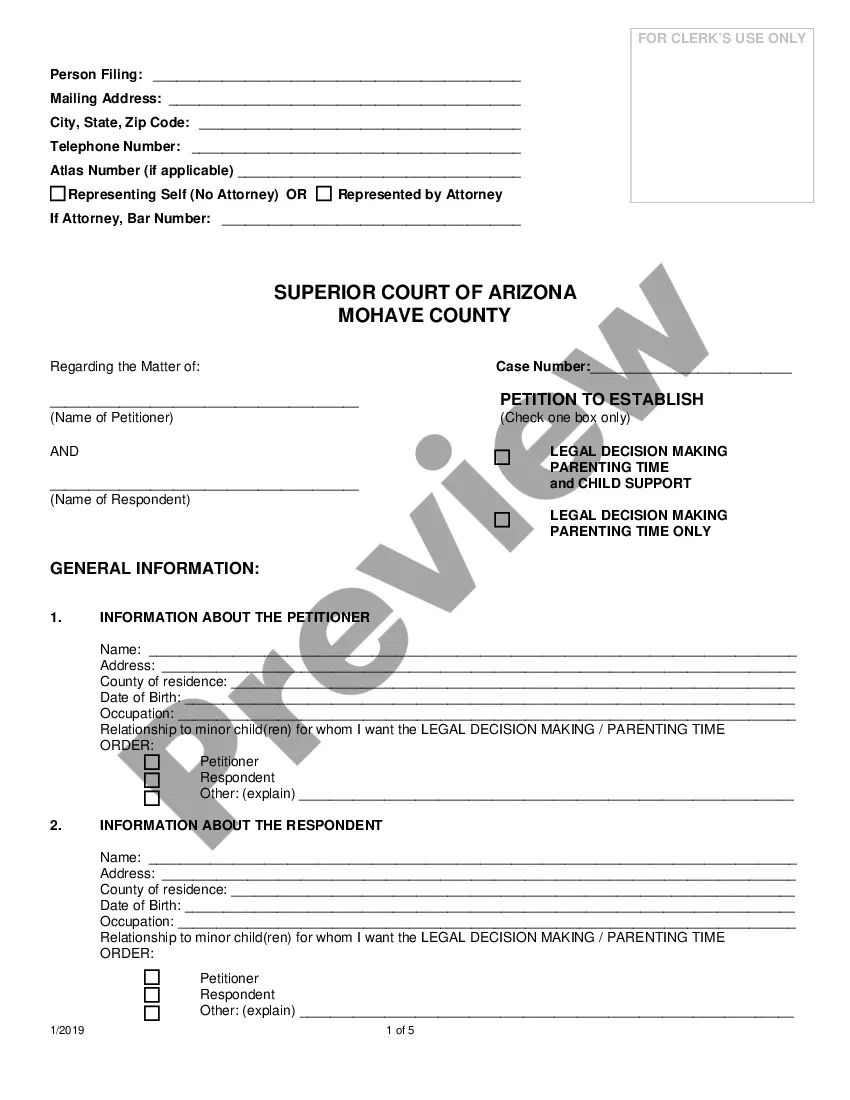

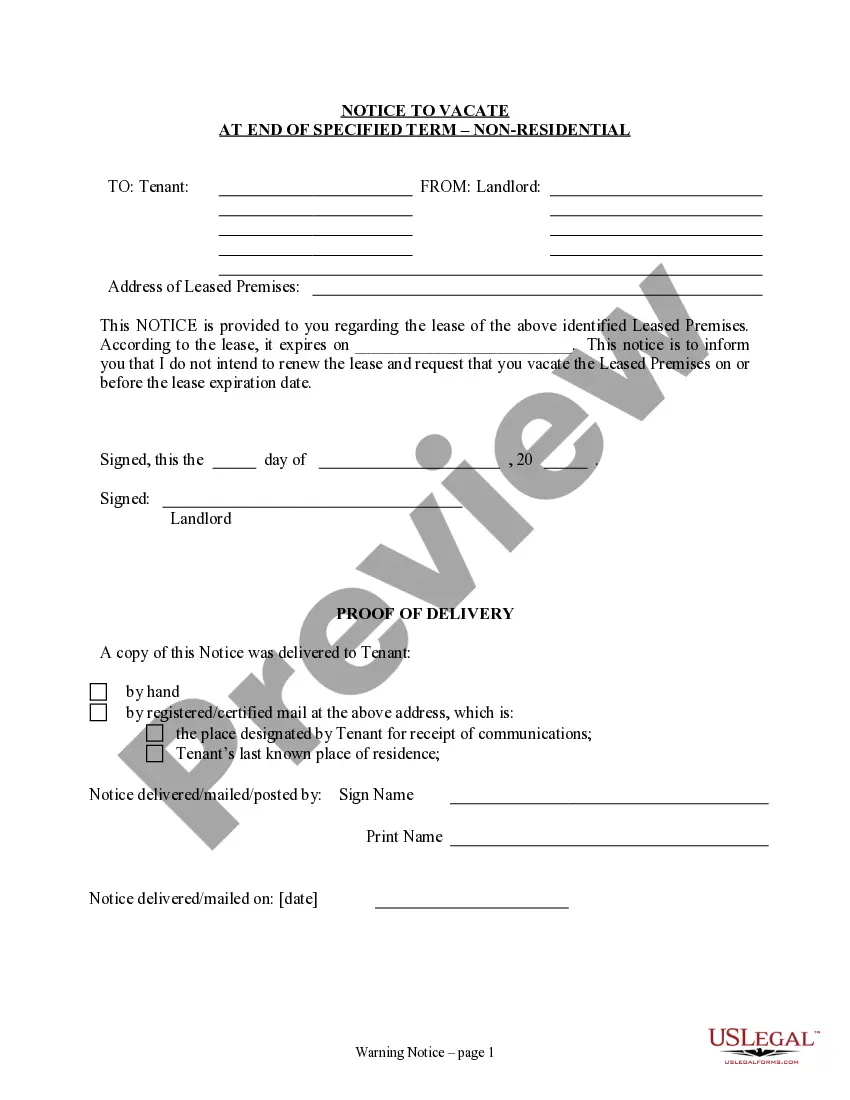

This Incorporation Package includes all forms needed to form a corporation in your state and a step by step guide to the incorporation process. The package also includes forms needed after incorporation, such as minutes, notices, and by-laws. Items Included: Steps to Incorporate, Articles or Certificate of Incorporation, By-Laws, Organizational Minutes, Annual Minutes, Notices, Resolutions, Stock Transfer Ledger, Simple Stock Certificate, IRS Form SS-4 to Apply for Tax Identification Number, and IRS Form 2553 to Apply for Subchapter S Tax Treatment.

Tucson Arizona Business Incorporation Package to Incorporate Corporation

Description

How to fill out Arizona Business Incorporation Package To Incorporate Corporation?

Obtaining verified templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms repository.

It’s a digital collection of over 85,000 legal forms for both personal and professional requirements and various real-life scenarios.

All the documents are appropriately categorized by field of use and jurisdiction areas, making it as straightforward and quick as ABC to find the Tucson Arizona Business Incorporation Package to Incorporate Corporation.

Maintaining documents organized and compliant with legal standards is crucial. Utilize the US Legal Forms library to always access vital document templates for any requirements right at your fingertips!

- Ensure to review the Preview mode and form description.

- Verify that you've chosen the correct one that fulfills your needs and fully aligns with your local jurisdiction regulations.

- Look for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate one.

- Once you have the desired template, proceed to the next step.

Form popularity

FAQ

How do I get copies of corporation or LLC documents? Most documents filed with the A.C.C. are already publicly available on the eCorp website. However, if you need to obtain a certified copy or a record that is preserved on microfilm or microfiche, you may submit a Records Request Form.

