This form is a Transfer on Death Deed, or Beneficiary Deed, where the Grantor are two individuals or hsuband and wife and the Grantees are two individuals or husband and wife. If one Grantee Beneficiary fails to survive the Grantors their interest goes to their estate or the surviving Grantee Beneficiary. If neither Grantee Beneficiary survive the Grantors, the transfer fails and the deed is null and void. This transfer is revocable by Grantors until death and effective only if filed prior to the surving Grantor's death. This deed complies with all state statutory laws.

Little Rock Arkansas Beneficiary or Transfer on Death Deed or TOD - Husband and Wife or Two Individuals to Husband and Wife or Two Individuals

Description

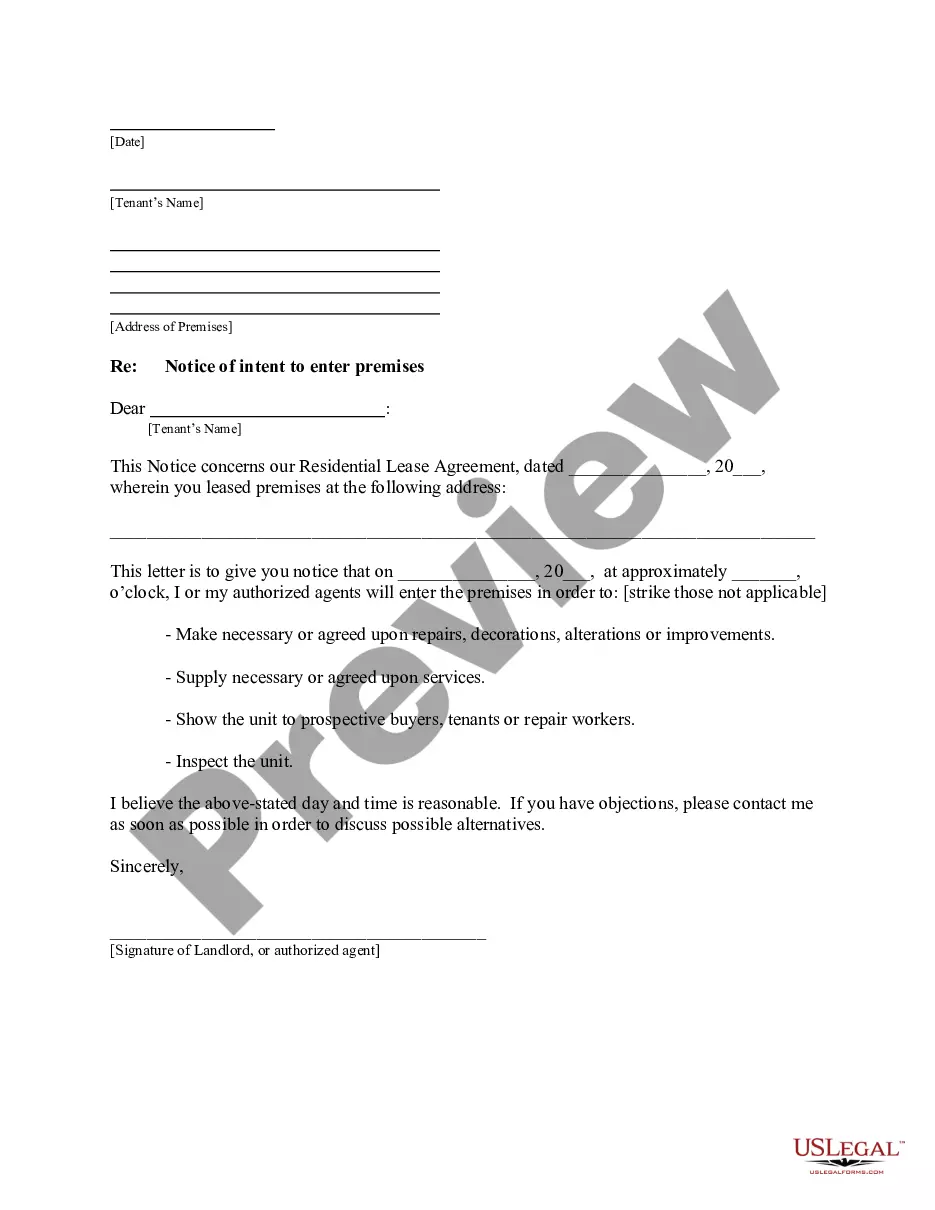

How to fill out Arkansas Beneficiary Or Transfer On Death Deed Or TOD - Husband And Wife Or Two Individuals To Husband And Wife Or Two Individuals?

Do you require a dependable and affordable provider for legal forms to acquire the Little Rock Arkansas Beneficiary or Transfer on Death Deed or TOD - Spouses or Two People to Spouses or Two People? US Legal Forms is the ideal choice.

Whether you are looking for a straightforward arrangement to establish rules for living together with your partner or a collection of documents to facilitate your divorce through the judicial system, we have you covered. Our site features over 85,000 current legal document templates for both personal and business use. All templates that we provide access to are not generic and are tailored based on the regulations of specific states and regions.

