confirm its title and description, and utilize the Preview feature if available. Otherwise, use the Search bar to find the correct one.

- Our knowledgeable legal experts frequently examine all documents to ensure that the templates are applicable for a specific region and adhere to current laws and regulations.

- How can you acquire the Tucson Arizona Affidavit Evidencing Successor Trustee.

- If you possess a profile, simply Log In to your account. The Download button will be visible on all the documents you view.

- Furthermore, you can access all your previously saved records in the My documents section.

Form popularity

FAQ

Arizona statutes offer an alternative to avoiding probate by using an Affidavit of Succession to Real Property in cases in which the real property value does not exceed a certain value. The estate value must be less than $100,000 minus all the liens and any other encumbrances when the decedent passed away.

Under Section 663(b) of the Internal Revenue Code, any distribution by an estate or trust within the first 65 days of the tax year can be treated as having been made on the last day of the preceding tax year.

2. Within sixty days after accepting a trusteeship, shall notify the qualified beneficiaries of the acceptance and of the trustee's name, address and telephone number. 3.

To act unanimously - Trustees must act unanimously unless the trust deed says otherwise. To act carefully and distribute assets correctly ? Trustees must provide income for the beneficiaries but still preserve the value of the capital.

Distributing Assets Most trusts can be distributed to beneficiaries in as little as one year and rarely will a trustee need to extend this timeframe to more than two years. In some instances, a beneficiary may be able to acquire a preliminary distribution.

According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

The living trust document should say whether you and any co-trustees can make decisions alone or must agree on decisions, either unanimously or by majority rule. If no instruction is given, Arizona law allows decisions by majority rule.

Filing the affidavit is a two step process. First, the affidavit is filed in the probate court in the county where the property is located, along with a certified copy of the death certificate, and the original will if there is one. Second, a certified copy of the affidavit must be recorded in the same county.

In Arizona, informal probate cases generally take 6-8 months to settle. Cases that qualify for the small estate exemption may be able to cut that timeline in half. When a will, trust, or estate is contested, the probate process may take 1-2 years.

Trustees should act jointly (unless the trust document specifies that they can act by majority). Trustees are jointly liable for mistakes and should therefore act together. Trustees should not normally delegate functions to each other. Legal advice should be obtained before attempting to delegate trustee functions.