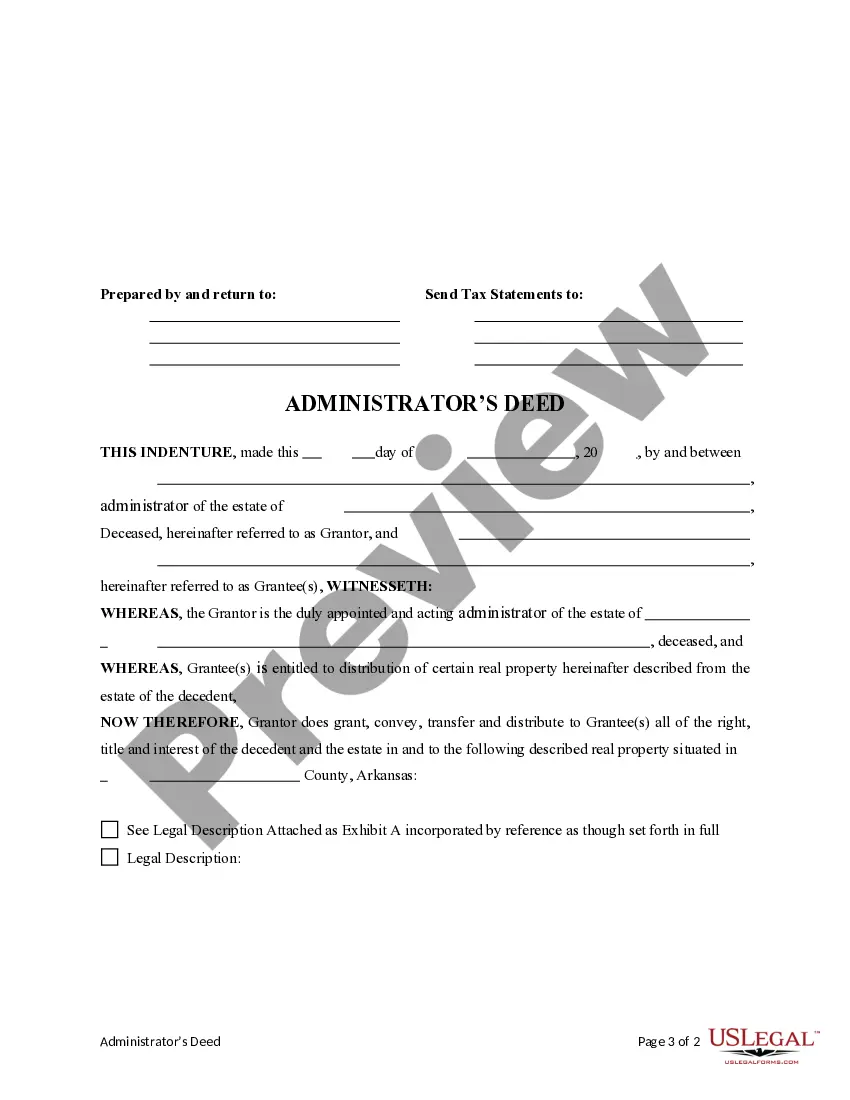

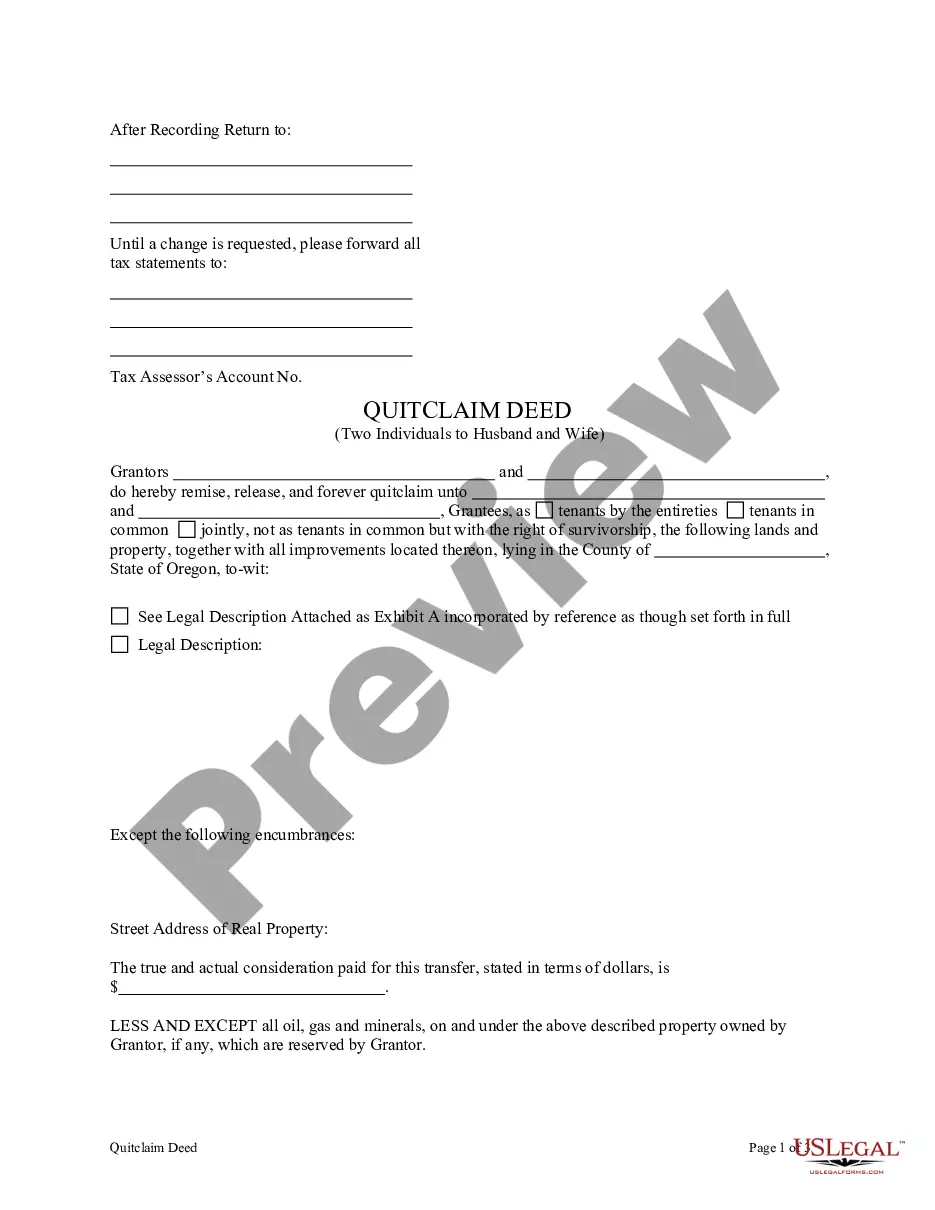

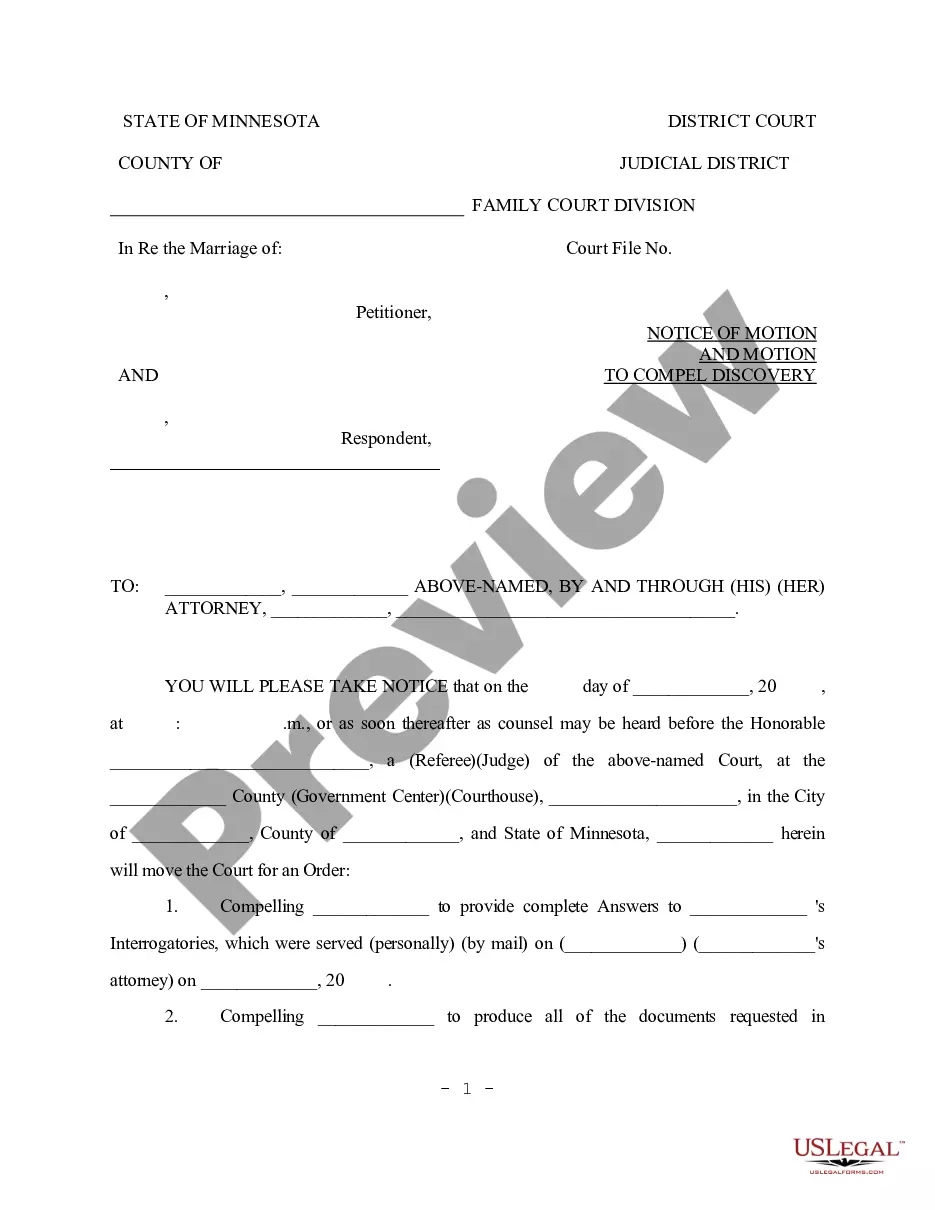

This form is an Administrator's Deed where the Grantor is the appointed administrator or administratrix of an estate and the Grantee(s) are the beneficiaries entitled to receive the property from the estate. Grantor conveys the described property to the Grantee(s). The Grantor transfers all interest in the property from the decedent and the estate to the Grantee(s). This deed complies with all state statutory laws.

Little Rock Arkansas Administrator's Deed Distributing Real Property to Beneficiaries of Estate

Description

How to fill out Arkansas Administrator's Deed Distributing Real Property To Beneficiaries Of Estate?

If you are looking for an appropriate document, it’s hard to find a superior source than the US Legal Forms website – one of the most extensive collections on the web.

With this collection, you can obtain thousands of document examples for business and personal use organized by categories and states, or keywords.

Using our advanced search feature, acquiring the latest Little Rock Arkansas Administrator's Deed Distributing Real Property to Beneficiaries of Estate is as straightforward as 1-2-3.

Obtain the form. Choose the file format and download it onto your device.

Make adjustments. Fill out, alter, print, and sign the received Little Rock Arkansas Administrator's Deed Distributing Real Property to Beneficiaries of Estate.

- If you are already familiar with our platform and have an account, all you need to access the Little Rock Arkansas Administrator's Deed Distributing Real Property to Beneficiaries of Estate is to sign in and click the Download option.

- If you are using US Legal Forms for the first time, just adhere to the instructions outlined below.

- Ensure you have opened the form you need. Review its description and utilize the Preview feature to examine its contents. If it doesn’t meet your requirements, use the Search bar at the top of the page to locate the correct document.

- Verify your selection. Click the Buy now button. After that, select your desired subscription plan and provide details to register for an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