To download the document, you must Log In to your account, locate the desired template, and click the Download button next to it. Please be aware that you can retrieve your previously acquired document templates at any time from the My documents section.

Is this your initial visit to our website? No problem. You can create an account easily, but before doing so, ensure that you follow these steps: Check if the Little Rock Arkansas Beneficiary or Transfer on Death Deed or TOD - Spouses or Two People to Spouses or Two People aligns with the regulations of your state and locality. Review the form's information (if available) to understand who and what the form is meant for. Restart the search if the template does not fit your legal circumstances.

Try US Legal Forms today, and say goodbye to wasting hours researching legal documents online.

- Now you can register your account.

- Then choose the subscription plan and proceed to payment.

- Once the payment is processed, download the Little Rock Arkansas Beneficiary or Transfer on Death Deed or TOD - Spouses or Two People to Spouses or Two People in any available format.

- You can return to the website at any time and redownload the form without any additional charges.

- Obtaining current legal documents has never been simpler.

Form popularity

FAQ

Yes, Arkansas allows transfer-on-death deeds, enabling property owners to transfer their interests in real property without going through probate. This legal option is beneficial for husbands and wives or two individuals looking to streamline property transfers after death. Utilizing a service like US Legal Forms can assist you in correctly implementing these deeds for Little Rock Arkansas to ensure effective estate planning.

Avoiding probate in Arkansas can be achieved through various methods, including establishing a beneficiary deed for your property. By designating beneficiaries on your real estate, you can transfer the property directly to them upon your death, thus eliminating the need for probate. Engaging services like US Legal Forms can help you navigate the specifics of Little Rock Arkansas beneficiary or transfer on death deeds, ensuring a smooth transition of assets.

To create a quit claim deed in Arkansas, you'll need to prepare the deed form with accurate property details and the names of the parties involved. After completing the form, sign it in the presence of a notary public, and then file the deed with the county recorder where the property is located. Using a proper framework like US Legal Forms can aid in ensuring the quit claim deed meets all legal requirements, particularly for Little Rock Arkansas beneficiary or transfer on death deeds for couples.

In the context of Little Rock Arkansas beneficiary or transfer on death deeds, both terms refer to a legal method that allows for the transfer of property upon the owner's death. Essentially, a beneficiary deed is a specific type of transfer-on-death deed that is used in Arkansas. Understanding this distinction helps you utilize the appropriate legal mechanisms to secure property transfers for husbands and wives or two individuals.

A beneficiary deed, also known as a transfer on death deed, allows property owners in Little Rock, Arkansas, to transfer their property to beneficiaries upon their passing. This deed bypasses the probate process, making it a straightforward way for husbands and wives or two individuals to handle property transfers. By executing a beneficiary deed, you ensure that your property directly goes to the chosen individuals after your death, offering peace of mind and clarity.

Yes, quitclaim deeds are legal in Arkansas and serve as a means to transfer an interest in a property without warranty. This type of deed is common among family members or acquaintances who want to transfer property rights quickly and informally. If you are considering a quitclaim deed for beneficiaries, think about the benefits of a Little Rock Arkansas Beneficiary or Transfer on Death Deed or TOD, especially for transfers involving Husband and Wife or Two Individuals, as it can provide more security and clarity.

Yes, Arkansas allows for transfer-on-death deeds, which provide a way to transfer property without the need for probate. This deed allows you to name one or more beneficiaries who will inherit the property upon your death, offering a straightforward transfer process. Utilizing the Little Rock Arkansas Beneficiary or Transfer on Death Deed or TOD is an excellent option for Husband and Wife or Two Individuals looking for an effective ownership transfer solution. Consider consulting a legal professional to explore this option.

The best way to transfer ownership depends on your situation, but often a deed is the simplest approach. A transfer-on-death deed, such as the Little Rock Arkansas Beneficiary or Transfer on Death Deed or TOD, allows you to retain control of your property while specifying who inherits it after your passing. This option is particularly effective for Husband and Wife or Two Individuals, as it avoids probate and simplifies the transfer process. Always consult a legal advisor to ensure the transfer meets your needs.

Filing a beneficiary deed in Arkansas involves drafting the deed and including the names of the beneficiaries. After completing the document, you must sign it in front of a notary and then file it with the county clerk where the property is located. This method provides a straightforward way to ensure property passes to beneficiaries without going through probate. Using the Little Rock Arkansas Beneficiary or Transfer on Death Deed or TOD can facilitate this, especially for Husband and Wife or Two Individuals.

To transfer a property title to a family member in Arkansas, you typically need to complete a deed, such as a warranty deed or a quitclaim deed. This deed must detail the property being transferred and the names of the parties involved. After completing the deed, you must file it with the local county clerk's office to finalize the property transfer. For a seamless process, consider utilizing the Little Rock Arkansas Beneficiary or Transfer on Death Deed or TOD for Husband and Wife or Two Individuals.