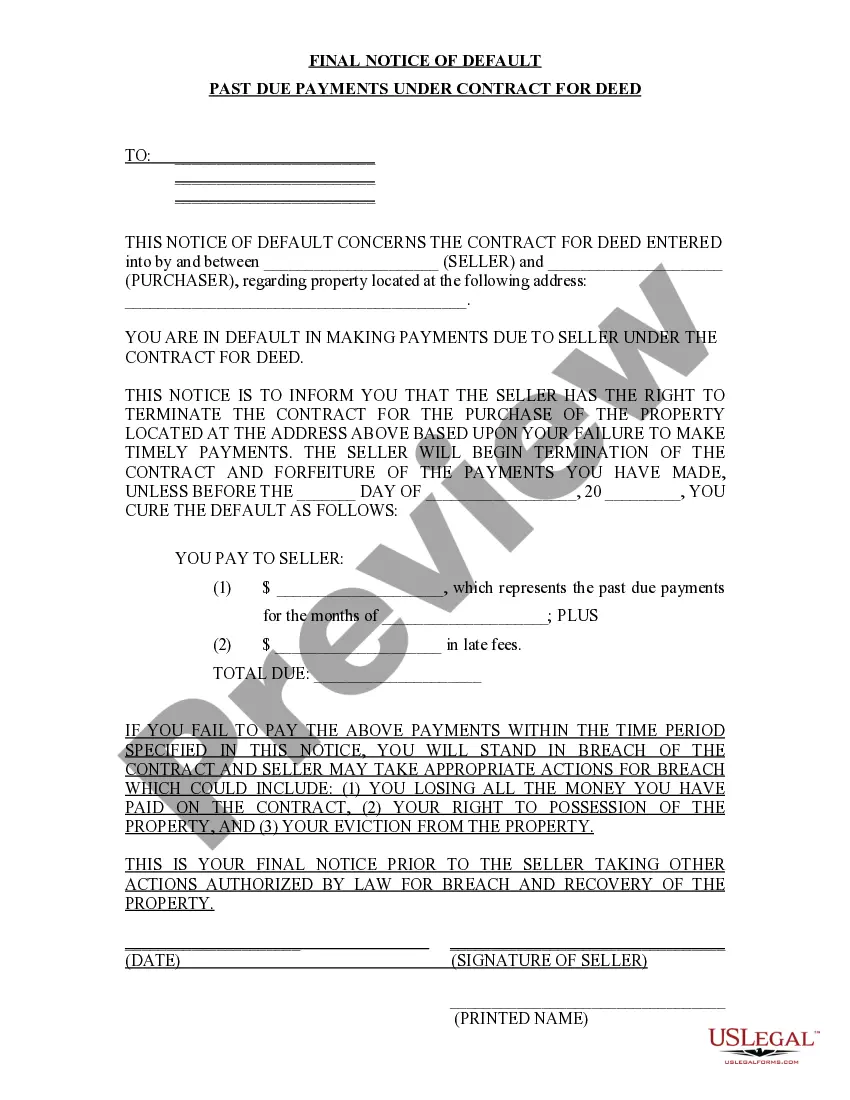

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Scottsdale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Arizona Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

We consistently seek to minimize or avert legal harm when managing intricate legal or financial matters.

To achieve this, we enlist legal services that are typically very expensive.

However, not every legal concern is of the same level of complexity.

The majority can be handled independently.

Utilize US Legal Forms whenever you need to obtain and download the Scottsdale Arizona Final Notice of Default for Past Due Payments related to a Contract for Deed or any other form in a simple and secure manner.

- US Legal Forms is an online repository of current DIY legal paperwork covering everything from wills and powers of attorney to incorporation documents and dissolution petitions.

- Our platform empowers you to manage your legal matters without needing an attorney.

- We provide templates for legal forms that are not always readily available.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

Form popularity

FAQ

In Arizona, a deed in lieu of foreclosure is a legal process where a borrower voluntarily transfers their property's title back to the lender to avoid foreclosure. This method allows homeowners to release themselves from mortgage obligations while protecting their credit score from a severe impact. It can be a compassionate alternative to traditional foreclosure, preserving some dignity in a tough situation. If you're facing a Scottsdale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed, this solution might be worth considering as a path forward.

A deed in lieu of foreclosure can provide significant benefits, such as avoiding the lengthy foreclosure process and the associated legal fees. It allows you to settle your mortgage obligations in a more straightforward manner, which can lead to a quicker resolution. Additionally, this option may provide you with a chance for a fresh start, as properties are typically sold without the stigma of a full foreclosure process. Understanding the nuances of a Scottsdale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed can help you make informed decisions.

Yes, you can buy a house after a deed in lieu of foreclosure, but it may take time and careful planning. Most lenders require a waiting period before considering your application for a new mortgage, typically ranging from two to four years. During this period, focusing on rebuilding your credit and demonstrating financial responsibility will be crucial as you work towards homeownership again. If you are navigating the aftermath of a Scottsdale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed, partnering with experts can help you recover.

A deed in lieu of foreclosure can negatively impact your credit score, similar to a foreclosure. While it might be less damaging than a standard foreclosure, it still appears on your credit report and signals to future lenders that you struggled to meet your mortgage obligations. This low credit score can affect your ability to secure new loans or favorable interest rates. If you've received a Scottsdale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed, it's wise to consider how this action might influence your credit in the long run.

One disadvantage of a deed in lieu foreclosure is the potential loss of equity in your home. When you proceed with this option, you hand over your property to the lender, which might lead to a lower financial recovery than expected. Additionally, the lender may still pursue the difference if the sale does not cover the outstanding amount. If you receive a Scottsdale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed, understanding these risks becomes essential.

To determine if there are liens on your property, you should check the public records at your local county recorder's office. Many counties also provide online databases for property records, which can reveal any existing liens, including tax liens. Being aware of potential liens is particularly important if you have received a Scottsdale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed, as it can impact your ability to resolve financial obligations.

Arizona does conduct tax deed auctions where properties with unpaid taxes are sold to recover delinquent amounts. These auctions can attract various buyers and can often lead to a change in property ownership. If you're receiving a Scottsdale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed, understanding tax deed auctions can be a critical step in protecting your property.

Yes, in Arizona, if someone pays the overdue property taxes, they can potentially acquire a tax lien certificate. This can lead to the property being sold at tax deed auctions if the original owner does not settle their debts. If you're facing a Scottsdale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed, it's vital to understand your rights regarding property tax payments.

To search for tax liens in Arizona, you can access the Arizona Department of Revenue's official website, which offers resources for locating state tax lien information. Additionally, many county recorder offices maintain public records of liens on properties. Understanding these records is essential, especially when dealing with a Scottsdale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed.

In Arizona, a tax lien can last for five years from the date it is placed on the property. However, if the tax obligation is not resolved within that period, the lien may be extended through legal proceedings. Ultimately, if you receive a Scottsdale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed, it's crucial to address any tax liens promptly to prevent further penalties.