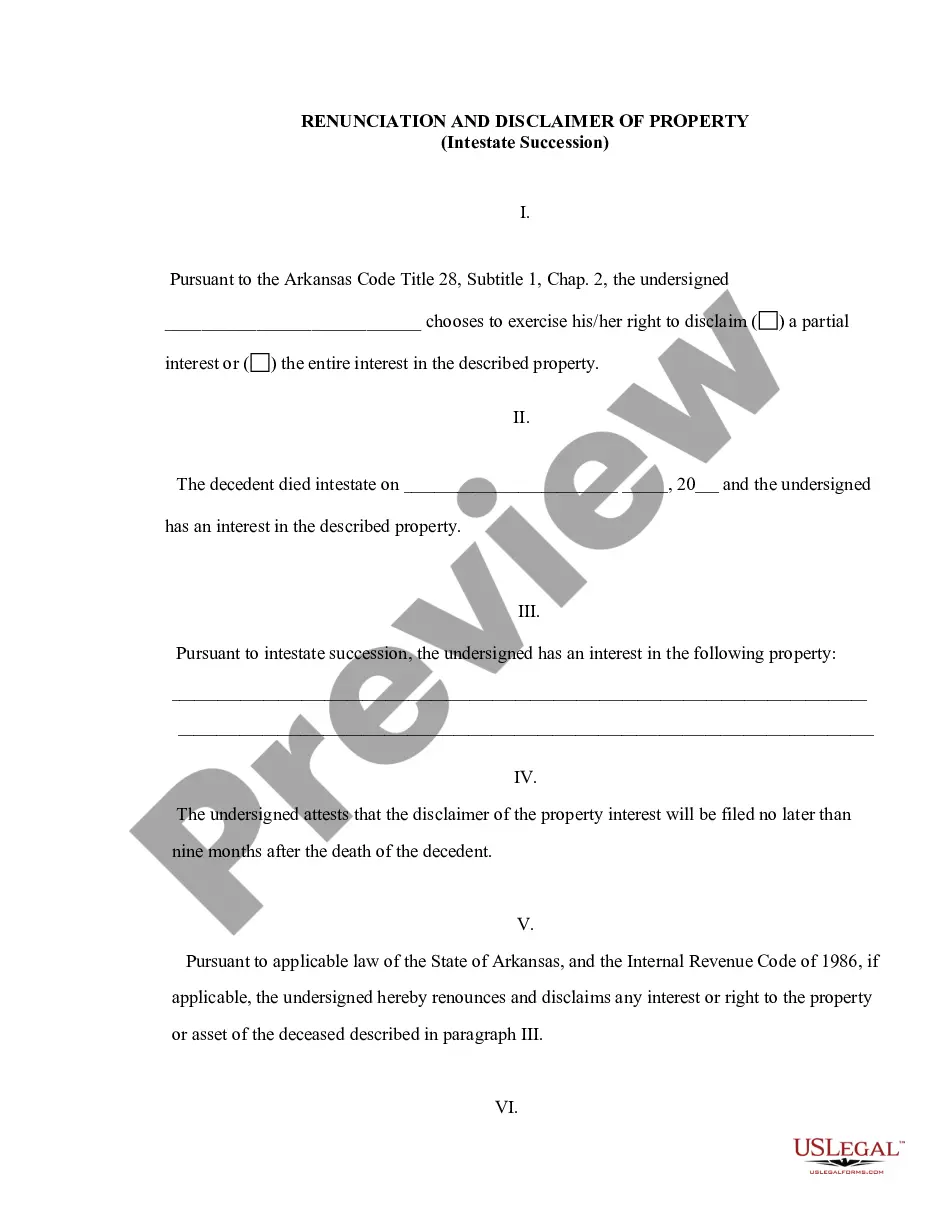

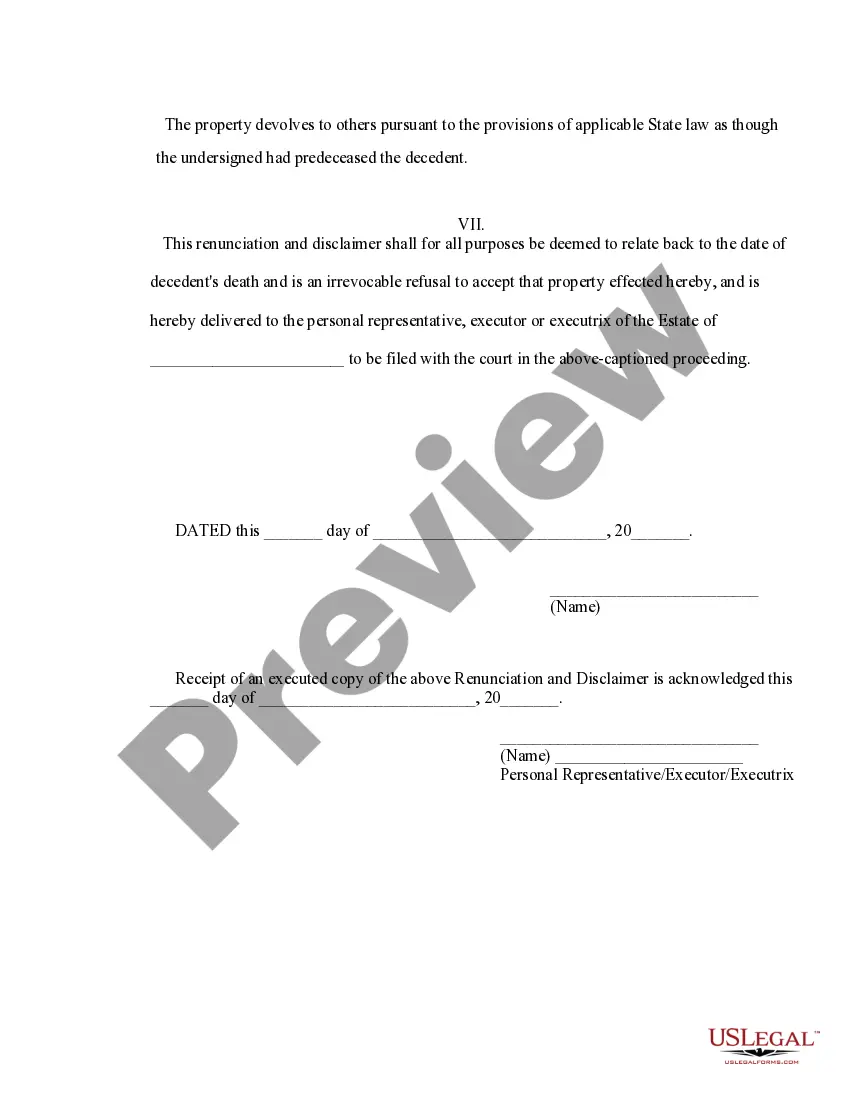

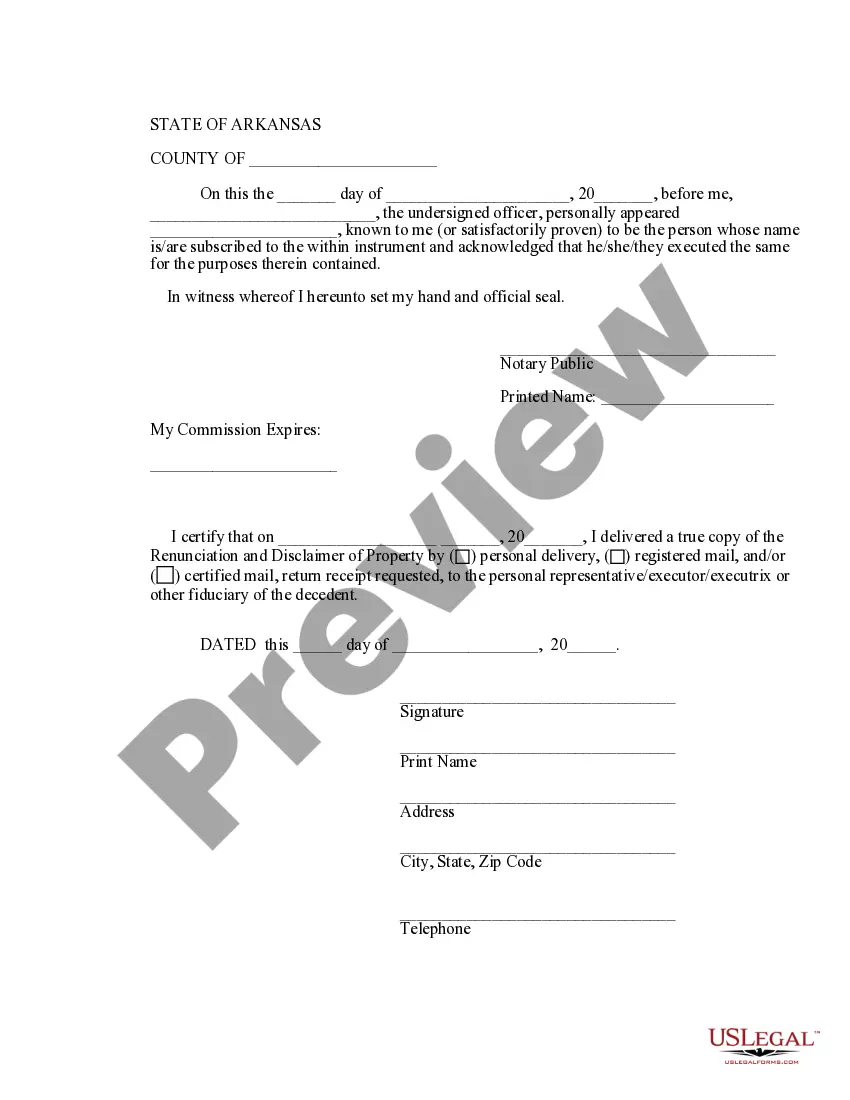

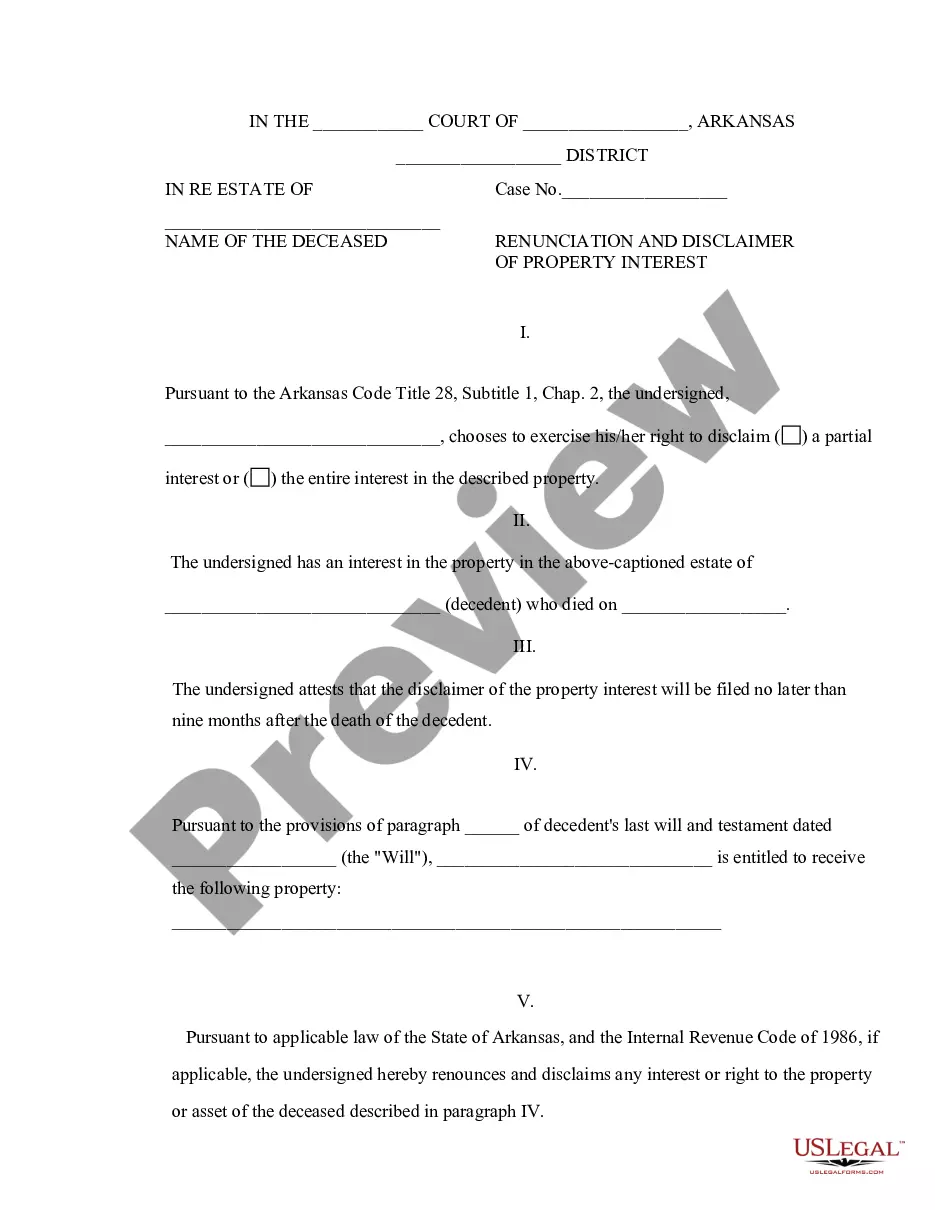

This form is a Renunciation and Disclaimer of Property granted to the beneficiary through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. The beneficiary has chosen to disclaim a portion of or the entire interest he/she has in the property. Based upon the Arkansas Code Title 28, Subtitle 1, Chap. 2 the beneficiary is entitled to disclaim the property and submit a copy of the disclaimer to the decedent's personal representative. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Little Rock Arkansas Renunciation and Disclaimer of Property received by Intestate Succession

