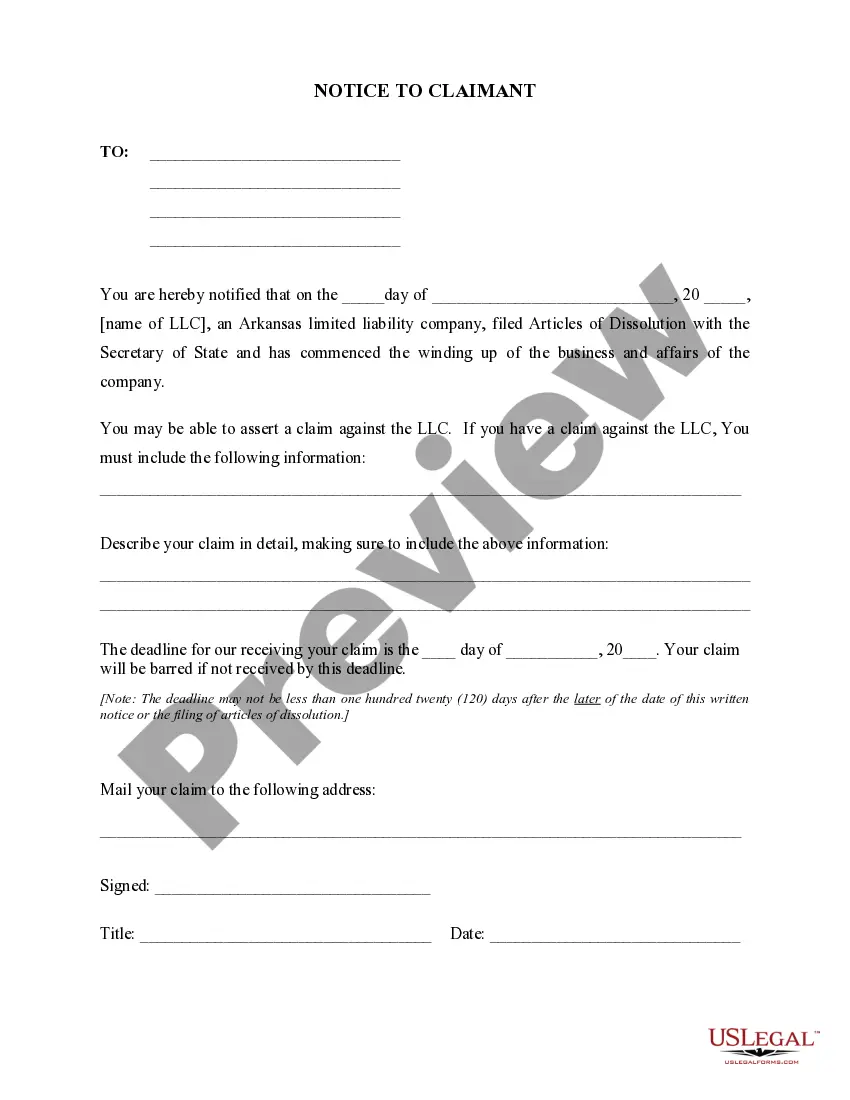

This dissolution package contains all forms to dissolve a LLC or PLLC in Arkansas, step by step instructions, addresses, transmittal letters, and other information.

Little Rock Arkansas Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Arkansas Dissolution Package To Dissolve Limited Liability Company LLC?

Obtaining templates that conform to your regional regulations can be difficult unless you leverage the US Legal Forms collection.

This online resource includes over 85,000 legal documents to cater to personal and professional requirements as well as various real-world situations.

All documents are appropriately categorized by usage area and jurisdiction, making it as straightforward as ABC to find the Little Rock Arkansas Dissolution Package for Dissolving a Limited Liability Company (LLC).

Maintaining organized paperwork that adheres to legal standards is of utmost importance. Utilize the US Legal Forms library to readily access essential document templates for all your needs!

- If you're already acquainted with our catalog and have used it previously, acquiring the Little Rock Arkansas Dissolution Package to Dissolve Limited Liability Company LLC only requires a few clicks.

- Simply Log In to your account, select the document, and click Download to save it on your device.

- For new users, the process will take a few extra steps.

- Follow these instructions to begin using the most comprehensive online form catalog.

- Check the Preview mode and form description. Ensure you’ve selected the right one that matches your needs and fully complies with your local jurisdiction criteria.

Form popularity

FAQ

Termination: All that must be done has been done This document may be called articles of termination, articles of cancellation, or a similar name. In it, the LLC has to state that all debts and liabilities have been paid or provided for and any remaining assets distributed.

Nevada requires an articles of dissolution form be filed with the Secretary of State by mail, fax or email. This form is available online, along with instructions. There is a fee for filing and it is usually processed within 5 business days. Expedited processing is available for an additional fee.

To dissolve your Arkansas LLC, you submit the completed form Articles of Dissolution for Limited Liability Company to the Arkansas Secretary of State, Business and Commercial Services (BCS) by mail or in person. You cannot file articles of dissolution online. Make checks payable to Arkansas Secretary of State.

Steps to Cancel a Delaware LLC Consult the LLC Operating Agreement.Take a Member Vote.Appoint a Manager to Wind up the LLC's Affairs.Payoff Creditors, Current and Forseeable, before paying Members.Pay The Delaware Franchise Tax.Pay the LLC's members.File a Certificate of Cancellation.

Domestic Limited Liability Company Name of Official DocumentForm #Paper FeeFranchise Tax Registration (use with LL-01)No FeeStatement of DissolutionLL-04$50.00Statement of Revocation of Dissolution for LLC$25.00Statement of Authority, Amendment, Cancellation or Denial for LLC$25.0016 more rows

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

How do you dissolve a Wyoming Limited Liability Company? To dissolve your Wyoming LLC, you must submit in duplicate the completed Limited Liability Company Articles of Dissolution form to the Secretary of State by mail or in person, along with the filing fee.

You need to dissolve your entity with the secretary of state or the corporations division in your state by filing a form or two. By dissolving your entity, you ensure that you are no longer liable for paying annual fees, filing annual reports, and paying business taxes.

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others.