Arizona does not require LLCs to file an annual report. Taxes. For complete details on state taxes for Arizona LLCs, visit Business Owner's Toolkit or the State of Arizona . Federal tax identification number (EIN).

To amend your domestic corporation's Articles of Incorporation, file Form CF: 0040, Articles of Amendment and one exact copy with the Arizona Corporations Commission. You can submit the amendment by mail, fax, or in person. Include the Arizona Corporation filing cover sheet.

Filing Requirements Required documents: The state of Arizona requires businesses to file Articles of Incorporation as well as a Certificate of Disclosure. Turnaround time: In general, turnaround time for incorporating a business in Arizona is 5-7 business days.

Online filings take 5 business days for both LLCs and corporations. California will process business formation documents hand-delivered to its Secretary of State's Sacramento office in around 3 business days if you pay a $15 counter drop-off fee. You can also pay the state $350 for 1-day expedited processing.

Option 1: Create or log into your account with the Arizona Corporation Commission. Then, fill in the required fields and submit. Option 2: Download and mail in the Articles of Organization to the Arizona Corporation Commission or submit it in-person.

It will cost $45 if you file online. To file your Articles of Incorporation, the Arizona Corporation Commission charges a $60 filing fee. All corporations doing business in Arizona must also file an annual report with a $45 filing fee.

How to Start an S Corp in Arizona Choose a Business Name.Appoint a Statutory Agent in Arizona.Choose Directors or Managers.File Articles of Incorporation/Organization with the Arizona Corporation Commission.Publish Arizona State Articles of Incorporation/Organization.File Form 2553 to turn business into an S Corp.

The document required to form a corporation in Arizona is called the Articles of Incorporation. The information required in the formation document varies by state.

Filing Requirements Required documents: The state of Arizona requires businesses to file Articles of Incorporation as well as a Certificate of Disclosure. Turnaround time: In general, turnaround time for incorporating a business in Arizona is 5-7 business days.