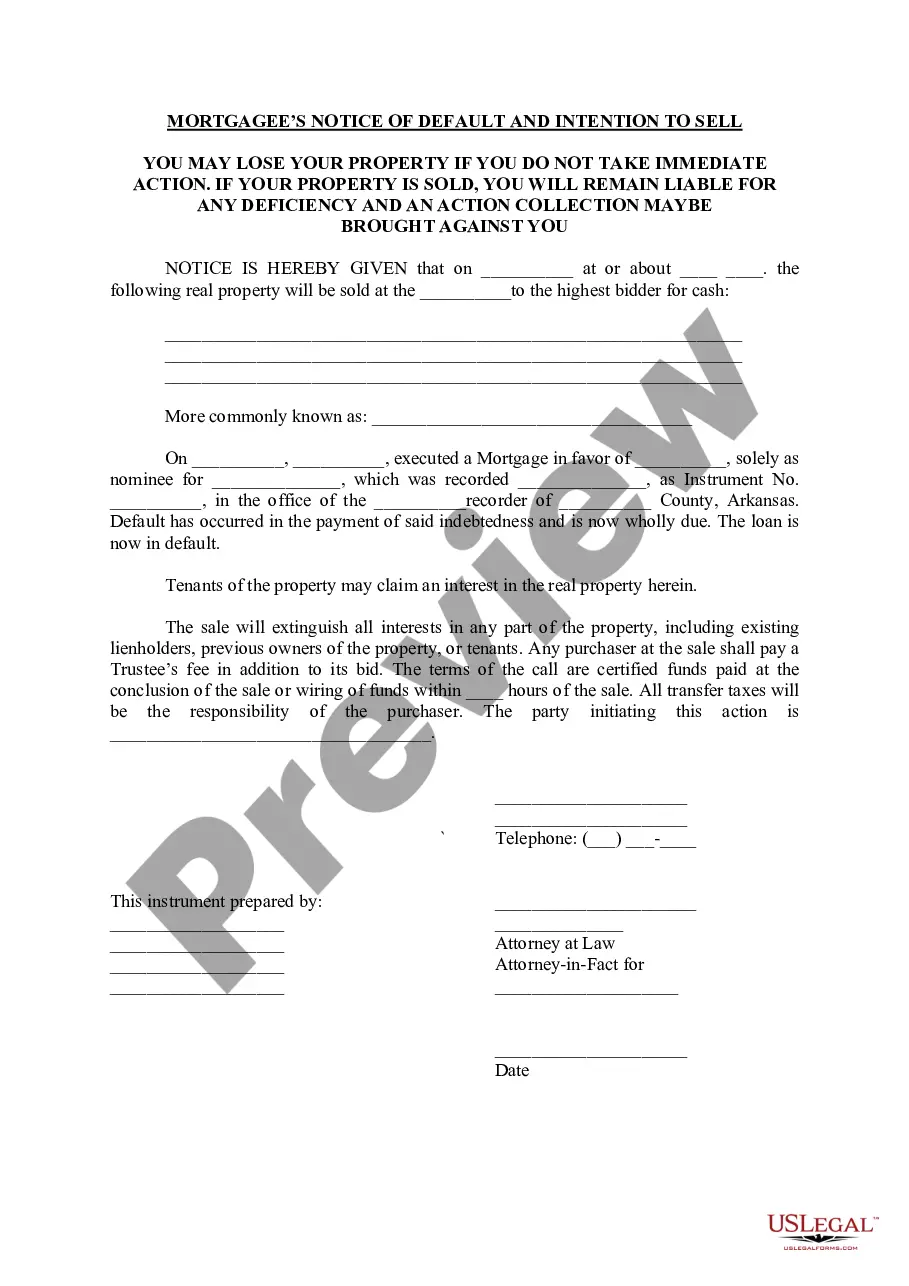

A Little Rock Arkansas Mortgagee’s Notice of Default and Intention to Sell is a legal document that serves as an official notification to the borrower, also known as the mortgagor, that they are in default on their mortgage loan. It signifies that the homeowner has fallen behind on their mortgage payments and has breached the terms of the loan agreement. This notice serves as a warning to the mortgagor that if they fail to take appropriate actions to resolve the default within a specified period, the lender, also known as the mortgagee, has the right to proceed with the foreclosure process. The purpose of this notice is to inform the borrower about the lender's intention to sell the property in order to recoup the remaining loan balance. The Little Rock Arkansas Mortgagee’s Notice of Default and Intention to Sell includes essential information such as the borrower's name, property address, loan account details, and the specific arrears amount owed by the borrower. Additionally, the notice typically outlines the steps the borrower can take to remedy the default, such as making immediate payment or contacting the lender to discuss alternative payment arrangements. It is important to note that there may be various types of Little Rock Arkansas Mortgagee’s Notice of Default and Intention to Sell, depending on the circumstances and stage of the foreclosure process. Some possible variations may include: 1. Notice of Default (Pre-Foreclosure): This type of notice is typically issued when a borrower has missed multiple mortgage payments and has entered into default, but the foreclosure process has not yet commenced. It serves as an initial warning to the borrower, urging them to take corrective actions before formal foreclosure proceedings. 2. Notice of Intent to Accelerate: If the borrower fails to cure the default within the designated timeframe mentioned in the Notice of Default, this notice may be issued. It declares the mortgagee's intention to accelerate the loan, meaning the full loan balance becomes due immediately, rather than being paid over the remaining loan term. 3. Notice of Sale: This notice is usually sent after the borrower has received earlier notifications and failed to address the default. It informs the borrower of the mortgagee's intent to sell the property at a public auction or through other means to recover the outstanding loan balance. 4. Notice of Sheriff Sale: In cases where the foreclosure process advances, this notice is sent to the borrower to inform them of the date, time, and location of the sheriff sale, where the property will be auctioned off to the highest bidder. These variations account for different stages of the foreclosure process and provide borrowers with opportunities to address defaults and potentially save their homes from foreclosure. It is crucial for homeowners facing default to seek professional legal advice and explore available options for debt resolution and loan modification to mitigate potential foreclosure consequences.

Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell

Description

How to fill out Little Rock Arkansas Mortgagee's Notice Of Default And Intention To Sell?

In case you have already utilized our service previously, Log In to your account and retrieve the Little Rock Arkansas Mortgagee’s Notice of Default and Intention to Sell on your device by clicking the Download button. Ensure that your subscription is active. If it is not, renew it based on your payment plan.

If this is your initial experience with our service, adhere to these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile within the My documents section whenever you need to use it again. Take advantage of the US Legal Forms service to swiftly find and save any template for your personal or professional requirements!

- Confirm you’ve located the correct document. Browse through the description and utilize the Preview option, if available, to verify if it suits your requirements. If it doesn’t meet your needs, use the Search tab above to find the appropriate document.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and complete the payment. Use your credit card information or the PayPal option to finalize the purchase.