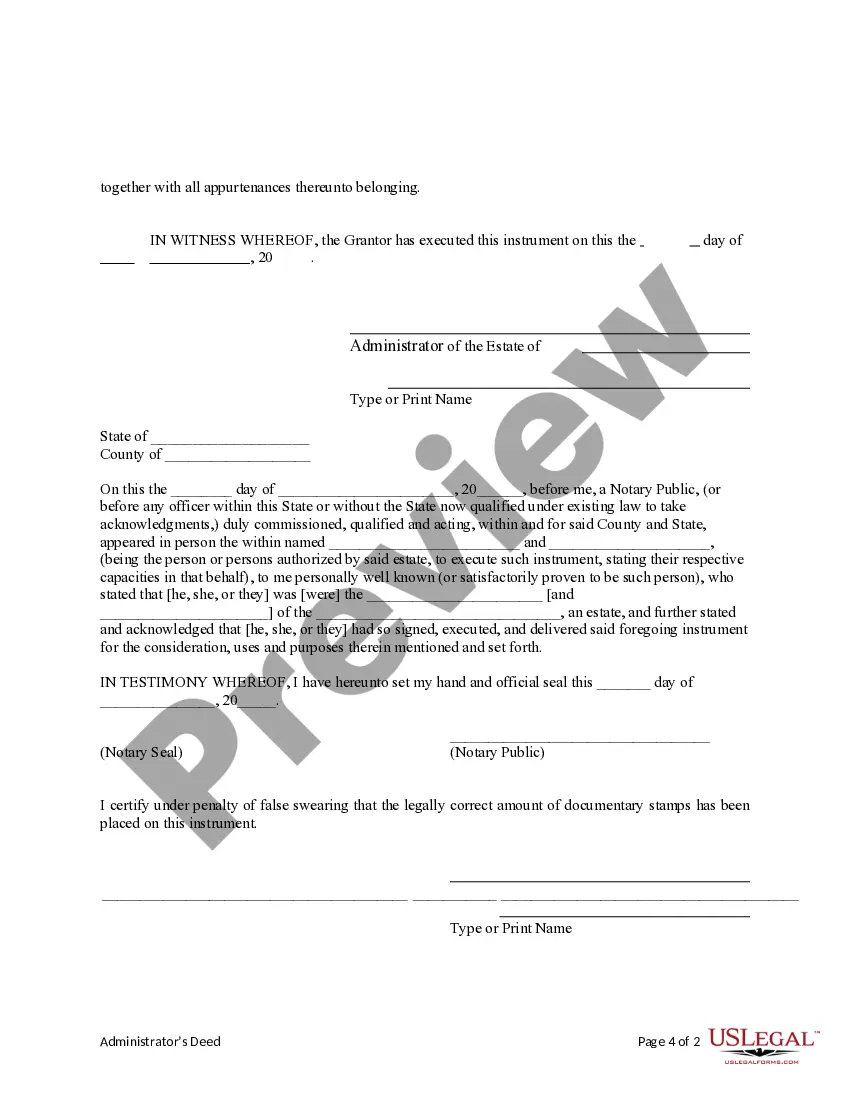

Filing a beneficiary deed in Arkansas involves drafting the deed to include the necessary information about the property and the designated beneficiary. Once completed, the deed needs to be signed, notarized, and then filed with the appropriate county clerk’s office. It’s imperative to double-check that all information is accurate and that you adhere to state requirements for filing. Using tools from US Legal Forms can simplify this process considerably, particularly for those considering Little Rock Arkansas Administrator's Deed distributing real property to beneficiaries of estate.

Yes, Arkansas recognizes a transfer on death deed, allowing property owners to designate beneficiaries who will inherit the property upon their death. This method bypasses the probate process, offering a straightforward transfer. It's important that the deed is executed properly and recorded to be effective. For additional guidance, US Legal Forms provides essential resources for your estate planning needs, including information about the Little Rock Arkansas Administrator's Deed distributing real property to beneficiaries of estate.

A beneficiary deed in Arkansas allows an individual to transfer property to a designated beneficiary upon their death, without the need for probate. This type of deed helps streamline the process and ensures direct transfer of property to the chosen heir. To ensure validity, it is essential to follow state-specific requirements for beneficiary deeds. For support with drafting these documents, US Legal Forms offers useful templates pertaining to estate management, including Little Rock Arkansas Administrator's Deed distributing real property to beneficiaries of estate.

Heir property in Arkansas refers to property that is owned collectively by multiple heirs, often without formal title transfers. In this arrangement, the title remains in the name of the deceased, creating potential complications for heirs looking to sell or manage the property. It's crucial to understand the legal rights and implications tied to heir property. Resources like US Legal Forms can assist in understanding processes related to Little Rock Arkansas Administrator's Deed distributing real property to beneficiaries of estate.

Transferring ownership of property in Arkansas involves a few important steps. First, you will need to prepare a deed that outlines the transfer specifics. After that, the deed must be signed, notarized, and then filed with your local county's office. Utilizing platforms like US Legal Forms can help you find the necessary forms and guidance for effective property transfers, including those related to Little Rock Arkansas Administrator's Deed distributing real property to beneficiaries of estate.

In Arkansas, property generally goes to the legal heirs of the deceased. If there is a will, the property is distributed according to the terms outlined in that document. In the absence of a will, Arkansas adheres to intestacy laws, which dictate that property is typically divided among close relatives. For specific cases, such as those involving an Administrator's Deed distributing real property to beneficiaries of an estate, consulting legal resources can provide clarity.

To file to be an administrator of an estate in Arkansas, you must submit a petition to the appropriate probate court. Along with this petition, include documentation proving your relationship to the deceased and any relevant information about the estate. Once appointed, you can use resources like a Little Rock Arkansas Administrator's Deed Distributing Real Property to Beneficiaries of Estate to efficiently manage and distribute estate assets.

In Arkansas, you generally have three years from the date of death to file for probate. However, it’s advisable to start the process as soon as possible to ensure a smooth administration of the estate. Delaying probate can complicate the use of a Little Rock Arkansas Administrator's Deed Distributing Real Property to Beneficiaries of Estate and other asset transfers.

Distributing items from an estate typically involves identifying all assets, settling any outstanding debts, and following the decedent's wishes as detailed in their will or state laws. If there is no will, Arkansas law dictates how assets are shared among heirs. This includes utilizing a Little Rock Arkansas Administrator's Deed Distributing Real Property to Beneficiaries of Estate to facilitate the transfer of real property to rightful beneficiaries.

In Arkansas, if a person dies without a will, you can petition the court to become the administrator of the estate. This process involves filing a request with the probate court and providing necessary documentation, such as proof of your relationship to the deceased. Once appointed, you will manage the estate, including the use of a Little Rock Arkansas Administrator's Deed Distributing Real Property to Beneficiaries of Estate for distributing assets.