Description

How to fill out Arkansas Renunciation And Disclaimer Of Property Received By Intestate Succession?

We consistently endeavor to reduce or avert legal setbacks when engaging with intricate legal or financial matters.

To achieve this, we enroll in legal services that are typically quite expensive.

Nevertheless, not every legal issue is as complicated.

A majority can be managed independently.

Utilize US Legal Forms whenever you need to obtain and download the Little Rock Arkansas Renunciation and Disclaimer of Property acquired through Intestate Succession or any other form swiftly and securely.

- US Legal Forms is an online compilation of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our repository empowers you to handle your matters autonomously without the necessity of an attorney's services.

- We provide access to legal form templates that aren't always publicly available.

- Our templates are specific to states and regions, which greatly simplifies the process of searching.

Form popularity

FAQ

Filing a claim against an estate in Arkansas requires you to submit your claim to the probate court where the estate is being administered. You must file within specific timeframes set by state law to ensure your claim is considered valid. Providing proper documentation is crucial for supporting your claim. If you seek assistance with this process, the Little Rock Arkansas Renunciation and Disclaimer of Property received by Intestate Succession can be a valuable resource.

If the owner of a house dies in Arkansas without a will, the property will pass according to the state's intestate succession laws. Typically, the home may go to surviving spouse, children, or other relatives. The estate usually goes through probate, where a court ensures debts are settled and the property is distributed fairly. Utilizing the Little Rock Arkansas Renunciation and Disclaimer of Property received by Intestate Succession can provide clarity during this process.

When a person dies without a will in Arkansas, the power of attorney they had during their lifetime becomes void. Therefore, no one retains that authority unless named in a legal document. Instead, the court appoints an administrator for the estate, often a close family member. Reviewing the Little Rock Arkansas Renunciation and Disclaimer of Property received by Intestate Succession could guide you in understanding your options.

In Arkansas, transferring property after a parent's death without a will can involve a legal process known as intestate succession. This means that the state laws will determine who inherits the property. Typically, the surviving children or other relatives will be entitled to the property. Engaging in the Little Rock Arkansas Renunciation and Disclaimer of Property received by Intestate Succession may also help clarify the transfer process.

Arkansas Code 28-48-103 focuses on rights of descent and distribution of property after someone's death. This code elaborates on how property is categorized and transferred to surviving relatives. It's essential for successfully navigating the Little Rock Arkansas Renunciation and Disclaimer of Property received by Intestate Succession.

Arkansas Code 28-40-103 outlines the laws regarding the distribution of an estate when no will exists. It identifies the hierarchy of heirs who may inherit assets from the deceased. Knowing this law aids in the process of the Little Rock Arkansas Renunciation and Disclaimer of Property received by Intestate Succession.

The Arkansas Code 28-41-101 deals with the documentation required for disclaiming property rights. This code serves as a guideline for how individuals can formally renounce their interest in property received through intestate succession. Therefore, it's a vital resource for those pursuing the Little Rock Arkansas Renunciation and Disclaimer of Property received by Intestate Succession.

Arkansas Code 18-27-103 addresses the specifics of property transfer and the processes involved. It clarifies how property can be jointly owned and the implications of transferring ownership. Understanding this code can assist individuals in making informed decisions regarding the Little Rock Arkansas Renunciation and Disclaimer of Property received by Intestate Succession.

Statute 5-28-103 in Arkansas pertains to the rights of individuals in relation to property and inheritance. It outlines procedures and stipulations for renouncing rights to property obtained through intestate succession. This is particularly relevant for anyone exploring the Little Rock Arkansas Renunciation and Disclaimer of Property received by Intestate Succession.

When a person dies without a will in Arkansas, intestate succession laws dictate how their estate is distributed. Generally, the deceased's property will go to their closest relatives. For those navigating the Little Rock Arkansas Renunciation and Disclaimer of Property received by Intestate Succession, familiarizing yourself with these laws is vital.