- Access your Little Rock Arkansas Mortgagee’s Notice of Default and Intention to Sell. Select the file format for your document and save it to your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

In a foreclosure, homeowners and their families often suffer the most due to the emotional and financial strain it imposes. Losing a home can lead to significant stress, and the negative impact on credit can hinder future housing opportunities. Additionally, communities may experience lower property values when multiple homes are foreclosed. Staying informed about the Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell can help homeowners navigate these challenges.

The most common reason for a foreclosure is typically missed mortgage payments. When homeowners face financial difficulties, they may fall behind on their payments, leading to the issuance of a Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell. This notice signals the lender's intent to reclaim the property to recover the unpaid balance. Understanding this process can help borrowers take proactive steps to avoid foreclosure.

A 10-day pre-foreclosure notice in Arkansas serves as a formal warning to the homeowner about impending foreclosure actions. It informs the homeowner that they are in default and provides a timeframe to address the missed payments. Being aware of the Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell is crucial, as it can provide additional insights into the foreclosure process and options available to you.

In Arkansas, the redemption period following foreclosure typically lasts for one year, allowing the homeowner to reinstate their mortgage by paying off the owed amount. Understanding the specifics of this period is vital for homeowners who wish to recover their property. It is beneficial to consult information related to the Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell to understand the full scope of your rights during this time.

A bank in Arkansas can initiate foreclosure proceedings as soon as a homeowner is in default, usually after missing a mortgage payment. Depending on the situation and the bank's actions, the entire process can unfold in just a few months. It's crucial to stay informed about the Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell, as it serves as an essential step in the foreclosure timeline.

In Arkansas, the foreclosure process typically takes around three to six months from the initial filing to the sale of the property. Various factors can influence this timeframe, including the court's schedule and compliance with legal requirements. Understanding the timing is essential, especially in the context of the Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell, which may shorten the notification period.

Yes, Arkansas does provide a redemption period after foreclosure. During this time, homeowners have the opportunity to reclaim their property by paying off the entire mortgage debt. The redemption period can last for up to one year, depending on the type of foreclosure. Knowing about the Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell can help you understand your rights during this process.

The biggest disadvantage for a lender regarding a deed in lieu of foreclosure is the potential loss of recourse against the borrower for the outstanding debt. While this option simplifies the process, it means they may not recover the total amount owed. Lenders often consider the implications of the Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell before proceeding with this option.

The time it takes to foreclose on a house in Arkansas can vary, but it generally ranges from several months to over a year. The process starts with the filing of a Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell and progresses through legal proceedings. Homeowners can face delays due to negotiations or court proceedings.

In Arkansas, a deed in lieu of foreclosure allows a homeowner to transfer the title of their property back to the lender to settle their debt without going through foreclosure. This option is beneficial as it often allows the homeowner to avoid negative repercussions associated with foreclosure. By referencing the Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell, homeowners can explore this possibility.